Bitcoin and its ever-expanding ecosystem are all about taking back control over your finances. You can have as much or as little control as you like, and you can scale it up or down as you learn and become more comfortable with the technology.

One of the biggest improvements to bitcoin has been the launch of the second layer known as the Lightning Network, which offers users cheaper fees on transactions, instant settlement, and a little more privacy when used correctly.

Starting on lightning can seem complicated at first, but the best way is to jump right in, find a wallet you like and play around with small amounts of bitcoin, known as satoshis.

Once you’ve got yourself a Lightning wallet and you want to fill it with bitcoin. To keep with you, to spend, or to try out the cost of Lightning Network-enabled apps that are popping up all over the place. You could use a Lightning-enabled exchange, but you would have to KYC.

If you don’t want to hand over your data for a few hundred bucks to get started, or you hate the idea of exposing your private information, there are options available to you.

Maintain your privacy with bitcoin

It’s okay; many bitcoins don’t agree with it too, which is why there are workarounds to help you avoid the creep that is KYC. You’re not doing anything wrong by acquiring KYC-free bitcoin, don’t feel like you’re on the run or you’re some shadowy super coder; that’s what governments want you to think. They want you to feel like you’re doing something illegal, that you’re funding terrorism or money launderers.

They use these hyperbolic situations to scare you away from exercising your right to financial privacy and push you into their walled garden of KYC.

What is considered KYC bitcoin?

Any bitcoin that you acquire where the exchange could only be concluded once you’ve provided some form of identity is considered KYC bitcoin. When you purchase KYC bitcoin, you’re creating metadata that chain analysis companies and governments can acquire, overlay that with the data on the public bitcoin blockchain and keep track of your funds.

Additionally, KYC bitcoin can be used to:

- Track your spending habits

- Prevent you from using other regulated services

- Confiscate your bitcoin

- Come after you for tax liabilities

- Generally know more about you than they should

What information will I have to provide?

Certain exchanges are centralised entities; these are businesses that assume liability for funds, both fiat and bitcoin. They control the funds and then meet the redemptions customers request as they remove funds from the exchanges pool of funds. When you a centralised entity, you are required to identify your customers by law.

To buy bitcoin from a KYC exchange, users must provide personal information. How much you need to supply varies from one region and exchange to another, but most of them will require one or a few of these personal details.

- Name

- Address

- Phone number

- Drivers license

- Government ID

- A selfie holding a piece of paper with the name of the exchange and the date

- A video call with the exchange

Having your identity tied to your bitcoin can come with considerable risks, the most obvious is that the exchange knows how much money you have, and if that data is leaked, your wealth is compromised and your safety. Keeping your wealth a secret is your right, but like any right, it’s something you need to exercise.

Lightning vouchers

Lightning vouchers are a method of turning cash into a voucher code that represents a certain fiat value. Once you have the code, you need to exchange it with a service provider, and in return, you would receive bitcoin. If you’ve ever purchased pre-paid airtime, data bundles, or electricity, you’ll be familiar with the following process. Using a bitcoin voucher allows you to turn cash into a voucher code and then into bitcoin without ever needing to provide your identity in the process.

Step 1

Find a local vendor that sells either Azteco or 1ForYou vouchers for cash and purchase a voucher value of your choice. If you’re unsure about where to find a vendor, use the Azte.co site or do a search for vendors in your area.

Step 2

Once you receive the voucher, it should contain a 16-digit pin code. Your next step is to head over to your phone and open your web browser.

Step 3

Type http://azte.co in the URL bar and type the pin in the boxes on the homepage.

Step 4

The Azte website will generate a lightning network receipt that you can scan with your favourite Lightning Network wallet. Once you scan the QR code, click receive on your wallet, and the funds should deposit into your bitcoin wallet immediately.

That’s it, as simple as a steak and kidney pie, you turned your Rands into Bitcoin in less than 5 minutes.

P2P LN purchases

If you don’t have a lightning voucher vendor near you or you prefer to conduct orders on online P2P markets, you have two options when it comes to Lightning.

