According to Chain Analysis, Nigeria ranks second overall on the Global Crypto Adoption Index, Kenya (21), Ghana (29), and South Africa (31) rank high on the index. In no region is Bitcoin more dominant than Sub-Saharan Africa, as Satoshi trades continue to make up a more significant share of transaction volume.

P2P markets and local exchanges feed the growing demand for Bitcoin in this part of the world, with local Bitcoiners willing to pay a premium to arb traders moving funds from international markets into Africa. The pace at which Bitcoin is spreading is not slowing down, but one part of the industry that has been a laggard is mining.

With its vast resources and growing tech adoption, Africa is a natural fit for Bitcoin mining. However, the reality is more complex; with the need for formal infrastructure, investment and expertise, the continent’s immense potential remains stunted, limiting Bitcoin’s widespread adoption.

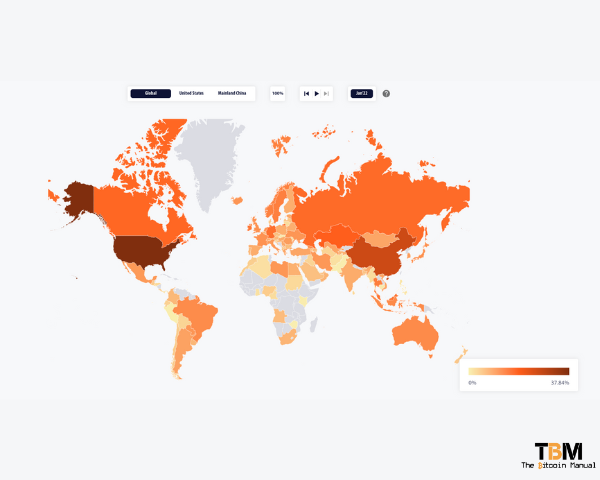

If we look at global Bitcoin mining, Africa is almost nonexistent. According to Cambridge’s reports, the continent’s hash rate is less than a single percentage point.

Why Africa develops a taste for Bitcoin

The African continent’s harsh realities can serve as a unique and potent testing ground for Bitcoin; if the network is the most robust form of settlement the world has ever seen, it should function under any conditions.

It’s one thing to promote decentralisation and censorship resistance, but putting it into practice is a completely different story; Africa provides a proving ground for the tech, driving company and developer solutions that will help Bitcoin proliferate in the toughest of conditions.

What conditions will Bitcoin phase, you ask?

Limited access to traditional financial systems

In many African countries, a large portion of the population remains unbanked, lacking access to essential financial services. Bitcoin, with its peer-to-peer nature, offers an alternative for sending and receiving funds without relying on traditional institutions.

Currency instability and inflation

Apart from the Tunisian Dinar and Saint Helena Pound, the currencies of the other African nations have not had the best track record of holding on to and protecting their citizens’ savings. Several African countries experience high inflation and currency fluctuations, eroding the value of savings and creating economic uncertainty.

When we think of hyperinflation, Zimbabwe is the poster child for currency mismanagement on the continent. Still, it doesn’t mean there aren’t those desperately trying to reach those lofty heights of currency devaluation. Currencies like the Leone of Seria Leone or Malagasy Ariary are in confetti territory and well on their way towards being scrapped altogether.

Bitcoin, with its limited supply and decentralised nature, offers a potential hedge against inflation and a store of value for those who might not have access to off-shore banking or complicated financial products to store value.

Infrastructure challenges

Uneven access to electricity and internet infrastructure can hinder traditional financial services. Bitcoin mining can incentivise investments in renewable energy and internet infrastructure, benefiting communities beyond just miners.

Decentralisation and censorship resistance

The realities of some African countries include political instability, and this is not your run-of-the-mill unrest or riot; regime change in the blink of an eye is nothing new, and coup d’états are as likely as a general election.

