If there is one thing altcoiners are brilliant at, it is the ability to throw a lot of words and situations at you without saying much; these glorified marketers are always coming up with new and innovative ways to rebrand the ability to print up inflation, couple it with an idea, and profit from the seignorage.

I hate to break it to you, but if it has a token, is not tied to proof of work and has a pre-mine, its only killer up is turning those who didn’t launch the project into exit liquidity.

The altcoin market is designed to come up with new jargon and terms and takes on the same premise, and puts the onus on you to debunk it. There is a never-ending supply of chains that differentiate themselves via consensus mechanisms, with proof of stake (POS) and delegated proof of stake (DPOS) being the most popular alternatives to proof of work.

With Greenpeace and the greenwashed media attacking proof of work, their solution is moving to POS or DPOS, and pointing to failed chains with no volume and centralised control but are still running as successful alternatives.

Being a recovering shitcoiner, one who dabbled in these projects offering alternative consensus mechanisms, I think I have first-hand experience in watching the Ponzi unravel and earned my stripes as being exit liquidity for projects. If that realisation isn’t enough to send a pain right up my neck, what really gives me more of a headache is when new shitcoiners tell me I am close-minded or don’t understand the tech.

Simply dismissing something as a scam is not a good enough argument for most people; they need to know how the scam works before they walk away. One way to learn is to get involved first-hand, put money on the line and get burned, or you can learn from the experience of others.

Having been a shitcoiner myself, I have some experience with DPOS chains, and this is what I’ve uncovered.

“Unintentional mascot”

— Greenpeace USA (@greenpeaceusa) March 27, 2023#SkullOfSatoshi #CleanUpBitcoin #ChangeTheCodehttps://t.co/Dv671O2W0U pic.twitter.com/EbyEdp266p

Attack on proof of work.

One common argument in favour of DPoS is that it is a more efficient and eco-friendly alternative to proof of work (PoW). PoW is the consensus mechanism used in bitcoin, where miners solve complex mathematical problems to validate transactions on the network. While this system has proven to be secure, it requires a lot of computational power, leading to high energy consumption and assumptions that bitcoin has a growing environmental impact.

DPoS, on the other hand, doesn’t require miners to solve complex problems but relies on token holders to vote for delegates who validate transactions. As a result, DPoS is often touted as a greener alternative to PoW.

At face value, looking only at the metric of energy consumption between the two consensus mechanisms, this is true, DPOS uses far less energy than POW. But we should only look at what the cost is to run a network, or the energy needed to run a network, but rather the quality of the product.

If the delivery of the product is a half-baked solution, then any energy going into DPOS would be a complete waste versus bitcoin. If we don’t only look at what we’re paying for but what we’re getting for that so-called “energy and cost” saving, we might actually see that the DPOS trade-off is not worth considering.

So what is DPOS? How does it work, and why do I consider this consensus mechanism a scam? Let’s find out.

What is delegated proof of stake DPOS?

DPoS was first conceived by Dan Larimer in 2013 and utilised in his project BitShares; he has been responsible for a litany of failed chains from STEEM to EOS.

In a DPOS chain, you would lock up your funds (stake funds), and then instead of running the validation software yourself, you delegate your stake and proxy voting powers to a federation member that will handle all the complexity for you. These appointed figures run the chain, validate blocks, and maintain the network, while you simply get the kickback from your inflation based on the chain’s issuance and your proportional stake.

Delegated proof of stake nominates “delegates” or “witnesses” to maintain security and mine new blocks on the chain based on a simple vote.

Delegates, witnesses or federation members (whatever you would like to call them) have a clear incentive; get those with the most stake to back them, so they remain in the top approved validators so they can access the rewards for securing the chain’s next blocks.

If an elected delegate performs poorly or tries to execute, some kind of fraud coin holders can remove their stake from the delegate and essentially vote them out of their position. This process is meant to ensure compliance among delegates because voting is frequent, and competition for spots can be fierce.

Delegated Proof of Stake (DPoS) is a typical utopian idea of sunshine and rainbows, where trade-offs don’t exist, and everyone will simply act moral and just. It reminds me of children playing in the park, creating “magical force fields” around their bags of sweets, and if you don’t play along and take the sweets, they’re shocked at how you were able to break through the barrier.

DPOS is a consensus mechanism that sounds like a fair system in theory, where token holders vote for delegates who validate transactions on the network. However, what seems like a democratic system is actually riddled with problems.

