The need for dollars continues to expand under the guise of stablecoins; as fiat currencies worldwide continue to lose value to the dollar and other assets, citizens are clamouring for USD in any form they can get it in. Tokenised stablecoins on bitcoin and altcoins have reached a market cap of well over 150 billion and show no signs of slowing down.

What started out as a way to clear USD balances between exchanges to take advantage of arbitrage spreads has turned into a global secondary market for dollars and, to a smaller extent, other fiat currencies. Today stablecoins are used for trading, commerce, degen DEFI and even by those in developing nations looking to escape local inflation.

As much as we bitcoiners would like people to skip the training wheels and move towards a bitcoin standard, stablecoins have become a necessary evil. We’ve accepted that some people simply cannot make the jump and need to be helped over the street like a nice old lady.

Stablecoins on bitcoin rails

As stablecoins become the normies walking stick into digital payments, we’ve seen more people veer off into “shitcoinery” and way from bitcoin, which is why we’ve seen the push for stablecoins on top of bitcoin. At the moment, there are several stablecoin projects in the work, such as:

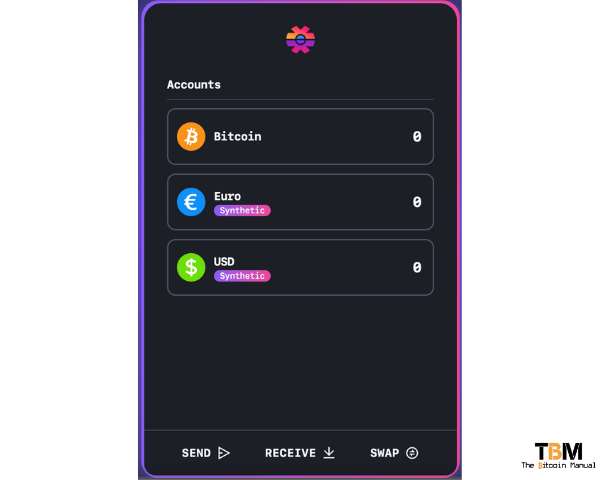

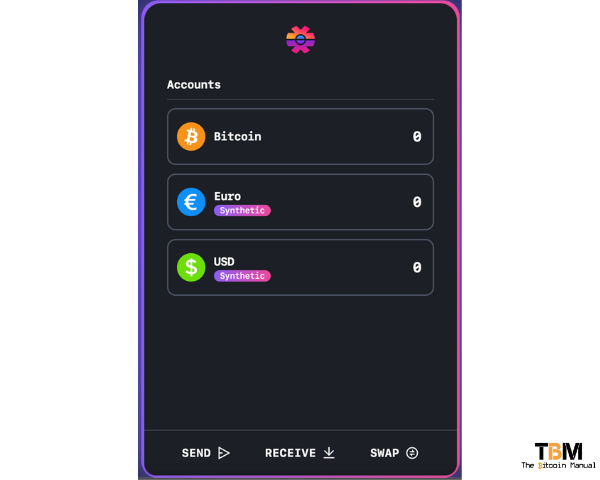

The idea of creating synthetic stablecoins backed by bitcoin continues to grow, with the latest offering coming from Kollider; with their new Kollider Pay wallet. Kollider spoke about leveraging perpetual swaps via their exchange to create synthetic stablecoins back in February of this year, and now the product is live for testing.

There are already synthetic stablecoins on the #LightningNetwork today ⚡

— Kollider⚡ (@kollider_trade) February 23, 2022

A thread 🧵 on what they are, how they are created, and who uses them.

👇

The following is not investment advice, it's purely an educational overview. Do your own research. pic.twitter.com/jg8lkDsCQZ

Users can now create a custodial wallet that runs on the Lightning network and accepts bitcoin or synthetic Euros, or USD, these are unit of account measurements. Still, instead of backing by 1 Euro or 1 USD, they are backed by an amount of bitcoin relative to that amount of fiat.

What is a synthetic fiat gateway?

