Bitcoin has grown in popularity over the years, with more people adopting it as a way to store savings, speculate on as an investment or as means of payment. As Bitcoin continues gaining traction, it needs more convenient and secure ways to use and spend it.

Bitcoin continues to clear millions each day, with a growing portion of it becoming commerce, but even with these supported facts, people still don’t believe that Bitcoin can become a medium of exchange.

One of the most common misunderstandings is that Bitcoin cannot be used offline, and without internet access, it is useless. This misconception has led many to believe that Bitcoin is a purely digital currency that can only be used online. If you’ve been in Bitcoin for more than 15 minutes, you’ve probably heard some fiat maxi tell you that Bitcoin is pointless without the internet and think they can drop the mic.

Now we can argue until we’re blue in the case, but the best way to crush narratives is to build practical solutions that debunk them. Using tools like OpenDime and Satscard, you can show people in real time that Bitcoin can be transferred between people without the need for the internet or on-chain transactions.

So, if you’re a “normie” who thinks Bitcoin is useless without internet access, keep reading to learn more!

So, what is a sats card?

A Satscard is a physical card that allows you to add Bitcoin to the card using its onboard wireless NFC smart chip that can hold Bitcoin. Once you’ve added some Bitcoin to the card, you can hand it to someone else, and then they control the balance.

It’s as if it were cash itself or a pre-paid gift card, and it doesn’t get more simple to pay or gift someone Bitcoin for the first time. The Satscard can hold any amount of Bitcoin, so it could be used for small purchases like P2P in-person trades, general commerce or even large-sized purchases where you don’t want to wait for an on-chain transaction.

The card works by holding a private key on it that can only be accessed by someone holding the card and, by doing so, makes the physical card the holder of the funds until those funds are swept to another wallet.

The Satscard can allow a private key slot to hold funds up to ten times, so if you receive one, you can sweep the funds and re-use the card again by topping up a balance on a new slot and handing it to another person.

This makes the Satscard a reusable method of transferring Bitcoin offline.

How does the sats card work?

A Satscard is a physical card that has NFC and the ability to generate its own entropy to create a Bitcoin wallet that you can use temporarily. Each Satscard is made by Coinkite and carries a certificate signed by their factory, and the Python code in cktap will always verify the certificate chain when speaking any authentic card. Verification does not require Internet access.

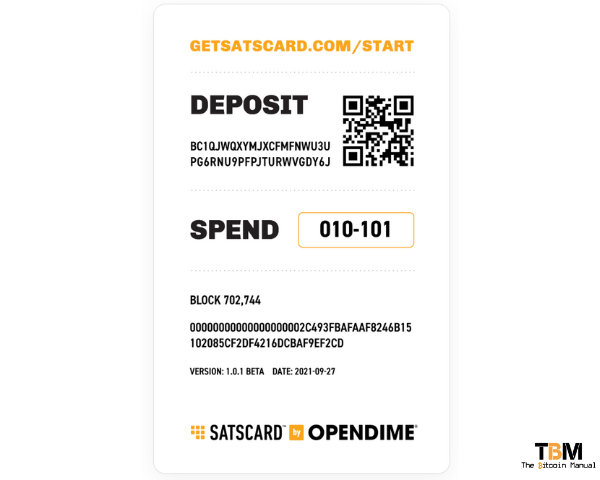

Once you have an authentic Satscard in your possession, you can flip it over to the back and see the following:

- A QR code with the first wallet slot.

- A public key is attached to the first wallet slot.

- A 6-digit CVC code for the Satscard.

You can immediately pay the card’s current wallet shown on the back and top it up with funds as many times as you like, and you can hold it close to a smartphone to verify that the funds are on the card.

Let’s say you’ve added 1 million satoshis on the card, and you hand it over to another person, that person can immediately hold the card up next to their device, and it will take them to a block explorer to verify that the address on the card holds the 1 million satoshis.

You might have a copy of the CVC code, but you no longer have the physical card required to sweep the funds, making it safe for the receiver to take the card, verify and assume they can sweep those funds at a later stage.

How to sweep funds from a Satscard?

When someone hands you a Satscard, and you’ve verified the funds are available, you will need to download a compatible software wallet on your smartphone, tablet or desktop device (the desktop device will need NFC).

Once you have the wallet software up and running, you hold the card up to the device, and the wallet will prompt you to sweep the balance to a wallet of your choice.

- You can sweep the funds to the current software wallet you’re using.

