Ever since I got my first job and got the taste of an honest days work, I’ve always been inclined to save some of it for later. Sure I fell for a lot of the consumer traps and purchased rubbish that is probably collecting dust somewhere. Still, these are all economic calculations that lead you towards better decisions. At least for me, it has; I can see many of my peers making the same mistakes I did in 2011 and finding ways to justify “treating themselves”.

Sure, you’re treating yourself, treating yourself to more future hours of work to recoup that purchasing power. You’re treating yourself to more debt; you’re treating yourself to less freedom. You’re treating yourself to less autonomy and sovereignty.

Now for some, the new smartphone, television, another holiday or a new car is worth shackling yourself to your banking overlords and you’re fiat faucet job.

To others like myself, it’s selling your future time today, not realising the opportunity cost of your future.

Saving is a losing game.

I am not some financial genius or very wealthy person; I, too, have made foolish mistakes in building wealth. Compared to those peers who I mentioned earlier, I was making the economic mistake of thinking I was being frugal. Those who took out debt to finance purchases or spent their money immediately actually got the better deal.

Why do I say that?

Well, when you spend your money immediately, you can realise the total purchasing power of that currency unit so you can get more stuff or investment assets per currency unit.

When you take out debt to finance something, you’re using today’s purchasing power per currency unit and paying back the nominal figure with a devalued currency unit over time.

I saved money under the assumption that the cash I have could maintain value over time, that the interest rates I was getting would make a difference as it compounds year after year. While the action of saving was an admirable one, the reality is that I was allowing governments and those accessing the debt markets to bleed away my purchasing power.

I was rewarding others with my stored purchasing power and not realising the value of my labour. Saving in fiat may be for suckers, but the action of saving is still a hugely rewarding one if you can find the right vehicle to save in.

I am eating compounding losses.

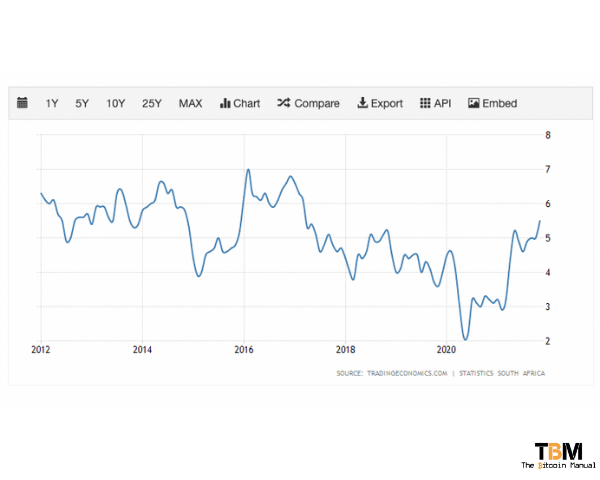

As I sat on my cash balance, taking some of it to invest in other financial assets and taking on additional risk, I was losing money faster and faster. During my ten years in the working world, the South African inflation rate or official CPI rate, has ranged between 4-7% per year.

In the best-case scenario of 4%, I would lose half my purchasing power every twenty years and, in the worst case, every ten years.

Now anyone who takes the time to look into those figures will realise it’s kept artificially low through hedonic adjustments, and South Africa has had double-digit currency debasement for well over a decade. If we average out an M2 money supply increase of the last ten years, it sits at around 12%.

As a result, I lose half my purchasing power every six years.

Despite my best efforts to get a favourable interest rate and some returns through financial assets I could afford, I fell behind. My wages were not growing at any considerable pace, and I could see myself getting poorer.

Considerations when earning in fiat.

The average joe like myself has no other means of acquiring capital other than trading our time, labour and skill for cash rewards. We go out into the working world. We find companies or people with problems, and we offer ourselves up as a solution to that problem. As we solve problems for others, our compensation comes in the form of a weekly or bi-weekly wage while others receive a monthly salary.

In some cases, we may have delayed our entrance into the working world by a few years, forgoing the opportunity cost of more work experience and a steady wage for academic pursuits. We give up either our parents savings or our future income to these educational institutions with the hope of receiving some paper accreditation.

This accreditation would be a four-year recommendation of competence in a particular field that may or may not give us access to a higher paying job.

Sure there’s also the option of self-employment, but the vast majority of us will not take on that route due to perceived risk.

