When you commit a transaction to the Bitcoin blockchain, it goes through several phases before being confirmed on-chain. Part of that process is having your transaction added to the mempool. The Bitcoin mempool plays a crucial role in the transaction process, acting as a holding area for unconfirmed transactions.

Usually, your transactions won’t spend too long of a time in the mempool before a miner decides to pick them up and add them to a block, but there are times of network congestion that can see your transaction stuck in this unconfirmed state of limbo for a long time.

If you recently broadcasted a transaction to the Bitcoin blockchain and you’re not seeing it in your wallet yet, chances are your transaction is still waiting in line for a miner to pick it up. When the mempool becomes full, users may experience delays and higher transaction fees.

Bitcoin block space is pretty limited, and when many people want to perform a transaction in a short enough period, that traffic will cause congestion like you would see on your local highway during peak hours.

What is the Mempool?

The Bitcoin mempool, short for memory pool, is a temporary storage space for unconfirmed transactions waiting to be added to a block and included in the blockchain. Miners select transactions from the mempool to include in the next block, prioritising those with higher fees because miners aren’t charities; they’re there for the money. If you’re spending money on mining rigs and electricity, your incentive is to compile blocks that net you the highest return.

Depending on the transactions in the mempool, a miner will compile a mix of transactions, and once a transaction is included in a block and added to the blockchain, it is considered confirmed and removed from the mempool.

When there is a bit of a drag on confirmations, you’ll see people try to get miners’ attention to skip their spot in the queue. Those who reprioritise their transactions by bidding them up to get into the next block push your transaction out of consideration by miners.

What is the Mempool’s Capacity?

The Bitcoin mempool does not have a fixed capacity. Instead, its size depends on the number of unconfirmed transactions and the amount of memory allocated by each node for the mempool; this can be transactions broadcast via your own node or a third-party node.

As each node operates independently, the mempool’s size can vary between nodes. However, the total size of the mempool across all nodes usually fluctuates between a few megabytes to several hundred megabytes, depending on the network’s transaction volume.

What is with all this Ordinal action?

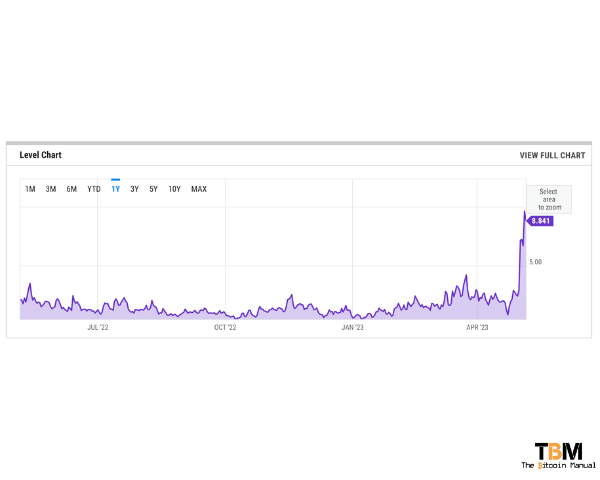

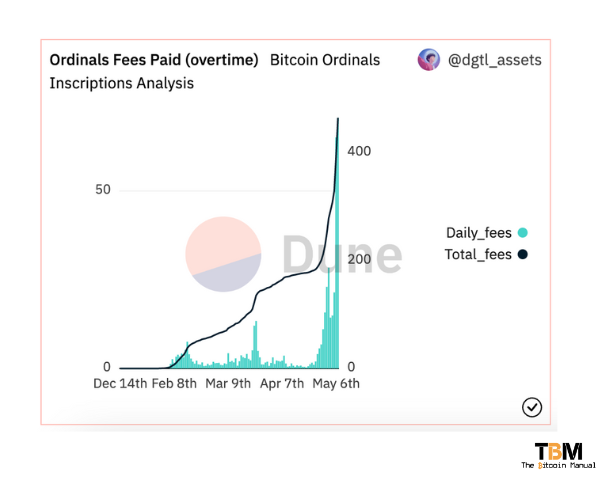

Fees have recently been a topic of focus as ordinal-based transactions have begun to clog up the mempool. The excitement around creating tokens and NFTs on Bitcoin has seen a flurry of activity driving up transaction fees and creating a lengthy backlog of transactions.

On-chain, you will see transactions of small amounts of Bitcoin paying a large fee which makes no sense to the average user looking at the chain data. But what is happening is users are buying, selling and trading “inscribed” satoshis and moving these UTXOs around in secondary markets, where fees are collected based on the “assets” inscribed on these sets of satoshis.

Since these assets like Inscriptions, BTC-20 tokens and BRC-721 tokens don’t have a formalised market with exchanges or large OTC markets able to conduct trades without the need to confirm on-chain, all transactions are moving on-chain and thus require block space to confirm.

Despite inscribing and trading obscure assets being a niche interest, it is still enough to affect the entire market and users who simply want to transact, create lightning channels or secure funds in cold storage have to compete with these traders for block space.

What Are Your Options if the Mempool is Full?

When the mempool is full, users may experience longer confirmation times and higher transaction fees. Here are some options for users in this situation:

Wait for the congestion to clear.

