In simple terms Bitcoin is a shared database that is checked by all nodes on the network and any new entry needs to meet certain conditions before a node is willing to add it to the existing shared database. On the surface, Bitcoin can look like a chain of time-stamped blocks; but it takes considerable coordination and effort to keep all these blocks uniform for over a decade.

For the most part nodes are passive actors, if everyone follows the rules, but the moment someone steps out of line, nodes spring into action to protect the Bitcoin network, as is the case with invalid blocks.

What are invalid Bitcoin blocks?

An invalid Bitcoin block is a block that does not conform to the Bitcoin protocol. These invalid blocks violate Bitcoin’s consensus rules, and is therefore rejected by network nodes. Bitcoin nodes are run by miners, exchanges, and ordinary users alike, who keep their own copy of the blockchain and verify new blocks of transactions as they come in.

When an invalid block is found by nodes, it is ignored, so any transactions in it do not get added to the chain. The miner might have won the race to secure a block, but because it’s rejected another miner will then submit their block as the next confirmation.

The transactions from the invalid block will remain in the mempool and since miners who would like to collect the transaction fees, they are likely to include them in another block.

An invalid block can happen for a number of reasons, such as:

- The block may contain invalid transactions.

- The block may order transactions incorreclty.

- A block that is larger than the maximum block size.

- A block that contains a double spend transaction.

- The block may not have been properly mined with an invalid nonce or timestamp

When a Bitcoin node encounters any of these issues it will declare that block an invalid block, it will reject it. This prevents invalid blocks from being added to the blockchain to preserve the santity of the blockchain.

When a miner mines an invalid block, they will not receive a rewards from the network which acts an deterent to those who act in their economic interest.

Sure a non-economic actor could try and spin up miners and continue to submit invalid blocks to try and disrupt the network, but they will eventually be burning through so much runway and wasting energy and would be able to cause any real damage to the Bitcoin network.

Invalid blocks don’t happen often

Since there are no self destructive miners on the network and all of the miners are looking to secure a profit, they want to avoid any possible mishaps in securing a block.

Therefore invalid Bitcoin blocks are rare, but they can happen. When they do happen, they are quickly rejected by the network and do not cause any damage to the blockchain.

Some of the things that can be done to prevent invalid Bitcoin blocks from being mined:

- Miners can use software that validates transactions before they are added to a block.

- Miners can use software that checks the size of a block before it is mined.

- Miners can use software that checks the nonce of a block before it is mined.

- Miners can use software that checks the timestamp of a block before it is mined.

By taking these precautions, miners can help to ensure that the Bitcoin network does not punish them for submitting blocks that violate any of the rules. While miners can do as they please, they have an economic incentive to follow the rules.

Invalid blocks can be seriously costly.

In 2019, Bitmain-owned mining pool Antpool squandered an estimated $150,000 worth of Bitcoin mining rewards, according to BitMEX Research. At 14:35 UTC, June 10, the Bitcoin network rejected a block after it had been mined and that effectively cancelled the 12.5 BTC ($146,200) payout intended.

Bitcoin had an invalid block at height 584,802, as spotted by @juscamarena

— BitMEX Research (@BitMEXResearch) July 10, 2019

All 8 nodes at https://t.co/WKQ8hPDGON identified the block as invalid:

Bitcoin Core 0.18.0

Bitcoin Core 0.17.1

Bitcoin Core 0.16.2

Bitcoin Core 0.10.3

bcoin

Bitcoin Knots 0.14.2

btcd

Libbitcoin pic.twitter.com/p5WKJ5rO0t

Recently, in 2023, an incident occurred on Sept. 26 at 9:42 pm UTC on block 809,478, according to Mempool.Space. Several Bitcoin developers and BitMEX Research attributed the invalid block to a “transaction ordering issue.”

We can confirm that Marathon did mine an invalid block. We utilize a small portion of our hash rate to experiment with our development pool and research potential methods to optimize our operations. The error was the result of an unanticipated bug that came from one of our…

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) September 27, 2023

The invalid block was later claimed by public company and Bitcoin Miner Marathon, who claimed:

“The error was the result of an unanticipated bug that came from one of our experiments,”

– Marathon Digital holdings

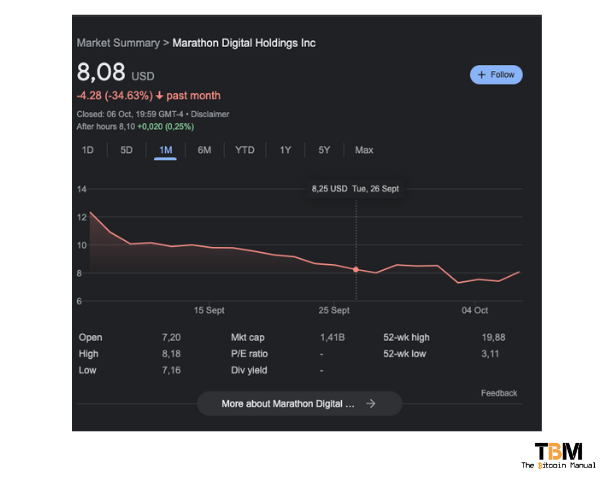

As is the case with Bitmain, Marathon, lost money on the energy expended only to miss out on the block subsidy along with transaction fees, but once the news went public, markets also reacted with shares for Marathon – which trades on Nasdaq under the MARA ticker – dropping 2.9% on the day.

Nodes know best

While Bitcoin miners provide an invaluable service to the network by securing cheap energy and generating hash rate, they are always slaves to the nodes and can never pull a fast one on the network to try and cheat the system or deviate from consensus in any way.

Bitcin with its large network of thoustands of distributed nodes ensure that there are always eyes on the mempool and the blocks compiled from those transactions..

This makes Bitcoin is one of the most robust networks with all nodes playing an essential role by working concert with its peers to preserve the Bitcoin network. In this manner, invalid transactions do not get passed along, the integrety of the network is preserved, and the chain continues to grow on a solid foundation of transactions.

Do your own research.

If you want to learn more about invalid blocks, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.