MicroStrategy (MSTR), the software company founded by Michael Saylor, is the first to adopt a Bitcoin treasury policy, and it’s done wonders for his share price and the growth of his business. He has set the stage for corporate involvement in Bitcoin from companies that don’t directly work in this space, and a few have joined him this year, such as MetaPlanet and Rumble.

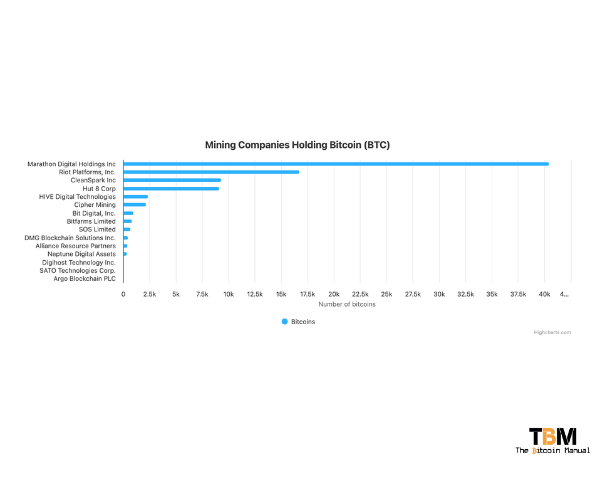

While MSTR leads the way with 400,000+ Bitcoin on the books, it’s not the only large-scale corporate buyer of Bitcoin (BTC). In a fascinating development within the cryptocurrency industry, public Bitcoin mining companies are increasingly turning to an unconventional strategy.

Raising capital through equity sales and convertible bonds, then using those proceeds to purchase Bitcoin directly from the open market.

This approach represents a significant shift in a miner’s traditional business model and reveals important insights about both the mining industry and the shift within the broader Bitcoin market.

The Traditional Mining Business Model

Historically, Bitcoin miners operated on a straightforward premise: invest in mining equipment (ASICs) and consume as much cheap electricity as possible to mine Bitcoin at a lower cost than the market trades at.

Miners then pick out opportune times to turn around and sell enough of the mined Bitcoin to cover operational costs while holding the rest.

This model worked well during bull markets where prices are bid to all-time highs but can leave miners exposed to significant risks during downturns as they struggle to extend runway or cover expenses.

Suppose miners do not cash in during frothy periods, and a deep or long bear market follows; they can be left with a cash shortfall or interest expenses they cannot service. This miscalculation can cause operations to go bankrupt.

Miners filing for bankruptcy is nothing new. Core Scientific filed for bankruptcy last week after saying that in October 2023, Celsius Mining and Compute North filed for bankruptcy because they were overleveraged and unprepared for higher energy costs.

Traditional Markets Don’t Like The Uncertainty Bitcoin Miners Bring

This feast of famine cycle has not been kind enough to raise capital from public markets. Bitcoin mining stocks have struggled to grow their share prices due to several fundamental factors that have led to multiple compressions, even as Bitcoin’s price has risen.

The mining business requires constant capital investment to:

- Replace ageing equipment with newer, more efficient miners

- Expand operations to maintain market share as the global hash rate grows

- Fund infrastructure for power and cooling systems

- Cover operating expenses during a market downturn

- Mitigate the impact of each halving cycle in the distribution of rewards

- Work around the lack of transaction fee growth to compensate for lowering block rewards

So what are miners to do?

Bitcoin Miners Are On A Diversification Mission

Some have tried to diversify operations by shifting towards data centre services and AI as they chase the capital flowing into the hottest trend, and you can’t blame them. So far in 2024, investors have pumped $26.8 billion into 498 generative AI deals, including from strategic investors, according to PitchBook.

When AI startups get funding, they’re not going to build out their own infrastructure; they’re going to lease it; while they can head to the big boys like Azure, Google Cloud or AWS, Bitcoin miners can offer sweeter deals for these startups.

The increasing demand for data centre services is due to the growth of cloud computing and AI works because you can repurpose your operations to scale each segment and use the same equipment, such as high-powered computing and cooling systems.

Pivoting Bitcoin miners still face the gamble of when the AI bubble bursts. This trend also has a life span where capital doesn’t expect an immediate return, but as AI matures, the funds dry up, and those downstream of these startups will see revenues shrink.

So, AI and data centre services are a stop-gap solution for now, and we will see how well they do going into the future. So, what’s the next play?

The market also rewards companies that hold Bitcoin on their balance sheet, à la MicroStrategy, so why not throw that into your operational mix, too?

You’re already holding some due to the nature of your business, so why not add more? That’s exactly the thinking behind companies like Marathon and Hut 8’s latest move.

Even miners like Cathedra Bitcoin have already announced their plans to pivot away from Bitcoin mining to providing general data centre services and buying Bitcoin on the open market.

Why the Strategic Shift?

