Bitcoin is a censorship-resistant and permissionless system that allows us to exchange value online. Transactions can come in different sizes and perform various actions, like CoinJoins or opening and closing Lightning channels. Still, they will always be confirmed if you follow the consensus rules.

If consensus is not broken, you’re free to play around and use your Bitcoin as you see fit, gamble with it, spend it, speculate with it; it’s all up to you. The emergence of Bitcoin Ordinals has introduced a new dimension to the ecosystem, making it easier for the average user to inscribe arbitrary data onto the blockchain.

The feature had always existed in some form; ordinal theory merely formalised it and gave it a new use case in the form of NFTs and Token issuance. Since the launch of ordinals, specific wallets added support for it, while platforms have spun up to make it easier for retail users to trade in these secondary market assets.

While this new use of the Bitcoin blockchain has garnered significant interest, it has also sparked discussions on whether this is a valid use for block space and questions around the potential migration of Ordinals to the Liquid Network, a sidechain of Bitcoin offering faster block times and lower fees. Despite these apparent advantages, there are several reasons why Bitcoin Ordinals users may resist this migration.

Mempool backlog and the mining fee bull market

If ordinal users aren’t violating consensus, why would anyone have a problem with someone using Bitcoin? We wanted the entire world to use this network for settlement and global money.

What’s the big deal? You ask.

Well, ordinals come with their own issues since they aren’t the standard form of Bitcoin transactions and require embedding of additional data like JPEGs in the blockchain; it not only costs a lot more in network resources and eats up block space like Takeru Kobayashi does hot dogs.

Ordinal first started embedding smaller image files on-chain but then found ways of saving larger ones within the block size limit. If we consider the fact that ordinals can be “interlinked” through recursive inception to embed larger files through fragments of transactions, you can see how space on the chain for standard becomes marginalised.

The protocol has also taken on a rather inefficient method of token issuance and transfers in the form of BRC-20 tokens, which has only compounded the load on the network.

With this new flurry of activity, it’s safe to say this ain’t your mama’s mempool anymore, and it’s become a mosh pit of sorts. The average user of the Bitcoin network has to either compete with these new transactions by bidding a higher fee or waiting longer clearance times for transactions, a situation that has left a sour taste in many a maxis mouth.

While users of Bitcoin who don’t have any interest in ordinals (myself included) can complain about it, the fact remains that these folks are paying for their use of the chain and not shying away from the bill.

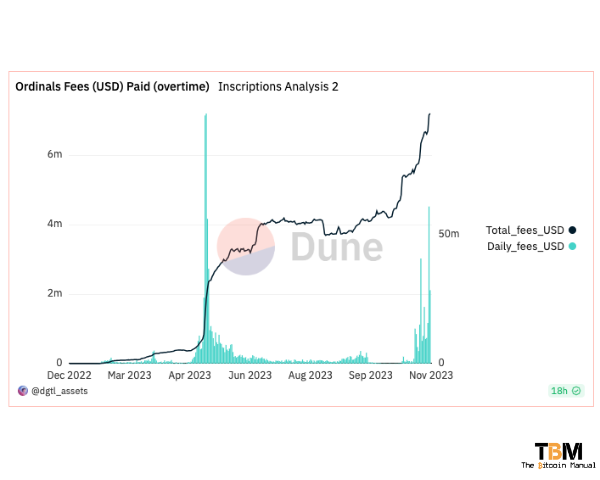

Ordinal-based transactions have netted miners a healthy return, with reports from Dune claiming that ₿2,843.1037 in fees have already been paid, and that figure is set to increase as these transaction types show no sign of slowing down. This is no small amount; to put this fee into perspective, Liquid Network has around 3,053.34 BTC locked into its network, while Lightning holds about 5,366.09 BTC.

Civil War: Block Space

Now, we find ourselves at a crossroads; there is only so much block space every 10 minutes for miners to secure transactions, and with these limits enforced by the protocol, someone will be left out in the cold.

Ordinal advocates claim they are generating additional income for miners, and this security budget boost keeps the network secure for everyone, so traditional transactions can find a home on a side chain like the Liquid Network or using an L2 like the Lightning Network.

While Bitcoin maximalists stand firm that ordinals are playing the fool, these transactions are not essential and take up space that can be allocated towards exchange settlements, merchant transactions, lightning channels and general commerce transactions. So, take your ordinary transactions to a side chain like Liquid instead of disrupting the primary network?

So far, of the two parties fighting it out, it seems the standard transaction crowd has moved some of their activity to Liquid.

