Speaking as a South African Bitcoiner, the country that has the most developed Bitcoin market on the continent, with several exchanges available to us with support for our local banking rails, it’s still hard to get a hold of Bitcoin, mainly when these exchanges and apps aren’t focused on pushing Bitcoin or self-custody.

As someone who advocates for the wonders of Bitcoin, I find it hard to recommend a local exchange because those new users will be cross-sold altcoins and encouraged to speculate and gamble once they open an account. They are also restricted from spending or using their Bitcoin outside exchanges due to the high fees exchanges charge and their lack of support for layer two solutions like Lightning or Sidechains.

South Africa and Africa lack a distinct Bitcoin-only onboarding experience until now. Strike, the popular US-based Bitcoin-focused payment app, has recently expanded its services to several African countries as its second round of expansion following the launch in El Salvador.

This move signals a potential shift in financial accessibility and innovation on the continent. Let’s delve into the reasons behind Strike’s African expansion, the app’s functionalities, and how you can utilise it in select countries across the continent.

Why is Strike Setting its Sights on Africa?

Jack Mallers, Strike’s CEO, cited several reasons for venturing into Africa:

Financial Inclusion

Oh, the term is rather triggering and beaten up, isn’t it?

Financial inclusion and banking for the unbanked have been shilled to high heavens when it comes to Bitcoin and developing markets.

Does Strike bank the unbanked? Yes and No!

Yes, as in all you need to do is download and KYC, and you can start using the app; no different from local fintech apps; the real difference is that local apps focus on local currency, but with Strike, you now have access to USDT and Bitcoin on-chain and via the Lightning Network, opening you up to a broader international network.

If you’re going to use Strike practically to get funds in and out of the app and move between your fiat and Bitcoin, the reality is you do need a bank account or a debit card to make the most out of what Strike has to offer.

Now, that’s not to say Strike becomes completely useless to you without a bank account. If you are unbanked, you can spend your Bitcoin or USDT directly with stores that accept Bitcoin or use Bitrefill to purchase vouchers to spend at local stores.

There is a bit of friction and added cost, but if you can’t get a bank account, Strike clearly gives you an alternative and, in some cases, might be cheaper to use, especially when it comes to remittance.

Remittance is costing Africans

In 2021, according to the World Bank, nearly $100 billion flowed into Africa in remittances, but it costs between 8.5% and 20% to bring that money into the continent, having a roughly 8 billion dollar leak annually compounds over time, and that is capital that could be put to good use.

Many African countries need help with traditional financial systems, with limited access to banks and high remittance fees making it hard to conduct trade and commerce across borders effectively.

Considering the fat margins remittance companies enjoy, this is a potentially profitable market for Strike to come in and undercut; by using Bitcoin’s Lightning Network, Strike can offer a faster and cheaper alternative for sending and receiving money. The more money ends up with the end user, is more money that can be used to grow these economies instead of being sucked back into shareholder value for international companies.

High Inflation

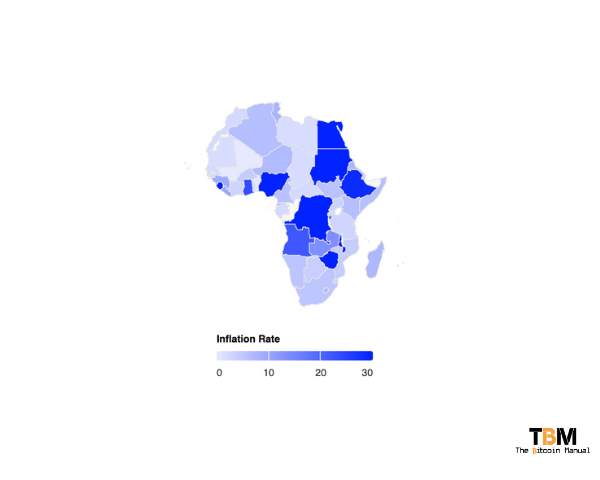

If there’s one thing that hits many Africans, like a knobkerrie to the back of the head, then it’s currency devaluation. We can all point to Zimbabwe and, recently, Nigeria as the basket cases of currency mismanagement, but apart from Tunisia, the rest are not having a good time.

While the big devaluations and hyperinflations make the headlines, it’s the slow grind of 10 – 20% inflation annually that really beats you to your knees and keeps you there over a long enough time period. There is no way you outwork that compounding and locally denominated assets (stocks, bonds and real estate) are surely not protecting you, either.

Inflation can significantly impact economies, and Strike hopes to provide residents with a more stable store of value through easier on-ramps to USD and Bitcoin.

While many an American might sample a lyric from Oliver Anthony and claim the “dollar ain’t shit” to the rest of the world, dollars are rock solid when compared to the local currency.