One option is to wait for the mempool to clear and the transaction volume to decrease. As miners continue to process transactions, the mempool backlog will eventually clear. However, this approach may take a significant amount of time, especially during periods of high network activity.

Increase the transaction fee.

Miners prioritise transactions with higher fees, so you can increase the likelihood of your transaction being processed quickly by increasing the fee. Most wallet software allows users to adjust the transaction fee manually. Be aware that increasing the fee may result in higher transaction costs.

Replace-by-fee (RBF)

If your transaction is stuck in the mempool and you’re using a wallet that supports replace-by-fee (RBF), you can create a new transaction with a higher fee to replace the original one. RBF allows you to “bump” the fee of an unconfirmed transaction, making it more attractive to miners and increasing the chances of it being included in the next block.

Child-pays-for-parent (CPFP)

Another option is to use the child-pays-for-parent (CPFP) method. This involves creating a new transaction that spends the unconfirmed transaction’s output, effectively paying a higher fee for both the original transaction and the new speedier transaction. Miners will then have the incentive to include both transactions in a block due to the combined higher fee.

Use second-layer networks.

Alternatively, if you’re not keen on playing the fee bidding game, your next step is to move off-chain. The simplest way to do so will be to use custodial services like exchanges or custodial Lightning wallets if you’re not technically inclined.

If you have the technical know-how and the time, your other options include paying a higher fee to set up a Lightning channel or setting up multiple channels in one go, and once it’s up and running, route your payments through this channel instead.

Another off-chain option would be to move your business over to the Liquid Network in the meantime, where you’ll be able to enjoy 2-minute confirmation times and an average cost of 0.10 sats per vbyte. Once congestion has died down, you can always swap your L-BTC balance over to the base chain at a fee you deem reasonable.

If you guys are going to continue to be ordinal A-holes and spam the chain driving up prices for block space then I will not be playing that game. There is not a chance in hell I'm paying 60 sats/vB pic.twitter.com/I7tmg67kED

— TheBitcoinManual (@TheBTCManual) May 4, 2023

Will ordinals keep fees higher forever?

The truth is no one knows; we have no idea how long this trend can last nor how much money could be poured into keeping it going, which could mean fees remain higher for longer.

The longer fees remain high, the more incentive it is for Bitcoiners to go off-chain and use second-layer solutions, which can be tracked by how much activity and capacity moves onto Lightning or Liquid.

Does this mean the average Bitcoiner will be relegated to L2s for the foreseeable future? Perhaps, but there are headwinds that could see ordinal demand move off the Bitcoin blockchain too.

Moving ordinals to other chains.

Since ordinals are an open protocol that can be run on top of Bitcoin, it was only a matter of time before other chains began to apply it to their chain.

Developers on altcoin chains like:

- Bitcoin Cash

- Bitcoin SV

- Litecoin

- Dogecoin

Are already working on implementations to support ordinals and inscriptions, which could drive demand to these ecosystems instead.

Exchanges could reduce on-chain trading.

Exchanges have also thrown their hat into the ring, claiming they will add support for BTC-20 Tokens and Inscription NFTs, which would see users sending their UTXOs to exchanges to custody and then allowing traders to use the exchanges engine to trade instead of transferring ownership on the chain.

Wrapped tokens are sure to be a thing.

Just as BitGo became the primary custodian of Bitcoin and issued wBTC, it would not surprise me if this style of wrapped tokens is in the works right now. In this model, users would then send their inscribed UTXO to a custodian who would read off the file or JSON and then mint a token on a smart contract blockchain like Ethereum, Binance chain, Solana, TRON etc. as a “bridged” asset.

Once your BRC-20 token is bridged into a token on these chains, they can form part of DEX trading, Liquidity pools and all the other yield farming activities that take place in these ecosystems.

Creating money out of thin air and storing it in Bitcoin blocks is still money out of thin air; Bitcoin doesn’t know these assets exist, nor does it validate them in any way. But if you like trading capital flows, and chasing the next hype cycle, go right ahead.

Who am I to judge?

The hype might die down with time.

Token trading and NFTs are a fickle market with traders moving to whatever is new and shiny; for now, its ordinals and inscriptions, but it surely will not remain that way forever. As this new toy loses is shine, as people find out they holding worthless jpegs and JSON files they cannot pawn off to the next person and as people realise they spent a fortune on miner fees for no return, we could see the market for the types of transactions try up.

You get what you pay for in the fee market.

Dealing with Bitcoin on-chain fees is an aspect of using the network effectively and ensuring that transactions are processed promptly. As a Bitcoin user, you have a few strategies to optimise your transaction fees and plan accordingly. As a savvy Bitcoin user, you should use services, including fee estimation tools, transaction batching, and timing transactions during periods of lower network congestion. By employing these techniques, users can better navigate the fee market and maintain control over personal transaction costs.

A fee market is a necessary component of the Bitcoin ecosystem as it helps avoid spam and Sybil attacks and acts as an incentive to secure the network. As block rewards diminish over time due to Bitcoin’s deflationary nature, the network will increasingly rely on transaction fees to incentivise miners and secure the blockchain. A fee market helps strike a balance between network usage and miner compensation, ensuring the long-term sustainability and security of the Bitcoin network.