The technology creates a secondary network that offers peer-to-peer payments trustlessly, with instant settlement and lower bitcoin transaction fees. But to gain access to all these benefits, you either need to use a custodial service, leverage a trusted node in your friendship, family or community circles or run the entire stack yourself.

When it comes to securing and managing your Lightning payments, there is no one-size-fits-all solution and providing users with options is essential for the network to scale based on natural incentives. The majority of people are not going to run a Lightning node, nor are they keen on dealing with all the complexities, but they still want all the benefits of the Lightning network.

That’s why Lightning network service providers exist – they bridge the gap between users who want maximum control of their funds and those who want a more hassle-free experience using Lightning.

What is a Lightning Service Provider (LSP)?

A Lightning Service Provider (LSP) is a business or centralised entity that provides Lightning Network services such as liquidity management and payment routing on behalf of others while charging a fee for their services. The Lightning Network is built on a series of channels; a single Lightning user can open up multiple channels by locking up bitcoin, allowing them to send payments, receive payments and route third-party payments.

Channels in the Lightning Network are naturally constrained by their size, and local and remote balances further limit capacity. As the network tries to route payments, capacity and balance management become tricky and with novice Lightning node users or absent Lightning nodes, you start to run into poorly managed payment routes that can lead to failed payments and a poor Lightning experience.

Lightning Service Providers aim to smooth out the supply and demand for liquidity and capacity, typically by managing a user’s liquidity by performing a few tasks.

- Swapping on-chain funds for off-chain funds or vice versa.

- Rebalancing local capacity of channels.

- Opening channels to increase a user’s inbound capacity

- Opening up and auditing channels to improve their position in the graph.

Today, LSPs are most commonly known for providing liquidity to users of non-custodial wallets through channels. This service allows users to immediately receive Lightning payments to their wallets without requiring a node, active channel management or ownership over a UTXO. The LSP typically charges an upfront payment to compensate for mining fees and capital costs, and users pay for this in favour of convenience.

LSP fees can be charged directly from an incoming payment or could also be charged upfront.

An LSP may also borrow bitcoin for this task or deploy its own funds. It is also possible for an LSP to buy such channels on the open market, such as Liquidity Markets like Pool or Magma or use sidecar channels instead of opening them themselves. LSPs provide direct demand to liquidity markets since their business model revolves around securing cheap liquidity to route user payments and net a return through the user’s use of that liquidity.

| Lightning Service Provider | Website |

|---|---|

| Blocktank | blocktank.to |

| Breez | breez.technology |

| C= | cequals.xyz |

| Greenlight | blockstream.com/lightning/greenlight |

| LightningTo.Me | lightningto.me |

| LNBIG.com | lnbig.com |

| LQwD | lqwdfintech.com |

| Thor | bitrefill.com/thor-lightning-network-channels |

| Voltage | voltage.cloud |

What functions do LSPs perform?

LSPs are counterparties on users’ payment channels that perform channel-management functions automatically in order to ensure that they work consistently and effortlessly from a user’s perspective.

They remove the complexity of using the Lightning network and provide foundational Lightning network management such as:

- Opening and closing channels

- Manage cross-network payments (Main chain or LN)

- Better routing with fewer hops

- Rebalance channels

- Reliable routing

- Reduce the risk of downtime

While managing Lightning might be the LSP standard business model, some LSPs might provide additional services.

The types of services offered include:

- Graphing and route calculation

- Liquidity provisioning

- Channel backups and recovery

- Submarine swaps

- Watchtowers

- Payment forwarding

Graphing and route calculation.

Keeping up to date with the graph and efficiently calculating optimal routes can be an intensive exercise for lower-capacity devices and for those who are still learning the ropes of building a Lightning footprint. LSPs offer High-performance nodes that function as “trampoline nodes” that can handle this routing for end users in setups that are trustless and private once their availability on the network is widespread enough.

Liquidity provisioning.

A significant starting hurdle and constant challenge for anyone transacting on the Lightning Network on their own is sourcing inbound liquidity and keeping channels balanced as transactions are routed through channels.

There are several options for rebalancing channels yourself, but LSPs can scour services looking for the best options.

- LSPs can provide inbound liquidity at a cost.

- LSPs can borrow funds from other users.

- Lightning Pool offers channel leasing.

- Lightning Loop and other submarine swap providers allow you to interchange between on-chain and off-chain liquidity.

Channel backups and recovery.

LSPs may act as a trusted peer that stores an encrypted static channel backup (SCB) for its users. ACINQ, the team behind eClair implementation, act as an LSP for their non-custodial wallet Phoenix and use this method of backup for its users.

Should a user lose their wallet and require a restore of their wallet, all they need is their regular recovery phrase, and their channels with ACINQ will be recovered from the encrypted SCB that ACINQ maintains with their node.

