A purely digital asset like bitcoin has changed the way we trade value online; depending on the type of trading you would like to do, you might prefer a certain platform over another. Regulated KYC exchanges tend to be many peoples jumping off point with a lot of bitcoin trading is done on these custodial exchanges due to lower premiums and ease of use.

Then there is a growing P2P market, which existed long before the first centralised exchange went up, with trades conducted via instant messaging and social media. The difference with P2P trades today is that we now have formalised platforms where you can host peer-to-peer offers.

In the altcoin space, there has been a massive push towards permissionless exchanges, a hybrid exchange model, where instead of a custodian holding your funds, a smart contract facilitates the trades using an automatic market maker.

Some advocates like to refer to these as DEXs or decentralised exchanges, but I don’t like that term, as it dismisses the risks involved in using these services. While the altcoin market has pushed this model as a way to get unregulated securities and scam tokens on the public faster than ever, bitcoin was largely excluded from this model.

You could trade bitcoin derivatives known as wrapped bitcoin on altcoin platforms and try to swap it for real bitcoin at a later stage. Alternatively, you could use an EVM-based extension leveraging bitcoin known as the RSK network, to trade rBTC. Wrapping and pooling bitcoin on both these options exposes you to a lot more risk with the amount of “assets” traded on these chains.

While they have proven to be a popular model for trading assets, and it does have their merits, permissionless exchanges have largely been a casino. So I get why people are apprehensive about seeing these models move to bitcoin, but it would happen. Eventually, it was only a matter of time.

Now you can conduct DEFI-type investments and speculative activities on the Liquid network, be it a little different, and it all starts with liquidity pools.

What is a liquidity pool?

A liquidity pool is a crowdsourced pool of funds like bitcoin or a stablecoin locked in a smart contract that is used to facilitate trades between the assets on a “decentralised exchange (DEX)”. Instead of traditional markets of buyers and sellers looking to match up with one another. These decentralised finance (Defi)” platforms provide automated market makers (AMMs), which allow bitcoin assets to be traded in an automatic and permissionless manner through the use of liquidity pools.

So what exactly does all that mean? Think of a liquidity pool as a digital pile of bitcoin locked in a smart contract. Then on the other side of the contract, you need an equal pile of stablecoins; let’s say it’s USDT.

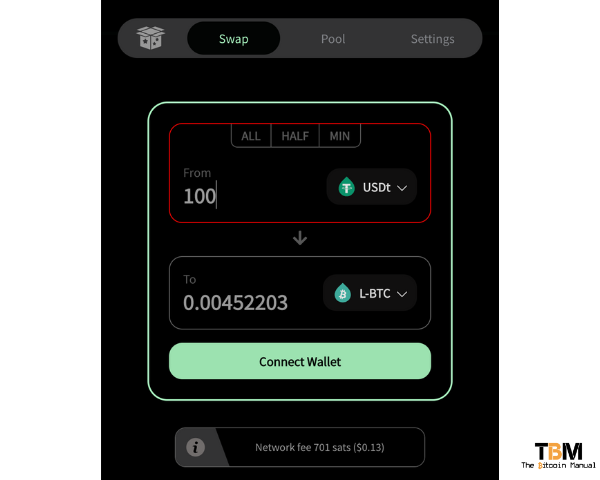

When a user with 100 USDT wants to purchase bitcoin, instead of having to fund someone with $100 bitcoin order or buying down the order book, they simply put their USDT into the pool and take out the bitcoin, and the pool rebalances.

This results in creating liquidity for faster transactions.

What are automated market makers?

In centralised exchanges, you have the custodian providing the liquidity to execute trades while the order book is filled with individual orders; the exchange cannot only rely on traders to meet orders and offer up their own funds to help facilitate trades and earn fees.

In the liquidity pool model, automated market makers (AMMs) fill this role. An AMM is a protocol that uses liquidity pools to allow for the pooled asset trades to be automated rather than through a traditional market of buyers and sellers. The AMM platform leverages the supply in liquidity pools to make trades based on certain rules.

Liquidity pools are designed to incentivise users to provide funds; those who risk their funds to seed the platform are called liquidity providers (LPs). After a certain amount of time, as the AMM earns fees for facilitating trades, the LPs are rewarded with a fraction of fees and incentives, equivalent to the amount of liquidity they supply. This is the real attraction of the service, the chance to earn fees on the assets you provide as a reward for improving market efficiency and allowing larger trades to move through the pool and exchange.

