Sweden consistently ranks among the happiest countries in the world by the happy police but now seems none too pleased with how certain data centre businesses operate within its borders. To outsiders like myself, the country is known for high car safety scorings and assembled furniture brands, but it also holds a surprising title in the Bitcoin world—it is a prime destination for mining in Europe and, at its peak, produced nearly 2% of the global hash rate.

This unlikely title stemmed from a unique combination of factors, but recent policy changes have cast doubt on Sweden’s future as a Bitcoin hub in Europe.

Western Europe’s top three hash rate producers are Germany, Ireland, and Sweden. Yet now it looks like the happiest country is not interested in competing anymore and is blowing up local operations, like a certain pipeline that flowed through the Baltic, but we’ll get to that.

While not actively kicking miners out as we saw in China with a straight-up ban, the soft power of taxes is used to pressure miners to shut off and ship out.

| Country | Percentage of global hash rate |

|---|---|

| United States | 37.84 |

| China | 21.11 |

| Kazakhstan | 13.22 |

| Canada | 6.48 |

| Russia | 4.66 |

| Germany | 3.06 |

| Malaysia | 2.51 |

| Ireland | 1.97 |

| Thailand | 0.96 |

| Sweden | 0.84 |

| Norway | 0.74 |

| Australia | 0.36 |

Why Sweden was a popular choice for miners

Sweden has a free market for energy production suppliers, with 140 companies selling electricity to consumers. Since 1996, Swedish consumers and companies have been able to choose their preferred power supplier. The country is an electricity powerhouse, generating the fifth-most electricity per capita globally in 2021. It has an extensive land grid and underground cables that channel energy to its various substations.

Hydro and nuclear power are the backbone of the electricity system, with 44% and 31% generation shares, respectively. Wind power, which currently generates 16%, along with bioenergy and oil, provides supplementary energy.

A come-and-get-me plea of stranded energy

The allure for Bitcoin miners came down to one key factor: Sweden’s exceptional energy mix. Sweden boasts a remarkably clean energy grid, unlike many countries heavily reliant on fossil fuels. So miners that are looking for ESG points could plugin into these energy sources without getting Greta and the gang on their back that we’re boiling the oceans.

Vast amounts of hydroelectric power are generated in northern Sweden, but due to limitations in the national grid, not all this energy can be readily transmitted southward.

This “stranded” hydropower presented a unique opportunity for Bitcoin miners in the north to access cheap, reliable energy perfectly suited for their power-hungry operations. The entire Bitcoin mining industry is located in the northern part of the country, and Boden, a small industrial town where both Hive Blockchain and Northern Data operate, is the biggest mining hub in the region.

This abundance of renewable energy held immense appeal for Bitcoin miners.

Sweden had been pretty chill on Bitcoin

With its clean energy and attractive northern pockets of cheap electricity, Sweden witnessed a surge in Bitcoin mining activity. Sweden also housed several GPU facilities that mined Ethereum pre-merge and are now mining altcoins or doing high-performance computing like AI.

Miners flocked to the country, drawn by the opportunity to combine profitability with environmental responsibility.

This influx of miners boosted the local economy and contributed to Sweden’s position as a leader in sustainable Bitcoin mining on the European stage. Sweden’s reputation for political stability and a business-friendly environment further bolstered its appeal.

The perfect climate (Literally)

Sweden’s cool climate added to its appeal for Bitcoin miners. Mining rigs generate a lot of heat, and keeping them cool is crucial for efficient operation. The average temperatures in Boden, where most miners are, range from -9C (-15F) to +17C (+62F) between the coldest and warmest months.

Sweden’s naturally cooler temperatures, particularly in the north, helped minimise the need for additional cooling systems, further reducing operational costs for miners.

Energy prices have been on the rise

After the lockdown re-opening and the start of the Ukraine-Russia conflict, Western Europe has had to deal with considerable bouts of inflation, especially in the energy sector, due to the cutoff of the cheap and reliable natural gas and oil coming out of Russia.

Between 2018 and 2020, southern Sweden’s average spot electricity price was only $41 per MWh. In 2021, the price rose to $82 per MWh, rendering bitcoin mining prohibitively expensive and making daily life more expensive for the average Swede and local businesses.

In 2022, the average price reached an unprecedented $148 per MWh, pushing even the most energy-efficient ASICs into cash flow negative territory.

This electricity price increase devastated southern Sweden’s miners, who went bankrupt or moved up north since electricity prices in those regions have stayed at around the same levels as before the energy crisis.

Inflation is a funny old thing; it can quickly sow discontent in the population, and if you don’t have a big bad boogyman to blame that isn’t money printing, you’ll have a bad time in public office.

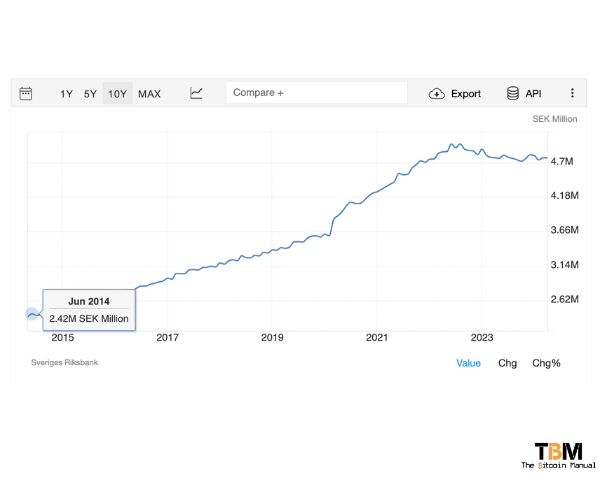

Bitcoin miners seem to be the sacrificial lamb in this example. Everyone, please ignore that Sweden has doubled its M2 money supply over the last ten years. The reason your energy and living costs are higher is those greedy Bitcoin miners up north. Oh, and Putin. You gotta throw in a Vlad jab; it’s provocative and gets the people going.

