South Africa, despite all its natural resources and is the most developed nation on the continent, still carries with it a large population of impoverished citizens. South Africa has been labelled the most unequal country in the world, with race playing a determining factor in a society where 10% of the population owns more than 80% of the wealth, based on a study by the World Bank.

According to the World Inequality report, they estimate that income inequality has been extreme in the country throughout the 20th and 21st centuries. According to their findings, the bottom 50% of the total population of South Africa has never captured more than 10% of the national income. To qualify as part of the bottom 50% of South Africans, you need to earn less than R1 030 per month ($60 roughly at today’s conversion rates).

Having a large population having very little disposable income after covering food and shelter means their savings aren’t really readily available. Many of these citizens save in physical cash and have no bank accounts.

So how do people purchase items larger than their weekly wage? How do they get access to credit or build wealth? Well, truth be told, many don’t; while some opt to combine their purchasing power through community efforts and pool together funds to achieve certain goals, these community savings schemes are commonly known as Stokvels.

A stokvel is a community-based savings club that has traditionally been popular in lower-income communities with groups that may not have had access to formal banking. Stokvels are often informal, but that doesn’t mean they’re run irresponsibly. They are a ground-up movement for saving or investing money, and they are built on a foundation of trust between friends and community members.

The Stokvel is typically formed by people who already know each other, or an invitation gets extended to other like-minded individuals in the greater community.

What is a Stokvel?

A Stokvel is a type of credit union in which a group of people with a similar intention enter into an agreement to contribute a fixed amount of money to a common pool weekly, fortnightly or monthly.

Stokvels are also known as a rotating savings and credit association (ROSCA), which is a group of individuals who agree to meet for a defined period to save together. This financial system is not unique to South Africa and exists worldwide.

They are also known as:

- Chama in Swahili-speaking East Africa,

- Tandas in South America,

- Kameti in Pakistan,

- Partnerhand in the West Indies,

- Cundinas in Mexico,

- Ayuuto in Somalia,

- Hui in China,

- Gam’eya in the Middle East,

- Kye in South Korea,

- Tanomoshiko in Japan

- and Pandeiros in Brazil

The size of the Stokvel market

Saving money through Stokvels has been extremely popular in South Africa for over a century. Despite South Africans having access to banking services and more payment rails than ever before, it hasn’t stopped the proliferation of Stokvels. The practice is widely adopted, and this traditional way of saving money is used both for personal and business purposes.

It is estimated that there are more than 820 000 Stokvels in South Africa, with a total membership of 11.4 million people, handling over R50 billion per year (Nearly 3 Billion USD).

Stokvels might have started as a group savings scheme, but it’s transformed over the years to provide a reliable means for investments and other financial needs. They are filling the gaps in the financial sector that formal financial institutions are still trying to formulate products for or simply cannot cater to due to their current infrastructure.

What also makes Stokvels such a popular financial tool is the ability to sign up for several Stokvels, contribute the amount you can afford and dedicate that capital to a certain future need.

The legal framework and governance behind Stokvels

As widespread as stokvels are, they do not always have legal personalities. However, they resemble several possible legal figures from the common law.

There are stokvels that register as companies, partnerships and, in the past, as closed corporations, but the most common forms are informal unregistered stokvel agreements. This means that no legal action can be pursued against the Stokvel itself, only against a member or members thereof.

Despite the informal nature, most stokvels will have a constitution. If a stokvel applies for a bank account, a written version of this constitution and South African banks have even made it possible for Stokvels to create accounts.

The constitution provides the blueprint for how meetings are run and office bearers are elected, as well as determining the rules of the stokvel and debt collection procedures. Their constitution dictates procedures for obtaining consent to a constitution. This is sometimes done through oral ceremonies or even through formalising written consent through an affidavit at the local police station.

The constitution also outlines how to deal with disputes and arbitration, but that is not to say that stokvels are foolproof and don’t fall apart, fund scams or are created specifically to defraud communities.

Disputes can often be resolved through the threat of violence if certain members fail to adhere to the terms or have stolen funds; members would approach a street committee or even the local taxi men for dispute resolution assistance.

