Bitcoin is a digital bearer asset that anyone can purchase or mine and hold in self-custody, which is the safest way to store the asset since you eliminate counterparty risk. The best way to buy bitcoin is to find an exchange or a person willing to trade you for bitcoin and immediately redeem that bitcoin to an on-chain wallet where you can verify the UTXO for yourself.

This is how bitcoin should be used, but it is not the most intuitive experience for the average person. Most people have been reliant on custodians to manage and provide access to money and financial assets. This is their base case for interacting and managing value, and these people might not consider getting out of their comfort zone by managing bitcoin themselves.

Instead of taking ownership of your bitcoin, many new bitcoin holders tend to store their claims in paper bitcoin with exchanges or regulated entities. These investors seem to trust institutions more than themselves, and there is a large addressable market for those who don’t want to manage their bitcoin but still want bitcoin exposure.

Paper bitcoin for paper hands

In bitcoin, we refer to those who cannot hold on to their funds as paper hands, so it shouldn’t be a surprise that paper hands would opt for paper claims on bitcoin. Paper products refer to you holding a promise that you either have a claim to bitcoin held by a third party, as is the case with a trust, or you have a claim to redeem bitcoin in the future, as is the case with an exchange.

What is the Grayscale Bitcoin Trust?

The Grayscale Bitcoin Trust is a digital currency investment product where individual investors and institutions can buy and sell shares in their own brokerage accounts. The Trust launched on Sept. 25, 2013, as a private placement to accredited investors and, later on, received FINRA approval for eligible shares to trade publicly.

Those interested investors have access to buy and sell public shares of the Trust under the symbol GBTC, and since then, the Trust has grown in the amount of bitcoin it holds under management.

On January 21, 2020, it became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC.

This will allow accredited investors who purchased shares in the Trust’s private placement to have an earlier liquidity opportunity, as the statutory holding period of private placement shares would be reduced from 12 months to 6 months, according to SEC rules.

The Grayscale Bitcoin Trust’s (GBTC) entire selling point is to give investors exposure to bitcoin’s price movements through a regulated vehicle that traditional finance and investors understand and find comfortable using via their preferred broker.

How does GBTC work?

The idea behind the GBTC is to open up a bitcoin investment to as many people as possible, yet in practice, it’s impossible to just buy into the fund at market prices.

First, Grayscale invites a pool of wealthy investors to give cash to the fund, using this money to buy Bitcoin. Once the fund has established a treasury that it can use to back its share issuance, it moves to the next phase.

Next, Grayscale places the fund on public stock exchanges, allowing anyone to buy and sell shares.

As the price of Bitcoin increases (or falls), the fund’s value tracks this price. This means that the fund itself, as well as shares in it, follows the price of BTC. This process means that accredited investors — or those invited to contribute to the fund during its initial, private round — make a direct return on reselling their shares.

ETF bid fails (for now)

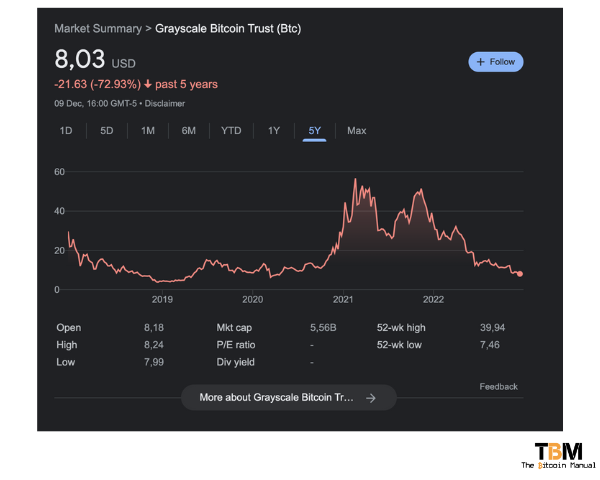

The GBTC trust has always had issues balancing the shares issued with the number of assets under management. In some cases, it can trade at a premium. In other cases, it can trade at a discount, and you’re relying on the market to come in and take advantage of these price movements.

Unlike an ETF, the Trust has no redemption mechanism, meaning GBTC shares can’t be created and destroyed as demand shifts. As a result, the fund’s price can fluctuate as high as 50% off the value of its underlying Bitcoin.

There have been several attempts to push for an ETF, but the SEC rejected Grayscale’s attempt to turn the Trust into an exchange-traded fund (ETF).

Regulators say investors are vulnerable to fraud and manipulation as the SEC does not have oversight over cryptocurrency-trading venues not registered as exchanges in the U.S. This is because they have no insight into where bitcoins are coming from and the record that bitcoin may have, such as criminal activity.

The company has hit back at the result and plans to sue the SEC. The firm’s CEO Michael Sonnenshein said the SEC fails to apply consistent treatment to bitcoin investment vehicles. Grayscale claims that converting GBTC into an ETF will likely help bring its share price to trade in line with its underlying value, which would be better for investors.

Advantages of GBTC

At the moment, the fund is primarily focused on those who are interested in investing in BTC but who have some concerns about doing this directly.

As mentioned earlier, some people fear self-custody or direct ownership and don’t feel comfortable dealing with the asset.

Another is that filing taxes for gains made on shares — such as those from investing in GBTC — is much less complex than the tax regime that applies to bitcoin holdings.

Some investors also feel as if the current bitcoin market is far too unregulated for them to use directly.

GBTC is an investment overseen by the SEC but still has significant exposure to the price of Bitcoin, allowing risk-conscious investors to take advantage of price shifts.

Disadvantages of GBTC

The first and most obvious issue with GBTC is that since shares in the trust trade can trade at a premium, they come with a significant up-front cost. This up-front cost is likely to be unimportant in an investment that lasts for five years. Sure, you could actively try to acquire more GBTC at low prices or if it trades at a discount, but there is no certainty you will get discounts that could be over the premium you paid.

Secondly, because the GBTC doesn’t track the price of Bitcoin directly, it can take a while for price fluctuations in BTC to be reflected in the price of the GBTC.

Those who hold GBTC are also subject to an annual management fee that can eat into your cost basis.

Finally, you cannot take self-custody of GBTC, and you are at the company’s mercy. If anything happens to Grayscale, the paper claims you have on bitcoin could be worth a lot less.

How can I buy GBTC?

The Trust is traded on the over-the-counter market. Investors can buy shares in GBTC just as they would other stocks and shares — through a broker or advisor or via an online trading platform. That opens up a whole range of options for investors. With instruments like GBTC, investors can trade BTC against stocks in other companies, albeit in quite a limited, expensive way.

Paper Bitcoin or the real thing, it’s your choice.

Paper bitcoin products are not going anywhere as they cater to a certain demographic, and while they may offer certain investors optionality, they don’t come without risk.

If you feel you want bitcoin exposure but dealing with the asset isn’t worth it, GBTC shares could be a better option. Although it shouldn’t stop you from exploring self-custody in the future, but rather form part of a portfolio that has different levels of exposure to bitcoin. If that’s the case, you could look at a mix of GBTC, bitcoin mining stocks, Volcano Bonds, bitcoin security token offerings like the BMN, bitcoin private equity and, of course, bitcoin in self-custody.

Depending on what risk factor you think is higher will factor the majority in your decision-making of which Bitcoin you should hold. Just remember, Bitcoin was created to be held by you and by holding a GBTC share, you effectively give your power back to the financial institution; bitcoin was designed to get away from and disintermediate.

There is also an opportunity cost loss involved through management fees and how they rebalance their fund. In the private case, you can pick the entry points you buy Bitcoin at and build a position for yourself.