Now let me start by saying I am not a gold and silver hater; I think they are excellent methods for storing value long term. Gold and silver have done exceptionally well in protecting your purchasing power in countries where monetary policy has hit its death spiral. Holding gold specifically in countries that have been under double-digit M2 money supply inflation for years, like my native South Africa, would have worked out great.

You would have protected your wealth far better than any savings account. The local stock market or real estate market could have been better betting, but you’re taking on more risk for that yield, whereas gold is a rather off-trade. It’s not that every year gold would outpace inflation in these countries, but if you’re a saver. For someone who wants to buy and hold, gold and gold coins like the Kruggarrand are were great options.

If I look back on the last ten years and look at the purchasing power gains, I could have preserved its evidence that gold would have been a good vehicle for me. By not purchasing these investment assets and sticking to fiat-based vehicles, it cost me dearly.

In the race against monetary unit inflation, you’re looking for the slowest horse in the race. IF gold is, as claimed, a 2% increase in supply each year, that’s far better than the double-digit increase in my local currency.

You step the bleeding.

How has gold performed in South Africa?

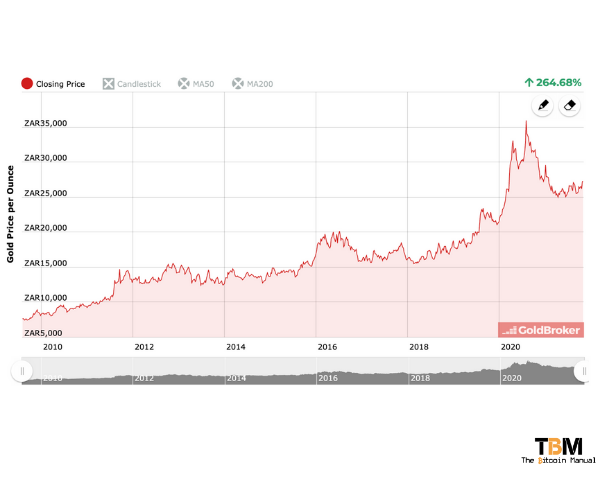

Suppose we have a look at how the gold price has performed over the last ten years when compared to the South African Rand. We can see an appreciation of 264.68% over that period.

If we annualise that over ten years, it’s a return of 26.46% per year.

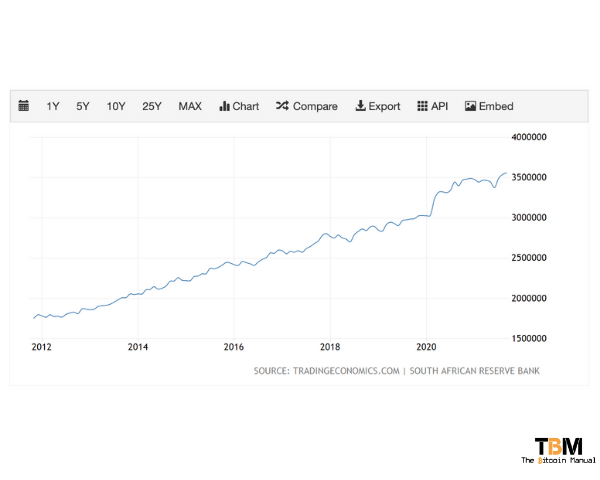

If we look at the growth of the M2 money supply during that same ten year period, we can see that the money supply increased from a base of 1.9 trillion Rand to its peak of 3.5 trillion Rand.

If we annualise the base money increase over ten years, it averages around 8.6% per year. Now it’s far more complicated than this as you’re always pricing against moving targets. Still, from these basic calculations, we can conclude that gold has preserved your purchasing power better than fiat.

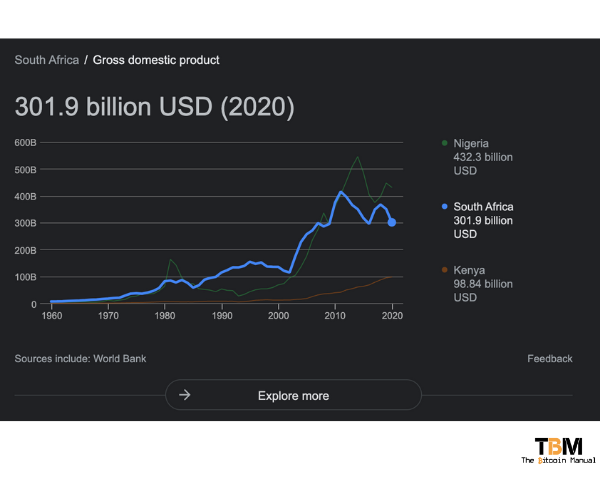

If we take a look at South Africa’s GDP, it’s pretty much returned to levels of 10 years ago, meaning we’re producing far less per currency unit, which is scary in itself.