African governments are also desperate to keep their citizens locked into their local currency; if they didn’t, it would bleed out faster than it already does. Capital controls many citizens face highlight the value of a decentralised and censorship-resistant currency like Bitcoin. Transactions cannot be easily blocked or manipulated by any single entity.

Adaptability and innovation

The diverse challenges faced across different African nations necessitate adaptable solutions. In some cities, you’ll be able to enjoy the modern conveniences of card payments or access to an ATM every few kilometres; this is not always the case once you leave the larger metros.

Bitcoin’s open-source nature and global community foster innovation and the development of solutions tailored to specific contexts, such as transferring money via your smartphone or feature phone with very little friction.

Security and transparency

In environments with limited trust in traditional institutions and enforcement or rule of law, Bitcoin’s transparent and secure blockchain technology can offer an alternative for secure transactions and financial record-keeping.

Mining operations in Africa

The direct impact of household energy supply on well-being and economic development is no secret. In Africa, nearly 50% of inhabitants don’t have access to reliable energy. Those numbers are trending sideways in most countries, while in countries like my own, South Africa, the number of days where 24-hour electricity is available, even in the most developed cities, is reducing each year.

Central planning and public management of energy infrastructure have not worked out in the favour of the majority of citizens, with off-grid solutions and mini-grid solutions only becoming more popular. Private citizens and private companies are used to generate their own power, and as these cohorts benefit, others are keen to follow their example.

Generating your own power with solar, wind, diesel or hydro can be scaled towards your operational needs, be that a little town, an industrial area or a local community, but when it doesn’t come without a price, independence will always require a premium.

When you generate your own power, you have to maximise production, or you’re wasting resources, and without a way to store unused power, your money is down the drain, and this is where Bitcoin comes in.

Bitcoin miners can be coupled to these mini-grids or off-grid solutions as a demand response mechanism that absorbs energy that goes unused and pays for the power, so these grids are constantly monetising and have a buyer of last resort. It makes tapping into stranded energy more attractive and incentivises to onboard more energy production in the continent’s most remote areas.

Libya

Libya has banned Bitcoin mining, resulting in limited information, but reports suggest small-scale operations powered by cheap, subsidised electricity continue to gobble up around 2% of the country’s energy supply each year. Despite being officially illegal, Bitcoin mining has surged in Libya, partly due to small-scale miners taking advantage of the country’s low electricity costs. In 2021, Libyans mined approximately 0.6% of all Bitcoins globally, which was the highest in the Arab world and Africa.

Kenya

On the grassroots level, pioneering initiatives like Gridless are using Bitcoin mining to power mini-grids in remote areas, highlighting its potential for positive impact.

Nestled in the tea fields of the Kenyan highlands, our next run of river site is built.

— Gridless (@GridlessCompute) February 10, 2024

Testing begins next week on this 3 turbine, 150kW minigrid. pic.twitter.com/at58YimrgT

Kenya’s energy production company, KenGen, offers Bitcoin mining companies surplus geothermal power to help them meet their energy needs. Kenya is Africa’s top geothermal energy producer, with an installed capacity of 863 MW, most of which KenGen supplies. The country has an estimated geothermal potential of 10,000 MW spread along the Rift Valley circuit.

Suppose KenGen is to reach optimal generation capacity. In that case, an energy-hungry economy will be needed to drive demand, and Bitcoin mining can be the required bootstrapping demand while they ramp up operations.

Ethiopia

The Grand Ethiopian Renaissance Dam, Africa’s largest hydropower dam, has been a product long in the making, and as it starts to generate more power, a lot of that would go to waste as the energy source is not fully integrated and the grid requires several upgrades. This mismatch in energy production and distribution attracted large-scale bitcoin miners from China to co-locate, seeking cheap, renewable energy.

Malawi

Innovative projects like “The African Village Mining Bitcoin” demonstrate how mining can bring electricity to underserved communities. Three turbines were installed in a micro-hydro scheme exploiting the fertile region’s rainfall. By mining Bitcoin, Gridless earns income to sustain the mini-grid and also provides affordable electricity to over 1,800 homes in a local community called Bondo.

