In the ever-evolving world of funnelling digital asset funds from one person’s wallet to another, new token standards emerge constantly; cooking up crypto crack in the kitchen that is GitHub is a lucrative pastime, especially when you get the timing right. As capital flows into the market in anticipation of the Bitcoin havening cycle and new demand from ETF buyers, the price increase only further lubricates the smooth brains in the market.

Brain cells for critical thinking are shut off in favour of the number go up narrative, and developers will throw anything at the wall and see what sticks.

While each token standard claims to solve specific problems or offer unique functionalities, the end goal is the same: how do I transfer funds from retail investor speculation into my pocket and bank that profit for the least amount of effort and marketing costs?

Among these newly branded scam tokens, BRC-404 tokens have piqued curiosity due to their connection to the infamous ETH-404 tokens and their distinct characteristics.

So, buckle up as we delve into the depths of BRC-404, exploring its workings, differences from the norm, and proposed use cases so you and your loved ones can avoid falling for this fractionalised farce.

Before We Begin: A Cautionary Tale

Before diving into BRC-404, we need to look at where this concept gets its inspiration from, and that’s Ethereum, of course, the place where financial engineering goes to breed and spawn all sorts of creations.

ERC-404 is an experimental token standard launched on Ethereum to form a market between ERC-20 (fungible tokens) and ERC-721 (non-fungible tokens). ERC-404 tokens are designed to functionalise assets that are pricing users out of becoming exit liquidity. If you cannot afford a high-priced NFT, or the price moves so high that it cannot be flipped, what will poor minters do?

They cannot just drop the price and obliterate the floor price of an entire collection when they need money or want to exit a position, so what could you do? Take a risky loan against your NFT, or sit on it until the next round of big pocket suckers come around.

Getting bailed out by an NFT collector sugar daddy isn’t the norm, so finding smaller bag holders is the easier option. This is where ERC-404 tokens come in; instead of seeking out deep pockets, you can pick the pockets of smaller traders by selling them on buying a fraction of your NFT, and the token claim would have its own market, hopefully with more liquidity.

It takes a play out of the push for acquiring Satoshis; since owning a whole Bitcoin starts to become nothing more than a dream for most people, getting comfortable with the idea of owning a fraction of Bitcoin will have to become the norm.

Now, instead of blowing thousands of dollars on a monkey JPEG, you can purchase a tokenised claim backed by the market value of that JPEG.

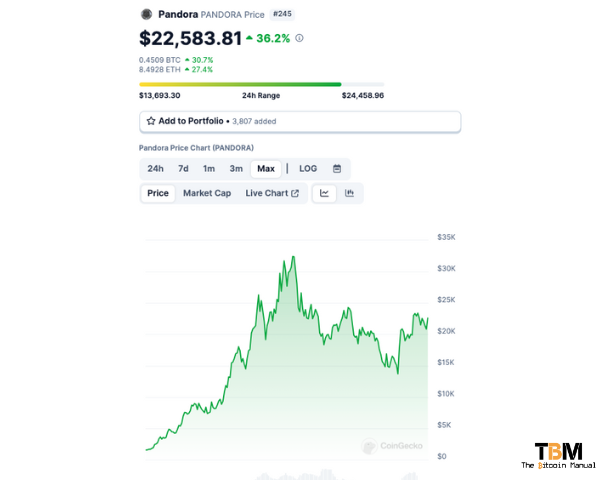

Pandora, the first asset under an experimental Ethereum (ETH) standard, pumped some 12,000% in less than a week on the back of hype and speculation and development teams behind tokens like Monarch and DeFrogs have also bought into the hype, fielding tokens built with the standard and allocating a portion of supply to Pandora holders.

What are BRC-404 Tokens?

When something new generates market excitement in one ecosystem, it’s bound to be replicated in others, so it was only a matter of time before BRC-404 tokens became a term circulating on Twitter. Inscriptions have generated a lot of excitement, debate, fees for miners, and, of course, mountains of metadata stuck on-chain with no one to trade with, and some bag holders are tired of waiting to dump their JPEGs.

