Bitcoin, as it states in the white paper, is peer-to-peer electronic cash; it has no central issuer since anyone who can mine can earn it, while those who wish to acquire it can do so by trading something of value with another person. These trades can be conducted as fiat to Bitcoin trades, trading your time and labour for Bitcoin or selling goods for Bitcoin.

Peer-to-peer markets for Bitcoin exist, as do a few Bitcoin circular economies where trades like those mentioned above are becoming the norm, but these users or Bitcoiners are exceptions, not the rule.

The overwhelming majority of people who wish to acquire Bitcoin do so by heading towards a regulated entity such as an exchange or fintech company and conducting their trades within these regulated walled gardens.

While exchanges and fintech apps make it nearly frictionless and easy to exchange your fiat for Bitcoin or vice versa, they are not without their trade-offs. To access these walled gardens, you need to provide proof of your identity, abide by a host of KYC and AML rules, and run the risk of associating all your purchases with your identification.

Exchanges becoming a choke point instead of a gateway

Exchanges work well until they don’t, and we’ve seen examples of exchanges going bust, closing down people’s accounts, blacklisting users and having private user data leaked, putting their customers at risk.

These are very real concerns when you deal with a 3rd party custodian and should not be taken lightly; they are a central point of failure and pressure and make it easy for regulators and governments to put a chokehold on a local Bitcoin market.

If the vast majority of a particular country’s Bitcoin trading happens on a local platform, shutting down or limiting that entity’s ability to offer Bitcoin trades can be devastating. It also enables the ability to easily 6102 individuals Bitcoin if users leave their funds with a service provider.

While this might sound like hyperbole to you now since we haven’t had an example of mass confiscation of funds or widespread blacklisting of users, the building blocks for it are surely starting to take shape with the update of the travel rule now starting to apply to Bitcoin transactions.

What is the Bitcoin Travel Rule?

The Bitcoin travel rule, officially known as the FATF (Financial Action Task Force) Recommendation 16, is a regulatory requirement claiming its aim is to combat money laundering and terrorist financing by enhancing transparency in cryptocurrency transactions.

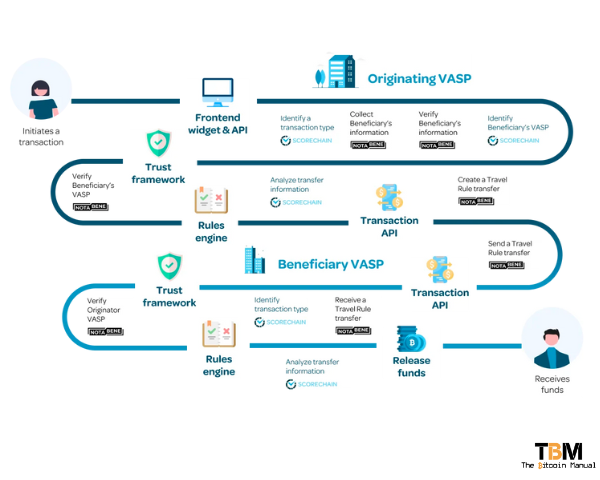

This rule, adopted by the FATF in 2019, mandates that virtual asset service providers (VASPs), such as cryptocurrency exchanges and wallet providers, exchange certain customer information with each other when transferring virtual assets above a specified threshold.

Key components of the Travel Rule

The Bitcoin travel rule encompasses several crucial elements that contribute to its effectiveness:

- Customer Identification: VASPs are mandated to collect and verify customer information, including names, addresses, and identification numbers, for both the sender and recipient of cryptocurrency transactions.

- Transaction Threshold: The rule applies to transactions exceeding a specified threshold, which varies depending on the jurisdiction. In some regions, the threshold is set at $1,000, while others may have higher or lower limits.

- Information Sharing: VASPs must exchange customer information with each other when sending or receiving cryptocurrency transactions above the threshold. This information exchange enables authorities to track the movement of funds and identify potential red flags.