Angola

Similar to Libya, information is scarce, but some reports suggest mining activity powered by abundant oil resources despite the country’s less than welcoming stance to Bitcoin.

According to Paulo Araújo, Co-Founder at WiConnect, Angola grapples with a significant challenge: an estimated 40% of its hydroelectric power, or 1400 MW, is lost due to inefficiencies in transmission., which is an opportunity for miners to help with demand response and help monetise one of the countries prized assets.

Local hashers have their work cut out for them.

It’s a tough road ahead for these projects and any others that are brave enough to spin up in this part of the world, as they face considerable challenges.

Energy consumption

Bitcoin mining requires significant energy, and many African countries rely on archaic or detective power stations that don’t get the most out of their fossil fuels. Sustainable solutions are viable in some parts of the continent, but renewable energy has limits, and load balancing is more complex with unreliable energy sources.

The lack of stable, affordable electricity is a major hurdle. Grid access remains limited, and relying on diesel generators is expensive and makes a lot of economic activity less feasible.

Regulation

African countries aren’t exactly leaders in regulation or proactive in providing a solid footing for investment. Having a murky regulatory landscape discourages investment, especially at scale, where it can be most effective.

Infrastructure

African countries don’t only have access to energy or high-speed Internet, and getting specialised hardware to provide these services is hard to come by locally, hindering wider participation. Additionally, grid lines to transport energy, roadways are unreliable, internal rivers aren’t always an option, and even shipping is not even close to international standards, making any operation on the Internet significantly costlier and more complex.

Early stage

The Bitcoin mining ecosystem in Africa is still nascent, requiring time to mature and educate people on how it works, its incentives, and why it might be a viable option. Public awareness and understanding of Bitcoin and its mining process are relatively low, so you’re not going to find many advocating for the introduction of the technology.

Raising awareness and educating people about Bitcoin is essential for wider adoption and responsible use.

The great leapfrogging forward

Those who are bullish on the adoption of Bitcoin despite the challenges look to the examples of tech leapfrogging. Africa has a reputation for technology leapfrogging, which refers to the phenomenon where African countries adopt new technologies rapidly, often bypassing older, established technologies that were prevalent in developed nations.

The most popular example is the mobile-first revolution in tech. African countries had very low landline penetration, but when mobile phones came around, they allowed millions of Africans to “leapfrog” inadequate landline infrastructure and join the rest of the world in using the latest tech and didn’t have any legacy issues to contend with, it was a fresh start, and it grew like wildfire and continues to show growth two decades later.

Miners are keeping one eye on Africa.

Miners are always looking for any advantage in the race for cheaper hash rate and the potential rewards involved, and Africa could be the next battleground. Florida-based Marathon Digital has already branched out to the United Arab Emirates and Paraguay in recent months; it also has its eye on Africa.

We are looking at Africa. We believe that bitcoin mining is, among other things, a technology solution for the energy sector, and Africa may be a great place to prove out this thesis.

Charlie Schumacher, vice president of corporate communications at Marathon Digital – Source: Blockworks

Breaking ground on Bitcoin mining in Africa

While the harsh realities of Africa pose significant challenges, they also present a unique opportunity to test and refine Bitcoin’s potential as a robust and adaptable global currency. By addressing the challenges and harnessing the power of the underlying technology, Bitcoin can play a positive role in Africa’s development, building new industries and improving financial inclusion.

Africa’s potential for Bitcoin mining is undeniable, and as these projects on the continent bear fruit, they could provide examples that attract more investment, improve infrastructure, encourage clearer regulations, and support economic growth on the continent.

Do your own research.

If you want to learn more about mining in Africa, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.

- The African village mining BitcoinThe cryptocurrency can be a liberating force

- Kenya’s Gridless looks to advance Bitcoin mining-power model

- Bitcoin miners flood into Africa

- Image source: Water Alternative Photos