I won’t go into detail on how these resolutions work, but let’s just say these committees are a real deterrent for trying to be a bad actor within the Stokvol ecosystem.

Types of Stokvels

Now that we’ve covered the framework of these Stokvels let’s take a look at how these pools of capital are used and why so much money sloshes around in these systems.

Rotational stokvels clubs

These are the most basic form of Stokvel, where members contribute a fixed amount of money to a common pool weekly, fortnightly or monthly. Members would receive the lump sum on a rotational basis, and they are free to use the money for any purpose. Contributions are usually made in cash or deposited into members’ bank accounts.

Grocery stokvels

This category of Stokvels members typically contributes a fixed amount of money towards the purchasing of groceries at the end of the year or to take advantage of deep discounts from retailers within the year. Some grocery stokvels save these funds in a Stokvel Club Account, while others save directly with the outlets, who record these contributions and make stock available for collection during the buying period.

Savings clubs

In this form of Stokvel, members contribute a fixed amount of money to a common pool at regular intervals. Each member receives a lump sum equal to their monthly contribution at the end of the cycle, usually annually. Typically, such funds are collected in cash and stored in a Stokvel Club Account held at a bank to collect interest on the larger principle, which may allow them to qualify for a higher interest rate.

At the end of the cycle, these funds are withdrawn and redistributed to members in cash.

Burial societies

Burial Societies provide an informal but reliable form of insurance to help members and their families with the costs of funerals. Burial societies also provide practical support for the family during the preparation. This is known as “izandla (helping hands)” and is often a substitute for the funeral cover of funeral policies which often price out lower-income individuals.

As a typical Stokvel, members contribute a set amount of money at regular intervals for a set benefit. Burial Societies typically provide policies that cover the main group member as well as family and extended family.

Most groups are “self-underwritten”, while many groups are opting to partner with reputable insurance companies to minimise their risk.

Investment clubs

Investment Clubs are established with the view of accessing opportunities that with grow their pooled funds by taking on more risk with the funds. This may be in the form of interest from a bank account, money market funds, index funds, buying stocks or establishing or taking part in a business venture.

The period of time the money is kept in the investment varies from group to group but could be considered an informal index fund.

Social clubs

These types of groups pool funds to arrange social activities. This entertainment may occur at every group meeting, or the group may save regularly towards less regular social activities.

Borrowing stokvels

Such groups save money in a pool and use it to loan money to members and sub-members who might not qualify for credit with banks and do not wish to use loan sharks. Borrowing Stokvels usually charge high-interest rates for the sustainability and profitability of the group’s operational model.

Multi-function stokvels

While some groups maintain the same modus operandi, others evolve to include new functions as the bond between members is strengthened by regularly participating in Stokvels. At times, you’ll see Stokvels pivot or offer new products and services based on the demands of their members.

- Rotational Clubs will evolve to add a Savings Club function.

- A Savings and Rotational Club may add a loans function, and a Grocery Club may grow into a burial function for immediate members.

- Social Clubs typically transform into Burial Societies and Investment Clubs, while successful Burial Societies eventually invest their surplus funds.

The Bitcoin Stokvel

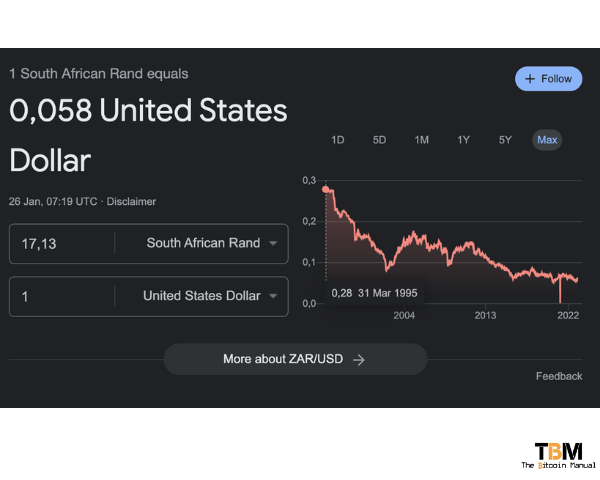

While Stokvels have offered individuals access to the benefits of banking services, they cannot account for the performance of the underlying currency. The South African Rand continues to lose relative purchasing power with major currencies like the US dollar. Even investment Stokvels often focus on local shares, index funds and businesses.

