Becoming your own bank has drawbacks, and Bitcoin users are finding that out the hard way. The days of having all your coins on-chain and paying negligible fees are slowly starting to erode, and we have to accept that certain financial transactions will never make sense on-chain. This leaves a new Bitcoin holder; you must decide how to custody your coins for different purposes.

On-chain wallets (hot or cold) are ideal for long-term holdings and those with large enough balances that would not turn into dust transactions later down the line.

If you’re onboarding to Bitcoin for the first time, looking to send or receive micropayments, or want to avoid on-chain fees until it makes economic sense for you, you have several options, like moving to second-layer solutions.

Currently, the most mature environments for off-chain payments are side chains like Liquid or Rootstock; alternatively, you can opt for the more popular scaling layer in the Lightning Network.

Many users face the problem of running Lightning in a non-custodial fashion, which requires some technical skills. Channel management involves a steep learning curve, as well as resource requirements such as having a dedicated node that remains online 24/7, managing liquidity, and connecting to suitable, reliable peers.

These overheads are a step too far for new Lightning users, and we’ve seen that, as the market adopts Lightning, many retail users opt to use custodial services instead.

It’s unfortunate, but very few people will spin up a node, perform an on-chain transaction, and source inbound liquidity to receive 69 sat zaps on nostr or pay for coffee using LN.

So, where do we go from here?

As a Lightning user who doesn’t want to run their own node, you have several options. You can entrust a friend to run one for you, set up an account on their node, and hope they don’t rug you.

You can use a wallet that supports Lightning Service Providers, who will manage a node and channels on your behalf, or you can spin up a wallet that interacts with eCash mints.

eCash mints are a hybrid layer; depending on the type of mint you’re using, they can interact with on-chain payments or Lightning. Imagine using Bitcoin with the anonymity and ease of cash. That’s the promise of Bitcoin eCash mints, an alternative Bitcoin custody solution.

What’s an eCash mint?

Think of an eCash mint as a trusted third-party service that bridges the gap between Bitcoin and anonymous, off-chain transactions. Users deposit their Bitcoin with the mint and receive eCash tokens in return. These tokens are essentially “blinded” versions of Bitcoin, meaning the mint doesn’t know the amount or who owns them.

How does eCash work?

The magic lies in cryptography; eCash mints leverage a technique called blind signatures. When you deposit Bitcoin, the mint creates a unique eCash token but remains oblivious to its value.

You can then spend these tokens with merchants who accept them; alternatively, you can burn them to redeem the Bitcoin backing them and pay a wallet on Bitcoin rails like an on-chain or a Lightning wallet.

This ensures eCash users are interoperable with the wider Bitcoin network and can swap between them anytime.

Why the appeal of eCash?

eCash mints offer several advantages:

- Enhanced Privacy: Transactions using eCash tokens are untraceable on the Bitcoin blockchain, offering a level of anonymity not available with regular Bitcoin transactions.

- Faster Transactions: eCash transactions occur off-chain, bypassing Bitcoin’s block size limitations leading to faster and cheaper transactions.

- Convenience: Using eCash feels similar to using cash—no need to manage complex wallet addresses or wait for on-chain confirmations.

Finding your mint

eCash mints allow the average person to offload their technical custody management to a third party, and you could pick one or several mints and distribute the risk.

You could use a mint where you know the owner or federation members personally or popular mints promoted and vetted by the community; it is an open and free market in custody providers.

Instead of dealing with the complexity of the various Bitcoin layers, you only need to select a compatible eCash wallet, run it on your device and connect the mints you want to use. Once your mints are connected, you’re ready to start sending and receiving Bitcoin payments—it’s as simple as that.

While the concept is gaining traction, eCash mints are still relatively new, with a few brave souls willing to test it out and spin up mints for community members to put through their paces. Bitcoin-backed eCash mints come in two distinct implementations: Cashu Mints and FediMints.

Here’s how to find one:

- Online Directories: Look for directories listing eCash mint providers. Independent developers or cryptocurrency communities may host these directories.

- Community Forums: Engage with online Bitcoin communities. Often, discussions revolve around reliable eCash mint providers.

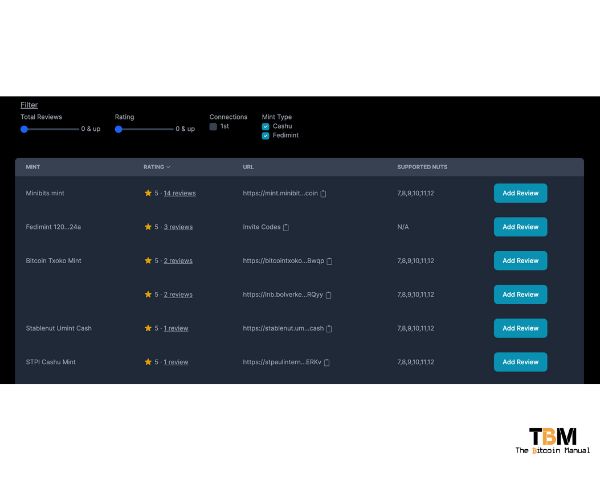

Bitcoin Mints is one of the first eCash mint directories where you can list your mint or find a mint. You can filter results by the type of mint you want to use (Fedi or Cashu) and also check out reviews of different mints published by users who have signed in using their nostr accounts.

You can also leave reviews on mints you use to help improve discovery for other eCash users.

Research reviews

Before trusting any mint, conduct thorough research. Remember: When using an eCash mint, you’re placing your trust in a third party to hold your Bitcoin. So be sure that you’re not using a Mint that has been review spoofed; choose a reputable provider with a solid commitment to security and transparency.

Like any custodial model, you also want to ensure you limit your exposure to them; you can do this by distributing your funds across multiple mints, so in case one does rug you, you still have access to funds on other mints.

It will also be up to you to decide how much exposure you feel comfortable with sitting in an eCash mint. If your balances are starting to make you feel nervous, it might be wise to reduce your position and move some funds on-chain so that you can sleep a lot easier.

The future of eCash mints

eCash mints offer a compelling solution for those seeking privacy and faster Bitcoin transactions. As the technology matures and more providers emerge, eCash mints have the potential to onboard a niche that may not have liked the current set of options available.

This alternative custody model could bring in a new cohort of people willing to interact with Bitcoin and make it easier for non-tech users to have a pleasant onboarding environment as they start their journey down the Bitcoin rabbit hole.

Do your own research.

If you want to learn more about eCash mints, use this article as a starting point. Don’t trust what we say as the final word. Take the time to research other sources, and you can start by checking out the resources below.