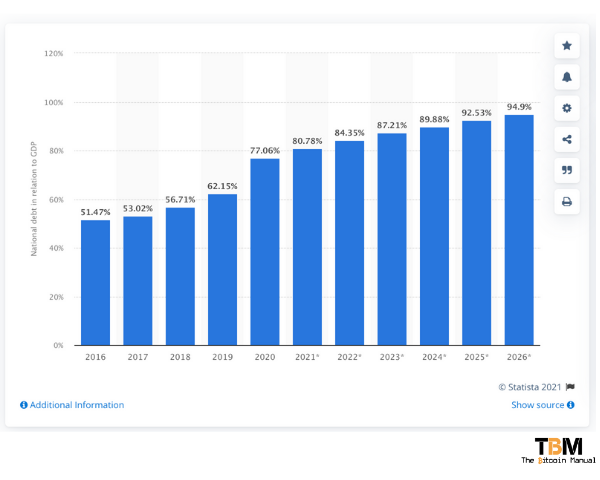

What’s worse is that for that similar GDP, we’ve continued to increase our debt burdens, making it even more costly to roll over and refinance debts and fund new productivity. This puts a severe limit on the chance of “growing out of your debt obligations” and forces governments to “print their way” out of debt through a soft default.

Currency debasement is not stopping, and as it continues to increase each year at exponential rates, more people will be seeking refuge for their savings.

It’s not only about inflation protection.

Gold has offered South African’s protection against currency debasement like Bitcoin. Still, Bitcoin provides some additional attributes that make it a far superior store of value to those on the lower end of the economic spectrum.

Bitcoin has superior divisibility.

When the money goes bad, the currency units you hold continue to lose value meaning the price of assets continues to rise in relation. When you try to purchase something like gold and silver, you are at the mercy of their standardised units. You either purchase by weight, such as grams, ounces or kilograms, or you can buy collectables like coins.

Sure there are plenty of options, but this unit structure does a disservice in countries with bad money. It may not be obvious, but you’re effectively pricing out people from owning these assets with a rigid unit of account.

As wages remain stagnant but asset prices increase, the amount of labour and proportion of disposable income you need to save per month to acquire one unit of gold or silver becomes too great for the average person.

As you price people out, you reduce the demand of the asset and liquidity as the asset centralises around those who can afford it.

I’ve seen a few companies locally try to combat this by allowing you to purchase gold on layby payment plans or gold shares you can then exchange for physical ownership once you own enough shares or complete your payment plan.

These companies aren’t doing this without a profit motive, and they tack on fees making it even more expensive to acquire that asset.

Once you’ve paid it off, you may be underwater for some time.

Bitcoin doesn’t have this problem; its infinite divisibility allows you to purchase a portion at any price. You’re no longer restricted to reaching a certain unit amount for the purchase. You can trade the currency you have for Bitcoin and lock in that price immediately. Bitcoin allows you to sell the bad money for good money instantly; you can do it at any value and at any time.

Gold and sliver allow some to save, and that use base shrinks with time, whereas Bitcoin allows anyone to save, so the user base is continually increasing.

Acquisition cost and opportunity cost losses.

There is no need to wait since waiting means you incur opportunity cost losses too, Bitcoin helps you avoid those losses.

What do I mean by this?

So as you wait to save and buy gold or silver or pay it off with a payment plan, your currency is losing value. This means that the longer you take to acquire it, the less of an asset you can receive. Bitcoin allows you to lock in your currency to satoshi pair price today. There’s no need to wait and hence no opportunity cost losses.

Purchasing gold on payment options also means you’re at the mercy of an institution. You cannot take physical ownership until the payments are completed, and they could change fees, they could charge delivery or ownership fees, and if you were to sell it before taking physical, there are fees too.

When you’re poor, you can’t afford to be adding on fees, it erodes your purchasing power even further, and you get less inflation resistant asset protection for spending more currency.

Sure Bitcoin has fees from brokers and on-chain fees, but YOU are in control; you pick the broker. You decide when you move on-chain and watch fees before transacting to limit paying mining fees. You can use second layer solutions to reduce fees and keep more of your Bitcoin.

The amount of Bitcoin you lose to fees is solely up to how you want to use it, not dictated by third parties.

As the money goes bad, it drives perverse incentives.

