Bitcoin continues to grow from strength to strength, and as it grows, so too does the competition for the monetary premium headed its way. Bitcoin is a black hole for the current misallocation of resources. As it sucks in more and of the worlds purchasing power, we see parasites hanging off it, trying to divert some of that value into their ecosystem.

Since Bitcoin is such a nascent asset, it’s easy for people to confuse it with the rest of the so-called digital asset market. It takes time to learn why Bitcoin stands alone between all other coins, and these other tokens have a vested interest in obfuscating the truth. These other digital assets have a financial incentive to lie to you and take advantage of naive investors.

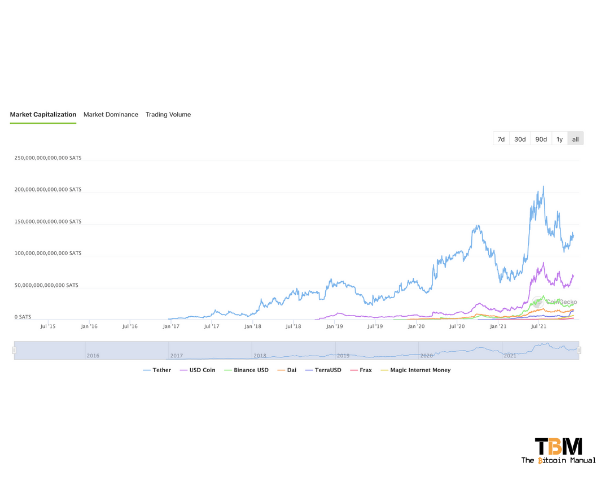

It’s a big business, and business is booming, but as Bitcoin continues to reach new heights, it trends to decouple from the performance of these tokens eventually. Bitcoin’s superior monetary policy ultimately shines through over a long enough time frame, and you’ll notice how all these other tokens constantly lose value when measured in satoshis.

Shitcoin apologists will never speak about these facts and instead focus on the US dollar value of their token versus Bitcoin. One of the ways in which the altcoin market has been able to juice its value and try to keep pace with Bitcoin is through the launch of stablecoins.

Stablecoins are funding DEFI.

Investors, both retail and institutions, are desperate for yield, and in their desperation, they are turning to digital casinos, but these casinos require liquidity. So to attract liquidity, the idea of stablecoins was birthed; instead of trying to convince people to buy 1 of 1000 coins, you can get them to get a digital representation of their current money.

The value is pegged one to one, but it now has a wrapper compatible with casino, I mean DEFI on-ramps and off-ramps.

Yes, stablecoins serve a purpose.

Sure, I am being a little hyperbolic, and I do understand that stablecoins do solve a big problem. We still live in a fiat world, and with so many countries living under double-digit inflation, their native currency is hardly a means of preserving wealth. The loss in purchasing power of these currencies increases the demand for dollars offshore. When physical dollars and Eurodollar facilities aren’t available, stablecoins naturally provides an excellent alternative for people in many countries.

In addition, the one to one oversight over stablecoins is hardly as evasive as the current banking system. All you need to do is spin up a wallet that can interact with a chain that has stable coins, and you’re good to go. There is no need for ID’s and dealing with institutions providing lower barriers to entry.

The lack of institutional oversight with stable coins also that you can access your money at any time. You can avoid sanctions and other local transaction laws that would be enforceable through permissioned services.

Stablecoins are pegged to the inflation of the asset they represent.

Stablecoins offer an alternative to banking services and remittance payments; it’s by no means a store of value. Despite the US dollars relative strength, the currency continues to lose purchasing power, which is not about to change anytime soon. Stablecoins are merely tokens that represent dollars and therefore inherit the purchasing power qualities of that dollar.

As US monetary policy focuses solely on debasement to ease their debt burdens, the purchasing power of your stablecoin erodes along with it. While retail banks may not control what you do with your stablecoins, central banks can surely make your stablecoin usage far less lucrative.

Stablecoins are fragmented.

When it comes to fiat, sure, you get different mediums, be it credit, cash, debit cards or loans; the asset it represents is the same. In most cases, they are pretty fungible. As long as you have 1 dollar in a particular medium, it should be accepted for purchase or swap toward another medium.

For example, I could spend on my credit card and pay my credit card back with cash, whether physical or digital cash.

In the stablecoin market, it can get pretty complicated since there are several issuers of stablecoins, all with their own markets. There are stablecoins like

- UST

- USC

- Gemini Dollar

- Binance USD

- TrueUSD

- And many, many more.

Depending on where you are in the world, you may only have access to one stablecoin over another. This can add to complexity when trading with individuals and merchants. Sure they all represent 1 dollar, but it could be a pain for someone to accept a stable coin they don’t usually use or add the onus on one party to convert their stablecoin to another version.