Regardless of the option, you choose you eventually end up spending your days exchanging time and bodily or mental action for your local currency. Once you receive that currency, there are probably several deductions that you need to account for; your compensation isn’t yours to keep entirely.

Depending on your job and the country you’re in, you may experience more or fewer deductions, with some of those line items including:

- Income tax

- Health care

- Life insurance

- Unemployment insurance

- Retirement annuity contributions

- Pension contributions

Once you’ve cleared that hurdle, you now have the privilege of paying your living expenses, and after that, you can put away savings with the rest.

Fiat continues to attack your compensation.

Now you’ve got a cash balance for a rainy day, you’ve paid your dues, and all that’s left is yours to enjoy, right?

Wrong!

As you store or use cash, several additional deductions will attack your savings kitty. As you consume your cash, you may fork over the capital for other taxes.

- Import tax

- Sin tax

- Value-added tax

- Energy tax (Electric, gas and petrol)

- Property tax

But that’s if you’re living and consuming; if you’re not being punished for living, you should be okay, right?

Wrong!

The next step in the fiat tax regime is inflation; for sitting on your money, be it digital cash in the bank or physical cash under your mattress, governments will extract their fair share of it. Sure the currency units remain the same, but what those units can purchase is reduced over time. If you’re sitting on cash for an extended period, you receive a hidden tax, called currency debasement or currency inflation.

You are putting your capital at risk.

When you consider all those deductions we face under fiat, it is no wonder more people are left with less at the end of each month. The little nest egg we build up is constantly attacked, so what do we do?

We invest.

We are all encouraged to invest; it’s an old cliche; you have to make your money grow, everyone says it, but no one takes the time to think about what it means.

What it means is you need to go out and earn your money twice.

You already worked your arse off to acquire that capital, and after deductions, you’re left with a pittance of compensation. To preserve it, you have to become a professional investor in your spare time and reallocate that capital into the markets to work for you.

You are actively putting your capital at risk to generate a return; if you don’t, you will fall behind.

This is why the financial and money management world has become such a large part of our economy; we need savings, but no product provides a way to save, so we have to risk our capital.

Ask your friends and family how they are saving, some may have a cash balance, but they probably have some stocks or have their money in a fund or ETF. I would argue that 100% of them have NO idea what they are investing in; someone recommended some fund called “conversation” or “growth” or whatever marketing term they like to convince you it’s a sound opportunity.

They didn’t ask many questions and signed up for the deal. They have no idea what the fund owns, what counterparty risk is involved, how much fees are taken off; they know their money is working for them.

- Can they verify it? No

- Do they know how much risk is involved? No

- Do these funds consistently beat the market? No

But it’s the best of a bad bunch of options. Investing because you have to gives you no leverage over the returns you get; you’re simply happy with anything as long as you’re not stuck on the same nominal figure.

You’re continuously sold lies that these investment vehicles can beat inflation and that once it’s all said and done. You can liquidate, you’ll be able to retire old and grey and take walks on the beach, but it’s not going to happen for most who follow this strategy.

Bitcoin is what savings should be like

Now that you get the idea of how the fiat system keeps you between a rock and a hard place, why would you continue to try and thread your future through the eye of an ever-shrinking needle?

You could opt-out like I have done, using bitcoin.

Ever since I discovered bitcoin and its compound growth effect, things have changed. My prudence has been rewarded; I didn’t have to change my way of thinking; I wanted to be a saver and found a way to save. I can save at ANY amount; I can buy bitcoin from $1 if I want to, any spare cash can be converted into savings that I can confidently hold long term.

I no longer have to go out and risk my capital; Bitcoin is my risk-free rate; bitcoin is my passive income; bitcoin is my savings. I am protected against inflation, I am guarded against third party institutional risk, and I am shielded from my national currency risk.

And the best part is I no longer need to go out and earn my money twice; once is more than enough.

The bitcoin track record

Every person who held bitcoin for four years or more has seen their relative purchasing power increase. Sure the price is volatile, but for accepting that volatility, I also receive a floor price in which you are guaranteed not to lose my purchasing power over time.

I am not too concerned with how much bitcoin can grow; I am only concerned with how much of my purchasing power can be protected year after year. Something bitcoin has provided me with for the last six years, and It should continue on as long as the network survives.

We only live once, so why would you want to spend that time earning your wealth twice?