Bitcoin’s core strength lies in its decentralisation and security. Every transaction is meticulously recorded on a public ledger, accessible to everyone, ensuring transparency and immutability. However, this robust consensus mechanism comes at a cost: slow transaction speeds. The Bitcoin network can only process around seven transactions per second, a far cry from the thousands handled by centralised payment systems like Visa and the front-end experience consumers are used to when making digital payments.

Bitcoins’ global settlement network continues to attract new users each year, while existing users are not planning to slow down their activity anytime soon, especially those who have fully embraced a Bitcoin standard. This increase in on-chain activity has an upper limit. Once we reach those ranges, everyone becomes a victim of transaction congestion, as transactions hit a gridlock, like early morning or late afternoon traffic from the big city.

Let’s face it: no one likes to wait for anything, especially when it comes to our money, and for those who don’t understand how Bitcoin works, it can be such a frustrating or worrisome period that it can turn you off from embracing the technology.

Imagine Bitcoin as a bustling marketplace, brimming with eager buyers and sellers. But there’s a twist: everyone has to use the same cash register, and it’s painfully slow. With more people joining the market, the lines get longer; transactions take forever, and frustration mounts.

Failing to scale is planning to fail

This, in essence, is the scalability dilemma that Bitcoin faces. This bottleneck threatens to stifle Bitcoin’s growth and limit its potential as a global currency. To overcome this hurdle, the community has turned to second-layer solutions – proposed workarounds that operate on top of the Bitcoin blockchain.

These solutions aim to:

- Increase transaction throughput: By taking some transactions off the main chain, second-layer networks can handle a higher volume, easing congestion and speeding up settlements.

- Reduce transaction fees: With more transactions flowing through the system, competition for space on the main chain drives down fees, making Bitcoin more accessible for everyday use.

- Enable new use cases: Faster and cheaper transactions open doors for exciting possibilities, from micropayments to complex financial applications.

Think of a second layer as the express checkout aisle; if you meet certain conditions, you can skip the traditional line, have your transaction confirmed and be on your way while the rest fight it out in the ever-growing queue.

No second layer is perfect.

Introducing a second layer adds new complexity, as anyone who has used a side-chain or Lightning would understand; it’s more complex than marketing pitches make it out to be, and each layer has its trade-offs and learning curves for users.

Each solutions come with their own set of challenges, raising questions about:

- Security: Can second-layer networks maintain the same level of security as the Bitcoin blockchain itself?

- Decentralisation: Do these solutions centralise control in any way, compromising Bitcoin’s core principles?

- User experience: How easily can users navigate the complexities of using the main chain and a second-layer network?

Faux Bitcoin second-layer solutions, as the term suggests, are projects that claim to be scaling solutions for Bitcoin but fall short in key aspects. They often present themselves as “Bitcoin-compatible” or leverage the Bitcoin blockchain in some way, but their approach raises concerns for several reasons:

Centralisation

True to their name, many faux solutions introduce centralised elements into the supposedly decentralised Bitcoin ecosystem. This could involve relying on trusted third parties, validator nodes with outsized influence, or other mechanisms that deviate from Bitcoin’s core principles.

Security risks

By introducing additional layers or components, these solutions may create new vulnerabilities or attack vectors that traditional Bitcoin transactions don’t face.

Limited impact

Some faux solutions offer minimal scaling improvements or address a narrow aspect of the scaling problem, failing to provide a comprehensive solution.

Misleading marketing

Often, these projects leverage the popularity and trust associated with Bitcoin for marketing purposes, overpromising their capabilities and downplaying the inherent risks.

I’ve heard about Bitcoin’s scaling, and I am here to fix it

Due to the impact of Ordinals and the different forms of inscriptions that use the protocol, we’ve seen times when the mempool was stuffed to the brim with transactions, bloating to well over 1GB of unconfirmed transactions. The pressure from these transactions naturally affects fees, pushing them as high as 300 sats/ vbyte or more at the most competitive times.

The rise in Bitcoin fees signals to the market that second-layer solutions are needed, and there has been no shortage of self-proclaimed solutions popping up as the next revolutionary technology.

Having done a quick scour of Twitter, a few press releases, and videos from paid influencers reading from scripts they need help understanding, the following names are ones to watch out for, but not in a good way.

| Project | Link |

|---|---|

| b²network | https://github.com/b2network |

| Bitfinity | https://bitfinity.network/ |

| Build on Bitcoin (BOB) | https://www.gobob.xyz/ |

| BVM | https://bvm.network/ |

| Conflux | https://confluxnetwork.org/ |

| Ligo | https://ligo.network/ |

| LumiBit | https://lumibit.xyz/ |

| Satoshi VM | https://www.satoshivm.io/ |

| Tectum | http://tectum.io/ |

| Merlin Chain | https://merlinchain.io/ |

| MintLayer | https://www.mintlayer.org/en/ |

Note: The content below about these scaling solutions and projects is not an endorsement. All content is solely for educational purposes.

b²network

B² Network is a ZK Proof verification commitment rollup solution designed for Bitcoin. This innovative system is divided into two main layers: the DA Layer and the Rollup Layer.

The DA Layer is used to archive and confirm rollup data. B² nodes are responsible for zk proof verification and other off-chain computations while final settlement and confirmation are carried out on the Bitcoin Network.

In the Rollup Layer, B² employs zkEVM, a native-based zk rollup which manages transactions and wallet balances.

Bitfinity

Bitfinity is a so-called Bitcoin scaling network, yet it’s built on the Internet Computer protocol; they’ve raised $7 million to launch the platform, it will focus on the management of Ordinals and EVM assets bridged into its own network.

