Grayscale was one of the first companies out of the gate, trying to build institutional-grade products centred around Bitcoin. It first launched as private placements, allowing accredited investors to gain crypto exposure through a familiar investment vehicle structure.

Grayscale’s claim to fame was its closed-end trust, created in 2013; GBTC has the longest operational history as the first publicly traded Bitcoin fund, at its peak, held around 617 000 Bitcoin.

If you were an individual or institution looking for a regulated product that gave you Bitcoin price exposure, GBTC was your play and boy, did it have some exciting times, sometimes trading at a premium and other times trading at massive discounts.

Being the only game in town with first mover advantage allowed Grayscale to build up considerable assets under management and charge a premium for their services—the 1.5% fee was the cost of doing business, and for the exposure they were offering, many investors felt it was worth it.

Competition in the US paper Bitcoin space

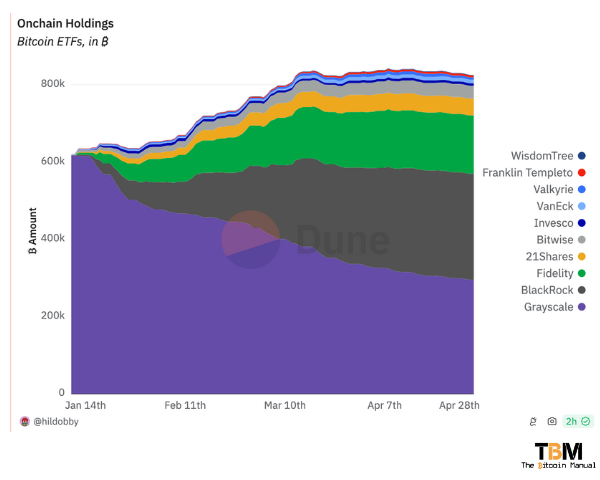

However, the moment competition rolled out with the opening up of spot ETFs in the USA, that unique selling point no longer applied. Now that investors have nine other ETF issuers to choose from, all offering considerably cheaper management fees, we’ve seen massive outflows from Grayscale.

Since January 2024, we’ve seen 300,000 BTC roll over into other funds, seeking cheaper management fees. Today, GBTC retains the most significant AUM in the ETF space, but it has more than halved over the last year, hovering around 295 000 BTC, with Blackrock not far behind at 274 000 BTC.

In an attempt to stem the bleeding, Grayscale Investments has announced that it is filing a registration statement for a new spot Bitcoin ETF called the Grayscale Bitcoin Mini Trust.

How the spot ETF opens up a new market

The uplisting of Grayscale Bitcoin Trust (GBTC) to a spot Bitcoin ETF on NYSE has made it easier for US investors to gain exposure to Bitcoin through a familiar investment vehicle.

ETFs have become a popular method of investing, allowing shares of the fund to be created or redeemed based on market demand. Passive investors love these sorts of products and tend to attract much more liquidity.

This increased accessibility has led to a surge in interest and investment in Bitcoin, with US ETFs holding a combined 826 000 BTC, meaning this market has captured 200,000 additional Bitcoin since January.

For those who already held GBTC for the long haul or purchased during those days of deep discounts, the conversion was what they were banking on. As soon as GTBC converted to a spot ETF, the discount was eviscerated as cash redemptions could be made, which obviously led to some short-term selling pressure.

The rest of GBTC holders likely feel the management fee is a small price to pay versus the tax event they would incur when trying to redeem and are willing to say put for the long haul.

Now that things have settled and ETFs are competing in this new avenue for Bitcoin demand, Grayscale has to find ways to compete or continue to bleed AUM.

When new participants enter the space, they’ll be looking for the best deal, and management fees are part of that consideration. Currently, the lowest fee of 0.19% comes from Franklin Templeton, and GBTC looks to undercut that by offering an even cheaper product.

The Bitcoin ETF provider has announced the creation of its new Bitcoin Mini Trust (BTC), which will feature a lower management fee of 0.15% compared to its existing GBTC product, which charges 1.5%.

What does the mini-fund do?

The success of other ETFs at the expense of GBTC has spurred competition in fees, and this new mini-fund directly addresses the issue of fees.

Grayscale acknowledges the high fees associated with GBTC and aims to provide investors with a more cost-effective option through the Grayscale Bitcoin Mini Trust. Additionally, they want to stay at the forefront of the Bitcoin ETF market.

A recent filing disclosed that Grayscale plans to transfer approximately 63,204.15294574 Bitcoin of GBTC’s current assets to the new mini fund. The shares of the Bitcoin trust will be automatically distributed to existing GBTC shareholders, and the event is expected to be a tax-free transition for them.

Key takeaways

- The Grayscale Bitcoin Mini Trust is a new spot Bitcoin ETF with a significantly lower fee than the existing GBTC.

- This new offering signifies increased competition in the Bitcoin ETF market.

- The mini-fund aims to provide investors with a more cost-effective way to gain exposure to Bitcoin.

- The distribution of the mini fund shares to GBTC shareholders is subject to regulatory approval.

This is a developing story. The Grayscale Bitcoin Mini Trust is subject to regulatory review and requires no action from GBTC shareholders.

Skip the Bitcoin management fees altogether.

Instead of having to worry about who gives you the best deal, which issuer is the most transparent, or how well their custody solutions are, you could opt for an even cheaper and more secure solution: Self-custody.

Ditch the ETF drama! Instead of spending time researching fees and issuers, why not take control of your Bitcoin with a one-time purchase of a hardware wallet?

This physical device securely stores your Bitcoin keys offline, so you have complete peace of mind. As long as no one nicks your seed phrase, your Bitcoin will remain safe in your possession.

Additionally, you avoid the ongoing fees associated with ETFs. Once your cold storage is set up, you can transfer your funds by paying a one-time on-chain fee. Then, you can “hodl” (hold onto your Bitcoin for the long term), knowing your investment is safe and not racking up any extra charges.