Bitcoin, often referred to as digital gold, is not just a revolutionary form of decentralised digital currency; it’s also a pioneer in security. It’s the first global open network to remain online for over a decade without a major hack, and it does so by encouraging miners from around the world to provide security.

As the amount of value locked and traded in the network increases, protecting the Bitcoin network from malicious actors, hacks, and vulnerabilities is paramount.

ASIC miners provide security through proof of work; the energy they expend is turned into cryptographic proofs to show the network that a certain amount of resources were used to secure a block on the network. If the miner can provide that proof and win the block, they are rewarded in Bitcoin.

This is where the concept of the Bitcoin security budget comes into play.

What is the Bitcoin security budget?

The Bitcoin security budget refers to the collective resources and incentives that the Bitcoin network allocates to ensure its security and resilience.

The security budget is how miners get paid and encompasses various aspects, including:

1. Mining rewards

A significant portion of the security budget comes from the Bitcoin protocols’ annual inflation rate. This is a fixed rate of coins issued by the Bitcoin network for every successful block mined, and these coins are added to the existing supply up until the hard cap of 21 million is reached in 2140.

2. Transaction fees

Beyond block rewards, Bitcoin miners also earn transaction fees for including transactions in the blockchain. These fees incentivise miners to prioritise transactions and maintain the network’s security by processing and confirming transactions.

Transaction fees can vary from block to block depending on how many transactions are available in the mempool and how much users are willing to bid to get into the next block. Miners favour a congested network because users are willing to pay more in fees, but this is hardly the norm.

What is the Bitcoin security budget?

The Bitcoin security budget is the total amount of money paid to Bitcoin miners to keep the network secure. It is made up of two components:

The block reward contains:

- Block subsidy: The block subsidy is the amount of new Bitcoin that is created and awarded to miners each time they successfully mine a block. The block subsidy is currently 6.25 BTC, but it halves every 210,000 blocks (approximately every four years).

- Transaction fees: Transaction fees are paid by users to miners to have their transactions processed and added to the blockchain. The higher the transaction fee, the higher the priority of the transaction and the faster it is likely to be processed.

The Bitcoin security budget is important because it provides an economic incentive for miners to participate in the network and secure it. The more miners there are, the more difficult it is to attack the network.

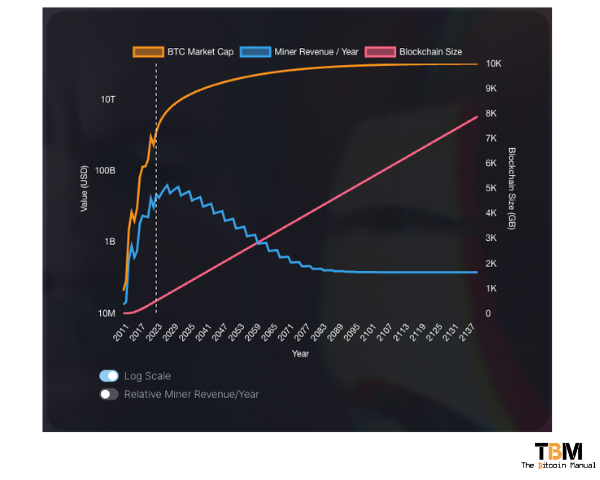

The Bitcoin security budget is currently estimated to be around $1 billion per year. However, this fiat amount could decrease over time as the block reward continues to halve each cycle, and if less Bitcoin is issued per block and fiat prices do not adjust to compensate, miners will have far less revenue to maintain operations, and some might have to quit providing security to the network.

This has led to some concerns about the long-term security of the Bitcoin network. Some claim the network will continue to find an equilibrium over time since there is still a large total addressable market for Bitcoin to tap into and attract new users and new capital.

However, others claim that you cannot rely on possible future demand, and if this demand doesn’t come in time to offset costs for miners, it will leave the network less secure. There are a number of proposals for how to address this issue, such as increasing the block size or introducing new types of compensation, such as tail emissions.

Why is the Bitcoin security budget crucial?

The Bitcoin security budget is essential for several reasons:

1. Protection against attacks

Without sufficient security measures and incentives for miners, the Bitcoin network could become vulnerable to attacks like double-spending, 51% attacks, or other malicious activities. A robust security budget deters potential attackers.

2. Trust and reliability

Bitcoin’s security is a cornerstone of its value proposition. Users trust that their transactions are secure and that the system is resistant to manipulation. This trust underpins Bitcoin’s role as a store of value and medium of exchange.

3. Network resilience

The security budget ensures the network’s resilience against technical challenges, such as software vulnerabilities or network congestion. In times of increased demand or unexpected issues, miners are incentivised to maintain network functionality.

4. Long-term sustainability

The security budget’s design is integral to Bitcoin’s long-term sustainability. As block rewards decrease over time (through halving events), transaction fees will play an increasingly significant role in supporting miners and network security.

5. Decentralisation

Bitcoin’s decentralised nature also contributes to its security. With thousands of nodes worldwide independently verifying transactions and maintaining a copy of the blockchain, the network becomes resistant to censorship and single points of failure.

Some proponents of increased security budget claim that If there is less of an incentive to spin up miners and only a select few with deep enough pockets or access to financing continue to mine, the network could centralise over time.

How does the Bitcoin security budget impact users?

Bitcoin users may not always be directly aware of the security budget, but it profoundly affects them:

1. Transaction confirmation

A robust security budget helps ensure timely transaction confirmations. When the network is secure, transactions are processed efficiently, reducing confirmation times.

2. Network stability

The security budget helps maintain network stability. Users can rely on the Bitcoin network’s consistency, even during periods of high activity or external challenges.

3. User confidence

The knowledge that the Bitcoin network invests heavily in its security instils confidence in users. This confidence is vital for both individual investors and institutional adopters willing to purchase the asset, settle using the network and hold large sums of Bitcoin for the long term.

4. Fee structure

The security budget influences transaction fees. When the network is secured by inflation, users need to pay lower fees for their transactions as miners are more interested in the issuance of new coins.

Incentives secure the network.

The Bitcoin security budget is integral to the network’s architecture, ensuring its continued security, reliability, and resilience. By aligning the incentives of miners, users, and network participants, Bitcoin has created a self-sustaining ecosystem where security is paramount.

Understanding the importance of this security budget helps users appreciate the robustness of Bitcoin as a decentralised digital currency and store of value. As Bitcoin continues to evolve and adapt, its security budget will remain critical to its success as it gobbles up value from traditional markets and upsets the status quo.