Bitcoin is lauded for its decentralisation and security, but these qualities come at a cost. You can’t have the hardest money in the world, providing global settlement reliably for over a decade, without dedicating considerable resources to it.

While Bitcoin secures well over a trillion dollars in value and settles billions in transactions daily in exchange for the energy the network consumes, that energy has always been a target of criticism, particularly regarding its environmental impact.

One of the most significant FUD points surrounding Bitcoin is that it uses as much energy as some countries; the network’s annual energy consumption is often compared to countries like Sweden and Argentina as a benchmark.

Comparisons will become outdated as the network attracts more miners and existing miners expand their operations. Bitcoin uses a lot of energy; that’s a fact; it will continue to use a lot of energy and even strengthen its energy demand.

If you think that Bitcoin is useless, no amount of energy consumption would be suitable, and by all means, take that stand, but you have to face the economic reality that Bitcoin miners are paying for the energy they use; it’s not as if they’re getting it for free.

Like any other industry, miners compete for resources and pay the market rate for energy in that jurisdiction; if they are priced out by other economic activity, miners will need to pack up and source cheaper energy sources, or they could roll the dice and try to operate at a higher cost.

If the miner miscalculates operational costs, it’s tickets, and they’ll be out of business.

Bitcoin, the ocean-boiling blockchain

Bitcoin energy demands stem from the complex validation process, with miners receiving rewards in newly minted Bitcoin and transaction fees in each block. Miners pay the upfront cost for the energy they use and hope they’ll earn enough Bitcoin to cover their investment and any future expenses.

The network’s energy use has generated some comical interpretations, such as A Nature Climate Change paper arguing that Bitcoin emissions alone could push global warming to above 2°C.

In 2022, environmental activists Green Peace, funded by Ripple Labs, launched a “change the code” campaign aimed at encouraging the Bitcoin community to replace Bitcoin’s proof-of-work consensus mechanism with the less energy-intensive proof-of-stake model employed by Ethereum, but that call fell on deaf ears.

Another meme-able moment in the climate war on Bitcoin came from a story published by the BBC, citing research by Alex de Vries of Vrije Universiteit Amsterdam, claiming that every Bitcoin transaction uses, on average, enough water to fill “a backyard swimming pool.

Clean mining the dirty coin

Miners are focused on their bottom line. They’re actively seeking out cheap and reliable energy sources to compete in this global game of producing the cheapest hash rate. In some cases, hydrocarbons are the preferred source of energy; in other cases, miners have colocated with what is categorised as renewable energy, such as wind, solar, or hydroelectricity plants.

There has been some debate on the “greenness” of the network, with CoinShares Research estimating that 74.1% of mining energy comes from renewables.

On the other side of the digital coin, the University of Cambridge found that only 28% of the energy used for Bitcoin mining comes from renewable sources.

The Greenwashing of Bitcoin

PayPal, the online payments giant, has sent ripples through the cryptocurrency this week with a proposal for an eco-friendly Bitcoin mining system. But before we celebrate Bitcoin going green, let’s unpack the facts and separate truth from fiction.

News outlets are abuzz with sparse reports of PayPal’s alleged plan to develop a sustainable Bitcoin mining solution to usher in a new incentive structure to reward “green miners”.

Basically, PayPal, Energy Web, and DMG Blockchain Solutions have had their “I’ve heard about Bitcoin and are here to fix it” moment.

Fiat incentives versus Bitcoin incentives

The program identifies so-called green miners who use clean energy or have a limited impact on energy grids, as defined by the platform Energy Web.