They do not allocate capital to offshore assets, which is where the middle class and wealthy tend to park their purchasing power.

Local inflation erodes the ability to preserve value and acquire the goods and services Stokvel members are saving towards. Bitcoin offers the lowest barrier to entry to acquire an “offshore” asset that is not tied to the local economy and allows Stokvels to hedge against the performance of the South African Rand and Rand-denominated assets like local shares, bonds and real estate.

A Stokvel wallet

The structure and established use case for Stokvels make it a pretty easy upsell for the concepts behind eCashMints like Cashu And FediMint, which provide the ideal infrastructure to create a bitcoin native Stokvel.

A Stokvel is often operated by a few members having copies of a ledger and calculating how much each person deposits, withdraws and holds within the pool of assets. This is a manual process that involves cash or bank deposits that need to be matched, and this accounting can allow for human error or theft.

If Stokvels were to move over to bitcoin, each member could have a recording of the transaction in their wallet, which is pretty hard to dispute and records. Transactions are kept not only by the custodian but by the individual, too, giving savers more clarity and surety around their funds.

The Stokvel custodians can operate a mint, and members can use any eCash wallet that can connect to the mint. The custodians need not manage the balances or the individuals, they handle deposits and withdrawals themselves via the wallet, talking to the mint, and the custodian simply offers them a low-cost way to engage with one another Stokvel member or any member of the bitcoin network via Lightning.

Debiting and crediting other Stokvel members

Many a time, two Stokvel members will need to make a transaction but not have the cash on hand to pay for the transaction. Instead of waiting to settle the transaction, they can approach a Stokvel custodian and reduce their balance in the Stokvel and increase other members and resolve payment via a custodian.

By using an eCash Mint, a Stokvel member could send the payment to the other member’s wallet via a Smartphone app or feature phone USSD prompt. Reducing the admin around handling your Stokvel balance frees up members to use their capital more freely and encourages circular trade between one another.

At the same time, the pool of funds remains within the bitcoin ecosystem.

The bitcoin grocery club

A grocery club typically saves capital for an entire year; should a bitcoin grocery club emerge, they could accept deposits for the year and dollar cost average into bitcoin. The funds are held within the mint, and each member has oversight over how much they contributed and how much it is worth.

Each member has oversight over their funds and can see if their funds appreciate through their exposure to bitcoin.

On the day of the big purchase with the store, the custodian could ask for all the funds to be transferred into one wallet so that they either liquidate the capital into fiat or purchase directly with the money with a retailer like Pick and Pay that accepts direct bitcoin payments.

Bitcoin burial societies

I think the use case that makes the most sense now is the burial society. If you’re unfamiliar with South African funeral culture, you might not realise what a big deal it is; it’s quite the occasion where expenses are not spared, but it is also a low-time preference action to save towards it.

Bitcoin burial societies would benefit from the long-term price appreciation of bitcoin, requiring users to contribute less or rather spend less of their bitcoin to fund funeral expenses. The leftover funds could be used as savings or for another family member’s funeral costs.

Stokvel interoperability

When you commit to a Stokvel, the custodians are incentivised to maintain the size of the Stokvel, especially in the investment-orientated ones. If you find a Stokvel offering something different or more favourable terms, migrating isn’t that simple. It can become a bit of a pain to request your money back and settle up so you can move to another.

By using blinded eCash mints, you could burn your allocation within the mint, request your bitcoin and move it to another mint that offers you better terms. The switching costs are so low that it allows for the free flow of capital, and Stokvel members have more say on where their funds are allocated.

This also encourages Stokvel custodians to act above board, knowing they could lose capital from their mint and the members who support them instantly.

Stokvel 2.0

Do you think that Stokvels will embrace a bitcoin standard? How do you see bitcoin playing a role in the group savings movement? Do you have the same savings schemes in your country?

Let us know in the comments down below.