The Bitcoin Lightning Network (LN) has emerged as the most promising solution to Bitcoin’s scalability issues. It’s the only layer two offering unilateral exit and multiple implementations that anyone can run on their node without too much hassle. This peer-to-peer network enables faster and cheaper transactions, making it ideal for everyday micropayments.

The Lightning Network lets any user commit a UTXO as collateral and then spend or receive those funds using a mechanism different from the base chain. Lightning’s main purpose is to help offload transactions to an off-chain environment and support transactions that would not be practical or priced out of the base chain.

Although Lightning can be added to other blockchains, it has yet to gain traction outside Bitcoin, probably because none of those other blockchains have issues with demand for their block space.

Lightning also allows for a lot more programmability and flexibility.

But what about integrating stablecoins – cryptocurrencies pegged to a fiat value like the US dollar – onto the LN? The reality looks like it is creeping ever closer with LND, an implementation of the Lightning, managed by Lightning Labs, who are finalising work on their Taproot Assets protocol (Formerly known as TARO).

⚡️ @starkness , CEO of @lightning, announced progress on bringing #stablecoins to #Bitcoin via the Taproot Assets protocol.

— Satoshi Club (@esatoshiclub) May 9, 2024

Stark demonstrated the first asset transaction on the Lightning Network, aiming to integrate crypto dollars and other stablecoins directly on Bitcoin. pic.twitter.com/Xk12E52Gtd

Why the push for Stablecoins on Lightning?

Lightning Labs is focused on building this protocol and hoping asset issuers support it, so we have to wait and see if the likes of Tether and Circle bother to spin up nodes, run Taproot Assets, and start to issue tokens on this layer.

So what’s in it for them?

The introduction of stablecoins on the Lightning Network (LN) has the potential to expand its market in a few ways significantly:

- Increased User Adoption: Stablecoins eliminate the concern of price volatility that plagues Bitcoin. This could attract new users who are interested in the benefits of LN (faster transactions, lower fees) but are hesitant due to Bitcoin’s fluctuating value. With stablecoins, users can transact with a more predictable value, making LN more accessible for everyday purchases.

- Reaching New Use Cases: Stablecoins bring a unit of account for the masses; it allows users to easily conduct commerce pay bills, buy groceries, or even top up their phones with instant settlements and minimal fees. These use cases, common in the traditional financial system, become more feasible with stablecoins on LN.

- Merchant Integration: Businesses are more likely to adopt LN if they can accept payments in a stable currency. This eliminates the risk of price fluctuations for them while offering faster settlements compared to traditional credit card transactions.

- Expanding the LN Economy: A broader user base and a wider range of use cases will lead to a more robust LN economy, which could attract further development, investment, and innovation within the LN ecosystem.

This could generate more excitement and enthusiasm for Lightning, which in turn leads to funding and business partnerships for Lightning Labs.

“The stickiest users have been those looking for a stable store of value. In some cases, they’re using Bitcoin. In other cases, they’re using stablecoins, and in some cases, it’s a combination of both.”

Lightning Labs CEO – Elizabeth Stark

Pros of LN-USD

- Faster settlements: Imagine buying a cup of coffee with a Stablecoin on LN. Transactions would be near-instantaneous compared to Bitcoin’s on-chain settlements, significantly improving the user experience for the normie. This could give them a taste of Lightning and encourage them to explore more of what Lightning has to offer.

- Reduced fees: LN’s micropayment channels could significantly lower transaction fees for everyday purchases, making it feasible for smaller transactions that wouldn’t be viable on the main Bitcoin network. Stablecoins might be cheaper than banks, but on Lightning, it would take those fees down to fractions of a percentage point.

- Enhanced use cases: Stablecoins eliminate price volatility concerns, potentially opening the LN to a wider range of use cases, like paying bills or buying groceries, in a unit of account people can understand.

- Encouraging exchange support: Exchanges have largely ignored Lightning because it keeps Bitcoin in their clutches. However, Stablecoins and the possibility of commerce might be enough to enable Lightning support and bring more liquidity to the network.

- Matching settlement speeds: Bitcoin on the Lightning Network settles nearly instantly, and no blockchain or fiat on-ramp can come close to this level of settlement, causing delays when exchanging value. Having Stablecoins on LN rails allows users to move between the two at the same speed.

Cons of LN-USD

- Technical Hurdles: LN channels require users to commit upfront capital to create a channel and require you to manage your inbound and outbound capacity; how will this be managed for users who want to receive and send stablecoins but have no Bitcoin?