Innovation & opportunity

As a small business owner on the continent, I can draw from experience when I say that liquidity is a real problem for conducting business. When you have to interact with a grey economy that is heavily reliant on cash, and you have to deal with a host of fractured digital payment rails costing you a damn fortune, it weighs heavy on your admin operational costs.

It not only means you have to pass on these costs to the customer but renders certain micropayments impossible. Additionally, having readily available capital to spend requires you to hold a large surplus, which isn’t always practical and also leaves you open to more losses through annual inflation if you don’t flip that currency fast enough.

But if you don’t have the capital on hand, you miss out on possible business opportunities; couple that with the fact that accessing credit to cover operations at times is burdensome and often costly, and you’ll see why pain it is a pain the arse to run a business on the continent.

But it’s not all doom and gloom; give us the tools, and you will surely see us find a way around these potholes, just like we do with our roads. Africa boasts a young, mobile-first population, and Strike can offer rails that unlock not only potential Bitcoin adoption but the use of Bitcoin to drive productivity that would otherwise be lost or remain stagnant.

How does Strike work?

The Strike app is an ultra-sleek, simple interface that anyone can get the hang of after a few minutes. Similar to apps like Venmo or Cash App (which none of us have here btw), Strike allows users to:

- Send and receive money: Pay friends, family, and businesses quickly and easily.

- Buy and sell Bitcoin: Invest in and trade the world’s leading cryptocurrency directly through the app.

- Hold Bitcoin and stablecoins: Store your digital assets securely within the app.

Strike is a KYC platform.

To use Strike, you will need to register your account using a passport, ID or driver’s licence so they can be sure you’re not a big boko haram baddie and can track your purchases should your local enforcement or tax agencies come knocking.

Now, In Africa, KYC is as helpful as a bone-dry calabash in the middle of the Kalahari; it would cost you $10 -$20 to get someone to KYC an account for you and hand it over, but hey, I’m not advocating anyone to do that, I’m just stating the reality on the ground.

Again, this is also a limiting factor in banking the unbanked since many people don’t have these types of documents to register; in some cases, one family member will be the middleman registering with a bank or service but facilitating a host of other people’s banking transfers.

Using Strike in Africa

Strike is available in Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia as part of this first phase launch. From what I can tell Strike seems to be using Yellow Card on the backend, who already have banking relationships across the continent, and your fiat deposits would flow through them before its credited in your account.

Here’s how you can start using it:

- Download the Strike App: Available on iOS and Android app stores.

- Complete the verification process: Provide your KYC information and follow the app’s instructions for verification.

- Link your bank account: This lets you send and receive money using your local fiat currency. If you don’t have a debit card, you can set a bank transfer and load up Strikes African banking partner as a beneficiary

- Start using Strike: Send money, buy Bitcoin, or explore other features offered in your region.

Note: If you are using bank deposit it can take 1 – 2 days, and in some cases even longer so be patient, before you start slamming tech support with tickets.

How to use Strike P2P?

If you want to use Strike as your method of converting into dollars but don’t want Big Brother watching what you’re stacking in Bitcoin terms, you have a few options to mask your Bitcoin trading.

- Use P2P markets like Robosats and look for Strike orders, sell your Strike USD and accept Bitcoin using an on-chain Bitcoin wallet or Lightning wallet.

- Send your Strike dollars via the Lightning Network to a swapping service and route those funds to your on-chain Bitcoin wallet or a Liquid wallet for temporary and cheaper storage.

Strike dollars are different

Another important caveat for those using Strike is that while you might have dollars in your account, they are not compatible with the wider stablecoin network on various altcoin chains.

Suppose, for example, you’re conducting business and need to receive payments in USDT or make payments in USDT on TRON; you’ll need to use a swapping service that supports Bitcoin to stablecoin swaps such as:

- https://ff.io/en/

- https://sideshift.ai/

Not your keys, not your coins

This expansion presents an exciting new chapter in financial technology adoption for Africa. Strike’s user-friendly interface and potential benefits for cross-border payments and financial inclusion could pave the way for a more accessible and innovative financial landscape on the continent.

But its arrival doesn’t come without a warning.

It’s crucial to remember that using Strike is a custodial service with third-party integration and, as with any financial product, involves risks.

So be sure that you’re comfortable with the exposure you have in Strike, and don’t use it as your personal banking app. If you feel you’re holding too much in Strike, trim your position by taking self-custody of your Bitcoin.

You can always top it up at a later stage should you run low on funds.

Strike can be part of your financial tool arsenal, but it can’t be your only tool, and you should learn to incorporate more robust tools as you become comfortable with using Bitcoin and Lightning.

So before you run off and deposit funds on Strike, do your research and understand the potential risks involved.

Do your own research.

If you want to learn more about Strike Africa and its impact on local Bitcoin markets, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.