As a currency loses value, so does working for an honest day pay. Why would I slave away for a set amount each week or month when I can use that same effort or less to scam others or steal from others. As the incentive to not work or contribute to society increases, the supply of goods and services decrease.

The lack of available goods and services puts even more pressure on the currency as the increased claims on fewer goods and services mean prices continue to rise. As prices rise and wages remain flat, it pulls more people below the poverty line and thus pushes them to do things that are perverse but rational.

We as humans are always looking to get more for less, and as money loses value, crime starts to pay a lot better. I live in a country where blowing up an ATM or hitting cash in transit vehicles is what we call an average Tuesday.

South African’s realise the danger of keeping any physical wealth, be that jewellery, cash or gold. This fear has pushed us into using digital means of transfer like online banking, vouchers, eWallets and credit cards—any method where the money can be dematerialised to avoid physical attacks.

The issue with dematerialised wealth in these cases is that it’s always run by a centralised institution. These institutions dictate the payment rails and fees to use it. As money goes bad, they can continue to eat into your capital through their fee structure to protect themselves, as incentives are misaligned. In addition, it is pegged to the local currency to ensure fungibility, so while you gain additional protection, you pay for it in loss of purchasing power.

Bitcoin improves on this; it gives you physical safety advantages of dematerialised money with the benefit of a sound money policy where you can protect and grow your purchasing power.

Bitcoin allows you to move money instantly across space and time, be it locally or internationally, for the same cost. It also allows you to travel with money through dangerous areas going undetected and gives you assurances that you and your wealth are never vulnerable while in transit.

The violation of property rights is profitable.

Holding precious metals means you have to accept the limitations of physical stores of value. If you can afford it, you can store your gold and silver with 3rd party service providers locally or internationally. You foot the bill for storage and take on third party risk, should there be a run on these institutions or they are captured by the government.

A reality that becomes an eventuality when the money gets too bad and governments become desperate. Bitcoin, however, costs you very little to secure safely; all you need is your private keys stored safely and off you go. It offers anyone the ability to hold as much value as possible for no additional cost or physical space.

If you think I can avoid those holding costs by taking physical ownership of my gold and silver, yes, that’s correct. Still, you would also need to add security in your home, such as a safe, which costs you additional capital that could have gone towards savings.

These storage mechanisms are not foolproof, especially if access codes or keys are kept on the premises. In South Africa, home invasions are an everyday occurrence; these criminals continue to be more brazen. Yes, we still have those who try to sneak in undetected, but we have a growing case of criminals who have no fear.

They are happy to run in behind you as you pull into your garage or take a sledgehammer and crowbar to your door while you’re in your home. Having wealth stored on site is a massive risk for any South African and will only increase as the money continues to debase.

In Bitcoin, I can store as much wealth as I want on a piece of paper or a hardware wallet that is easy to hide. You have fail-safes like duress passwords or multi-sig that offer you even more protection in the case of an in-person attack.

If I’ve learned anything about criminality, it’s that the best way to ensure your safety and protection of your wealth is to make it harder than it would be to go after your neighbours. Criminals are looking for bang for their buck; time is money, so they’re not going to waste it if you’re adding all this complexity trying to access a score.

They are likely to move on.

Bitcoin offers everyone the same level of protection that I would say disincentivises brute force attacks. Sure they can leave with your car, your TV or your devices, but your Bitcoin can always be kept safe.

Bitcoins hard money is savings technology for those who face hardship.

South Africa, like many African countries, have unique problems that aren’t easily solved on the individual level. We’ve been at the mercy of government incompetence and being the patsies at the international monetary table. While politicians broker deals that enrich themselves, they sell off the promise of their citizens labour and savings as payment.

And as they say, the fish rots from the head.

As corruption in the government is rife, as corrupting of the money continues to increase, it filters down to the individual. Those that refuse to play by the rules get to benefit.

Those that don’t get stolen from, it’s a reality we’ve had to accept.

Until now, Bitcoin has enforced the same set of rules. It levels the playing field and gives the individual autonomy like never before.

I would go as far as to say it is the perfect store of value for the situation we Africans find ourselves in and why I think we should embrace it. I am not advocating for people to put their entire life savings into Bitcoin; what I am saying is, having a little capital off the grid will give you peace of mind.

Bitcoin is the offshore savings account for everyone.

Don’t you think it’s time to take some chips off the table and keep it away from those who are willing to break any and every rule to get at your wealth?

I do.

One Response

This is a very compelling argument for Bitcoin.. Taking your chips off the table and at least putting something in to BTC so you have some cover in case of worst case scenario is definitely worthwhile, no matter which country you are in but especially if you’re at a higher risk of physical attack/burglary etc.