South African Bitcoin traders, investors, and long-term holders, your free ride in the Wild West has had to end sometime. The days of cashing in on your stash and not worrying about what SARS would think about it or bother reporting it are not going to fly anymore.

What was once an ignored niche market now clears Trillions of Rands annually, and whenever a market matures to a point where it exchanges value at a scale such as this, the South African government will want a piece of the action.

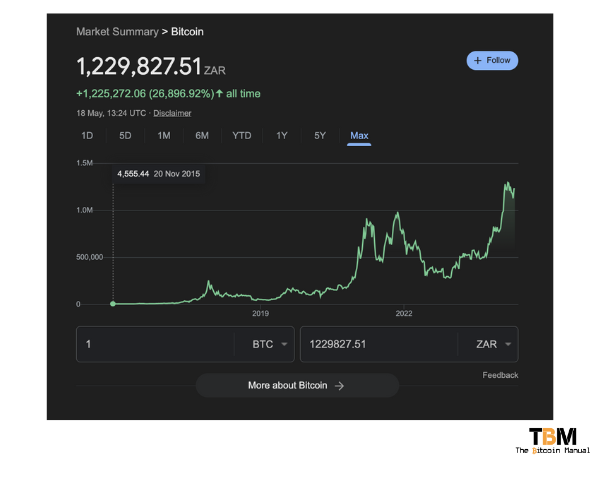

If you’ve been around for one or two Bitcoin cycles and didn’t panic-sell during the bear markets, you’ve probably made some juicy returns from Bitcoin’s price appreciation and received an extra bump from the Rand’s annual losses in purchasing power.

Considering the 27,000% return over the last 10 years, what may have been a modest allocation to Bitcoin a few years ago could leave you with a small fortune.

A fortunate situation will come with a new set of obligations, and you must plan accordingly.

Who is going to build the roads and other stuff?

Living under the “democratic socialist” kakistocracy we find ourselves in, someone has to produce the value that pays for NSFAS students to earn degrees that don’t net their jobs, for RDP houses that have no facilities connected, the plethora of grants and the robber baron tenderpreneurs suckling off the state going.

With the country’s growing debt burden (13% of annual spending or R284,4 billion) showing no sign of reducing and the recent signing of the NHI bill creating a fresh cash drain, the South African Revenue Service (SARS) is setting its sights on Bitcoin as a potential revenue stream for the state coffers.

The JSE hasn’t produced much of a return over the past 20 years compared to global markets, and South Africa’s capital controls regarding off-shore investment allocations also limit investors’ income. So, investors naturally looked for alternatives, and they found a new escape valve in Bitcoin, which has performed well enough to warrant the attention of SARS.

What was previously in the grey must help the government get out of the red

The change of heart comes after years of South Africans trading Bitcoin in a grey area, where many investors would buy both KYC’d or non-KYC’d Bitcoin, sell it for cash at a profit, and wouldn’t be too concerned with filing these trades with SARS.

The lack of tax filings is not to say that traders were non-compliant; back then, there weren’t guidelines on the South African government’s stance on Bitcoin and how it should be handled, so traders merely played it by near and worked with the benefit of non-existent reporting.

Exchanges weren’t connected to SARS eFiling systems like many local banking and investment firms, leaving it up to individuals to report their activity. Neither was it explained to individuals how to report it, so very few bothered to do so.

However, with the recent licensing requirement for cryptocurrency exchanges, SARS is now poised to gain access to a wealth of data on these transactions.

Exchanges have turned impimpi

This means that, whether you like it or not, your Bitcoin trades are likely to become part of your annual eFiling process soon. In this climate, Bitcoin, with its growing user base and significant transaction volume, has become an attractive target for SARS.

For South African Bitcoin traders and investors, it’s time to get compliant. With exchanges now obligated to report data to SARS, there’s no escaping the taxman’s gaze. Whether you’re a seasoned pro or a curious newcomer, familiarising yourself with the tax implications of Bitcoin transactions is crucial because non-compliance can result in penalties.

Remember, every buy, sell, or trade on a cryptocurrency exchange is a taxable event, and come eFiling season, if you’re sitting in profit for that year, SARS will be expecting its cut.