A Shift in the landscape

In 2017, Sweden offered a too-good-to-pass-up 98% tax cut for data centres, looking to attract businesses, which they did. Tech giants like Microsoft, Amazon and Facebook have recently set up data centres in the country off the back of these policies.

Fast-forward a year, and what they give, they take away and then some. The government claims the move brought in capex and business, but the industry hasn’t created the jobs the country was hoping for, and the macroeconomic environment has changed.

While Sweden initially embraced Bitcoin mining, concerns suddenly began to arise regarding the immense energy consumption associated with mining, particularly as energy prices fluctuated across Europe.

The claimed fear was that a surge in mining activity could strain the national grid and potentially hinder Sweden’s ability to meet its climate goals while completely ignoring the additional income, demand response savings, and energy monetisation that would otherwise have gone to waste.

Sweden goes tax maxxing

Now, removing incentives is one thing, and if a business can’t run a profitable operation on its own, competing in the free market, it should die or move to a place with more favourable conditions, right?

Well, Sweden isn’t going to take any chances on these cockroach miners finding a way to survive. In 2023, a policy change sent shockwaves through the Swedish Bitcoin mining industry.

The government implemented a tax hike on data centres, which significantly increased the energy costs for miners. This move, coupled with rising energy prices across Europe, made Sweden a less attractive proposition for many mining operations.

The tax will increase from SEK 0.006 ($0.0006) to SEK 0.36 ($0.035) per kilowatt hour (kWh) starting July of 2024. The 6,000% increase in taxes per kilowatt hour of energy may “ultimately destroy the industry” in the country.

Once this goes into effect, many, if not all, miners will be forced to relocate to regions with lower energy costs, effectively pushing them out of Sweden.

Bitcoin miners are left out in the cold

The recent tax hike leaves the future of Bitcoin mining in Sweden uncertain. While the country still boasts a clean energy grid, the increased costs have eroded its competitive edge. So, let’s see what they do with the spare capacity now that miners cannot purchase it.

Will it bring down energy costs?

Will a new industry absorb that energy, and can this industry create new jobs so politicians can claim they did something? It remains to be seen if Sweden will find a way to balance its obsession with environmental goals versus the potential economic benefits of having an active, profitable industry.

The story of Bitcoin mining in Sweden offers valuable insights into how you can have a favourable climate and access to low-cost resources. Still, if the population and representatives of the population can’t see the value in what you bring to the country, you’ll be out on your arse.

Bitcoin is competition for the eKrona

Sweden is lauded as one of those close to cashless or near cashless countries after a surge of armed robberies in the 1990s. Since the push for electronic payments, the country has one of the world’s lowest ATMs per capita; only around 8% of Swedes said they use cash.

As cash becomes marginalised, so does financial privacy and certain financial transactions; it also makes tax monetisation easier, meaning more of a citizen’s hard-earned labour lands in state coffers.

The Riksbank is also investigating a digital complement to cash, known as the e-krona, which would be a digital Swedish krona issued by the Riksbank, with all sorts of programable shitfuckery baked into it.

Suppose Bitcoin is allowed to increase in the country, and more local miners feed local P2P networks for trading. In that case, this can circumvent the digital silo that is the Riksbank wet dream and ensure you’re subject to the local inflation rate.

Sweden’s central bank governor is already saying the quite bit out loud and wants as little bitcoin (BTC) as possible in the country’s financial system, Bloomberg reported.

“It’s an instrument that is impossible to value, and in practice, it’s based on pure speculation,”

Riksbank Governor Erik Thedeen.

If Bitcoin is fundamentally flawed, it will fail on its own merits, and the citizens of Sweden, with their higher per capita education than a third-world pleb like myself, should be able to figure it out on their own, right?

Why do they need such an infantilisation of the public, barring them from things, as if these aren’t adults and rational economic actors? I guess we can’t expect much from a country that feels putting restrictions on buying booze is for the greater good.

One team’s own goal is another team’s winning goal

The Swedish House Mafia of Representatives can do as they please; it’s unlikely the general public, uneducated on Bitcoin mining, will push back or kick up a surströmming stink about it.

But don’t you worry, don’t you worry, child, Bitcoin’s got a plan for you.

While it’s up to Swedes themselves to fight for their right to Bitcoin by pushing for better laws, that’s their problem.

The honeybadger doesn’t care!

When you take a shotgun to your Achilles like this, you only make another region of the world more attractive to miners. All miners need to do is unplug their ASICs and haul their operation somewhere new or give up and sell to someone in a country with favourable conditions. This could lead to a significant shift in the global Bitcoin mining landscape.

Moreover, mining capacity can be redistributed from a single point of attack in Sweden. The average garage miner could pick up a rig for a steal and start mining their own non-KYC Bitcoin, contributing to a more decentralised mining network.