When Satoshi Nakamoto, the anonymous creator or creators behind bitcoin, designed the world’s first digital bearer asset, they wanted no ambiguity surrounding the supply or the insurance. The bitcoin network’s maximum supply was meant to mimic the finite quantity of physical commodities, which would see demand hit an ever-decreasing supply.

The maximum number of bitcoin that can be issued is set at genesis to be 21 million. At the same time, the issuance of each coin is known and immediately verifiable on-chain through the running of a full node. At the same time, the monetary policy is programmed and known to all participants.

The rules of the bitcoin networks supply of coins are no secret but what we do with those coins and where they flow is always up for debate.

Keeping tabs on coin flows

Since we all know how many coins have been issued already, how many coins will be created every day and at what rate they will be issued, the metric many traders tend to focus on is the bitcoin float.

In the legacy financial markets, the free float of a company refers to the number of shares that can be publicly traded. But in bitcoin, this metric refers to the number of coins that are likely to be available for public trading.

Calculating the free float is up to interpretation.

Different chain analytics firms use different flags and triggers. Still, to give you an idea of what could qualify as a free float in bitcoin, let’s look at According to Chainalysis Market Intel definition. They refer to bitcoin free-float as the amount held by wallets that send at least 25% of the assets they receive and that have held the assets for less than a year.

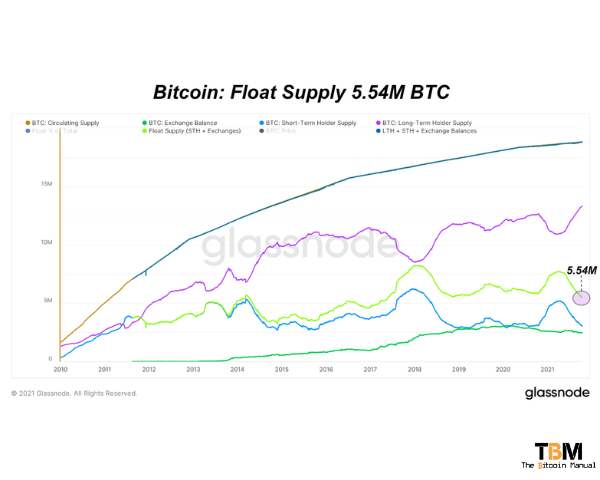

Another method of looking at the float is to look at short-term holder supply (based on a certain date range) and add the supply balance on exchanges in total and compare that as a percentage of circulating supply, which is a methodology that Glassnode tends to use.

What is the bitcoin free float?

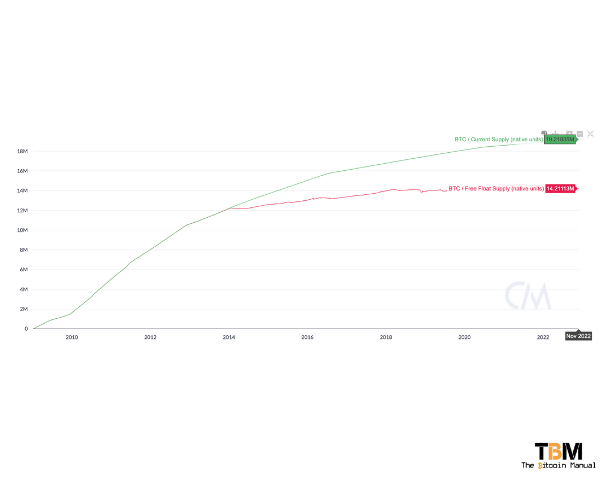

To understand the free float, we first have to look at the circulating supply of bitcoin. The circulating supply refers to the current amount of a bitcoin that has been mined and issued to a wallet and is technically available. Circulating supply is also the key metric used when calculating the market capitalisation of a coin (Market Cap = Price x Circulating Supply). Circulating supply deals with a perfect world where no coins have been lost or sent to addresses that do not exist and can never be recovered.

According to the major cryptocurrency aggregators, there is 19.2 million bitcoin in existence at the time of writing. However, as chain analysis firms point out, many coins are lost and not available to the market anymore.

This led the researchers to create a so-called “free float supply”, something they believe gives “a more realistic representation of the market’s Bitcoin supply.”

According to the metric, this number currently stands at 14.5 million BTC. This means that roughly 3.9 million BTC that are supposed to be in circulation has been wiped out by sitting in dormant addresses that have not moved in years.

Now, this is all an assumption, sure, some addresses have not moved bitcoin in ages, but that doesn’t mean that those funds aren’t accessible by the owner of the seed phrase. While some well-known public addresses are known to hold lost coins, many of these dormant addresses considered whipped out supply might still become available in the future.

What is the bitcoin float supply?

This metric applies to traders, investors or digital exchanges that tend not to hold on to their digital assets but make them available to trade versus different currency or coin pairs. The floating supply looks at how many coins are available in centralised exchanges’ wallets and the liquidity of pairs on order books.

According to Chainalysis Market Intel, the free float of bitcoin sits at around 2.4 million bitcoin, just 12.5% of the 19.2 million bitcoins mined to date. While Glassnode measure float supply at around 5.54 Million, around 29% of the circulating supply.

The numbers for free float will vary from service to service and depends on the exchange data used if they consider P2P order books if they consider liquid and lightning-locked funds.

Hence, it’s not the most reliable indicator but more of a trend tool.

As evident from the chart above, periods of price gains are usually preceded by a decline in BTC free-float. This suggests that BTC available to buy remains scarce despite record prices and as cycles move and the halving reduces new supply, the amount of coins traded on exchanges continues to decrease.

If this trend persists and hodlers continue to claw supply off the market while miners issue less for sale, this means that each year we should see fewer coins dictate the price of the bitcoin market as part of the float supply.

The float can be inflated.

One factor that dilutes the merits of looking at the float is the number of claims laid to the float and how the amount of rehypothecation of funds. While we can see known exchange wallets, we do not know how many of their customers have claims to that bitcoin. An exchange could sell the same bitcoin to several users, knowing that these clients will not redeem it by taking self-custody.

The exchange could then leverage up the claims on bitcoin, knowing that a certain percentage of people would only intend to sell their position for fiat. If you know a certain amount of redemptions will be made in fiat or a stablecoin, you don’t need to hold that bitcoin, only a promissory note, since you will never be called out on it.

Since we have no idea how many paper claims are sitting on exchanges versus the amount of bitcoin in the exchange wallet and on exchange order books, we don’t know how many people think they have bitcoin exposure but don’t have real bitcoin.

The amount of paper bitcoin reduces the demand for real bitcoin and impacts the demand on the float.

Do you take self-custody of your stack?

If you’re new to bitcoin and have not ventured down the self-custody rabbit hole, what is stopping you? If you’re already self-sovereign, how has the experience been since you took hold of your funds? Let us know in the comments down below.

We’re always keen to hear from bitcoiners from around the world.