It’s been three years since the great Chinese mining ban of 2021, which saw majority ownership of the global hash rate go offline, as miners had to pack up and perform a great trek towards greener pastures. Some found their footing in other parts of Asia and continental Europe. The fact that 70%+ of the hash rate sat within the borders of one country was a constant critique of mining centralisation and the risk that the CCP could heavily influence the Bitcoin network.

The CCP cleared that FUD talking points themselves by forcing out miners, which briefly saw their reported hash rate hit zero. This is not to say that China has successfully purged all miners from within their borders; the surviving operations are mobile, smaller or have made friends in the right places so they can remain in operation. Today, the country reportedly maintains second place at 20% of the hash rate production, a far cry from the dominance they once had.

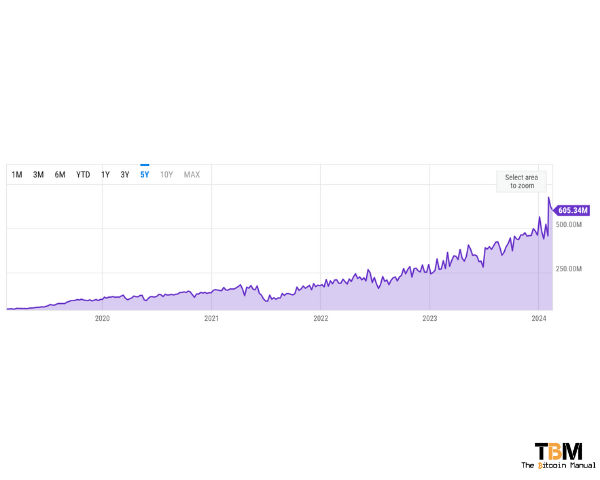

As miners had to ship out of China, the biggest beneficiary was the land of the free and home of the whopper, as the US became the global powerhouse of Bitcoin hash rate. The scales tipped in the US’s favour, and with the country being the leader in global hash rate, they would likely have seen more Bitcoin issuance in the hands of companies domiciled within their borders; it’s a game that officially became the US’s to lose.

Over the last three years, mining has had its ups and downs but has remained consistent in terms of adding additional hashing power, with the global hash rate continuing to rise, but as the sector grows, it has begun to make a few enemies, some in the form of local residents, others in the form of local politicians and various government agencies.

Bitcoin mining has a new boogeyman

US-based Bitcoin miners have started to attract heat, and not the kind coming from their many ASICs; no, it’s coming from Uncle Sam Wants, who wants Answers on the inner workings of their operations. The latest round of inquisition comes from US EIA Demands Energy Data, who have requested miners fess up on and provide data related to energy consumption and configuration of their mining sites.

According to reports, miners have until February 23 to respond with the info regarding the activities carried out in January. Answering these questions is mandatory, and EIA-862 specifies that:

“Failure to comply may result in criminal fines, civil penalties, and other sanctions as provided by law.”

EIA-862

Non-compliance can result in criminal penalties and fines of up to $10,633 per day until metrics on electricity consumption, identity of power providers, number and age of ASICs, total hash rate, and more are handed over.

This curveball will sail over the heads of the average garage miner, but for those with large-scale operations and publicly listed miners, the target is firmly painted on their backs. This move, while seemingly innocuous, has sent ripples through the sector, raising questions about its impact, potential responses, and the future of Bitcoin mining in the US.

BIG BRREAKING: #Bitcoin miners begin receiving letters from the EIA forcing them to report sensitive data.

— Dennis Porter (@Dennis_Porter_) February 14, 2024

The miner who received this letter only has 10 days to respond to the request by the EIA or face huge fines or worse!

Fortunately, we have a plan on how to fight back,… pic.twitter.com/KcYViQBxND

A Looming Storm or Transparency Triumph?

On the surface, the EIA’s request appears straightforward: Gather data on energy usage to understand the industry’s environmental footprint. I mean, how bad could it be? Public Bitcoin mining operations already have to be pretty forthcoming regarding their operations, while many large-scale private miners want to have a clean bill of health, hoping to one day transition to the public markets.

So, what’s the big deal about their energy consumption? If you’re paying your energy production bill and your provider is happy, what more does anyone need to worry about? How you use the energy you pay for is your business, and if you’re using that energy to run a profitable business, it’s a net gain for all involved.

