The centralisation risk around Coinbase seems to have no limits, with the US’s largest Bitcoin honeypot constantly looking for new ways to source and custody Bitcoin. Coinbase is not only an exchange for retail to buy and sell Bitcoin and altcoins, but it’s grown its business substantially with institutional custody services for large businesses and, of course, who can forget that Coinbase is the preferred technical backend for the majority of US spot Bitcoin ETFs.

It’s safe to say that this business holds the keys to a considerable amount of Bitcoin; according to Arkham Intelligence, Coinbase warehouses 986,000 BTC, but they’re not done yet.

If we consider the total amount of coins locked in a settlement layer, Coinbase is the biggest settlement layer apart from the base chain, which is disgusting. Especially when you compare it to Bitcoins premier scaling solution, the Lightning Network, with 5100 BTC locked, Coinbase is almost 200x its size.

It really makes you wonder how captured Bitcoin is and how bad the self-custody market for Bitcoin has performed; if Coinbase was ever hacked or rugged, the effect on the spot market would be Roland Emmerich-inspired disaster movie epic.

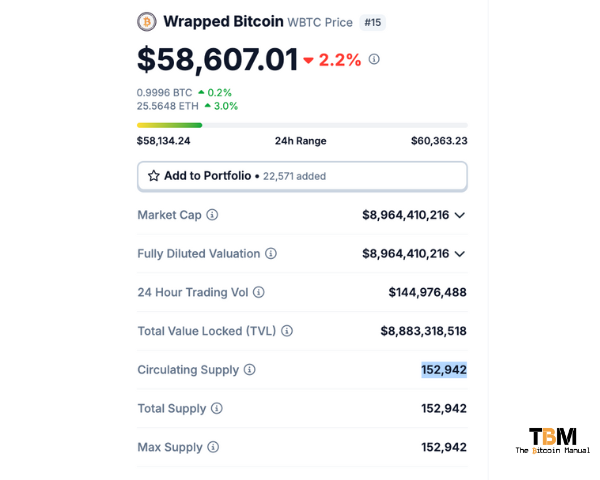

While we all seem to be asleep at the wheel to this growing behemoth’s control of the UTXO set, Coinbase has set its sights on the market for Wrapped Bitcoin, which currently holds just 153,000 Bitcoin.

Instead of listing support for WBTC and trying to make fees on any trades that go through their platform or briding to base, CoinBase launched a new derivative token, cbBTC, representing their next step in capturing more Bitcoin on their balance sheet.

What is cbBTC?

cbBTC is Coinbase’s tokenized version of Bitcoin, designed to bring the world’s leading cryptocurrency into the realm of blockchain-native assets in a new way.

Essentially, cbBTC is a digital asset that is pegged 1:1 to Bitcoin, allowing users to hold and transact in Bitcoin’s value without directly dealing with Bitcoin’s underlying blockchain.

cbBTC is issued on the Ethereum and Base networks, allowing users to use Bitcoin in DeFi applications. Direct purchases of cbBTC will be available to Coinbase users in the US (excluding New York State), UK, EEA states, Singapore, Australia, and Brazil.

cbBTC will not have a separate order book or trading pair on Coinbase, but your Bitcoin could be withdrawn as cbBTC on supporting chains. Alternatively, users who connect to Base or Ethereum could purchase cbBTC from any supporting on-chain DEXs with liquidity pools set up.

The pot calling the kettle black

WBTC is the biggest player in the Wrapped Bitcoin space. The token is managed by the digital asset custodian BitGo and is issued on multiple chains from Ethereum to Tron.

Tron founder Justin Sun, who partially controls an entity named BiT Global that now handles the custody for WBTC, has already hit back at the launch of cbBTC, claiming it’s unbacked and has no proof of reserves.

Way to project their buddy!

#cbbtc lacks Proof of Reserve, no audits, and can freeze anyone's balance anytime. Essentially, it’s just 'trust me.' Any U.S. government subpoena could seize all your BTC. There’s no better representation of central bank Bitcoin than this. It’s a dark day for BTC.

— H.E. Justin Sun🌞(hiring) (@justinsuntron) September 12, 2024

How Does cbBTC Work?

cbBTC operates on the Ethereum blockchain and utilizes the ERC-20 token standard.

Here’s a simplified breakdown of how it functions:

- Tokenisation Process: Coinbase mints cbBTC by locking up an equivalent amount of Bitcoin in a secure reserve. For every cbBTC created, there is a corresponding amount of Bitcoin held in reserve to back it 1:1.

- Smart Contracts: The creation, transfer, and redemption of cbBTC are governed by smart contracts on the Ethereum & Base blockchain. This ensures transparency and security in how cbBTC is managed and tracked but has no real enforcement on the underlying.

- Redemption: Users can redeem cbBTC for Bitcoin at any time. This means that you can exchange every cbBTC held for an equivalent amount of Bitcoin, ensuring that the token always represents the value of the underlying Bitcoin. This is on the condition you haven’t done anything with the cbBTC that could be deemed criminal or that Coinbase has the liquidity to pay you out.