Hodlhodl

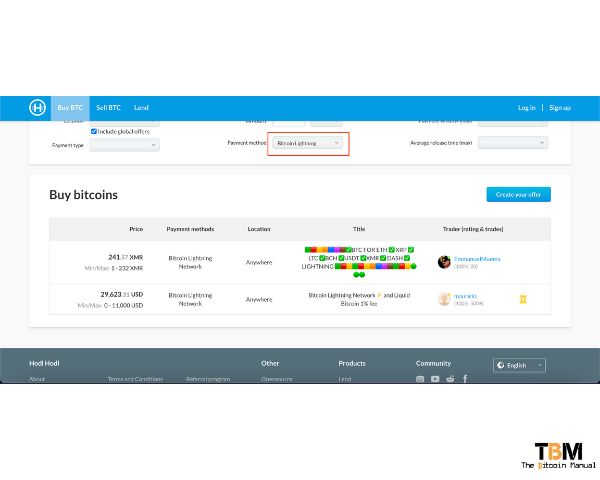

HODL HODL is a peer-to-peer exchange which means users trade directly with each other, and the site hold users’ funds. When making a trade, funds are locked in multi-sig escrow instead. This minimises the possibility of theft and reduces trading time, both very cool features.

All you would need is an email address; once you’ve signed up to the platform, search through buy orders willing to trade on the Bitcoin Lightning Network by using the filter system. Once you find a willing seller, place an order with them and provide the LN-URL or Lightning Address to settle the trade.

If you’re looking for a step-by-step tutorial on how to get set up buying bitcoin or placing orders for bitcoin on HodlHodl, then check out the video below.

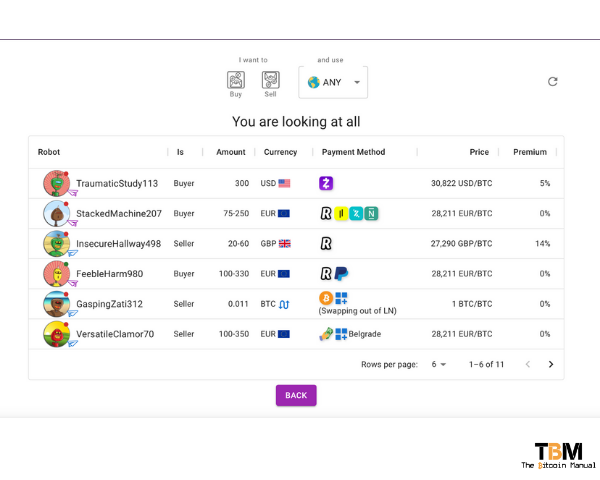

Robotsats

Note: The URL will not work in a standard browser; you will need to use a Tor browser to access the site

Robosats are named after the robot avatar a Bisq clone that focuses on lightning support and provides a web interface. Market makers create offers to buy or sell bitcoin and name a payment method and a spread. Takers check the list of offers and take ones that appeal to them. Both parties put up 1% of the trade as collateral which they get back at the end of the trade if all goes well. Robosats uses hodl invoices and cancels the collateral payment at the end of the trade.

Trades have a time limit of 6 hours.

Buyers and sellers have a rating system, and there is a no-login-required setup where a new identity is generated for users every time they go to the site. However, to maintain this level of privacy, the identity is tied to a password-like string that the site gives you. Users can optionally restore an old identity by typing it into a box on the homepage so you can maintain your ratings from previous orders).

If you’re looking for a step-by-step tutorial on how to get set up buying bitcoin or placing orders for bitcoin on Robotsats, then check out the video below.

Buying non-KYC bitcoin is expensive

Before you run off and try to acquire KYC-free bitcoin, know that these methods come at a premium. Since these service providers or individuals don’t have the backing, liquidity, and volume of centralised exchanges, they cannot reduce the fees they charge to what you may be used to buying from a regulated entity.

These vendors and individuals are looking to make a profit on the trade and will set their markups according to the risk they feel they are taking, selling to strangers on the internet.

Instead of paying with your privacy, you will pay a premium above the current market value to acquire a bitcoin not tied to your identity. These premiums can be as low as 3% to as high as 20%, so make sure you’re ready to pay a little extra when using these methods.

Do you stay KYC-free?

Do you purchase KYC-free bitcoin regularly? If so, what method do you use? If there are any other tips and tricks we didn’t mention, let us know in the comments below, we’re always keen to hear how bitcoiners stack their sats privately.