What is the purpose of a liquidity pool?

In a trade, traders or investors or even the average retail user can encounter a difference between the expected price and the executed price. That is common in both traditional and bitcoin markets. The liquidity pool aims to eliminate the issues of illiquid markets by giving incentives to its users and providing liquidity for a share of the trading fees.

Trades with liquidity pool programs don’t require matching the expected price and the executed price. AMMs, which are programmed to facilitate trades efficiently by eliminating the gap between the buyers and sellers of bitcoin, make trades on “DEX markets” easy and reliable in terms of filling orders.

All you would do as a user is set the value you want to exchange, review the value you receive, along with fees and possible slippage, execute the trade, and you’re done. The funds will be in your wallet where you hold the keys reducing the barrier to trade in and out of assets.

How Bitmatrix liquidity pools work

Bitmatrix is an automated market maker (AMM) built on Liquid; the platform utilises certain bitcoin opcodes to enable trustless liquidity provision across Liquid Bitcoin (L-BTC) and other Liquid-based assets like stablecoins. With a few clicks, users can create their own liquidity pools, add liquidity to other pools, or swap Liquid assets.

The application is currently in mainnet beta, but enables pool deployment with custom LP fee strategies, too, giving liquidity providers the ability to create pools using a spectrum of fee tiers. For example, stablecoin to stablecoin pools such as L-USDt<>FUSD may have lower fees, while more volatile pools like USDt<>L-BTC tend to have a higher fee tier.

The default fee tier is set to 0.25% for now, although it can be adjusted to as high as 1% or as low as 0.01%. Note LP fee tiers are immutable and thus cannot be modified once a pool is deployed.

As a Liquidity provider, you can either add funds to a pool you think would work for you or establish your own pool with fees and its own set of rules to compete with other pools for fees.

The edge for Liquid network liquidity pools

I can hear you thinking, what use is this service to a bitcoiner. I just want to hodl coins, and if I wanted to degen I could already subscribe to liquidity pools on other blockchains, so what makes Liquid different? Why would I consider even using this tool?

Well, a few reasons.

Confidential transactions

In the altcoin space, you’re not only putting your funds at risk, but your trading advantages and your identity when using their services. Since you’re probably using static wallet addresses on an EVM chain, one slip-up with associated metadata or purposefully doxing yourself with a vanity address means people can watch where you place your funds.

In the Liquid Network, since we don’t reuse addresses and they provide masking of balances through confidential transactions, this makes it ideal for providing Liquidity to permissionless exchanges.

Fees

The competition for block space on the Liquid Network and its ability to process blocks faster means the cost to submit a transaction is far cheaper. Anyone who uses Liquidity pools in the altcoin space will tell you that on-chain fees can kill this model, especially when you’re rebalancing the pool by adding or taking out funds as you see fit. Many LPs leave their funds in a pool while they seek out other revenue-generating opportunities and want to be able to pull out their funds at any time without paying too much for it.

Another advantage is Liquid Taxi, which allows traders to pay for their on-chain fees upfront in USDT; instead of spending your bitcoin to pay on-chain fees, simply fund your Liquid Taxi, and you can swap in and out at your heart’s content. You need not worry about how many satoshis you’re losing because you’ve covered that with fiat.

No fake yield

Now Liquidity pools on Liquid might not be the most attractive to traders looking to take on more risk since you’re only earning fees. As opposed to the altcoin space where you earn fees + a reward pool token, which you can then trade to try and earn more fees. These Liquidity Pool tokens only have value because the largest holder of Liquidity tends to be the protocol owner, and they backstop the market of that token.

This attracts in other people who also wish to pool for the token, providing additional yield by getting more people to provide liquidity and buy up this LP token. In these cases, the new users are the yield not the efficient use of the pool. So yes, Liquid Pools might not generate the same amount of dollar value, but at least the return is tied to the efficient use of capital and demand for capital in the pool.

The risk of using liquidity pools

Liquidity pools do allow for a lot more freedom for people to trade, but they are not without their risks. While there is lower risk for those simply using the service as they simply execute the exchange with the agreed slippage, and off they go with their funds.

But on the side of the liquidity providers, there is far more to think about before deploying your capital to a certain pool.

