ASIC miners help to secure the Bitcoin network by validating transactions. ASICS generating hash power is a necessary part of the Bitcoin ecosystem. Still, the most important aspect for the average person is that these noisy computer boxes can generate new Bitcoin. Each year, individuals and businesses try their hand at this digital gold rush and acquire as many of these digital picks and shovels as they can afford.

Miners can purchase miners directly from manufacturers or resellers on the secondary market. If there is a significant interest in ASICS during a bull market, a reseller could net a healthy profit.

Having seen a dramatic drop in the price of ASICS over the last cycle, Blockstream is betting on the trend reverting and launching a financial product to back it. The Blockstream BASIC Note is a security token that provides investors with exposure to Bitcoin mining through speculation on the demand of ASIC miners, which has its own primary and secondary market. The note is backed by a portfolio of ASIC miners acquired by Blockstream with the intention to sell them on secondary markets as the demand for these devices increases.

The BASIC Note is a simple and efficient way to invest in Bitcoin mining without dealing with the complexity of mining yourself or the risks involved with hosted mining operators.

Why Do ASIC Miner prices spike?

Several factors could contribute to the rising price of mining ASICs; since these are specialised machines that only do one thing, mining Bitcoin, they are relegated to niche manufacturers who only source and supply units based on the current demand.

Computer chips are the most expensive component in an ASIC rig, and orders for these chips compete with other manufacturing sectors worldwide. If you’re a niche manufacturer trying to secure a supply of microprocessors, and you’re competing with phones, automobiles and other electronics with larger budgets and scale, your allocation of chips will be limited.

While chips and semiconductors are pricey, another issue is the scarcity of wafers which are small discs made of silicon that hold a chip together to build integrated circuits.

Cyclical factors also influence the price of ASICs, namely:

- Increased demand: As the price of Bitcoin increases, so does the demand for ASIC miners. This is because ASIC miners are more efficient at mining Bitcoin than other types of miners, such as GPUs.

- Limited production: The supply of ASIC miners is limited by output, which can also contribute to price spikes. This is because a small number of companies manufacture ASIC miners, and the production process is complex and time-consuming.

- Fear of missing out (FOMO): During a bull market, there is often a lot of FOMO among investors. This can lead to people buying ASIC miners even if they are not profitable, in the hope that the price of Bitcoin will continue to increase.

- ASICS fall out of circulation: The supply of ASICS is also limited by their lifespan; miners push these devices to their maximum to generate as much hash power as possible. ASICS will eventually fail and end up on the rubbish heap.

How does the BASIC Note work?

The Blockstream BASIC Note works by issuing tokens that represent a share of a portfolio of ASIC miners. The tokens are traded on the Liquid Network. When you buy a BASIC Note, you are buying a share of the profits generated by the underlying miners, and you will receive a token you can hold in your Liquid wallet.

This new BASIC investment vehicle is seeking to raise $5 million by selling its first tranche, with the Series 1 BASIC Notes priced at $115,000 each.

The BASIC Note is a Bitcoin basis vehicle aiming to generate a bitcoin-on-bitcoin return. It only charges performance fees when the returns surpass that of Bitcoin itself. In other words, fees are levied only when the product outperforms Bitcoin.