Well, the claims are the protection of the public, with the rationale being miners are going to want to draw even more power and happily bid up prices for energy as the price of Bitcoin increases, moving into the next halving and resulting bull market that usually follows.

Some see the EIA’s move as an attack on Bitcoin, driven by environmental concerns or ideological opposition, so if this is an attack, what could we expect if miners don’t try to fight back?

Increase regulatory scrutiny

While we can only speculate on what the data collection will result in or how it will be interpreted, it could used to build a case against mining companies’ ability to scale. The data could be used to justify stricter regulations on energy consumption, potentially impacting mining profitability and location choices.

Miners could be capped to a certain amount of ASICs, have access to power, purchase power at certain rates, or have to reduce their operations based on arbitrary metrics, making some operations less efficient and, as a result, less competitive.

Fuel public debate

Transparent data might influence public perception of Bitcoin’s environmental impact, potentially affecting its social and political standing.

In theory, yes, more information can help the public make better decisions, but when data can be used to support certain narratives, it can be hard for the public to understand what these numbers mean and put the use of energy into context.

If all you’re hearing is Bitcoin miners use more energy than Argentina and Sweden or that a transaction can empty out an entire swimming pool without digging into the claims, it’s easy to see why people would side against these greedy Bitcoin miners, boiling the oceans.

Attract carbon taxes

Depending on the data’s interpretation, carbon taxes or other environmental levies could be imposed on miners, impacting their operating costs of miners and reducing their ability to remain profitable.

This might not be a direct ban as we saw in China, but more of an indirect one as you push miners who were on the fringes out of the market earlier than they otherwise would have chosen to exit the market.

Regulation can be centralising

Well-designed regulations can encourage responsible practices and sustainable growth within the industry, but they can also provide a barrier against competition. The more onerous the regulation, the fewer participants can handle it, and regulation could favour certain miners over others and even force certain operations out of business or sell up to those miners who can comply.

The Future of US Bitcoin Mining

These EIA demands have stirred up quite a reaction online, and the ball will be in the miners’ court now: Either they comply, start to push back or prepare for unfavourable conditions in the US.

Cooperative Compliance

Miners could take the open approach and proactively share data and engage in constructive dialogue with the EIA and policymakers. This fosters trust and builds a positive image as they showcase their compliance and willingness to work with these institutions to drive policy that works for all involved.

Legal challenges

Miners could contest the data collection, arguing its legality or scope. This could be a lengthy and costly process with uncertain outcomes.

Technological solutions

Bitcoin miners are no strangers to fighting an uphill battle to satisfy their need for hash rate. The result of this data challenge could spur innovation in clean energy solutions and more efficient mining technologies to meet new requirements. Investing in renewable energy sources could appease regulators and public perception, but this isn’t a solution for all miners, as only certain parts of the world can really offer viable wind and solar energy.

Relocation

Ultimately, Bitcoin mining comes down to economic calculations; the more costs added to your operation, the more it erodes your margins; eventually, as costs rise, it makes seeking out other regions of the world more attractive.

Areas that previously didn’t offer reliable energy or low-cost energy become attractive as you could still have better margins than if you continued to operate under restrictions in the US.

Since Bitcoin mining can be scaled to meet energy availability, miners will need to do their calculations to figure out how many ASICs make it worthwhile in the US and where else they can get cheaper or similar energy access in other parts of the world and start to set up shop there or uproot completely.

Hamstring US hash rate

If Bitcoin miners and lobby groups fail in their bid to curb coming pressures, stringent regulations based on unfavourable data could cripple the US mining industry and lead to relocations and lost economic opportunities.

Sure, it will suck for these companies, for those that lose their jobs, for those who would not be employed as these companies cannot scale to the sizes they once projected, but there is a silver lining.

When the US makes itself less competitive, it opens up opportunities for other countries to welcome Bitcoin mining into their economy.

Distributing hash rate makes for a more robust and decentralised network. It also brings Bitcoin into direct contact with local communities, where Bitcoin can be spent, jobs can be created, governments can earn additional tax revenue, and citizens can access Bitcoin in their local currencies with less reliance on arb traders bringing in more expensive Bitcoin from international markets.

Do your own research.

If you want to learn more about EIA-862 and its impact on Bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.