Stablecoin conversions will also depend on markets for the stable coin if there are swap lines available, and who wants to deal with that?

Another layer of complexity is that stablecoins are blockchain agnostic; you can find USDT (Tether) on more than five different blockchains. Now depending on the chain, I prefer, this may cause conflict. Yes, we both have USDT, but the chains don’t talk to one another, and again, one party will need to pay the cost of swapping to another chain.

These cross-chain swaps can add unnecessary cost and friction when conducting transactions.

Stablecoins can offer a negative return.

Now some stablecoin fans will point to the fact that you can earn a yield on the way higher than anything you can get in the traditional markets, and that is true. We’ve seen platforms desperate to attract liquidity offer up to 10% APR for supplying stablecoins.

However, these rates are teaser rates and aren’t long-term sustainable. The more people pile in, the lower the return will become with time. As the yield decreases and annual monetary debasement increases, that margin you once could capture erodes.

Sure, you may make additional dollar units, but you will fail at maintaining purchasing power parity over time.

Stablecoins carry third party risk.

Just because an asset exists on the blockchain does not mean it has no counterparty risk. Stablecoins are not Bitcoin, which is digitally native. Stablecoins receive their value from either the backing of the central entity that holds dollars or, in most cases, dollar-based assets in their treasury.

If you hold this type of stablecoin, you’re at the mercy of that company; if they are to go bust or can’t honour redemptions, those tokens you have could be worth a lot less as market participants rush to get out.

The other type is algorithmically backed stablecoins; these fancy computer jargon terms mean they lock up other tokens at a certain minting ratio; let’s say it’s 50%.

You would lock up a token, and then you could access 50% of its value in stablecoins. In this case, you’re trusting a smart contract on a chain that is pretty much centralised, to begin with, so you’re at risk of the smart contract, the smart contract issuer, the assets used to rehypothecate the stable coins and the chain.

That’s a bunch of risks you’re taking on right there.

Stablecoins carry a tax burden.

Another reason why shitcoiners love stablecoins is the ability to lock in profits, they can play these trading games on various chains, and when they are done, they can lock profits with a stablecoin. The issue here is that once you convert to and from stablecoins, you’re creating taxable events.

Many novice traders will find that those juicy profits they locked in are far less than they thought once the tax bill comes due, while Bitcoin hodlers will remain untouchable with their CAGR.

Stablecoins can be censored.

Stablecoins are permissionless, you don’t need any ID or KYC to use them, but it doesn’t mean they are uncensorable. Stablecoin contracts can set a blocklist of wallet addresses, and if you’re wallet address lands on it, those balances are now out of your control.

Sure this risk is more familiar with the regulated stablecoins as authorities can put pressure on the token issuers, but it doesn’t mean algorithmic stablecoins are untouchable.

In 2020 alone, Stablecoin issuer Tether blacklisted 40 wallet addresses holding millions of dollars of the tether cryptocurrency, 24 of which were banned this year. This finding follows the Centre Consortium taking a similar action due to a request by law enforcement.

Stablecoins are subject to regulation.

Stablecoin issuers are currently running on the fringes of the financial markets and can conduct business in this grey area as they grow their market share. The size of stablecoin markets won’t slow down anytime soon, and as it grows, so will the pressure to have them regulated.

The US is still dragging its feet as well as other countries. Still, as these tokens continue to grow and allow capital to sit outside their oversight and a look at the possible tax revenue from it, you can be sure regulation is coming.

Your stablecoin may be free-range dollars now, but they’re going to become factory-farmed dollars shortly.

Stability is merely a fiat concept, it’s not practiced

The idea of a stable currency comes at a cost; sure, the currency is stable in terms of relative purchasing power for a period where you can adjust to it. But it would help if you considered the cost; each year, you’re purchasing power erodes, so yes, it’s “stable”, making it easier to price goods and services, but its value erosion creates instability elsewhere.

The trade-off for relatively stable pricing is creating instability that is far worse than fluctuating prices.

The stability of a currency is also pretty much a privilege of developed nations like those using the US Dollar, Euro, AUD, CAD and the like; the rest of the world’s currencies are far from stable. These larger currencies offshore the instability to these developing currencies, and stable coins are no different.

Bitcoin is the true stablecoin

Yes, Bitcoin is volatile, but it’s only because it’s still moving through its monetisation phase and emerging as a currency and unit of account. As more people own it as purchasing power prefers its safety, the amount of value needed to move the relative purchasing power of Bitcoin will be higher and higher.

The volatility will then reduce, and you will see Bitcoin become more stable as a means for purchasing goods and services without giving you or the local shopkeeper a math lesson.

One satoshi will always be one satoshi, the number of goods and services it buys you will change around it, and I hardly see that as a bad thing.