Proof of stake vs delegated proof of stake.

While DPoS is seen as a greener alternative to PoW, this overlooks the centralisation of power that occurs in the system. To understand the centralising forces at play better, it’s important to compare DPoS to PoS. In PoS, token holders, in theory (I say in theory because the truth is very few POS users stake tokens on their own and would rather stake via a proxy).

Once the validator software is running and funds are staked, users are able to run validators backed by their proportion of tokens staked; they then use these validators to produce blocks and verify transactions. The users that stake their funds are rewarded with new coins.

Since this is all software-based, your only cost is running a server, which, compared to an ASIC miner, is far less energy intensive.

This proof of stake system, if not reliant on proxy services, is much more decentralised than DPoS because there are no delegates or middlemen involved in the process. The issue with proof of stake is that many of these chains encourage centralisation due to the number of computing resources needed; laptops and home servers are not going to cut it, so you either need to rent out space in a data centre or have industrial grade servers on hand, something most people are not going to do, or know how to manage.

PoS is not without flaws – it can be susceptible to a “nothing at stake” attack where validators have no incentive to choose one chain over another in the event of a fork, but most pertinent is that it all trends towards more centralisation over time.

DPoS attempts to address the centralisation issue of PoS by embracing these forcing functions and allowing token holders to delegate their voting power to representatives who validate transactions on their behalf. However, this system leads to a few delegates holding a significant amount of power and can also be vulnerable to vote buying and bribery.

In addition, a small group of delegates can collude to control the network, making it less secure and decentralised. With this understanding of how DPoS differs from PoS, we can better see why DPoS is considered a scam. The centralisation of power in the hands of a few delegates and the susceptibility to vote manipulation make DPoS a less secure and less decentralised system than PoS.

These centralising factors are further compounded through the token allocation, which is often pre-mined and handed to founders who can then retain their power over the network, with no actors able to dilute their relative position.

Centralisation of power.

DPoS’s attempt to address the centralisation problem of PoS has not been entirely successful. In theory, token holders can delegate their voting power to representatives who validate transactions on their behalf.

However, in practice, a few delegates hold a significant amount of power, and this system is vulnerable to vote buying and bribery. Additionally, a small group of delegates can easily collude to control the network, making it less secure and decentralised.

The centralisation of power in the hands of a few individuals makes DPoS a less secure and less decentralised system than PoS.

Vote buying and bribery.

In theory, DPoS aims to decentralise power in the hands of token holders by allowing them to delegate their voting power to representatives.

However, this system is vulnerable to vote buying and bribery, enabling a few individuals to control the network. This centralisation of power makes DPoS less secure and less decentralised than PoS.

The ability of a small group of delegates to collude and control the network can lead to significant security risks, which we’ll explore in the next section.,

Security risks.

The ability for a small group of delegates to collude and control the network in DPoS can lead to significant security risks. Because DPoS allows token holders to delegate their voting power to representatives, malicious actors can buy votes or bribe delegates to gain control of the network.

This centralisation of power makes DPoS less secure and less decentralised than PoS, which relies on a larger number of validators to secure the network.

In addition to vote buying and bribery, DPoS is susceptible to 51% attacks, where a single entity gains control of the majority stake in the network and can manipulate it for their own gain. In fact, most DPOS chains are 51% attacked by default, as founders are holding most of the tokens in any case.

Since DPoS relies on a small number of delegates to validate transactions, making it easier for attackers to gain control, if a validator’s keys were ever compromised, an attacker could easily disrupt the network.

The lack of security and decentralisation in DPoS poses significant risks for users and investors. Without a secure and decentralised network, users are vulnerable to attacks and theft, while investors risk losing their stake if the network is compromised.

Lack of decentralisation.

The centralised nature of DPoS raises concerns about its security and decentralisation. With a small number of delegates responsible for validating transactions, it’s easier for attackers to gain control of the network, leaving users and investors vulnerable to theft and loss of investment.

A lack of decentralisation in DPoS contributes significantly to these security risks, making it imperative for users and investors to take proactive measures to protect their interests.

