Stablecoins are by no means a new idea; the first version of it was launched nearly ten years ago, in 2014, with BitUSD issued as a token on the BitShare blockchain; this was an algorithmic stablecoin backed by the debt of another third-party token BitShares, which faded into obscurity as did many of the early altcoin projects. Despite this failure, we’ve seen the idea of algorithmic backing for stablecoins rehashed cycle after cycle, with the most recent failure being UST backed by Luna.

Where algorithmic stablecoins have failed, centrally issued and controlled stablecoins have been a rampant success and have emerged as a pivotal player, their popularity soaring as users seek a safe harbour in the highly volatile digital currency market. While there are several centrally issued stablecoins, the only ones worth mentioning are the two market leaders, USDT (Tether) and USDC (Circle).

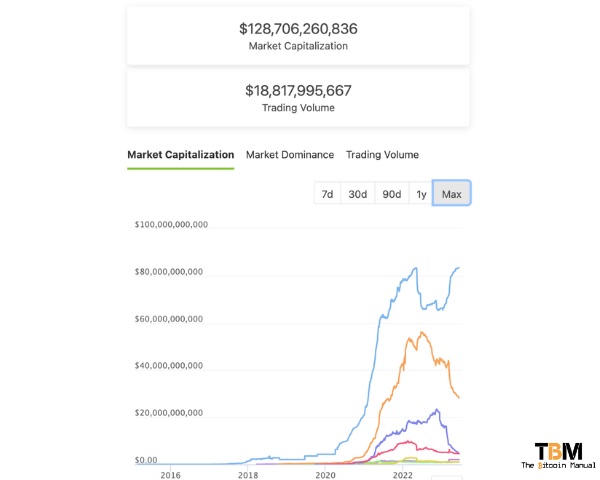

Today the stablecoin market sits at well above 120 billion dollars and shows no sign of slowing down. While these tokens clearly have a market demand and carved out their own niche, they also raise potential concerns.

Why Stablecoins Have Become So Popular

Stablecoins have ascended in popularity for their ability to mirror the self-custody model of a barrier asset of Bitcoin with the stability of traditional fiat currencies. By pegging their value to a reserve asset (often the U.S. dollar), stablecoins provide a level of price predictability that pure cryptocurrencies like Bitcoin cannot offer.

This “stability” has made them especially attractive for daily transactions, trading, eCommerce and remittances, and as a means to avoid losses during periods of crypto market volatility.

Use Cases for Stablecoins

Stablecoins have found application in a variety of areas of this new digital economy. They serve as a medium of exchange, offering quicker and cheaper cross-border transactions compared to traditional banking systems.

As a unit of account, stablecoins provide a consistent measure of value in the inherently unstable crypto markets. While a lot is made about the ability of the global South to access dollars and leave their failing local currencies behind and enable easier local and international transactions, it is by no means the biggest driver of stablecoin demand.

Stablecoins are widely used in the realm of DeFi (Decentralised Finance), enabling users to lend, borrow, or earn interest and speculate on unregistered securities on the various altcoin chains. They’ve also been used to prop up these altcoin markets and provide token issuers with an easier off-ramp to dump their allocation and realise a return. Stablecoins have made it easier and more profitable for pump-and-dump schemes to continue to operate.

Limitations of Stablecoins

Despite their benefits, stablecoins come with limitations and potential risks. Their value depends on the stability of the underlying asset, which can be influenced by economic factors beyond the control of the stablecoin issuer; if issuers cannot meet redemptions, it could cause panic in the market, and the token could de-peg, and that peg would be even harder to defend.

Also, the centralised nature of most stablecoins opens them to regulatory scrutiny and the risk of censorship. Since there is a company behind these coins, there is always a chokepoint that governments and financial institutions can put pressure on or bar them from operating in certain markets or from certain users using their tokens.

Lastly, many stablecoin systems lack full transparency and auditing, raising doubts about whether they are fully backed by reserves as claimed. While stablecoins mirror the feel of moving an asset on a chain, what you’re moving around, and custody in your wallet remains an IOU backed by a central entity.

