Mining has played a significant role in South Africa’s history and economy, with the country home to a wide range of mineral resources, including gold, diamonds, platinum, coal, and iron ore. The first recorded mining in South Africa took place in the 18th century when Khoisan people mined copper in the Northern Cape. In the early 19th century, European settlers began mining gold and diamonds in the Witwatersrand region, and that’s when things kicked off.

The discovery of diamonds in South Africa in 1867 sparked a diamond rush that attracted people from all over the world. The town of Kimberley grew rapidly, and by the 1880s, it was the largest city in South Africa.

In 1886, gold was discovered on the farm Langlaagte in the Witwatersrand region. This discovery led to the Witwatersrand Gold Rush, which transformed South Africa into a major economic power.

It’s safe to say mining is part of the culture, and fortunes have been made and lost in mining. Despite the country maturing and diversifying with agriculture, technology and some manufacturing, digging stuff out of the ground remains a core part of the country’s GDP.

Today, South Africa still has a large mining sector. Still, it has shrunk as a portion of the country’s GDP and continues to shrink due to political issues, investor confidence and, of course, access to energy.

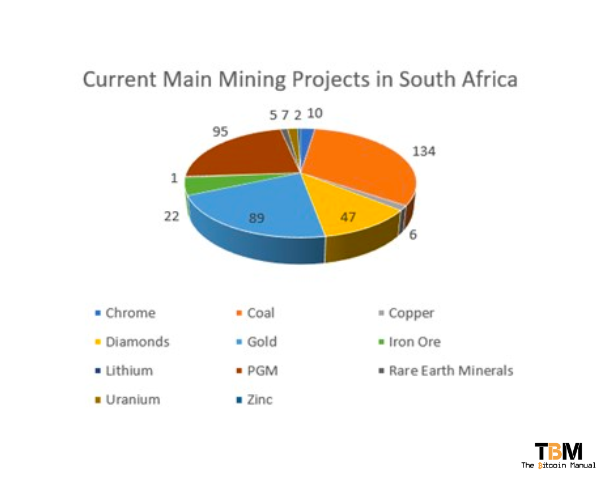

The current focus for miners in South Africa includes commodities like:

- Gold

- Diamonds

- Copper (6)

- Lithium (1)

- Manganese (18)

- Nickel

- Rare Earth Minerals

- Zinc

But no Bitcoin, so what gives? Surely, if you have the temperament to explore, find deposits, dig them out of the ground and haul them to refinement centres or ports for export, Bitcoin mining sounds like a breeze.

Bitcoin mining is the process of verifying and adding new transactions to the Bitcoin blockchain. Miners are rewarded with Bitcoin for their work. Bitcoin mining can be a profitable business, but it is also very energy-intensive.

And that’s the real issue here: if you’re going to be paying the market rate for electricity in South Africa, and you’re going to use some of that for ASIC miners and cooling under African heat, you’re going to be eroding your runway faster than the ANC does our national coffers.

Just as Cecil Rhodes left Kimberely with die Groot Gat, so will Bitcoin mining leave your bank account with an equally Groot Gat if you try to run it profitability in South Africa.

Bitcoin mining has not taken off in South Africa.

In another lifetime, South Africa could have been Africa’s mining hub; believe it or not, there was a time when one of our issues was an energy surplus, days that are long gone. Given that the South African government is slow to react to any innovation and has taken a relaxed approach to Bitcoin, it could have been the ideal breeding ground for Bitcoin miners.

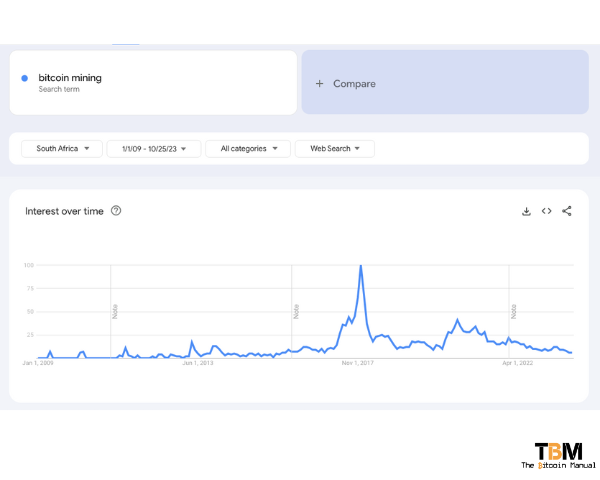

If we head over to Google, we can see that there is interest in Bitcoin mining. Still, interest doesn’t always translate into action, especially when you realise the barriers you have to overcome.

- Unreliable electricity: South Africa has a shortage of electricity generation capacity, resulting in load-shedding

- Failing infrastructure: South Africa had good infrastructure, including reliable ports, rails, internet access and power grids, but that is a thing of the past.

- Failing currency: If you’re going to secure ASIC miners, parts and all the amenities required to set up a Bitcoin mining farm, you’re going to have to import it, which means you’re at the mercy of the ZAR/USD exchange rate which has not been favourable to importers for many years, so expect to pay a premium.