Impermanent loss

If you provide liquidity to an AMM, you’ll need to be aware of a concept called impermanent loss. In short, it’s a loss in either dollar or bitcoin value compared to HODLing when you’re providing liquidity to an AMM. Impermanent loss happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes compared to when you deposited them. The bigger this change is, the more you are exposed to impermanent loss.

In this case, the loss means less dollar value at the time of withdrawal than at the time of deposit. The risk liquidity providers make is hoping that the fees they earn make up for the possible losses in the rebalancing of the pool and losses from future price appreciation.

Exploits with funds

Another thing to keep in mind is smart contract risks. When you deposit funds into a liquidity pool, they are governed by the contract. So, while there are technically no middlemen holding your funds, the contract itself can be thought of as the custodian of those funds. If there is a bug or some kind of exploit through a flash loan, for example, your funds could be lost forever.

Code vulnerabilities and hacks

Also, be wary of projects where the developers have permission to change the rules governing the pool. Sometimes, developers can have an admin key or some other privileged access within the smart contract code or worse expose this key to the public by mistake. This can enable them to potentially do something malicious, like taking control of the funds in the pool.

Trust involved

Remember earlier I mentioned I don’t like the term decentralised exchange because it often implies that there is no trust involved or custodial risk. That’s not true; while you have removed the exchange, you have different trust assumptions. In the case of Liquid Network pools, you’re trusting the:

- The issuer of the asset, in USDT’s case it would be Tether

- You’re trusting the contract managing the AMM and Liquidity pool

- You’re trusting the liquid federation members to honour your peg in and peg outs

That’s why I prefer the permissionless exchange since there is no need for sign-up or KYC, all you need is a wallet, and you’re ready to use the service. Using these permissionless exchanges might have less red tape, but there is still risk involved to weigh it up before you dive in head first.

Risk on your keys

When you use one of these swapping services, you’re interacting directly between the service and your wallet, so you’re using your private keys to sign the transaction. Those keys are on your device and hot, and any issues in software could see those keys being exposed.

I would always recommend setting up a trading wallet instead and only keeping funds in it you wish to swap; you can always move out to another Liquid wallet or swap out to bitcoin on the main-chain or Lightning when you’re done.

How liquid network liquidity pools expand the network

Having liquidity pools on the Liquid network provide another swapping service for those looking to trade between L-BTC and other liquid assets, so instead of having to rely on centralised exchanges listing Liquid bitcoin or Liquid assets, you can use these markets instead.

Another interesting use of Liquidity pools is routing trades; an example would be wallets that leverage the Liquid Network; instead of pushing users to an exchange, the wallet can provide an interface to swap assets inside their wallet without leaving the app or site and route the transaction through the liquidity pool.

Obviously, the chance to earn a return on your L-BTC and Liquid assets is another attractive proposition for those with a high time preference and willing to risk their funds to capture a portion of those fees. Those that are willing to put up capital create markets outside the centralised and P2P exchanges allowing for larger volumes to flow through these liquidity pool avenues.

Liquidity pools also provide a bridge between centralised exchanges and P2P exchanges. Bitcoin is a global asset, but access to it isn’t the same for everyone. If you’re in a developed nation, it’s rather easy to get bitcoin from an exchange. In developing nations, not so much. In addition, P2P exchanges charge a massive premium because the user who buys the bitcoin wants to make a profit, and he is taking on risk and fees.

P2P traders will be able to access cheaper bitcoin through liquidity pools that will end up on P2P exchanges driving down the premium. Liquidity pools also give people from around the world the option to access bitcoin without the need to match a certain order size and can acquire bitcoin cheaper. The liquidity pools open access and put downward pressure on premiums and fees in the P2P market driving more liquid markets too.

Get the app

There you have it, another tool you can use to improve your Liquid experience. If you’re new to the Liquid Network and you’re only getting started with your wallet and all the things you can and should do. At first, It can be overwhelming but take your time to learn more about how transactions work and how to properly interact with this side-chain.

Then you can decide if you want to use the benefits of Liquid versus traditional payment methods and if you would like to participate in the so-called bitcoin DEFI market.

Sources:

If you would like to learn more about Liquidity pools or Bitmatrix and dive down the rabbit hole, then we recommend checking out the following resources.

Give us your take on Liquid

Are you a bitcoin purist that refuses to use anything but the base chain? Are you new to bitcoin and didn’t know that second layers and side chains exist?

Have you used the Liquid network before? What are you using it for? How do you find its usability compared to that of the base chain or the Lightning network? Let us know in the comments down below.