Bitcoin is built on a public and pseudonymous blockchain, which grants strong privacy to users who remain inside the network. Privacy on bitcoin is not guaranteed by default, and because privacy is optional, many bitcoiners have used it in a way that has limited their ability to remain private. In a perfect world, we would all have earned our bitcoin through mining or voluntary peer-to-peer exchange, making it extremely hard to tell who owns what simply by looking at on-chain data.

As bitcoin has grown and institutions have come on board as custody providers, regulated exchanges and fintech companies, they’ve begun to create a massive dataset of off-chain information that allows them to label and identity on-chain bitcoin with customers’ identities. In addition, these customer databases are collected by several parties, including governments and chain analysis companies, who actively work to erode this privacy by analyzing the blockchain and using AML/KYC data.

One way around this constant financial doxing is to purchase non-KYC bitcoin either on a P2P exchange, bitcoin ATM or via bitcoin mining, which is easier said than done. If you are limited by your options to acquire bitcoin, the other alternative is to mask where that bitcoin is kept. While your KYC purchases might be kept on record, you can mask the wallet addresses that hold that bitcoin on-chain.

This breaks the ability to track those funds on-chain, and now those funds’ movement in future cannot be tied to you unless you hit another KYC on-ramp or use a known public address once again. To mask transactions, you can use options like confidential transactions, CoinJoins, Whisper Payments, SIlent Payments, PayNyms or even stealth addresses.

Each solution has its trade-offs, but they help the modern bitcoiner reduce their on-chain surveillance. Of the many options available, masking your transactions with collaborative spending is one of the most popular means of on-chain privacy. Wallets like Wasabi and Samourai offer CoinJoin payments, while a third more decentralisation option in JoinMarket actions joined payments without a coordinator.

The issue with JoinMarket was it was notoriously hard to use and set up, and the UI wasn’t very easy, and that’s where Jam comes in.

What is Jam?

Jam is a free and open-source project that provides you with an interface to a greater JoinMarket; Jam aims to improve the financial privacy of yourself and others without relying on a trusted third party to custody and manage your funds. The Jam app was started in 2021 by various volunteers and is still being developed and maintained on a volunteer basis. As mentioned above, Jam is a front-end for JoinMarket, a privacy-focused bitcoin software that leverages a peer-to-peer marketplace to make it easier to facilitate collaborative transactions.

The goal of Jam is to provide an interface that makes JoinMarket easier to use, deploy liquidity and make it an easily accessible experience so more bitcoin users can enjoy on-chain privacy should they choose to engage in these collaborative transactions.

What is a JoinMarket?

JoinMarket is a special software aimed at improving the privacy and fungibility of bitcoin transactions via collaborative transactions. A collaborative transaction requires the coordination of multiple parties. The right resources (UTXOs) must be available in the right quantity at the right time.

Consequently, the problem that needs to be solved is not technological but an economic problem; there needs to be an incentive to go private, either through saving on cost or earning fees to help keep transactions private. JoinMarket solves this problem not by central coordination but by creating a market that allows participants to allocate these resources in the best way, according to their individual needs.

How to get Jam?

If you want to give JoinMarket a go via Jam, the software is pretty easy to install and get set up; Jam comes packaged for the following full-node solutions:

- Umbrel

- Citadel

- Raspiblitz

If you’re using one of these full node operators, simply head over to their native app store, download Jam and install it on your device. If Jam is not supported by your node implementation, you might want to reach out to the software provider and ask them to add it to their app store. Alternatively, if you’re not running one of these node implementations, you can do a manual installation.

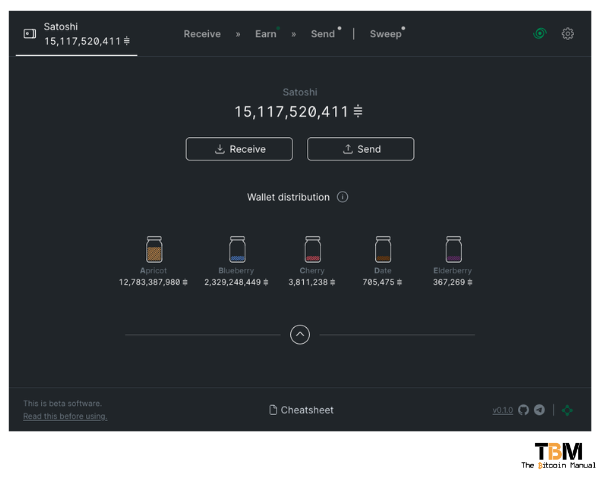

Once Jam is installed, create a brand new bitcoin wallet using a new set of private keys, save your keys, name your wallet, and the primary interface should load up.

What can you do with Jam?

Once your wallet is set up, you’ll have a new bitcoin wallet you can use to send and receive bitcoin more privately. You can use your Jam wallet as a bridge between your cold storage when pulling funds off a KYC exchange. Instead of handing over a bitcoin address that an exchange can tie to you and monitor the funds moving in and out of that address, you now have a buffer wallet.