The launch of BRC-404 and various iterations like it could help these inscribers who got stuck with a bad deal pension off the responsibility to someone else within a derivative token market. Like ETH-404, BRC-404 has legitimate intentions to suck up as much exit liquidity as possible. It’s a token standard built on the Bitcoin blockchain utilising the Ordinals protocol, but it doesn’t mean it cannot live on other chains and protocols, either.

Since you’re building a secondary market anyway, where the NFT exists should be open to where the tokens are created and exchanged. The early versions could be Ordinal exclusive, with fair mints created on-chain to represent the trading of certain fractionalised Inscriptions shares. Still, those tokens could be bridged into other chains, too, to seek out as much exit liquidity as possible.

🔸MultiBit’s Ordinals Improvement Proposal (OIP-404) aims to define a framework that encapsulates both fungible (BRC20) and non-fungible (Ordinal NFTs) characteristics in a single standard (BRC404), bridging the gap between fungible (BRC20s) and non-fungible tokens (NFTs) within…

— MultiBit (@Multibit_Bridge) February 8, 2024

Proposed use cases for 404 tokens

While still in its early stages, ERC-404 and BRC-404 have nothing going for it apart from speculation that it will have some viable use case in the future. To encourage traders to get involved, some hastily prepared possible users have been put together to provide these tokens with an element of futility.

Improving liquidity

Every year, millions of new tokens are launched, all vying for newcomers’ attention, and the idea many new investors have is that they’re going to diversify. A play that makes no sense if all your buying is hugely correlated and in the same asset class, but hey, having different logos in your wallet makes some people feel good.

404 token issuers would be the beneficiaries of that investment principle as new investors would be encouraged to have a piece of these various projects they would have otherwise been priced out of if these tokens didn’t exist.

Digital Ownership Certificates

The whole real-world asset tokenisation trend is starting to pick up pace again. If you’ve been in the space long enough, you’d likely be annoyed at this narrative since it was debunked ages ago on why a blockchain cannot enforce real-world laws and claims, nor how they solve the oracle problem.

But here we go again, and with 404 tokens, this time, you can be sure someone is going to start partitioning digital art and digital items first and later claim they are splitting up real-world assets for trade. These 404 tokens represent ownership of real-world assets like artwork or collectables by inscribing relevant data onto the token as securities, so I wonder how these issuers will get around that legal hurdle.

Gamification and Metaverse Integration

Creating unique in-game items or avatars tied to a certain game might have had a lower appeal due to certain users being priced out of the market. But suppose a user can accumulate fractions over time to trade those 404 tokens in to claim the NFT item. In that case, gamers might be encouraged to do this instead of avoiding the game altogether.

Additionally, if you can liquidate an in-game item faster, you will be able to use those funds to purchase other game items or move to another game without being stuck with those single-game NFTs.

Personally, I don’t see why you’re playing a game as a possible investment, and I don’t see how adding additional speculation on top of flawed gaming mechanics is going to help you attract a larger user base, but hey, I’m just a boring old boomer coin bro.

404 fortunes will go missing

As Bitcoin moves closer to the $ 50,000 range, and many predict it could double over the next few years to $ 100,000, investors will feel like they missed the bus. Who wants to buy Bitcoin at those prices? Some will consider how much alpha they can get from buying at all-time highs.

So they’ll start to look around, and unit bias will trick them into so-called “cheaper” alternatives, where tokenisation thrives. The fear of missing out (FOMO) and greed are powerful emotions that can cloud judgment and lead to irrational investment decisions. Investors might jump into hyped projects without proper due diligence or hold onto losing positions, hoping for an unrealistic comeback.

Most people invest in cryptocurrencies without fully understanding how they work, the risks involved, or the underlying technology; it’s all about how much I can get in and how much I can get out; the underlying matters very little; it’s all about chasing stories and capital flows. This can lead to impulsive decisions based on hype or misinformation, often with negative consequences.

Navigating the crypto ecosystem can be complex, especially for newcomers, and those who have experience in this space know it; the developers, the VCs, the influencers, and the early bag holders are all playing to get in one noob flows. So, crafting new stories and possible world-changing solutions can get attention and funds flowing in their direction without any merit or proof of work.

Unfortunately, The crypto space is rife with scams and fraudulent schemes, and calling a token a 404 is fitting because the only thing you will lose is the funds you put into any of these projects.

Do your own research.

If you want to learn more about BRC-404 on Bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.