Bitcoin mining has changed over the years; gone are the days of opening a .exe file on your computer and running the mining software on your GPU to collect your 50 or so Bitcoin every ten minutes without the assistance of a mining pool. Today bitcoin mining is a hugely competitive race against the ever-repeating next block to bag that block subsidy and the accompanied transaction fees.

Today you’re competing with home miners, industrial miners, cloud miners, bootleg miners, garage miners, hosted miners, and even state miners, in the form of El Salvador and their volcano miner.

As mining becomes more competitive, the fight for the best resources, the cheapest electricity, the optimum temperatures, the best setups, the most reliable equipment, and supply chains will set you apart from others.

Getting into bitcoin mining without mining

If you want to get into bitcoin mining, but you don’t feel comfortable running your own setup or shelling out for a hosted mining operation, then there are other ways of getting in on the action.

The most obvious would be to purchase shares in a bitcoin mining company. Still, you will be paid your dividends and price appreciation in fiat, with no direct bitcoin exposure.

If you’d like more direct exposure to bitcoin mining, another way to do this is to purchase securities that represent a certain amount of hash rate, which in turn means an amount of hash power that will be used to mine bitcoin.

While you’re not purchasing bitcoin outright, you’re buying the future returns in bitcoin that the hash rate will acquire as it competes against other mining operations.

What is the BMN?

The Blockstream Mining Note (BMN) is an EU-compliant security token that provides qualified investors access to the Bitcoin hash rate of Blockstreams enterprise-grade mining facilities across North America.

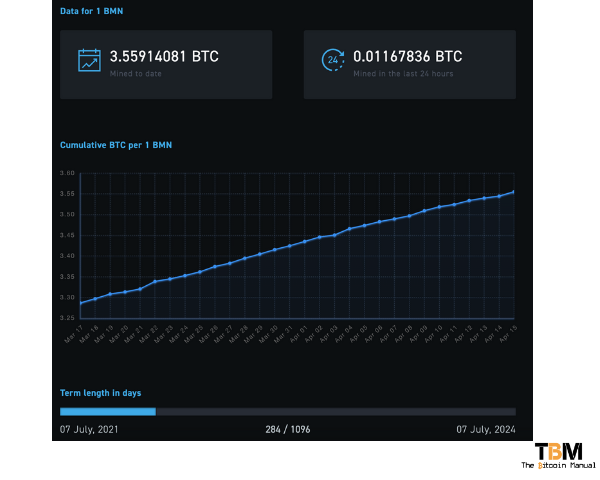

1.00 BMN token entitles the holder to bitcoin mined by up to 2,000 TH/s of hash rate over a 36-month term.

Performance data for 1 BMN

Current price of a BMN

Granular control of exposure

If you had to invest in bitcoin mining with physical machinery involved, it would require a large upfront investment in specialised hardware and facilities, so you’ve got this sunk cost that keeps you locked into the trade. Depending on future difficulty adjustments, you may need to remain in the trader for a more extended period than you would like or not have access to liquidity should other opportunities present themselves.

Selling a mining operation is not an easy process.

If you want more liquid exposure to mining, leveraging the Blockstream Mining Note (BMN) lowers the barrier to entry for qualified investors, providing exposure to Bitcoin mining through a simple token purchase.

In addition, by securitising the hash rate on the Liquid Network, investors can adjust their exposure to Bitcoin mining based on market conditions by trading the BMN tokens on the secondary market.

Where to buy a BMN?

There are several different options for acquiring the Blockstream Mining Note, however, availability may vary from platform to platform.

This BMN token is currently trading on:

But there are telegram channels where people are making P2P trades for BMNs

Taking custody of your BMN

You can leave your BMN on the exchange you’re using or you can take custody of the note in your Liquid Wallet. In order to store the BMN, you will need to set up a Liquid wallet with an AMP account enabled.

- Download Blockstream Green and create a Liquid wallet, if you do not have one already.

- Add an AMP account to your wallet and record your AMP ID.

BMN FAQs

– Users can deposit BMN in units as small as 0.01 BMN

– There is no maximum deposit

– If the combined balance of your green wallet and your withdrawal amount is >= 1 BMN, withdrawals as small as 0.01 BMN can be facilitated

– If your green wallet balance is 0, only withdrawals >= 1 BMN can be facilitated

-Withdrawal will not be facilitated in the initial phase

– Any investor able to purchase >= 1 BMN

Individual Investors

– Investors that buy 1 BMN in the primary issuance

– Buyers who purchase >= $100k BMN in the secondary market or deposit >= $100k BMN

Sellers in any size. Sellers with a balance < $100K will have orders auto-converted to fill-or-kill

Corporate Investors

– Not subject to minimum wallet balances.

– 1 BMN

Individual Investors

– If the user’s Bitfinex BMN wallet balance is >= $100K, users can buy and sell BMN in increments of 0.00001 BMN

– If the user’s Bitfinex BMN wallet balance is < $100k, Buyers can only place orders equal to the difference between their wallet balance and $100k. Orders will be auto-converted to fill-or-kill

– Sellers with a Bitfinex BMN balance < $100K can sell in any size but will have all orders auto-converted to fill-or-kill.

Corporate Investors

– Not subject to minimum wallet balances and can place orders in increments of 0.00001 BMN

– All spot order types. In some situations, fill-or-kill will be enforced.

– If the user’s Bitfinex BMN wallet balance is >= $100K, users can buy and sell BMN in increments of 0.00001 BMN.

– If the user’s Bitfinex BMN wallet balance is < $100k, Buyers can only place orders equal to the difference between their wallet balance and $100k. Orders will be auto-converted to fill-or-kill

– Sellers with a Bitfinex BMN balance < $100K can sell in any size, but will have all orders auto-converted to fill-or-kill.

– USD & L-USDT

– BTC & L-BTC

– €270,000