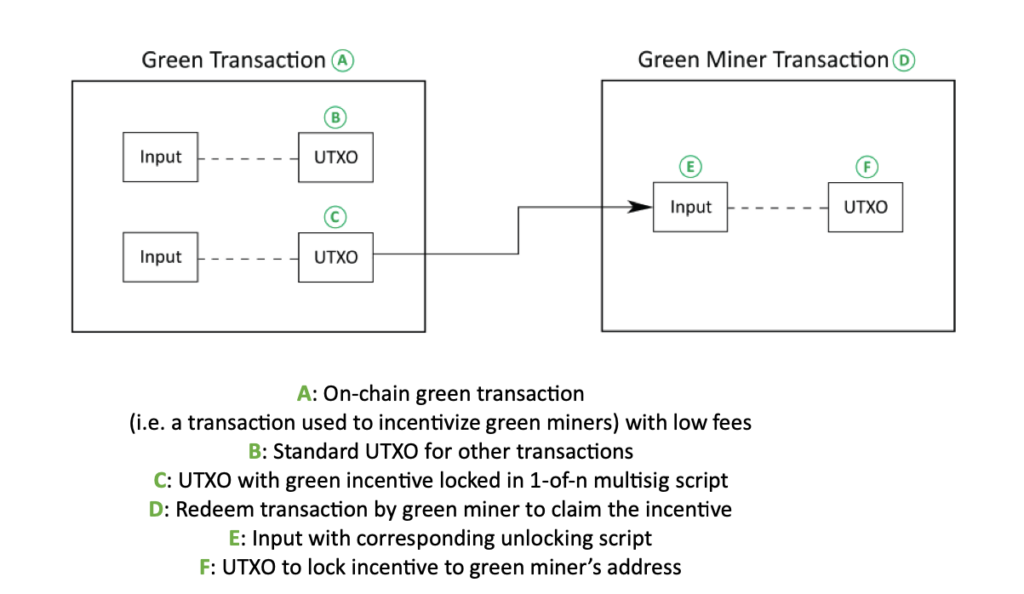

Once they have been whitelisted or rather greenlisted, these Green miners’ would generate keys that will give them special privileges, allowing miners to claim additional Bitcoin rewards using their “green keys.”

I would assume participating exchanges and wallets would virtue signal to users to use the “Green” transaction, which would broadcast these low-fee transactions to the mempool. While any miner could pick up these transactions, the idea is that competitive miners will ignore them, making them more appealing for green miners, who would compile these low-profit blocks and transfer those funds into the green multi-sig.

As funds fill up the multi-sig, these green miners could claim a portion of the funds based on their contribution to the total supply.

The report draws a parallel between the program and an ‘indirect grant’ system. In this context, it’s like providing a financial benefit to Bitcoin miners who use cleaner energy, indirectly incentivising sustainable practices.

The report does not give a specific amount for the “subsidy,” only saying the green miner multi-sig would contain “some bitcoins.” So, where do the subsidies come from?

The same place the yield in crypto comes from, I suppose.

Paypals' new green scheme makes no sense. It wants miners to pick low value fees (uneconomical) & some benevolent entity (tbd) will give them a subsidy to make up for it

— MAGS 🔑⛏️🚒 (@Crypto_Mags) April 23, 2024

Bitcoin doesn't need wonky schemes, miners are already building renewables & cutting methane & toxic waste pic.twitter.com/pTzzP87Zwl

A proposal with the possibility of snowballing

A proposal doesn’t guarantee a finished product. Even if PayPal’s green mining plans don’t come to fruition, the filing signifies a growing awareness of Bitcoin’s environmental impact and possible use as an attack vector against the network.

Even if the proposal makes no sense for miners economically, it could encourage other players in the cryptocurrency space to advocate for it; if you can make Bitcoin the enemy and present your altcoin as a solution, why wouldn’t you?

Additionally, larger miners, such as publicly traded companies, might come under pressure if this idea gets any traction; if regulators and governments push these bad ideas as part of operating in a certain jurisdiction, some miners might have to bow to these rules or pick up and move somewhere else.

Can PayPal pull it off?

If PayPal is serious about this green mining pitch, it will face significant challenges with a proposal like this, and I don’t think it stands up to any scrutiny in the wild.

Developing a scalable and efficient renewable energy-powered mining system is challenging; we’ve already seen other projects attempt to build in green incentives like the Sustainable Bitcoin Certificates carbon credits market.

Green initiatives sound good on paper and appeal to our emotional side. Still, economic reality, especially in a network like Bitcoin, will quickly dispel ideas that could be more financially sound. A proposal must be cost-effective to compete with existing mining operations. What would be the point of promoting an inefficient form of producing hash rate?

The Future of Green Bitcoin

The path towards eco-friendly Bitcoin mining is long and complex. It should be allowed to develop where stranded or cheap energy can be unlocked, not due to 3rd party subsidies or forcing miners to be altruistic.

Even if miners were to bow to pressures and more miners turned to renewable energy sources, it would likely never please the Greens; there would always be something wrong with Bitcoin.

PayPal’s rumoured proposal might raise eyebrows, but I highly doubt it will get off the ground. Mining is a ruthless game, and if you actively add any level of inefficiency to your setup, you are sure to see your operations shut down as other miners outcompete you over a long enough time frame.

There is nothing particularly wrong with green energy; it can definitely form part of the Bitcoin energy mix if and when it makes economic sense for the miner and the energy producer. Adding borked incentives is not going to improve the adoption of onboarding green energy; in fact, proposals like this would likely end up achieving the opposite result.