- Philosophical Conflict: A significant concern arises when stablecoins, often reliant on centralised entities to maintain their peg, introduce a centralisation layer that contradicts Bitcoin’s fundamental decentralised ethos.

- Limited Liquidity and switching costs: Not all stablecoin liquidity is created equal, and without bridges allowing users to swap their stablecoins or platforms supporting Taproot assets, this version of stablecoins might not go anywhere.

- KYC/AML Integration: Regulators are more likely to scrutinise transactions involving Stablecoins due to money laundering and terrorist financing concerns. This pressure could lead to the integration of KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures on the Lightning Network, compromising its anonymity. We’ve already seen the creep of KYC into Lightning with protocols like UMA and Amboss’s latest OFAC compliance toolset; bringing Stablecoins into the equation could fuel this fire.

- Potential for fracturing issues: A surge in stablecoin transactions on the LN could lead to the network fracturing, as KYC nodes will choose to exclude routing to non-KYC nodes and vice versa.

Stablecoins within the Bitcoin ecosystem

While the idea of stablecoins on Bitcoin has promise, considering the size of the market today, history says something completely different. Past attempts at bringing stablecoins into a Bitcoin ecosystem haven’t had much success.

Tether (USDT) on the OMNI layer, a Bitcoin scaling solution, was one of the first methods of issuing USDT, yet it failed to gain traction. Ethereum dominated the space, while TRON has carved out a niche for itself as the poor man’s Tether chain.

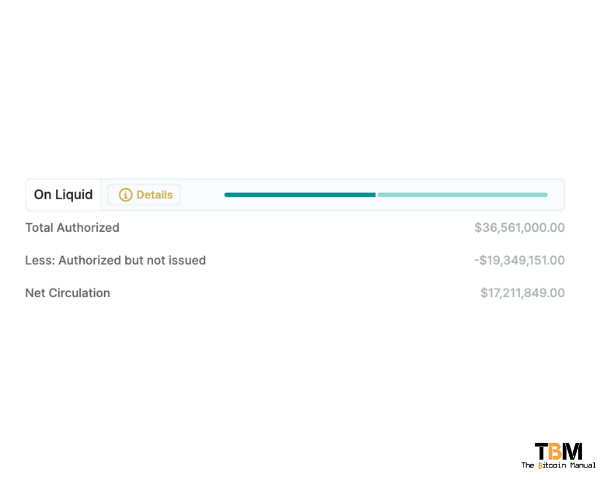

Another attempt in the Liquid Network is still around, but the issued L-USDT makes up less than 1% of the total circulating supply.

Are stablecoins the trojan horse towards KYC nodes?

There’s a possibility that Stablecoins could indeed incentivise the adoption of KYC nodes on the Lightning Network. With all this drama centred around money transmitters and who is allowed to be one, Stablecoins hand regulators the club they need to bash node runners over the head.

When Lightning was Bitcoin only, you could argue that you were routing data based on an underlying digital commodity. However, bringing USD into LN raises the argument that nodes engaged in international money transfers require onerous regulation to ensure they are not laundering money.

Regulators are increasingly scrutinising stablecoin issuers due to concerns about money laundering and terrorist financing. Suppose stablecoins become widely used on the Lightning Network, the regulatory pressure might extend to the Network, requiring specific nodes to be blacklisted and forcing nodes to break ties, changing the topology of the Network.

The Verdict: Fiat around and find out

Stablecoins have already proliferated on other chains, and despite the low switching costs for the user, it doesn’t mean users will move toward using Lightning overnight. Saving on fees is not always enough of an incentive for users to break from a network that works for them. Besides, a lot of the appeal of stablecoins is that they are a stop-gap to trade in and out of Ponzi tokens, something Lightning cannot provide.

Issuing stablecoins on the Lightning Network holds immense promise for faster, cheaper, and more user-friendly transactions, but at what cost? Once you invite the dollar into your home, this blood-sucking vampire begins to go to work, sucking out as much liquidity and freedom as it can from you.

Lightning will likely have to deal with that, too.

Stablecoins bring significant regulatory hurdles, and potential centralisation concerns remain a concern for any Lightning node user and create misaligned incentives when deploying liquidity. We’ve never had another asset running on Lightning before, so we don’t know how the network will react and how routing will work.

Sure, Stablecoins could make it easier for people who hold dual balances in their Lightning wallet to access dollars and pay for goods and services in a unit of account they are comfortable with, but Stablecoins could become more troublesome than they are worth. They begin to detract from Lightning’s true focus, which is improving Bitcoin scalability while maintaining or improving user privacy and sovereignty.