Bitcoin has changed how we transfer value online, allowing users to transfer funds without an intermediary. It has chugged along nicely over the last decade, increasing its user base yearly. While several bull cycles have come and gone, on-chain transactions could meet demand interest, and the user base was manageable.

Yes, there were a few hiccups along the way with large fee spikes, but it eventually worked its way out over time, and we continued on as normal.

Tick, tock, next block.

Still, as Bitcoin grows into a Trillion dollar and hopefully soon a multi-trillion dollar asset, it will have to deal with a greater need for throughput. Some Bitcoin transactions have already priced themselves out of on-chain use and migrated to existing scaling offerings like side-chains or the Lightning Network.

Mempool backlogs and the scaling debate

Last year’s mempool clogging madness and resulting fee spikes from Ordinals gave Bitcoin users and the market a lot to think about when onboarding the next cohort of eager on-chain stackers.

As a result, scaling discussions have ramped up once again, with ideas on how Lightning can be improved and work around main-chain block space issues, while side-chains have seen more peg-ins than ever before.

But with every legitimate market reaction, a few opportunists and a bunch of BLINOs (Bitcoin Layers In Name Only) are spinning up, claiming to be the next-generation scaling solution, and it’s all become tiresome to review and leave disappointed in their pitches.

Yes, coming up with a layer two solution is so hot right now that even publicly traded Bitcoin miner Marathon decided to step into the ring, announcing their Anduro layer two proposals. Anduro is a second-layer solution that borrows from existing Bitcoin scalability solutions to offer its hybrid take on side chains.

Today, we’re announcing Anduro: a multi-chain, layer-two network on #Bitcoin. pic.twitter.com/kgEAlbJdto

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) February 28, 2024

What is Bitcoin scalability?

Bitcoin’s core strength lies in its decentralised and secure nature. Bitcoin, the network, remains easy to run by all participants, with node requirements kept as low as possible. What Bitcoin gains in security and redundancy, it loses in processing more transactions at a given moment.

Bitcoin’s network can currently handle only a limited number of transactions per second (TPS), around seven if you’re looking for a numerical figure on which to base things. This limitation can lead to transaction backlogs and higher fees, especially during periods of high demand.

As a result, more transactions need to be processed in layers above the base chain, with second layer networks aiming to process transactions between users without constant need for final settlement on the base chain.

What is Anduro?

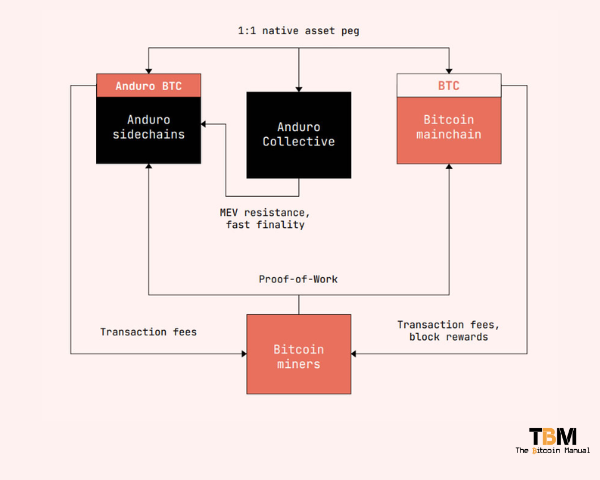

Marathon, as a miner, would naturally want to leverage the assets they have at their disposal, which is likely why they’ve opted for Anduro to maintain its blockchain and consensus through merge mining, similar to Rootstock (RSK). As new blocks on Anduro chains are added, the fees will go to miners who support the chain, which could provide additional revenues for miners.

Like other side chains, to get Bitcoin into Andura, you will need to use a peg-in system, and in Andura’s case, the peg will be managed by a “Collective” This is a federation of 15 members who act as Functionaries that handle the multi-sig keys involved with managing the peg.

The Collective acts in the same way Liquid Federation members do and could expand to 50 or more Contributors if there is enough interest in the Anduro network.

