Ever since payments became digital, we’ve seen an increase in the ability to censor transactions; financial institutions and payment intermediaries shut down accounts or inhibit transactions daily. As custodians of other people’s funds, these platforms require the ability to reverse transactions, as they custody funds and take the risk of moving them; when fraud occurs, they are on the hook. While these tools keep them in business and help prevent fraud, it’s not always used for that purpose.

We’ve seen payment rails shut down many proponents of free expression online from websites, whether they accept donations, sell goods online, or have a bank account to cover day-to-day expenses. Today most businesses rely on their financial institutions to ensure they can continue to operate. A position that continues to become more precarious by the day.

There are countless stories of social media personalities and websites that have seen their ability to receive payments and have basic banking services shut down to silence them, including online booksellers, story archives, alternative social networks and others.

In one of the most famous examples in 2010, WikiLeaks’s whistleblower website suffered an extra-legal financial blockade spurred on by unofficial government pressure. However, they were not charged with any crime in the United States.

Financial censorship has not slowed down as more transactions move to online rails, and recently PayPal made waves when it announced it would fine users up to $2500 for “misinformation.” or shut down their accounts altogether.

New PayPal Policy Permits Company to Fine Users $2,500 for ‘Misinformation’ https://t.co/kEWxuEbAd0

— Jeffrey A Tucker (@jeffreyatucker) October 8, 2022

Distributed networks are not censorship resistant

So you probably think I don’t need a bank account or a fintech app like PayPal; I can use stablecoins or one of these smart contract blockchains. Well, you can, as long as you play by the rules; if you don’t, you’ll find that there will be a block in your access to the chain; despite the marketing of decentralisation and censorship resistance, we hear from the crypto crowd.

Saying something is resistant to attack and actioning it are two very different things, so don’t look at what the cheerleaders say; look at how the blockchain performs.

Censorship resistance is a much-touted attribute of decentralised in-name-only (DINO) networks. These networks allow anyone to permanently store anything on-chain without seeking permission, but there are some carve-outs. While this is technically true, the reality is you can be stopped from broadcasting to the network by the nodes or added to the chain by the miners in a proof of work system or the validators in a proof of stake system.

Since the infrastructure for these chains is highly centralised, putting pressure on the node operators and large stakeholders means the network has no choice but to comply or see that infrastructure taken down or seized.

As the fate of controversial dapps such as gambling services or privacy tools like Tornado cash has shown, even decentralised app stores aren’t immune from censorship and de-platforming. If we take a look at the largest altcoin chain, a large portion of their blocks are OFAC compliant and continue to censor transactions every day.

We reached another sad milestone in censorship: 51%

— Martin Köppelmann 🇺🇦 (@koeppelmann) October 14, 2022

This means if the censoring validators would now stop attesting to non-censoring blocks they would eventually form the canonical, 100% censoring chain. pic.twitter.com/JrYUjowLpt

If these so-called distributed networks aren’t censorship-resistant, what does it mean and do the same rules apply to bitcoin? Let’s take a look and see.

What is censorship resistance?

Censorship resistance is the feature touted by blockchains that ensures a transaction will go through as long as all the set criteria are met. It is an assurance that as long as you remain in consensus with the network’s rules, no one may interfere with your transferring of funds. This ensures that no government or organisation can influence or alter transactions on a blockchain, regardless of the amount of power they wield.

Is bitcoin censorship resistant?

Bitcoin is censorship resistant in the sense that no single entity has the ability to reverse a bitcoin transaction or blacklist a wallet or address. Any node can broadcast a transaction, and any miner can mine any transaction. As long as a miner is willing to take the fees, you offer them. You’ll get added to a block. Asking someone to turn down money is a pretty hard prospect, don’t you think?

Thus, censoring a Bitcoin transaction is virtually impossible.

Submitting a transaction to the bitcoin blockchain has relatively few chokepoints. As long as an individual can reach a node on the bitcoin network, they can broadcast a transaction and trust that it will be confirmed or spin up their own node and broadcast directly to the network.

While governments could censor the internet, your IP address or certain websites, bitcoin developers have engineered many unique ways of broadcasting transactions, including TOR transfers of data, mesh networks, satellites, and HAM radio.

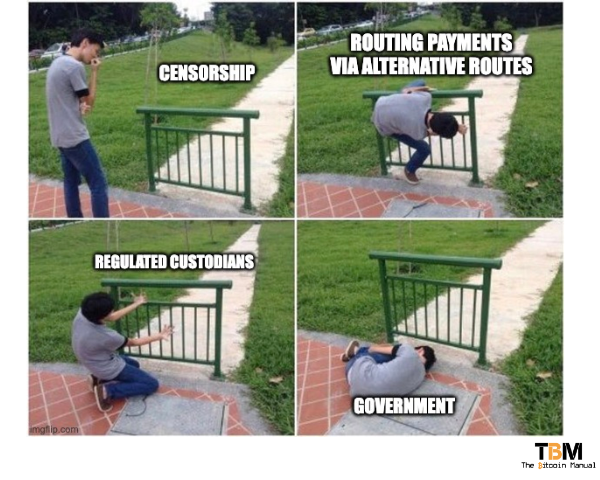

Depending on how strict the censorship is, you can always find a route to transfer funds via the bitcoin network.