You can move it to your Jam wallet and then CoinJoin out into a cold storage wallet, which protects the privacy of the final address where you cold store your funds. You might pay a little extra in on-chain fees in certain cases, but that’s the price you pay to keep your coins from being watched.

Receive bitcoin with Jam

When you receive funds to your Jam wallet, it will be distributed into “jars” these jars separate funds into disconnected containers which hold some sats of yours. Jars exist to segregate your sats into multiple buckets that are disconnected from each other, which aids privacy. To not risk any privacy degradation, you can only spend from one jar at a time.

There are five jars, with the default jar to receive funds being Jar A.

Think of jars as different pockets in your wallet or different identities. You can use your Jam wallet to deposit some funds yourself or receive them from others and mix the funds in this wallet for later use.

Send bitcoin with Jam

Once your Jam jars are filled with satoshis, and you’re ready to secure some funds to an air-gapped cold storage device, you can use the ‘Send’ tab to transfer funds to someone or to one of the jars. Jam defaults to collaborative transactions when sending, which enhances your privacy and security.

Your funds will be mixed with other users in a collaborative transaction which increases the privacy of yourself and others.

How to earn with Jam?

Remember I mentioned earlier that JoinMarkets aren’t a coordination problem but rather an economic problem. If you want people to coordinate with one another to do combined transactions, you will need to provide an incentive, and this is where the “earn” function of JoinMarkets comes into play. Yes, we will be moving into bitcoin DEFI eventually. JoinMarket yields will be another measure of the base interest rate for deploying bitcoin in a hot wallet, with the other being Liquidity markets on Lightning or Liquidity Pools on Liquid.

If you have bitcoin you’d like to use to support JoinMarket, you can offer the liquidity to the marketplace for a fee. No trust or custody is required—you are always in full control of your funds since you’re using a hot wallet where you hold the keys. Use the ‘Earn’ tab to earn sats by offering liquidity to other market participants who want to do combined transactions.

You will be acting as a market maker for combined transactions, and you set how much capital you want to risk. By providing liquidity to the market, you improve the privacy of others, and they are paying you the premium for that service.

You can choose how much you want to charge for your offer.

You can charge an absolute fee or a relative fee, for example:

- Absolute fee (250 sats)

The fee to charge others as an absolute amount denominated in sats.

- Relative fee (0.03%)

The fee to charge others as a percentage of the transaction amount.

Note that you participate and compete in an open market—there is no guarantee that other market participants will take you up on your offer. Being chosen for a collaborative transaction can take some time, and you will have to compete on fees to increase your chances of getting paid.

Don’t expect to shoot the lights out with this service; it is no DEFI yield farm, but more an honest service you can provide to the bitcoin community.

Create a fidelity bond

A fidelity bond is a long-term deposit that makes cryptographic identities deliberately costly. By cryptographically locking up funds in a time lock contract for a specific duration, you signal that you are a serious market participant and increase the chance of your offers being taken.

A fidelity bond is a mechanism which ensures that market actors act honestly. It is a protection mechanism against various kinds of attacks that involve the creation of fraudulent identities.

You can create a fidelity bond via the Earn screen. It involves the following steps:

- Set expiration date (which defines the bond’s duration)

- Select a jar as a funding source

- Select a UTXO, preferably one labelled

cj-out

After that, you will be asked to review the bond configuration. If everything looks right, you can create the fidelity bond, which will time-lock your funds for the set duration.

Scheduled Sweep

The ‘Sweep’ option can be used to empty your wallet using the scheduler. The scheduler will execute a series of collaborative transactions with randomized parameters, which will send your funds to multiple destination addresses over time. Execute multiple transactions using random amounts and time intervals to increase privacy with scheduled transactions conducted as a collaborative transaction.

You can then sweep your funds to cold storage or use them to open lightning channels.

Get the app

If you’ve been bothered by having your bitcoin tied to your identity, thought that coin privacy tactics were too hard or complex, or you’re simply looking for a better way to manage your funds before sweeping them into cold storage, then Jam is a great option. Jam wallets are also great for those who do tend to share public on-chain addresses to receive tips, donations or payment and want to obfuscate where those funds are going after they’ve been received.

Jam can also be an attractive option for businesses using bitcoin since all the transactions you might accept via your BTCpay server address can be swept into Jam before you need to pay salaries and bills or send money to your cold storage.

Sources:

If you want to learn more about Jam and dive down the rabbit hole, we recommend checking out the following resources.

Are you a bitcoin and privacy fan?

Have you been using bitcoin privately to mask your on-chain footprint? What is your preferred method of masking your transactions? Which app is your favourite? Have you tried all the forms of privacy payments? Which one do you prefer?

Let us know in the comments down below.