Build on Bitcoin (BOB)

Bitcoin apparently secures BOB but is natively connected to Ethereum using a roll-up stack. Personally, I couldn’t get my brain to sift through most of the word salad, jargon and marketing from the available documentation and just shut my brain off on this one.

BVM – Bitcoin Virtual Machine

BVM is a B2B modular blockchain metaprotocol that lets developers customise and launch Bitcoin L2 blockchains and has its own token with a 100 million supply, and that’s really all I could stomach because the rest of the documentation read like LLM fluff.

Conflux

Conflux Network, another ETH copycat, has announced its Bitcoin Layer 2 roadmap. The short-term goal is to establish a BTC staking mechanism and integrate basic Bitcoin protocol features, such as Ordinals and Inscription.

Ligo BTC

Ligo BTC is yet another EVM-based chain tethering itself loosely to Bitcoin as a scaling solution, just a remora chain looking to differentiate itself from the rest of the copypasta projects.

LumiBit

LumiBit is another ZK-Rollup solution that adopts a Type2 ZK-EVM and is considered fully equivalent to EVM. , LumiBit’s UTXO Channel Bridge uses a UTXO to record user status and combines root-proof status encryption with hash time-locked contracts for cross-chain channel validation.

SatoshiVM

SatoshiVM is yet another ZK Rollup, but it employs EVM for off-chain computations. SatoshiVM garnered considerable attention not for its technology but for the controversy due to the apparent presence of a handful of wallets controlling a sizeable share of the initial token supply.

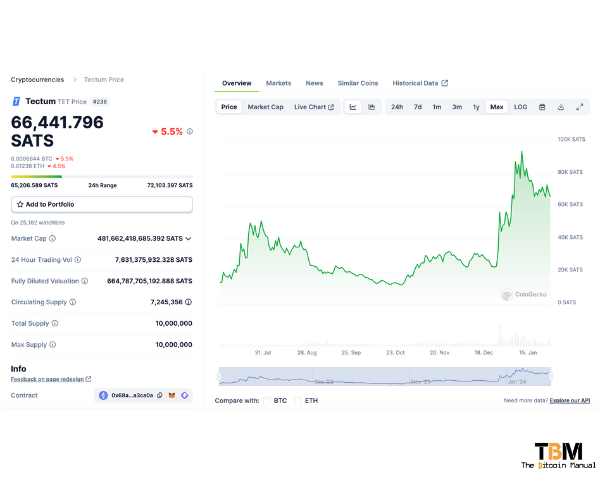

Tectum

Tectum is another separate distributed ledger protocol managing platform that employs the proprietary record change signature management algorithm, with its claim to fame being soft notes, a transactionless payment system with instant payments and zero fees.

Tectum uses its Bitcoin node and overlay network to facilitate on-chain transfers with low fees and fast transaction times. It should also be no surprise that Tectum has its own token, so you can speculate on the idea without ever using the network.

Merlin Chain

Merlin Chain is an apparent Bitcoin Layer 2 that integrates the ZK-Rollup network using a centralised Oracle network and an on-chain BTC fraud-proof module. Merlin Chain will have a governance token, a major red flag 🚩 and plans to sucker users in with a bunch of staking events and distribute it through a “fair launch”.

MintLayer

Mintlayer is another Proof-of-Stake (PoS) system that aims to act as a Layer-2 protocol focusing on smart contract programmability. MintLayer has its own token, of which 67% were pre-mined, with the rest locked up and will be used for block rewards.

Why are these projects created?

The motivations behind creating faux solutions can vary from well-intentioned but misguided solutions, ignoring the trade-offs they make, to nefarious Bitcoin affinity scams.

Cashing in on the hype

Scaling Bitcoin is a complex problem, and the potential solution could attract billions in capital; despite their limitations, we’ve already seen side-chains attract a number of Bitcoins. Currently, Rootstock holds just under 2800 BTC, Liquid holds 2900, and the Lightning Network has close to 5000 Bitcoin.

While Lightning is a leader in scaling, there is room for other solutions, and these projects know it. Capitalising on the interest in Bitcoin scaling and attracting investment without delivering actual value is the grift, which can attract attention to your project and investment from broader retail participants.

Promoting a specific technology

Using Bitcoin’s popularity and popular tech-like rollups or smart contracts to gain traction for your proposed scaling solution makes for an ideal marketing pitch to attract the uninitiated investor with little appreciation for how Bitcoin works. All these investors understand is Bitcoin + features = massive alpha, as if it is as simple as building with Lego blocks.

Personal gain

Some projects might be driven by individual or group interests seeking to profit from the perceived need for a scaling solution, like venture capital. VC-funded projects can claim they are trying to scale Bitcoin, but they need to sell tokens or force you to use, hold or stake tokens and encourage you to speculate on the success of their scaling solution instead of actually using it.

It makes for an attractive narrative to dump on retail, having the “killer use case” of scaling Bitcoin but never delivering a polished product, as the product itself was only a funnel for extracting retail liquidity.

Don’t fall for the hype

There is nothing wrong with exploring other solutions for Bitcoin. If they solve the problems you find with speed cost or give you access to features you’ve been interested in, but only some scaling options, despite what their marketing says will be a solution.

These scaling layers need to be complementary to the network and support the base asset, not trying to carve off revenues for themselves or funnel you into a secondary tokenised ecosystem.

It’s crucial to approach these projects cautiously and carefully evaluate their claims. Consider factors like the team’s expertise, the project’s transparency, the solution’s technical soundness, if you can run it yourself, participate in the network and verify for yourself, and evaluate its alignment with Bitcoin’s core principles before giving them any credence.

Remember, true scaling solutions for Bitcoin should prioritise decentralisation, security, and long-term sustainability, not just quick fixes or temporary improvements.