- Or use a public key of your choice and move the funds directly to that wallet instead.

Pick the amount you want to sweep; this can be partial or the full amount, add the CVC pin and tap the card a final time and the funds will be removed from the Satscard and moved on-chain to a wallet of your choosing.

The Satscard only works with transactions on the Bitcoin base chain, so you are subject to mining fees when sweeping funds. If you’re looking for a similar option but using the Lightning Network, you can use the gift card option using something like the Bolt Card.

How can I reuse a Satscard?

You’ve been paid with a Satscard for some goods or service, and you take home the card, and when you’re in a quiet room, you decide to sweep the funds. The Bitcoin has been moved to a wallet you are more comfortable using for spending or long-term storage, but now you’re sitting with a useless piece of plastic that you’re thinking of tossing in the bin.

Before you do that, hold the card up to a compatible wallet and check how many slots are still available on the card. If you’re the first person to receive the card, you should have nine more slots available.

Using the software wallet and the CVC, you can create a brand new slot with its own public key, which you can top up either via the new address or the original address on the card. ( Since the next person to receive the card can sweep funds from any of the previous slots).

Once your Satscard is topped up, you can go ahead and pay the next person and pay it forward offline.

Why would you want to use a sats card?

One of the main advantages of using a Satscard is that it allows you to physically spend your Bitcoin in the real world without converting it back into fiat currency. When you pay someone with a Satscard, you are handing over the means to sweep the funds to another user.

The user who now holds the card has all the information required to move those funds from the Satscard to a wallet of their choosing; this could be a cold storage signing device, a hot wallet on their smartphone or an exchange for it to be sold for fiat.

Funds can be pre-loaded onto the card and topped up so you can continue to add funds to the active card slot until it is eventually swept.

The Satscard can be useful for people who want to use their Bitcoin to pay for goods and services but don’t want to go through the hassle of exchanging it for fiat currency or don’t always have access to the internet or electricity.

Another advantage of using a sats card is that it can be more secure than a standard Bitcoin hot wallet since you need both a software wallet on your phone and the card to sweep the funds.

Pros of the Satscard.

- Allows you to spend your Bitcoin with a delayed on-chain payment.

- More convenient than using a traditional Bitcoin wallet if the competition for block space is high.

- A Satscard can be verified without the need to sweep the funds.

- Some Satscard doesn’t need on-chain transactions for you to hand over ownership of funds.

- It can be a useful way of keeping a balance of Bitcoin with you at all times.

- It looks like a normal card, so it’s less obvious it holds Bitcoin and can slot into your wallet with your fiat cards.

Cons of the Satscard.

- The user experience is a bit complex for the average person.

- Some people will lose these cards with filled slots and, along with it, their Bitcoin.

- Satscard is only compatible with the Bitcoin base chain.

- Most software wallets for mobile devices aren’t compatible with reading or writing to the Satscard, so you only have one option: The Nunchuck wallet.

- Eventually, it needs to be thrown away after ten slots have been used.

What happens if I pay one of the old Satscard wallet addresses?

The general rule when dealing with Bitcoin is never to pay an old address and always generate a new one, not only for privacies sake but also to ensure you’re paying the correct person. Relying on old addresses is never a good idea; with the Satscard, it’s even more evident.

As mentioned, the Satscard has ten slots available for creating public keys that can be topped up and then later swept. If the 10th user is holding the card and someone pays any one of the previous nine addresses, the person with the card will be able to sweep the funds.

Let’s say your friend was the 3rd owner of the card, so you paid him using the third public key created with the card, the final/current owner of the card will then be able to sweep those sats.

What if someone tries to tap my Satscard?

The Satscard comes with a special radio frequency (RF) blocking sleeve. It prevents unwanted access by RF readers with bad intentions. So be sure to insert the SATSCARD fully into the sleeve, and if you lose the sleeve, you can always substitute it for a generic RFID-blocking sleeve or wallet.

If the person doesn’t have your CVC pin and they’re simply trying to tap the card to sweep the funds, you’re safe, but if they have somehow gotten hold of the CVC number, you’re pretty exposed without your sleeve.

Do your own research.

If you want to learn more about the Satscard, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.

Do you take self-custody of your stack?

If you’re new to Bitcoin and have not ventured down the self-custody rabbit hole, what is stopping you? If you’re already self-sovereign, how has the experience been since you took hold of your funds? Let us know in the comments down below. We’re always keen to hear from bitcoiners from around the world.