The Lightning Network has brought some much-needed throughput to the Bitcoin ecosystem, allowing ordinary users to create their own peer-to-peer network of payment channels and route funds cheaply and instantly without the need for block confirmation every time. This second-layer solution is by far the most popular when it comes to off-chain scaling options, holding over 5000 BTC at its peak and made up of over a thousand payment channels.

It’s like a super-fast highway built on top of the Bitcoin blockchain, allowing for instant and cheap payments. But just like any highway, it needs gas stations – places where drivers can top up their tanks (wallets) quickly and efficiently.

While Lightning offers speed and uber-cheap transaction fees, it doesn’t mean you don’t have any trade-offs; it has a different set of requirements and commitments, such as running a Lightning node, locking up funds you want to spend, managing inbound and outbound liquidity, finding peers to connect with so you can access the network, and you always have to remain online.

Those are a lot of commitments and require some technical expertise, and due to the technical overhead and burdensome approach to Lightning, many casual users opt for custodial options or integrate with some sort of LSP instead of using Lightning in a non-custodial manner.

What is Nucleus?

When you use Lightning in a non-custodial manner, you are required to find a peer, preferably a well-connected peer, and ask them to put up funds. The two of you will enter into an on-chain agreement and lock up funds together.

Once established, you’ll be able to pay that peer directly, route payments through them to others, or receive payments via your peer’s linked routes.

As a peer of the Lightning network, you must remain online, keep track of your inbound and outbound liquidity, and keep channel state backups. If you’re not ready for that kind of commitment, then sharing the burden with several peers would be the next step; you could either share it by running a cloud node, using an LSP or engaging in a multi-peer channel.

That’s where Nucleus comes in.

Imagine Nucleus as a capital-efficient gas station for the Lightning Network. Instead of each driver (user) needing a huge gas tank, Nucleus lets them share a large one with others.

This means everyone benefits from:

- Lower costs: You don’t need to keep a lot of money locked up in your wallet, reducing fees.

- Faster transactions: No more waiting for individual payments to settle – Nucleus handles them instantly.

- More accessibility: Even users with limited funds can participate in the Lightning Network.

- Lower management burden: Nucleus is run by multiple participants, making their liquidity fully available inside a multi-peer channel, which makes it easier to deal with channel capacity issues than if you had to manage it on your own.

The protocol name Nucleus is inspired by the atomic and quantum physics analogy, where strong forces bind together baryons participating in the atomic nucleus (nucleons).

But how does Nucleus work?

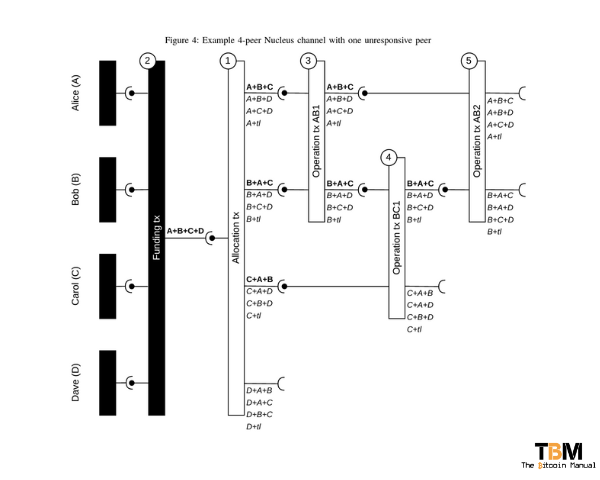

A Nucleus channel creation acts differently from a standard channel by creating a channel held by any number of peers (two or more). Think of Nucleus as a pool of funds that multiple users contribute to. When you need to make a payment, you simply tap into the pool, and the funds are instantly transferred to the recipient inside a pool or to the wider Lightning network via any of the connected channel routes.

Nucleus uses clever math (don’t worry, you don’t need to be a math whiz to understand this!) to keep track of everyone’s contributions and ensure everything is fair and secure. It’s like having a magic accountant who ensures everyone gets their share without cheating.