Account-based models blockchains are the tax man’s dream

If you’re one of those crypto-clowns that think they can migrate their trading on-chain and all will be hunky dory, you’re mistaken. Once you transfer your funds from a local KYC exchange to your EVM wallet, you’ve already doxxed your wallet address, and all your on-chain trades can be tied to you.

While we have yet to determine how far SARS will go in terms of chain analysis when it comes to calculating your liabilities, they have the luxury of tracking you on these public databases and can easily figure out how much you’re sitting on.

Remember, public blockchains like Ethereum make it reasonably easy to extract your wallet balances across both the L1 and L2s, with time stamps for all trades for each financial year.

Don’t assume that SARS cannot go back more than five years. SARS is well within its rights to investigate all historical transactions in which a taxpayer has failed to disclose material facts, committed fraud, or made misrepresentations.

What will my tax bill look like?

In South African tax law, Bitcoin is considered a financial instrument under the Income Tax Act. Any realised profits in Rands or another Digital Asset (Altcoin or Stablecoins) resulting from dealing in Bitcoin may fall within the tax net and be subject to disclosure and possible liability towards SARS.

Under South African domestic law, Bitcoin is not considered a currency but has either a capital or revenue nature; depending on the circumstance, the returns could be considered revenue (day traders, arb traders or staking and DEFI), but in most cases (price appreciation over a certain period – IE 3 years), it would fall under capital gains tax.

CGT applies to individuals, trusts and companies, and rates differ for each.

- Only 40% of the gain is included in taxable income for individuals and special trusts.

- For companies and any other trusts, 80% of the gain is included in taxable income.

Once the gain as per inclusion rates has been calculated, the effective tax rate will then apply to the gain according to the various tax rates for individuals, trusts or companies.

SARS gives you some breathing room with an annual exclusion of R40 000 capital gain or capital loss granted to individuals and special trusts. After subtracting that, you must apply the 40% gain rule mentioned above and then use the tax rate from the table below.

| Type | 2025 | 2024 | 2023 | 2022 |

|---|---|---|---|---|

| Individuals and Special Trusts | 18% | 18% | 18% | 18% |

| Companies | 21.6% | 21.6% | 21.6% | 22.4% |

| Other Trusts | 36% | 36% | 36% | 36% |

The example above is an oversimplified version of what to expect, but the reality of selling your Bitcoin and calculating the taxes will be much more complicated since you’ve likely purchased your Bitcoin at different prices throughout the years.

Depending on how much Bitcoin you’re selling, it could require grouping multiple purchases. If your funds are in an exchange, FIFO is usually used to determine the order in which you sell your Bitcoin.

If you’re selling on-chain Bitcoin, you’ll have to look into which UTXOs you sold, the date you acquired them, and the fiat price at the time, and use those figures as your base for calculation.

Keep it simple, hodl

If all of this tax talk sounds like a pain in the arse, and you are in a position to leave your Bitcoin alone, then don’t bother liquidating now; sit on your Bitcoin and hold it; it remains the most tax-efficient strategy.

If you’re not selling, and all you’re doing is buying Bitcoin and putting it away in cold storage for retirement one day, you’re not creating any taxable events to worry about reporting.

Leave the tax funding to the traders who think they can beat the market.

Get your house in order before Luthuli House does

If you’re going to sell your Bitcoin for the guaranteed debasement symmetrically built into holding Rands, go right ahead, don’t let anyone stop you, but accept the toll involved in moving back to government-controlled payment rails, and pay to Caesar what belongs to Caesar.

Tax avoidance strategies are possible, but tax evasion is never a good idea. For the love of all things Bitcoin, don’t try taking tax advice from online personalities or think reading a few blog posts has you covered; rules can change, limitations and allowances can change, and rates can change. If you plan to sell your Bitcoin, take some of that capital and spend it speaking to a tax professional.

It might save you a few pennies if you’re smart with your sales or can employ tax loss harvesting strategies to help alleviate some of the admin headaches.

So, South African Bitcoin enthusiasts, it’s time to adapt.

Get your records in order, understand your tax obligations, and prepare to declare your Bitcoin income alongside your traditional earnings.

The future of Bitcoin in South Africa might be less Wild West, but this is the price you have to pay for mainstream adoption, using regulated platforms and heading back to “Fiatnam” with your wealth.