Bullish Case for Stablecoins

The bullish argument for stablecoins is that they simplify global access to digital currencies and enable quick entry into the Bitcoin market, thus enhancing liquidity. Instead of relying on a specific exchange or P2P traders making a market to get in and out of Bitcoin, stablecoins allow traders to tap into a global market for Bitcoin.

Investors from non-dollarized countries can instead access stablecoins and then move those coins to any market in the world to buy and sell Bitcoin.

By acting as a bridge between the traditional fiat and crypto worlds, stablecoins can draw in a broader pool of participants, potentially leading to a more efficient and liquid market.

Stablecoins as a Potential Threat to Bitcoin Blockchain

While the benefits are clear, the potential threats posed by stablecoins on the Bitcoin blockchain should not be overlooked. Stablecoins could be used to ‘capture’ a blockchain by dominating its transactional volume, thereby gaining a disproportional influence over the network. This could potentially lead to scenarios where stablecoin issuers force a blockchain fork, taking a significant portion of the network’s liquidity with them.

The Ethereum network is an ideal warning, with major concerns that the network has effectively been co-opted by the largest stablecoin issuers, in USDC and USDT stablecoins. Since these stablecoins have their claws firmly in Ethereum and other smart contract chains. Stablecoins are widely used on the network; they form part of on-chain trading pairs and liquidity pools that make up DEFI.

If these coins were blacklisted or removed from networks like Ethereum, it would be catastrophic for the chain and all projects built on top of it; this is a risk that grows every day as the stablecoin market grows and becomes a larger part of on-chain liquidity.

Due to the centralised nature of issued stablecoins, the issuers can also throw around their financial weight by deciding where liquidity can go, who can use it and the direction of the network, and who to censor. If certain parts of the community do not like the way stablecoin issuers throw their weight around, they could fork, but if you’re comparing two chains, one with massive liquidity and stablecoin support and one that doesn’t, the one that stablecoin issuers don’t support is pretty much dead on arrival.

The organisations behind these stablecoins also pose a risk should they have shown an interest in complying with state sanctions; these organisations will then become extensions of the state and effectively make the chains they control an extension of the state.

Interoperability of Stablecoins on Bitcoin

The Bitcoin stablecoin market is different to that of the smart contract chains, where the stablecoin is issued as a token standard on a specific chain. Since Bitcoin doesn’t have a Turing complete feature set, stablecoin projects have had to look at alternatives.

Today the Bitcoin network does have stablecoin options, but they are all silos that aren’t interoperable with one another. Since you could never “decentralise” an asset that isn’t native to the chain, it makes sense that certain client-side protocols and companies would take on the liability to provide these services for certain customers who demand stablecoin support.

- USDT on the Liquid Network

- Synthetic FUSD with Fuji Money on Liquid

- Stablesats with Bitcoin Blink wallet

- Synthetic USD with Kollider wallet

- USDT via OMNI-bolt protocol

- Stability pools via FediMint

- Stablecoins via Taproot assets

While many perceive the limited interoperability of stablecoin iterations on Bitcoin as a bug, it could be seen as a feature that guards the integrity of the Bitcoin network.

The relative isolation of different stablecoin systems within the Bitcoin blockchain can act as a safeguard against systemic risks. By segregating the activities of different stablecoin systems, the potential spread of any disruption caused by a single stablecoin can be contained, preserving the stability of the larger Bitcoin network.

To me, this makes far more sense than trying to horse-shoe stablecoins into Bitcoin and putting that burden on Bitcoin users who might see stablecoins as shitcoins.

The double-edged sword that is stablecoins

Stablecoins have established their importance in the crypto space by addressing the problem of volatility and bridging the gap between traditional fiat and digital currencies, and solving the clearance time issues.

However, their integration with the Bitcoin blockchain is not without potential pitfalls and needs to be reviewed carefully. As we navigate the ever-evolving landscape of digital currencies, it’s crucial to strike a balance between leveraging the benefits of stablecoins and mitigating their potential risks.