BRC-20 tokens started out as a joke, an experimental token standard using the ordinals protocol, with some clear issues that even its creator claimed were flawed from the start. Even the creator of the ordinal theory on Bitcoin has proposed an alternative implementation in Runes. It was never meant to be anything but a novelty use case for ordinals, but it hasn’t stopped users from flocking to it.

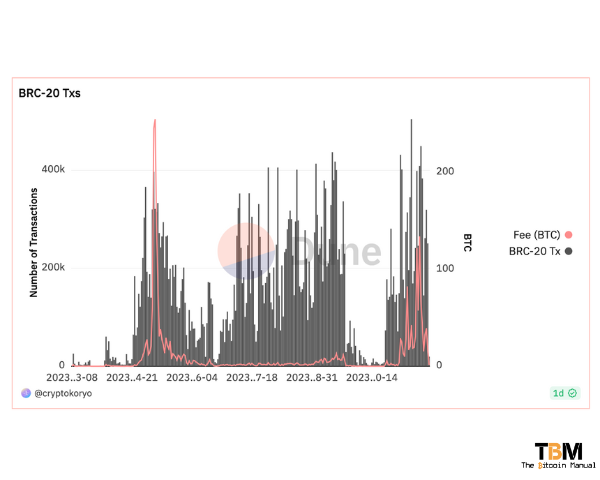

As more users started to mint and trade these tokens, it’s put a significant strain on the mempool, pushing up fees and gobbling up block space.

According to BRC-20.io, there are currently 55.3k different tokens on the Bitcoin blockchain, held by 286.9k different holders, and it has a total market cap of $3 billion dollars, not bad for arbitrary data embedded into the Bitcoin blockchain, with its only valuable proposition being the cost of block space used to create and move these tokens around.

As BRC-20 token minting and trading bloat the mempool and make it more expensive to run your standard Bitcoin transactions, the debate around how to scale these transactions heats up once again. Some claim that ordinals users should migrate their activity to a side-chain like the Liquid Network or Rootstock, while the emergence of Taproot Assets has sparked a debate about its potential to supersede BRC-20 tokens as the dominant standard for fungible assets on the Bitcoin blockchain.

While Taproot Assets offers several advantages over BRC-20, it faces significant challenges in encouraging users to migrate from the existing BRC-20 degeneracy.

BRC-20 Mania

The BRC-20 standard for creating fungible tokens on the Bitcoin blockchain has gained immense popularity due to its simplicity and compatibility with existing Bitcoin infrastructure. Now that these so-called tokens can be inscribed into the blockchain, a frenzy of memecoins, pump-and-dump schemes, and tokenomics grifting. BRC-20 tokens might be pitched as a fun new way to use the Bitcoin blockchain, but it is riddled with risks, as participants all try to mint unregistered securities and later try their tokens for more than they paid in fees in order to secure a profit.

Ordinals might live on the Bitcoin blockchain, but the network’s consensus does not back them; they are created and managed through third-party data indexes, and actions such as token deployment, minting, and transfers depend entirely on users publishing specific data fields to the blockchain. Ordinals can only provide “legitimacy” interpretation based on the protocol’s interpretation of data retrieved from the Bitcoin blockchain.

It might have its novelty now, but we have no idea how long the market will see this as a novel use of Bitcoin and block space before they move on to the next trend. As to when BRC-20 tokens will lose their shine, it’s anyone’s guess, but for now, it’s a market we have to deal with as users plough millions into on-chain fees to keep this trend going.

We did have a short reprieve of BRC-20 tokens trading during the launch of the Sophon bot, but since its discontinuation, BRC-20 token transactions have been on the rise.

Why are BRC-20 tokens attractive to traders?

While much can be said about BRC-20 tokens’ technical implementation and issues, but there is clearly enough about it to attract thousands of Bitcoin into this secondary market and the fees required to sustain it.

- The cost of doing business: There is something about paying a lot of money that triggers humans to think something is valuable. The fact that it costs so much in Bitcoin to mint and transfer these tokens gives holders the feeling that these tokens are of value. BRC-20 tokens sort of fall into the category of a Veblen good, a type of good for which demand increases as the price rises.

- The backing of the time chain: Besides paying high on-chain fees for your BRC-20 token transactions, you also have your data secured in the longest-serving blockchain with the most robust security.

- Fairness launch narrative: There is an idea that BRC-20 tokens provide inherent fairness in launching; users can participate in asset circulation by sending transaction notes with specific parameters directly to the blockchain to secure an allocation of a coin during the minting phase. This is seen as a better distribution method than the age-old pre-mine, ICO, IDO, and IEO launches of the past, but anything would be better than those scams.

- Potential for high returns: BRC-20 tokens have the potential for high returns, as the Bitcoin blockchain is a rapidly growing ecosystem with a tonne of liquidity versus altcoin chains. This makes BRC-20 tokens attractive for traders seeking high-risk, high-reward opportunities. It is easy to FOMO and speculate on a chain with some people sharing their moon bag profit stories from front-running market sentiment, only making the idea of gambling on these tokens more attractive.