How could Ordinals move to the Liquid side chain?

The Liquid Network already has its own token protocol native to its chain, ready to be used; Liquid AMP assets can be used to deploy tokens such as regulated securities in the form of STOs or unregulated securities in the form of tokens.

Liquid also allows for NFT issuance on chain, which uses hosted files, but you could also host files in a Liquid network block if you found that a better option.

Minting 21 animations of 300-400 KB each would have cost $26,867 using #Ordinals . On Liquid Network it cost $0.3 all together. Without bloating the blocks.

— Dr. Scam Artist (@FacepalmMonkey) April 5, 2023

If the standard options available on Liquid do not appeal to ordinal users, another option would be to add support for ordinals on the Liquid network instead. Users could continue what they are doing now but broadcast their transactions to the side chain instead of the main chain.

Legacy ordinals could also have their UTXOs pegged into Liquid and then recognised by ordinal wallets that support the side chain.

Once moved over, ordinal transactions would have ample block space that is far cheaper and faster in confirmation times since most Liquid blocks are never filled to the maximum size.

Why won’t Ordinals users find Liquid appealing?

If ordinal users moved over to Liquid, they would have an undisturbed playground with ample block space, faster transactions, cheaper fees and the ability to use stablecoins for trading since Liquid already supports L-USDT.

Ordinals will not work on Liquid Network because of confidential transactions.

— ₿ Lord Kristaps Kaupe ($ is for sats) (@kristapsk) February 24, 2023

It sounds like the ideal environment for what they are trying to do, so what is behind the hesitation to move over?

Preserving the immutability of the time chain

Bitcoin Ordinals derive value from their inscription on the Bitcoin Core blockchain, the original and most secure blockchain. The fact that they do pay a high fee and that miners are expending resources to secure that block in the blockchain for all time is appealing to these users.

This immutability is a critical aspect of Bitcoin’s appeal, ensuring that Ordinals cannot be tampered with or censored.

Migrating to the Liquid Network, with its federated governance structure, could raise concerns about censorship and potential changes to the protocol.

A possible solution here could be for the initial mint and file to take place on the base chain but for future transactions to be conducted on Liquid, which might help reduce mempool bloat.

Bitcoin Ordinals and their relationship with miners

The Bitcoin Ordinals community has flourished around the main chain and their fee generation angle, fostering a collaborative and innovative environment with miners. Migrating to a new network could reduce their influence as miners do not see that additional revenue bump as fees would move towards Liquid Federation members instead.

Users may be hesitant to abandon the existing infrastructure and supportive network that has facilitated the growth of Bitcoin Ordinals.

Ensuring compatibility with existing Bitcoin tools and infrastructure

Bitcoin Ordinals have become integrated with various tools and infrastructure within the Bitcoin ecosystem, such as wallets, explorers, and marketplaces.

Migrating to the Liquid Network could require significant adaptations to these tools and services, potentially causing compatibility issues and disrupting existing workflows.

It also adds a layer of complexity as users would need to learn about the nuances of the Liquid Network, which adds a further barrier to the adoption and use of ordinals.

Annoying the principles of Bitcoin maximalism

A significant portion of ordinal supporters enjoys playing agent provocateur to Bitcoin maximalists, which advocates for the exclusive use of the Bitcoin Core blockchain for standard transactions.

By staying on-chain ordinals, users can always generate controversy, which can be amplified through clashes with Bitcoin maximalists and use this as a marketing and recruitment drive and a method of generating PR and media.

If ordinals move to a sidechain and quietly go about their business, these projects will generate less attention than they get today.

Liquid doesn’t have the reach of the base chain.

While Liquid Network offers faster block times and lower fees, there has yet to be a real drive for the adoption of the network by exchanges and P2P platforms.

If the goal is to bring Ordinal users into the side chain ecosystem, there must be easier ways of accessing L-BTC outside of buying BTC and pegging it into the Liquid Network.

Block space becomes premium real estate.

The decision of whether to migrate Ordinals activity to the Liquid Network is a complex one that involves trade-offs between technical advantages, community dynamics, and philosophical considerations.

While the Liquid Network offers certain benefits, Bitcoin Ordinals users may prioritise the immutability, community, and core principles of Bitcoin Core, leading them to resist this migration.

As the Bitcoin Ordinals ecosystem evolves and fees remain high, it will be interesting to see if they can remain steadfast on-chain. High fees eventually eat into profits and limit your project’s reach as retail investors constantly seek cheaper alternatives.