So you’ve heard about Bitcoin mining, and you want to get in on the digital gold rush. You’ve done your research, and you know that it’s a risky investment, but you’re willing to take the chance and set up that ASIC. Maybe you have some untapped power by running home solar, and you want to divert some of that excess that would have been lost into Bitcoin instead.

Perhaps your motivation to mine isn’t purely about monetary gains; perhaps it’s about privacy, and you plan on stacking non-KYC sats instead, then mining does provide an avenue for that too. By mining Bitcoin, you not only acquire KYC-free Bitcoin, since you’re getting paid directly from the block subsidy, but you also get some virgin Bitcoin without a track record in addition to the satoshis you net from the fees that make up the block reward.

Mining for KYC-free Bitcoin can also be a more hands-off approach to increasing your private stash since you only need to ensure your miner is up and running and sending hashes. It can save you a lot of time wasted trying to mix and match deals on various P2P exchanges and dealing with the premiums traders slap on their capital.

Bitcoin mining is a competitive market where you compete with miners from all over the world, all with different size setups, different ASIC models and different input costs. If you’re trying to compete as a solo miner, you’re one brave soul, or you’re willing to burn electricity to play the lottery every 10 minutes.

As a miner looking to maximise the possible returns of the hashes you produce, your incentive is to pair up with miners in a pool.

What is a Bitcoin mining pool?

A Bitcoin mining pool is a group of Bitcoin miners who combine their computing power to increase their chances of winning Bitcoin rewards. When a miner successfully solves a Bitcoin block, the reward is split evenly among all the miners in the pool based on the proportion of hash rate contributed.

Bitcoin mining is a computationally intensive process that requires specialised hardware and a lot of electricity. Individual miners often have difficulty competing with large mining farms, which have more resources at their disposal. Mining pools allow individual miners to pool their resources and receive a regular income they can use to gauge if their operations are worthwhile or not.

Mining pools turn your hash rate from a lottery ticket for an entire block reward into getting paid a fair market rate for the hash rate you commit to the network. There’s an obvious financial incentive to join a mining pool, and different mining pools compete with one another for miners.

They compete through the fees they charge miners and the value-added services they provide to miners, such as support, access to a network of resources, regular and quick payouts and more.

Bitcoin mining pools act as intermediaries and hash rate brokers for the network, and while they provide a vital role in optimising the resources committed to the network, they are subject to centralising forces and regulation, depending on where the mining pool is geographically situated.

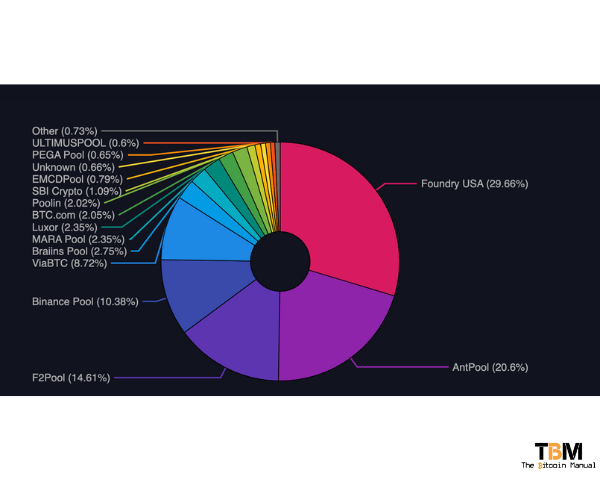

| Rank | Pool |

|---|---|

| 1 | Foundry USA |

| 2 | AntPool |

| 3 | F2Pool |

| 4 | Binance Pool |

| 5 | ViaBTC |

| 6 | EMCDPool |

| 7 | Luxor |

| 8 | MARA Pool |

| 9 | SBI Crypto |

| 10 | Poolin |

| 11 | BTC.com |

| 12 | Unknown |

| 13 | Braiins Pool |

| 14 | ULTIMUSPOOL |

Why Bitcoin Mining pools are pushing for KYC?

A miner can select from any competing mining pools, but they need to consider the conditions of each pool since individuals give up some of their autonomy in the mining process. Miners are typically bound by terms set by the pool itself, which may dictate how the mining process is approached.

As mentioned earlier, mining was traditionally a way to earn KYC-free Bitcoin, but these avenues are starting to erode with time as large-scale miners come online. When companies raise massive amounts of money, they don’t want to take unnecessary regulatory and operational risk. Because these operations require enormous startup costs and tie themselves to a specific location, they have very little choice but to comply with regulators.

The idea of KYC is one conditional creep that has moved from exchanges to miners. KYC (Know Your Customer) is a process that requires individuals to provide personal information, such as their name, address, and date of birth, in order to open an account or participate in certain activities.

KYC requirements are used to erode the privacy of all miners who join a pool under the guise that these processes will prevent money laundering and other financial crimes and ensure that miners aren’t processing transactions that regulators don’t like and can be used as a measure of control over how blocks are compiled.

The cons include:

- Loss of privacy: KYC requirements require individuals to provide personal information, which can be a privacy concern.

- Increased fees: Some pools charge fees for KYC verification.

- Decreased flexibility: Miners in a pool may have less control over how their Bitcoin is mined and spent.

- Self-censorship: Miners might have to exclude certain transactions from blocks to remain compliant

- Lower returns: If “tainted” transactions pile up and generate a healthy return in fees, KYC-compliant miners will have to miss out on those profits.

Ultimately, the decision of whether or not to join a KYC mining pool is a personal one. There are cons, but if you’re a public mining company, you are likely forced to take the regulated path.

Considerations when joining a mining pool

When choosing a Bitcoin mining pool, it is important to consider the following factors:

- The pool’s fee structure: Some pools charge fees for mining, while others do not.

- The pool’s hash rate: The hash rate is a measure of the pool’s computing power. A higher hash rate means that the pool is more likely to solve Bitcoin blocks.

- The pool’s payout policy: Some pools pay out miners immediately, while others payout miners at regular intervals.

- The pool’s reputation: It is important to choose a pool with a good reputation.

- The pool’s customer support: It is important to choose a pool with good customer support.

Why are KYC mining pools such a big deal?

A possible issue with KYC mining pools is that governments have a single target to put pressure on miners to comply with restricting certain transactions, like the way we’ve seen Ethereum validators push for more OFAC-compliant blocks.

KYC also creates a list of businesses and individuals governments can target should they turn hostile towards Bitcoin. Even if regulation imposed on mining pools becomes too onerous, miners can leave and point their hash rate to another pool, but the record of their personal information tied to their history of mining and income remains.

Statist cucks. Don't do this, kids. Your hashrate matters. Send it only to pools that deserve it. https://t.co/E05Gxosv3e

— Giacomo CISA-gang-member Gatekeeper Zucco⚡️🌋🧀💀 (@giacomozucco) August 10, 2023

Do your own research.

If you want to learn more about mining pools, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.