Storage

Since the channel doesn’t use a penalty mechanism and relies on timelocks, storing signatures for the past transaction is not required. If a node loses part of the transaction graph, it doesn’t lose access to the funds.

Number of peers

The channel computational and storage requirements scale linearly with the growth of the number of peers. Per-peer liquidity accessibility doesn’t get reduced with the number of peers, and the total liquidity usable by a channel grows linearly.

Liquidity

Liquidity can be removed and added to channels with channel split-in and split-out operations, where a funding transaction is replaced with a new one. This requires a single on-chain operation and is similar to splicing.

Inter-channel scalability

Liquidity is freely exchangeable between peers participating in the same channel. Performing transactions outside of the channel will require a form of cross-channel atomic swaps.

What about channel factories?

A Necleus operational transaction creating the various “subchannels” does sound a lot like what Channel Factories aims to achieve, but Nucleus has two distinct differences.

First, parties can create new operation transactions even when up to half of their peers are offline. At the same time, all possible subchannels have to be pre-signed – or all peers of a Channel Factory have to be online to sign subchannel commitment transactions.

Second, unlike subchannels, which can’t share liquidity, operational transactions can spend outputs from other operational transactions. This provides increased flexibility (different peers can go offline at different moments – and the remaining peers can continue to transact) and higher capital efficiency (no capital is kept inside separate subchannels) – at the cost of reduced security.

Why is Nucleus important?

By making Lightning payments more efficient and affordable, Nucleus helps:

Tackling Lightning’s biggest critique

If ever you bring up Lightning as a solution for payments, you will be met with criticisms like “no one uses real Lightning.” They’re all relying on someone else’s node and keys and only moving balances around; this isn’t Bitcoin, and you know what?

Those people aren’t wrong.

That is because using real Lightning costs real Bitcoin in startup costs, and it’s a pain in the arse to manage; that’s just the reality. By getting users involved in on-chain multi-sigs instead, we get users one step closer to using real Lightning and removing a layer of trust required in the current landscape.

Boost Bitcoin adoption

The more people who now enjoy the benefits of fast and cheap transactions, the more they will want to use the network and the asset. This can lead to more liquidity flowing to support these demands, which increases the possibility of earning a yield on the Lightning Network as a routing node.

Grow the Lightning Network

As more users join, the network becomes even faster; payment settlement becomes more reliable, larger payments can be settled without always having to use multi-path payments, and the network becomes more robust.

Fully unlocking those new use cases

Lightning has made micropayments, instant tipping, and seamless online payments a reality, but these use cases have not been fully exploited. The truth is the current implementations are only testbeds with Lightning loosely involved.

If we take a look at most zaps on nostr, for example, very few people are using non-custodial wallets and merely moving funds between custodians, while a streaming service like Fountain provides a custodial wallet, and most users are not streaming directly from their own Lightning wallet.

Nucleus can help ease the burden and complexity of lapps (Lightning apps) having to cater to the average user with custodial services and rather focus on their product while the wallet interactions are taken care of on the protocol level, reducing fiction.

Nucleus like Lightning is blockchain agnostic

The Necleus solution could operate on top of any UTXO-based blockchain equipped with N-of-M threshold signature scheme(s) and timelocks, without introducing new consensus-level requirements of script operational codes.

So, as is the case with Lightning, other forked versions of Bitcoin (Bitcoin Cash, SV, Litecoin, Dogecoin) could also benefit from the scaling solution for their networks, but it remains highly unlikely that these networks would adopt Lightning as these blockchains have already made throughput on the base chain their scaling priority.

Don’t bet the farm just yet

Nucleus is only a proposal and is still under development; as the idea matures and implementation rolls out, then we can judge its ability to scale the Lightning network. Nevertheless, the proposal does provide some interesting solutions that indeed have the potential to revolutionise the way we use the Lightning Network and might put the single payment channel concept out of business.

Well, not really. We will always have people who will want to run their own stack and not have to deal with others, but those who are willing to work in tandem and spare themselves completely will have an option that doesn’t involve funding complete custody of their funds.

So keep an eye on this exciting project – it might just change the way you think about money!

Do your own research.

If you want to learn more about Nucleus, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.