Token contracts are as follows:

- Base: 0xcbb7c0000ab88b473b1f5afd9ef808440eed33bf

- Ethereum: 0xcbb7c0000ab88b473b1f5afd9ef808440eed33bf

It’s basically an ETF, but instead of having the paper claim reflected in your brokerage account, you have a paper claim on Bitcoin reflecting in your MetaMask or any other EVM-compatible wallet.

Why cbBTC Matters?

Short answer: it doesn’t!

The product is designed to extend Coinbases’s reach into on-chain trading activity, which it had to compete with in previous cycles. You see, during the frenzy of the last bull market and DEFI summer, many traders would only hop on to CoinBase to purchase Bitcoin and Ethereum, withdraw it to an on-chain wallet and go full degen on-chain, adding funds to liquidity pools, farming DEFI yield tokens and borrowing against their funds and all that action was outside Coinbase’s reach.

But now that they have BaseEVM and have issued a wrapped version of Bitcoin and ETH, they assume that some of that action will happen in their environment, and it would net the company additional income.

Okay, side note:

cbBTC might have one small benefit, in that degen trading isn’t happening on the main chain, wasting resources and increasing the UTXO set, so I guess we won’t need 5 TB drives to run a node anytime soon.

Apart from moving some of the transactions that would settle on Bitcoin to Base and Ethereum, resulting in a reduction in the competition for mainchain block space, I don’t see what value cbBTC brings.

Honestly, there isn’t anything in it for Bitcoiners, and you can safely ignore this product.

Potential Impacts on the Crypto Ecosystem

Bitcoin is now a trillion-dollar asset class, and even during its struggles, it seems to maintain that level of market cap; it’s a big-boy asset now, but it still has room to run.

The introduction of cbBTC is likely to have several implications for the crypto market:

The increased speculative use of Bitcoin

By making Bitcoin more accessible within the EVM ecosystems, cbBTC expands the potential use cases for leveraging and double spending Bitcoin.

Boost to DeFi fodder

The influx of Bitcoin value into DeFi platforms could lead to trading, which brings in more opportunities for large funds to rug the little guy.

Enhanced revenue from MEV

The ease of use and lower transaction costs associated with cbBTC bring unsophisticated fee-sensitive investors, which means MEVbots and funds can snipe a lot more value. In theory, customers think they save in fees but lose in trades anyway.

And who is to say Coinbase won’t be running the MEV bots themselves through a third-party fund?

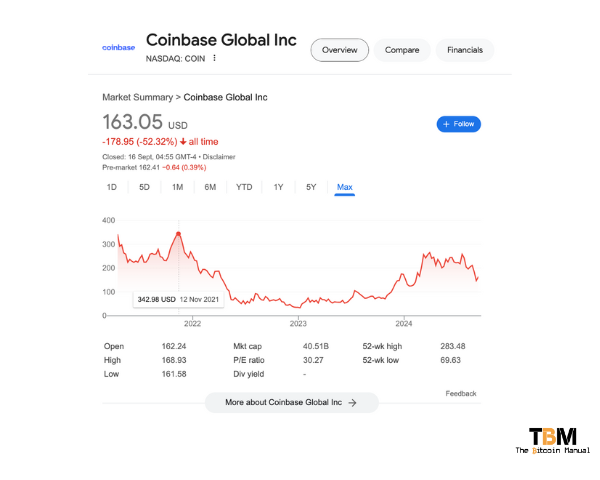

We’re regulated, and we don’t have our own token

Coinbase is as regulated up the arse as they come, they are a publicly listed company, and their books are open for all to see, so they can’t pull off some of the stunts that those private companies and offshore exchanges would do, like making their own exchange token and leveraging it to the gills.

Instead, they need to work within the frameworks given to them, and this is where Base and Wrapped tokens come into play.

Coinbase needs to show signs of revenue growth and potential avenues for growth, or its stock will continue to perform poorly.

cbBTC or cbDC?

Coinbase’s cbBTC is a concerning development of Bitcoin since Coinbase is the first point of contact for many first-time buyers. If Coinbase actively encourages users to use risky derivatives instead of real mainchain Bitcoin, this misdirection and reliance on native investors could see more Bitcoin captured within Coinbase.

I would not be surprised to see them break over 1 million Bitcoin and go way beyond; holding 5% of the total supply of Bitcoin shouldn’t be ruled out at this point.

Now, what could happen if Coinbase controls a greater portion of the UTXO set?

If you’ll allow me to speculate, let’s think it through.

What if this product becomes popular and Coinbase, in conjunction with pressure from the US government, encourages users to move to ETFs or cbBTC instead of real Bitcoin? The walled garden could be achieved by force or market incentives like offering tax rebates, borrowing against your asset at cheaper rates, or access to greater merchant networks, making spending your Bitcoin easier.

Either way, it would lock people into an easily surveilled system that can be centrally controlled, censored and even taxed and is no different from a CBDC. The only difference is this CBDC would be tied to the purchasing power of Bitcoin instead of the US dollar.