Issues with BRC-20 tokens

BRC-20 tokens might be the darling of the speculators for now, but it is not without its issues; just because you’re moving your gambling over to Bitcoin doesn’t make it any less risky. Users of BRC-20 tokens are already giving up the established token standards and Turing complete smart contracts of other chains for trading metadata indexed by 3rd party protocol; seriously, what could go wrong?

- Market manipulation: Fair launching is merely a concept to try to stimulate the growth of a completely fake and useless asset. It takes work to participate in early minting or low-cost fundraising. While it might seem like these token mints are done above board, all on-chain and out in the open, it doesn’t mean they are not susceptible to market manipulation; whales can deploy a token at any time to gain traffic and followers by pumping it.

- Indexes need to be in sync: It’s easy to have Ordinals index ledger discrepancies when depositing or withdrawing BRC-20 assets on exchanges, leading to false deposit attacks. There might also be logic errors in the accounting between Ordinals indexes and some third-party service platforms, disrupting the order of asset circulation or creating double spending situations.

- Sniping transactions and MEV: As proven by Sophon, it is technically possible to monitor Mempool data in real time to block BRC20 deployment, disturbing the fairness of token issuance. However, that is only one use of transaction sniping, and it could be used to front-run minting and other transactions to gain an advantage over other users and drive profits through MEV.

Taproot Assets: A new contender for token issuance

Taproot Assets is a new extension to the Bitcoin and Lightning Network; this new protocol introduces a more efficient and flexible mechanism for creating and managing fungible assets through the help of Merkle trees. It leverages Taproot, a soft fork upgrade to Bitcoin, along with Bitcoin’s multi-signature and hash time-locked contracts to embed asset data directly into Bitcoin transactions, eliminating the need for separate data structures like UTXOs.

Advantages of Taproot Assets

Taproot Assets offers several advantages over BRC-20, including:

- Efficiency: Taproot Assets reduces transaction fees and improves transaction throughput by embedding asset data directly into Bitcoin transactions.

- Flexibility: Taproot Assets provides more flexibility in asset design, allowing for features like asset issuance, locking, and burning.

- Security: Taproot Assets leverages Taproot’s security enhancements to protect asset data and transactions.

- Cost: Taproot Assets are transferred via Lightning channels, ensuring that it has a vastly smaller on-chain footprint and, as a result, are far cheaper to create, manage and transfer versus BRC-20 tokens

If BRC-20 token activity were to migrate towards Taproot assets, it would reduce the strain on the mempool and the need to inflate the cost per transaction as block space is used more effectively.

Challenges in migrating BRC-20 to Taproot Assets

Despite its advantages, Taproot Assets faces significant challenges in migrating the existing BRC-20 ecosystem:

- Network adoption: Taproot adoption still needs to be higher among Bitcoin nodes, which could hinder the adoption of Taproot Assets.

- Ecosystem compatibility: Existing BRC-20 wallets, dApps, and exchanges must be updated to support Taproot Assets.

- User migration: Convincing BRC-20 token holders to switch to Taproot Assets may be challenging due to network effects and switching costs, with the idea of running your own node and Lightning complexity alienating some users.

- Miner income: Another critical aspect of BRC-20 and ordinals transactions is the considerable fees it generates for miners, with some proponents claiming these transactions will provide a more robust security budget in the future. Miners will want to retain this revenue and would support the status quo. If BRC-20 token activity were to migrate to Taproot Assets, the fees earned through running a Lighting node, even with additional user activity and scale, would be way less than what miners could achieve in the current environment.

A transition looks unlikely for now.

Taproot Assets do have the potential to address the current battle for block space by giving users who want to speculate a method of creating and managing fungible assets on the Bitcoin blockchain without the technical overhang and cost.

But anything that falls into the crypto space doesn’t always have to make logical sense, and sometimes, network effects can be built on inferior technology that is hard to break. If we look at this from an incentive perspective, it will make sense to migrate to Taproot Assets. It offers superior efficiency, flexibility, and security, but the pace of adoption will depend on network upgrades, ecosystem compatibility, and user adoption.

Ordinals already have users, platforms, wallets and software that have all sunk costs tied to the protocol. Additionally, BRC-20 tokens are easier to distribute but hard to secure supply for yourself. At the same time, Taproot Assets don’t have this minting mania mechanism driving speculation, and they remain but are hard to distribute and manage.

Migrating the existing BRC-20 ecosystem is also a complex task as the two protocols are not interoperable, so even if users and platforms want to switch over or support bridging, the transition is likely to be gradual, with BRC-20 and Taproot Assets coexisting for an extended period.

Do your own research.

If you want to learn more about Taproot assets vs BRC-20 tokens, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.