So why are you buying something you can produce yourself? Wasn’t the goal of miners to generate Bitcoin and sell it for a profit?

Two publicly traded Bitcoin mining companies just bought the BTC dip:$MARA Spent roughly $1.53B to acquire 15,574 BTC$HUT Spent roughly $100m to acquire 990 BTC pic.twitter.com/vggJ8Fjijc

— Tetron (@TetronInvest) December 19, 2024

Several factors are driving this new approach:

1. Mining Economics Have Changed

The Bitcoin mining landscape has become increasingly competitive, with rising hash rates and energy costs squeezing profit margins. Mining a Bitcoin can be more expensive than buying one outright, especially considering the cost of infrastructure and operations, spikes in energy costs or having to pause or slow down operations due to demand response clauses in contracts with energy producers.

2. Market Opportunity

With bitcoin showing strong performance and institutional interest growing, many miners believe we’re in the early stages of a significant bull market. By raising capital now to acquire Bitcoin directly, they’re essentially making a leveraged bet on Bitcoin’s future appreciation.

3. Risk Management

This strategy helps miners diversify their exposure to Bitcoin. Instead of relying solely on their ability to mine profitably (which depends on many variables outside their control), they can build bitcoin reserves through direct acquisition.

As a miner, your end goal is to acquire as much Bitcoin as possible for the lowest price and in the shortest period, and sometimes, buying it is the better use of capital.

The Financial Engineering Behind It

Now, I’m not going to go into depth about convertible bonds; that’s a story for another day. I would suggest you listen to Saylor himself on the topic, but the TLDR is that convertible bond traders are thirstier for volatility than a simp with $1000 bucks and an Onlyfans account.

They’re desperate for some alpha but can only play in certain markets; companies like MSTR and now Bitcoin miners, using convertible bonds to acquire Bitcoin, offer these funds the 5, 10, 20x the volatility they can get in other products, and they’re all too happy to walk into these trades blindly.

The use of equity sales and convertible bonds is particularly clever for several reasons:

- Cost of Capital: In the current market environment, many mining companies can raise capital at relatively attractive rates, especially through convertible bonds, which typically carry lower interest rates than traditional debt.

- Flexibility: Convertible bonds offer flexibility to both the company and investors, potentially making them more attractive to institutional investors who want exposure to the Bitcoin mining sector.

- Balance Sheet Strength: By acquiring bitcoin reserves, miners strengthen their balance sheets with an asset that, while volatile, has historically appreciated over the long term.

Potential Risks and Criticisms

This strategy isn’t without its critics.

Some argue that:

- It dilutes existing shareholders

- It transforms mining companies into pseudo-Bitcoin ETFs

- It could create additional pressure if bitcoin prices fall significantly

But as long as your business can generate income to cover operations and acquire more Bitcoin, your dilution shouldn’t matter since you’re backing the stocks with a high allocation of retained earnings in Bitcoin.

Unit bias with ETFs and Bitcoin stocks

The high price of Bitcoin can be a barrier to entry for many retail investors, especially those with limited capital. Additionally, the volatility of Bitcoin can be intimidating for some investors, who may prefer the perceived stability of ETFs or stocks.

Unit bias is the tendency to favour smaller, more numerous units, may also play a role. Investors may feel more comfortable purchasing a larger number of ETF shares or mining stocks, even if the overall investment value is the same as a single Bitcoin.

Shitcoins have exploited this bias for years and have proven to be a decisive factor in retail allocation methodology. Unit bias also supports the adage of diversification. Instead of spending my $ 10,000 on 0.1 BTC, I can get a basket of MSTR, MARA and ETF shares and feel I have more bang for my buck.

The Bigger Picture

This trend reflects a broader evolution in how the Bitcoin mining industry thinks about capital allocation and risk management. Some miners are transitioning from pure operators to more sophisticated financial players who see their role as producing Bitcoin and managing Bitcoin exposure optimally for shareholders.

Now, holding Bitcoin is working; for now, miners will need to look to combine these new elements of their business. Who is to say that AI startups wouldn’t benefit from using Lightning to better monetise their operations?

Instead of limiting their services to archaic packages, they could move towards a pay-per-query model. A model like this will need Bitcoin, which miners can provide via side chains or as part of a Lightning node offering.

It also reduces costs for AI startups who have to deal with many payment providers, so they save on operational costs and make them more reliant on their data centre provider.

Looking Ahead

This strategic shift could have lasting implications for the mining industry:

- We might see more miners adopt this hybrid model

- The distinction between mining companies and other bitcoin-focused financial companies could blur

- The industry might develop new financial instruments and strategies for managing mining operations and bitcoin exposure

Public Bitcoin miners’ decision to raise capital for direct Bitcoin purchases represents a sophisticated response to evolving market conditions. While not without risks, this strategy shows how the mining industry matures and adapts to remain competitive in a changing landscape.

You either adapt, or you die! That’s the ruthlessness of the Bitcoin market.