Kollider Pay runs on lightning accounts infrastructure with a synthetic fiat gateway via a service known as LndhubX is a reimplementation of LndHub , which was created by BlueWallet. This project is meant to be an improvement and an enhancement of the original LndHub.

Regarding Lndhubyou’diates from the original in the following areas:

🦀 Use of a strongly type programming language (Rust) to ensure type safety and performance.

💾 Use of a scalable relational database to persist account data and transactional dayou’dSQL)

📒 Use of double-entry accounting to ensure a transparent and fault tolerant accounting trail.

💶 Support synthetic fiat accounts and payments by integrating directly with Kollider.

LndhubXThe project consists of 3 microservices, namely:

API

A simple REST API that allows users to interface with the bank. The API is stateless and uses JWT tokens for authentication.

Bank

The bank is the central ledger of the project. It keeps track of account balances and transactions and connects to the Lightning node.

Dealer

The dealer is an OTC desk that works on the bank’s behalf to hedge the bank’s fiat exposure. We implemented an RFQ system for the Dealer and the Bank for the dealer to manage risk levels and for the user to see an exchange rate before making a currency swap.

How Kollider pay works

Kollider pay leverages LndhubX to natively supports synthetic fiat accounts if it is run with the Dealer service, the dealer, in this case, being Kollider. Kollider offers users different units of account achieved by hedging the banks fiat exposure through taking a short position in an inversely price perpetual swap.

Currently supported fiat currencies:

- USD 💵

- EUR 💶

- GBP 💷

Users of the Kollider wallet can instantly swap between the three available assets or send and receive them as they like between other Kollider pay wallets or any other Lightning wallet. If you send a synthetic asset to an external Lightning wallet, the user will receive the current satoshi value.

The Kollider pay service is currently in Alpha testing, so you can mess around with it but be sure not to risk too many sats as you give it a go. In the meantime, the team have said they are looking to add the following features to help sure up the service.

- Add spread configuration to the dealer RFQ system to charge users for currency conversions.

- Insurance fund for the dealer.

- Add more parameters to the Dealer to improve its strategy.

- No prevention or monitoring of fee ransom attacks.

- API rate limiting

- Add a fee model to the bank so the bank can charge transaction fees on top of the network fees.

- Add LN-URL auth. For users and the Dealer to log in over LN-URL auth rather than API Keys.

- Admin dashboard to manage accounts.

What is the benefit of synthetic stablecoins?

Optionality is the spice of life, and while many bitcoiners may not agree with the move towards stablecoins, there is a market demand for it in the short and medium term. If you are a bitcoin holder who wants to leverage their satoshis as a medium of exchange, then this service could be an option.

For high-time preference purchases or fiat emergencies

You could lock in a bitcoin value and secure your Bitcoin to the current price in fiat to make a certain purchase.

For remittance and multi-currency users

Perhaps you’re doing remittance, and someone else wants a fiat currency instead. You could instantly swap into one of the multiple currencies and make and receive cheap payments in fiat over the lightning network.

For traders

As for traders who are looking to secure fiat profits, you can transact in these assets you prefer, and all balances stay on the network and are ready to trade anytime.

Leave bitcoin at your own risk

As is the case with all things bitcoin, you’re going to have to make trade-offs, and taking control of your money means you’re the one that has to weigh up the risks. When you leave the bitcoin base chain and its safety, you automatically take on more risk.

In this case, you’re taking a custodial risk in handing over your satoshis to a service, risk of the underwriter of these synthetic assets and opportunity costs for all the time you’re sitting in fiat.

So be sure to consider that before you use any stablecoin products.

Follow the app

There you have it, a detailed breakdown of a new app proposal to bring stablecoins to bitcoin. Do you think this is a positive for bitcoin, or does it only delay the move to the bitcoin standard? Let us know in the comments down below.

If you’d like to learn more about the app or give it a try.

Are you a bitcoin app affianado?

Are you using bitcoin inspired apps? Which app is your favourite? Do you have one you’d like us to cover? Let us know in the comments down below.