Submarine swaps.

A Lightning Service Provider should aim to interact with their clients in a purely non-custodial way. Still, different LSPs will choose different implementations based on the customer base they wish to service.

Some LSPs will manage swaps that can be constructed as Submarine Swaps to guarantee that the service provider cannot abscond with funds at any time.

When opening channels to peers, the LSP retains custody over their side of the channel and earns routing fees as they forward payments.

Watchertowers.

A watchtower is a program that watches the bitcoin base chain and lightning network to see when a particular transaction is broadcast to the mempool. Their purpose is to look for invalid transactions that do not adhere to consensus rules in order to flag them should a user try to steal funds locked in a channel.

Individual Lightning users can run watchtowers on their nodes, and it’s recommended for anyone who plans to connect with public peers they do not know personally. Instead of having to safeguard against channel attacks yourself, the LSP will act as a watchtower for any channels they run on your behalf.

Async payments/payment forwarding.

When managing the Lightning network yourself, you need to ensure that you have a wallet with hotkeys constantly connected to the internet, checking for requests to route payments or receive payments. If your node is to drop offline due to hardware or software issues or even a lack of electricity or internet connection, those channels will enter a zombified state until you reconnect to the network.

During that time, payments cannot be routed through your liquidity since you cannot update balances, so payments sent to you will fail. To help mitigate that, an LSP can provide asynchronous payments, which store payments temporarily, waiting for you to come back online.

Once you’re back online, all those stored payments can safely be forwarded to you.

Reliability and centralisation.

The critique of LSPs is that if more users onboard to Lightning and use a specific wallet or LSP that this will be a centralising factor for the Lightning Network. One LSP could onboard a bunch of users and manage a large portion of liquidity, but that is on the condition that no one comes in to provide competition or Lightning wallets don’t allow other LSPs in their software stack.

Those looking to support the Lightning Network, who have the expertise and bitcoin to spare, could turn from ordinary routing nodes to LSPs over time as it becomes a more attractive business model.

In the near future, I expect a growing LSP market that wallets would offer as options, all competing on features and fees to provide users with the smoothest onboarding experience into Lightning.

Users could use the same wallet and easily swap between LSPs or their own node or have a combination of the two leaving the LSP as a fallback if your node is offline.

The choice is good for users, competition is good for the market, decentralisation is good for the network, and the competition will drive a better user experience for users.

Lightning with training wheels.

As the Lightning Network expands, we will see new market solutions, and LSPs are a natural evolution due to the network maturing and reaching more non-technical users. LSP services make it easier to experience Lightning with a lower risk involved than that custodial services. It might also be the gateway for many to experiment with Lightning before migrating to a fully non-custodial stack as users migrate through the different options.

LSPs might also make mobile payments a slicker experience allowing users to offload some of the complexity and resource demand onto the LSP and have their mobile device as a terminal to interact with the network.

Growing pains of the Lightning Network.

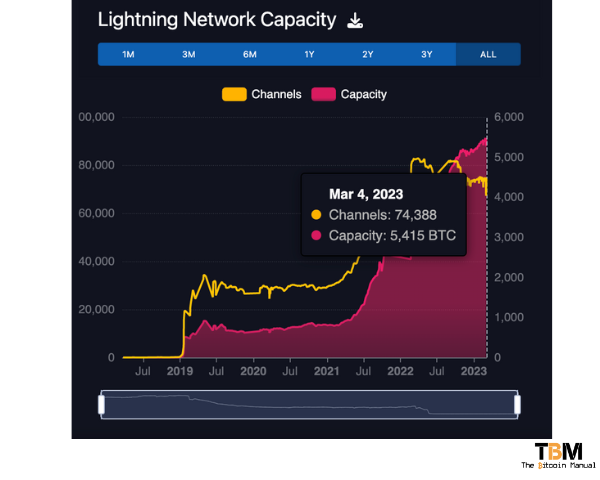

Lightning continues to grow with new channels and more bitcoin locked into those channels, but the network is experiencing growing pains. There will come times when there are liquidity mismatches; it’s all about how quickly actors respond, and with LSPs around, it could reduce the lag time when Lightning needs additional capacity.

Do your own research.

If you want to learn more about Lightning Service Providers, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.

- Lightning Service Provider

- The Breez Open-LSP Model: Scaling Lightning by Sharing ROI with 3rd-Party LSPs

- bitcoin.design – Lightning services

Are you a bitcoin and lightning fan?

Have you been using Lightning to make micro-payments? Stream sats or engage with apps? Which app is your favourite? Do you run a Lightning node? Have you tried all the forms of Lightning payments? Which one do you prefer?

Let us know in the comments down below.