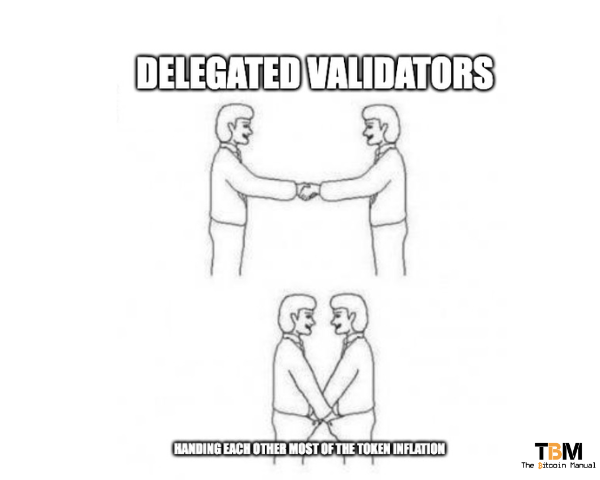

Circle jerks, sock puppets and useful idiots.

In the DPOS world, you will run into a host of characters, all looking to get as close to the inflation pipeline as possible. In bitcoin, the only way to get some of that new issuance is to run a miner and boil the oceans; there is no other way to access fresh bitcoin.

In DPOS, there is no tether to resources; it is solely based on how many tokens you hold or how many people with loads of tokens will vote for your validator. In this game of shifting stake thrones, you will encounter all sorts of gimmicks to try and game the system.

- Valditors will spin up bot accounts to message users or create chats to encourage voting in their direction.

- Validators will offer backdoor deals to large stakeholders to vote for them (yes, you won’t be privy to those discord groups).

- Validators will use their stake to create sock puppet accounts with stake to vote for themselves to give the illusion that a lot of accounts with a sizable stake vote for them.

- Validators will collude to create sock puppets to vote for one another.

- Validators will spin up derivative tokens.

- Validators will send small amounts of inflation to useful idiots that will act as mindless brand ambassadors for the chain, to recruit more members to the Ponzi and vote for that validator.

If the founders have not secured total control over the network through their pre-mine held via proxies, where they pretend to be individuals who are coming to the same conclusions all the time, the chain falls into chaos, and eventually, the factions aim to fork the network.

DPOS becomes a political game where validators look to retain power by throwing smaller users some scraps in the form of staking returns.

Too much work to secure your funds.

A lack of decentralisation in DPoS poses significant threats to its security and users’ investments, but there are other issues you must deal with in DPOS; you are compelled to also be an active participant in the network at all times.

1. Research delegates.

Before staking your tokens, research the delegates you plan to vote for. You need to find information about delegates’ reputations, performance, and security measures on forums, social media, and DPoS analytics websites. You want to avoid voting for delegates with a history of missed blocks, security breaches, or scandals.

2. Diversify your delegation.

You would not want to put all your tokens in one delegate’s basket. Divide your delegation among several reliable delegates to distribute your risks and avoid relying on a single delegate’s performance. By diversifying, you also contribute to decentralisation by balancing voting power among more people. But this is all an illusion; in reality, you have no idea if that validator is not the same person or if validators have backdoor relationships and would always opt to collide with one another.

3. Cold wallet use is punished.

In DPOS, you are not encouraged to keep your funds cold; in fact, you want to keep them hot, so you can stake your coins and vote for validators. If you don’t, you’re not getting that sweet staking rewards, and you are getting diluted by those that do.

DPOS encourages you to take risks and leave yourself open to hacks, theft, and other cyber-attacks. It’s fairly simple for a fake validator to approach users and send them to a voting page that could get the user to sign over their keys and lose their account, which has been seen to happen on DPOS chains.

4. Stay Informed.

In DPOS, you also need to keep yourself updated on the latest news, updates, and vulnerabilities related to DPoS and the delegates you voted for. Follow trustworthy sources and be cautious of scams, phishing attacks, and social engineering tactics.

Now, do you honestly want to deal with all that drama simply to secure your money? Personally, I don’t see how a network like that allows me to store value long-term. If I simply want to save money and fall asleep for five years, and then come back to it, DPOS is not the type of network you would look at.

Why delegate when you can take personal responsibility?

Delegated Proof of Stake (DPoS) may present itself as a fair and democratic consensus mechanism with a low carbon footprint for validating transactions on the blockchain network. Still, it remains inherently flawed and trends towards capture if not already captured from the start.

Instead of having to deal with all the drama and politics that come with a stake voting system, you can opt for a system based entirely on individual responsibility.

In bitcoin, you don’t need to care what other nodes on the network are doing; if others want to use Taproot, add UtreeXos, run Lightning nodes, use Ordinals or prune their node, that’s their business and has no effect on how you interact with the network. It’s your node, and it’s your rules, and you communicate directly with the network with no intermediaries.