- Sanction Screening: VASPs are required to check counterparties against sanctions lists to prevent transactions with individuals or entities under sanctions.

- Due Diligence: VASPs must conduct due diligence on counterparties to assess their risk profiles and ensure compliance with the travel rule.

The original (fiat) Travel Rule

Published in January 1996, the Financial Crimes Enforcement Network (FinCEN) Advisory presented the original Travel Rule:

A Bank Secrecy Act (BSA) rule [31 CFR 103.33(g)]—often called the “Travel” rule—requires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. (FinCEN 1997)

The rules remained unchanged for several years and never applied to Bitcoin for the first decade of its existence. Only in 2019 did the Financial Action Task Force (FATF) update its recommendations to extend them, including the Travel Rule, to virtual assets (VAs) and VA service providers (VASPs).

Since the expansion of the travel rule in 2019, several countries — including Germany, Singapore, Switzerland, Canada, the United States, South Africa, the Netherlands, Estonia and a few more — have adopted or introduced legislation that mirrors these FATF-driven AML compliance obligations.

Even if the travel rule doesn’t apply to you now, consider it a work in progress and plan accordingly. Like anything regulatory, the larger economies set the rules, and the rest eventually follow.

The essence of the travel rule

The core principle of the Bitcoin travel rule lies in its ability to trace the origins and recipients of cryptocurrency transactions, thereby enabling authorities to identify and investigate potentially illicit activities.

By requiring VASPs to collect and share customer information, the rule seeks to bridge the anonymity gap inherent in Bitcoin transactions, making it more difficult for individuals to access the wider Bitcoin network via exchange on-ramps.

The claim is that by adding more onerous requirements to send and receive Bitcoin when using an exchange, there is less chance of criminals using exchanges to liquidate the proceeds of crime. The truth is criminals can always find ways around this, such as selling on P2P markets, purchasing KYC accounts that are for sale through online markets, and using complex mixing services and stablecoins to conduct business.

The only ones affected by the travel rule are law-abiding citizens who will need to provide even more information every time they withdraw funds to an on-chain wallet or those sending on-chain Bitcoin to exchange to liquidate it to acquire cash.

The travel rule will not only increase your KYC footprint but also make it harder for you to hide your on-chain footprint, which can put you at risk should that data ever be leaked.

Impact of the Bitcoin Travel Rule

Implementing the Bitcoin travel rule will significantly impact the Bitcoin industry, introducing a new layer of compliance and accountability and making it more expensive to offer compliant Bitcoin services. While some industry participants have expressed concerns about the rule’s potential to hinder innovation and reduce privacy, others view it as a necessary step towards legitimising Bitcoin and fostering a more responsible financial ecosystem.

Those who welcome it also see the added regulation as another barrier to entry, reducing the possibility of future competition entertaining the space and securing their place in the current regulated Bitcoin market.

Under the crypto Travel Rule, VASPs and Bitcoin businesses must share customer information when transferring Bitcoin, or digital assets, above the threshold.

This personally identifiable information (PII) must include: (Note this may vary based on your country)

| Sender Information | BSA Regulation | FATF Regulation |

|---|---|---|

| Transaction threshold | 3000 USD | 1000 USD/EUR |

| Legal name | Required | Required |

| Account number | If available | Required |

| Legal Address | Required | Required |

| Financial institution | Required | Not required |

| Transaction amount | Required | Not required |

| Transaction date | Required | Not required |

Sender reporting requirements:

| Recipient Information | BSA Regulation | FATF Regulation |

|---|---|---|

| Legal Name | If available | Required |

| Legal Address | If available | Not required |

| Financial institution | Required | Not required |

| Account number | If available | Required |

| Additional PII | If available | Not required |

Recipient reporting requirements:

What are the concerns around the travel rule?