Federated peg-ins will only sit well with a portion of the market, as users prefer unilateral exit from a second layer. Marathon states they intend to work towards a trustless peg-in-out mechanism with research into two-way BitVM pegging and how this could be achievable.

The Road Ahead for Anduro

To give users an idea of this network of chains, the mining giant said it is working on the first two sidechains on Anduro, Coordinate and Alys.

Coordinate

Coordinate is a Bitcoin sidechain variant most users will be familiar with, as it offers a cost-effective UTXO (unspent transaction output) model similar to the base chain and Liquid. Coordinate will support asset issuance similar to Liquid and intends to cater towards Ordinals and token use cases such as BRC-20 and any DEFI protocols/platforms that have sprung up to support this ecosystem of meme coins and unregistered securities.

Alys

Alys is the account-based model and Ethereum sidechain variant running the Ethereum Virtual Machine and Solidity, similar to Rootstock. The idea behind this chain is to provide a bridge between Bitcoin, the asset, and Ethereum application developers who want to shift their focus towards building services and tools on top of Bitcoin or those looking to access Bitcoin liquidity.

It’s important to note that Anduro is still under development, and its success hinges on several factors:

- Technical Implementation: The technical complexities of Anduro need to be carefully addressed to ensure its smooth operation.

- Community Adoption: Widespread adoption by users, miners, and businesses is crucial for Anduro’s long-term viability.

- Security Audits: Rigorous security audits ensure Anduro doesn’t introduce new vulnerabilities to the Bitcoin ecosystem.

- Regulatory concerns: Marathon is a publicly traded company launching a side chain, which is an entirely new business model bringing new risks. Sidechains can fall under regulatory jurisdictions different from the main chain, creating legal and compliance complexities, especially with how you manage fraud, OFAC-compliant transactions, and the trading of unregistered securities on your network.

- Market adoption: Anduro already has competition from existing sidechains with over 3000 Bitcoin pegged into Liquid and Rootstock, respectively. Anduro chains must compete with these more established networks to secure liquidity, users, wallet integrations and exchange support.

“We believe in testing, iterating, and letting the market decide what ideas succeed, Anduro is one of those ideas that provides value to Bitcoin holders and application developers, all while reinforcing the long-run sustainability of Bitcoin’s Proof-of-Work.”

Marathon Chairman and CEO, Fred Thiel

Potential Benefits of Anduro

If successfully implemented, Anduro has the potential to offer the same things other scaling solutions offer,

- Faster Transactions: Increased transaction processing speeds could lead to quicker and more efficient Bitcoin usage.

- Reduced Fees: Lower transaction fees could incentivise wider adoption and use of Bitcoin.

- Improved Scalability: Anduro could pave the way for Bitcoin to handle a larger volume of transactions, making it more scalable for the future.

- Smart contracts: Allowing developers to port over existing tools from other EVM chains

- Asset issuance: Allowing users to issue non-native assets like wrapped tokens or stablecoins

Anduro: A niche scaling solution or possible white elephant?

Now, I am all for innovation and experimentation, but nothing genuinely unique stands out when it comes to comparing Anduro to the host of existing solutions.

Liquid and Rootstock blocks are a ghost town, so where will this newfound demand for side chain Anduro block space come from? Until we have consistently high fee pressure on the base chain, I don’t see how side chains will have any luck convincing users to make the switch.

The other side chains have had a few years to develop a user base, developer base and avenues for liquidity, which means Anduro will have to play catch up.

Launching a new scaling solution requires building robust technology to handle transactions securely, attracting a critical mass of users to create a valuable network effect, and competing with established players with a foothold in the market.

Suppose you’ve followed Lightning’s progress over the past five years.

In that case, you’ll know all the teething issues involved, from getting support from exchanges to releasing developer-friendly packages so other wallets and service providers can integrate with your network.

All this must be done while convincing users to try a new system or switch from familiar alternatives.

Do your own research.

If you want to learn more about Anduro and its impact on Bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.