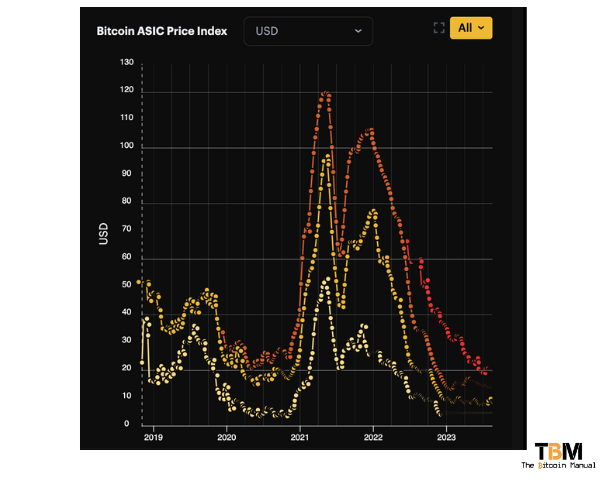

During the latest Bitcoin bull market, prices for Bitcoin mining machines witnessed a significant surge followed by a major crash, the latest one bottoming in December 2022. ASICS are seen as a leveraged market on the Bitcoin price. To give you an idea of how steep the fall from the peak, Bitcoin ASIC prices dropped over 85% from their highs as large Bitcoin mining companies have struggled to remain profitable throughout the bear market, with many either filing for Chapter 11 bankruptcy, taking on debt or selling their BTC holdings and equipment to stay afloat.

If Bitcoin prices begin to tick up due to the halving, demand for these machines could pick up and with $5 million worth of deeply discounted stock pulled off the market, BASIC Note owners are betting that a repeat of the bull market can net them a healthy return.

Who is the BASIC Note for?

The Blockstream BASIC Note is designed for investors who want to gain exposure to Bitcoin mining without the need to manage their own miners. It is also a good option for investors who wish to diversify their portfolio with a more alternative asset.

The investment product will be offered as an EU-compliant digital security on the Liquid Network. The BASIC Note won’t be accessible in every jurisdiction. Each Series will feature its own distinct set of BASIC Notes issued via the Liquid Network.

The benefits of the Blockstream BASIC Note

There are several benefits to investing in the Blockstream BASIC Note:

- Exposure to Bitcoin mining: The BASIC Note provides investors with exposure to the growth of the Bitcoin mining industry. As the price of Bitcoin increases, so too does the profitability of mining.

- Potential for capital appreciation: The BASIC Note is a tokenised asset, which means that it can be traded on exchanges. This gives investors the potential to profit from capital appreciation, as the price of the note can fluctuate based on market conditions.

- Diversification of assets: The BASIC Note is a non-correlated asset, which means that it does not move in the same way as traditional assets such as stocks and bonds. This makes it a good way to diversify your portfolio and reduce your risk.

- Liquidity and Access: As capital gradually becomes more available, with miners earning more Bitcoin or acquiring funding to compete for more Bitcoin, these miners will likely have better access to resources to procure ASICs.

- Lag in new supply: As Bitcoin miners push for maximum returns, they’re not going to want to see operations slow down; as they acquire energy, they want to use it as effectively as possible; this could involve expanding their ASICS or having some on hand as others fail. Since manufacturers can only build so many ASICS monthly, having a supply to sell into the market might put you in an advantageous position and command a healthy premium.

The Risks of the Blockstream BASIC Note

There are also some risks associated with investing in the Blockstream BASIC Note:

- The volatility of the Bitcoin price: The price of Bitcoin is volatile, which means that the value of the BASIC Note can also fluctuate significantly.

- Regulatory risk: Bitcoin mining has come up against increased hostility due to its energy consumption, and we’ve already seen several countries move to ban these devices and business models. If mining is banned or reduced in certain countries, it could depress the demand for ASICS.

- Operational risk: As an investor in this product, you are relying on Blockstreams’ expertise to secure ASICS that will sell for a premium in the bull market and that the stock they acquire is not damaged or becomes obsolete.

- Correlation: It is important to note that investment correlation is not always constant, and past performance isn’t a guarantee it will perform in a similar fashion in the future. Correlation can change over time due to a variety of factors. Investors should be aware of this and monitor the correlation between their investments to ensure they are not taking on too much risk.

Front running the FOMO.

The Blockstream BASIC Note is a unique investment product that exposes investors to Bitcoin mining. It is a good option for investors who want to gain exposure to the growth of the Bitcoin mining industry outside of Bitcoin mining stocks and as a complementary product to the Blockstream Mining Note.

As mining becomes a more complex operation to tackle at scale, certain investors will want to hedge their bets while others who are unhappy with the returns Bitcoin can provide can, or additional alpha through Bitcoin-adjacent products in these leveraged market plays.

Do your own research.

If you want to learn more about Basic Note, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.