What are bitcoin censorship attack vectors?

Yes, in every network, there will be ways to attack it and depending on how you interact with bitcoin, the asset and the network, you could leave yourself open to censorship and even seizure.

Custodial services

You might think you own bitcoin when you purchased it from a centralised exchange or hold it in a custodial wallet, but you only have an IOU from the custodian to move funds on your behalf, but you have rights to the funds from the viewpoint of the bitcoin blockchain.

You are trusting a third party to manage your funds, a third party that doesn’t want to jeopardise their business because of you and will be all too happy to comply in censoring your transactions because your incentives and there’s are no longer aligned. If you have bitcoin in a wallet where you did not generate a set of keys, or you hold it with a service provider, then your transactions can be censored.

As we say in bitcoin. Not your keys, not your coins. Not your node, not your rules.

Third-party nodes

If you’re using a bitcoin hot wallet or cold storage signing device, but your public key has been identified as problematic by authorities and wallet providers are asked not to broadcast transactions from this address, you could be censored. To get around this, you could connect your wallet to broadcast to another third-party node that couldn’t care less or broadcast directly via a node you’ve created, and you should have no problem moving those funds.

Regulated miners and mining pools

Mining pools and large-scale mining operations are easier targets for governments since they are located within a certain geographic area and tied to that local energy supply. Governments can either shut off their access to energy or shut down their operations if they do not comply. To appease their local authorities, these miners might need to mine compliant blocks and exclude transactions, let’s say, from sanctioned countries as an example.

While these mining pools and operators might ignore these transactions, other miners will not because it’s leaving money on the table, and they’ll add it to the next block they win. Even if all large mining operations were forced to comply, there are always individual miners willing to supply hash rate and secure blocks and would be more than happy to secure a juicy block filled with high fees being ignored by others.

Layer two solutions

If you are going to conduct bitcoin transactions off-chain and you’re wondering if those transactions can be censored before you move funds to these environments, here’s what you need to know about Lightning and Liquid.

Lightning network

Lightning network nodes can be brought online permissionless manner. Once you establish a channel through your node, you can route directly to another user using a private channel that only the two of you know about, making it impossible to censor. If you are using a public channel, certain nodes could avoid routing your payments and lose out on those funds, but others will happily transfer your funds via their routes and pick up the fees instead due to the network’s topology.

In addition, new privacy techniques, like onion routing to the Lightning Network, will make it even harder to identify and thus censor transactions in any way.

Liquid network

The Liquid network manages blocks through a federation of members distributed worldwide; In contrast, one member might be subject to certain restrictions based on their geographic location, others may not and being able to find transactions to censor requires far too much effort to make it worthwhile.

Liquid users can self-custody their assets on the blockchain, with the assurance that no Federation member can block, censor, or reappropriate funds because users don’t have to trust any individual entity or node. Using Confidential Transactions by default also blinds transaction amounts and asset types, making distinguishing what on-chain output(s) to censor nearly impossible.

You will need permission from a federation member to peg out back to the base chain, which can be seen as a choke point, but you can get around this by swapping L-BTC for BTC using a swap service or P2P transaction.

Censoring on-chain

It’s worth noting that censoring transactions on the bitcoin network aren’t completely impossible, but the barrier to doing it remains high. It would require a central actor to amass a majority of the hash power of the network, which is extremely resource-intensive.

The security model of bitcoin heavily relies on the majority rule. In theory, garner enough hash rate to gain control of the network in a scenario called a 51% attack. The chances of this happening are slim, but it’s possible nonetheless.

Once a re-org of the chain is possible, the actor will have control of the chain as long as they retain the majority of the hash power; other miners can either increase their hash power to dilute this actor, or nodes could ignore hashes coming from this actor aiming to harm the network.

Bitcoin can be unstoppable money

Once you have your bitcoin on chain and you’re running a full node, there is no way your transactions can be stopped. Authorities might threaten you; your social circles might put pressure on you; there will be limitations on custodial services; there will be psyops and FUD around bitcoin use because that’s the only way to deter people from using the network.

If you remove yourself from that risk by running a sovereign set-up and educating yourself. There are very little authorities can do other than seek you out and physically stop you from using your hardware and accessing your private keys. So be sure to keep your operational security and privacy on piont.

The fact that individuals can break ties with governments and financial institutions will be seen as a threat in certain countries. Some governments will come down harder on bitcoin and bitcoin users. Still, it shouldn’t deter you from taking on the responsibility and using power to make financial choices without authority oversight.

As long as you can hold on to your seed phrase, you can take yourself, your family and your wealth to any part of the world.

Have you been censored?

Have you been curbed by your financial custody provider in the past? Why did it happen? How did you get around it? Did it show you the value of bitcoin? Have you used bitcoin to get around censorship of transactions?

Let us know in the comments down below.