- Government regulation: The South African government is in desperate need of revenue, and if you could set up a cash cow within their grasp, you can expect them to want a piece of the pie.

- Political unrest: Under ANC rule, many promises have not been met, and poverty remains a massive issue, which boils over into political unrest, such as increased crime, riots or sabotage.

- Security costs: If you’re going to set up a Bitcoin mining farm in South Africa, you will need proper security barriers, security guards and much more, and all these precautions will eat into your possible profits.

Despite the challenges, there is some Bitcoin hash rate generated within the country, with reports from the University of Cambridge estimating that South Africa accounts for around 0.01% of the global Bitcoin hash rate.

Who are those mining, or should be mining in South Africa?

Bitcoiners are a stubborn bunch and have different time preferences and economic incentives. There is a silent minority out there mining on the grid power, probably not generating much of a profit or any profit for that matter. Still, they’re willing to pay the premium to secure non-KYC bitcoin or even sell it for a higher premium on P2P markets where they could net a profit.

Those who steal electricity

South Africa is no stranger to the concept of stealing electricity; many do it in informal settlements, but you’ll be surprised how many of the average residential homes or businesses also have illegal or unmetered connections.

These connections can go on for months, even years, without detection and for those who benefit from “free electricity”, they only shift the burden to those who are paying Eskom.

Stealing electricity is pretty easy in South Africa, but you need to watch your consumption; something like Bitcoin mining isn’t easy to do under the radar, as one mining operation found out recently. The South African Revenue Service and the South African Police Service raided a warehouse in Vryburg, North West, in May of 2023 and confiscated millions of Rands worth of illegally manufactured alcohol along with bitcoin mining equipment. The warehouse, in the industrial area of Vryburg, was used to illegally connect Bitcoin mining equipment to the town’s electrical power supply.

This is, of course, only the one that got caught, and there are surely a few scattered around the country, all pulling the same stunt.

Solar and wind farms

As you can imagine, South Africa is desperate to bring online any additional energy generation capacity, be it coal, nuclear, gas or unreliable energy like wind and solar.

While work continues on fixing the coal fleet, bringing online decommissioned power stations and upgrading the one nuclear facility, we have a lot of focus remaining on “green energy”.

The South African government has set a target of generating 100% of its electricity from renewable sources by 2050, which is never going to happen, but that doesn’t mean there won’t be considerable mall investment in trying to get there, especially since wind and solar power are expected to play a major role in achieving this target.

The problem with solar and wind is that it requires demand response and additional storage. If your solar setup hits peak production on a hot summer day, you’re probably not using all of it, and your batteries would be full, so where do you divert that excess energy? You can’t, but with Bitcoin miners, you have a battery that will continue to absorb any energy you give it and pay you for it.

The beauty of Bitcoin miners is that they can be scaled up or down to meet any setup; you could have a simple setup of one or two ASICs to supplement your home solar or something more robust to manage solar farms and wind farm output or support for mini-grids.

Gas fields in South Africa

Mossel Bay in the Western Cape Province of South Africa has had a fully functional gas plant for many years. This gas field is run by the national gas company PetroSA, which is also the operator of fields within the block and has had an issue with stranded gas for some time.

The company has made claims that they plan to attach themselves to the national grid in a few years to help bring online an LNG plant and support the country’s demand for energy, but until such a solution comes online, flaring gas is the only solution and a total waste. Instead of sending possible energy into the sky and generating no value, adding a Bitcoin mining operation nearby could capture that energy, turn it into Bitcoin and provide a revenue source for what is currently a waste product.

Additionally, Renergen’s Virginia Gas Project in the Free State is now in operation, and the company is South Africa’s first commercial liquified natural gas (LNG) plant. While LNG can be exported or moved to LNG terminals where they can be used, South Africa’s transport industry is in tatters and adds to the cost of operations.

By having Bitcoin miners co-locate with these gas fields, energy producers can make the rational decision to fund miners while waiting for LNG orders that can’t be shipped immediately.

Where can I buy Bitcoin miners in South Africa?

If none of this has put you off Bitcoin mining and you’re still determined to generate some local hash rate, then have a look at these vendors selling ASIC miners and equipment. If you can’t find what you need from them, you will have to import it yourself.

| Company | Website |

|---|---|

| Bitmart | bitmart.co.za |

| Crypto Rig | cryptorig.co.za |

| Hash Rate ZA | hashrate.co.za |

Bitcoin mining stunted on the continent, nevermind the country

Overall, the state of Bitcoin mining in South Africa is negative. The country has a number of disadvantages that make it unattractive for Bitcoin miners, and the industry is growing locally to any meaningful scale.

Short of massive growth in private energy generation projects and a robust grid that can connect buyers and sellers of energy, I don’t see retail jumping on board anytime soon, either.

Bitcoin mining may remain on the fringes, but that shouldn’t be seen as a bad thing; South Africa has a lot to offer the world, and South Africans should rather focus on fiat mining as a method of bringing Bitcoin to our shores.

- Image by: Mark Turner on flickr