Applying the travel rule to Bitcoin is not without its controversies and brings a lot of concerns to the Bitcoin community.

- The Travel Rule can be considered a breach of individuals’ privacy rights.

- There’s a common belief that the regulations will slow down blockchain development in the EU and halt innovation in the industry.

- The negative impact comes from the requirement to collect data on the transactions, which could make crypto exchange activities slower and more expensive.

- Technical experts are concerned about the security of the data. More specifically, combining the data with information from the Crisis Management Platforms and the European Commission, European Central Bank, and European Banking Authority could make it vulnerable to cyber-attacks.

- There is an additional risk from illicit or fake VASPs who might use legislation as an opportunity to collect user data, as well as from oppressive regimes seeking to control legitimate users of Bitcoin as a method of moving funds outside the system.

- Travel Rule requires VASPs to share the personal information of a transaction’s sender and recipient with other financial businesses or VASPs. Since the FATF does not advise the use of any specific data-sharing technology, there is no single protocol or network for data transfer. That is why several third-party networks for encrypted data transfers exist, including OpenVASP, Shyft, and Trisa, which only add to the complexity, the data footprint and the chances of data leaks.

The travel rule could be part of a spot ETF push.

If the travel rule makes it harder for exchange users to move funds in and out of platforms and makes it more expensive for exchanges to operate, why would exchanges want to comply with this added regulation?

The obvious reason would be they do not want to be shut out of large markets like the U.S. and are willing to play ball to access the customer base, but it could also be a play for a future approval of a spot ETF. If one is approved, regulated custodians will be required to custody the Bitcoin on behalf of these ETFs, and these exchanges will need to comply with strict regulations on the type of coins they hold and how they move funds in and out of their service if they want to capture some of that spot ETF inflows.

To help make exchanges more attractive, we’ve already seen some of them push for the creation of interoperable systems for compliance. Paxos, with partner members including Coinbase, Circle, Gemini and Kraken, introduced Travel Rule Universal Solution Technology.

This initiative aims to aid exchange compliance in the U.S. and beyond, with exchanges obliged to meet security and privacy requirements and create platforms that are preferred custodians for ETF-managed funds.

Keeping your Sats safe requires secrecy.

Travel Rule enforcement is simultaneously a significant milestone and the biggest setback for Bitcoin, depending on how you see the asset. If you’re only in it for the capital appreciation in fiat terms, you would have no issue with these rules since you never planned on spending or using the funds outside an exchange, and the only reason you hold Bitcoin is to sell it for fiat later.

If you only use Bitcoin as a trade, and the funds remain in a walled garden and trust a third-party custodian, these rules won’t affect you. You may welcome the rules since they make it harder for capital to flow in and out of exchanges and could drive up volatility in these markets.

Additionally, the building of regulated walled gardens for Bitcoin could be the base needed for the approval for a spot ETF, which will bring institutional money into the market and pump ye o’l bags.

On the flip side, the Bitcoin travel rule represents another step backwards in improving financial privacy in the Bitcoin realm. Adding more personal information relayed on transactions facilitates traceability, putting users at risk. That data could fall into the hands of hackers who could target these users with online or in-person attacks or used by governments who wish to place oppressive measures on capital, leaving their failing economies.

If you believe in self-covering money and financial privacy, you first should accept that exchanges will not be friendly towards your ideals and use of Bitcoin. You may need to cut ties with exchanges, sell off your KYC Bitcoin and re-buy on P2P markets. P2P market premiums might not be so expensive in the future when compared to centralised exchanges, which might need to increase their fees to pay for the additional operational costs, making P2P purchases more attractive.

If you do remain with a KYC exchange, you will need to consider consolidating your coins in an on-chain wallet and mix it with the mixing service of your choice later so your coins cannot be traced back to you and your future spending habits are no longer monitored.

While you can never get rid of the initial purchase data from the exchange, those who have that data will not be able to follow your funds after they’ve left the exchange.