Bitcoin is a digital currency that has become increasingly popular in South Africa. Its decentralised nature and fixed monetary policy mean that any government, especially the South African government or financial institution, does not control it.

These attributes make it an attractive asset for some people, as it offers a degree of financial freedom and independence or as a hedge against poor governance and local currency mismanagement.

Additionally, South Africans have been starved of inflation protection through local equities. If you’re not lucky enough to own Cape Town real estate, the property market has not been a place to grow your wealth.

Finally, the limitations to how much capital you can move offshore also impact South Africans with a larger kitty to protect, which leads to Bitcoin as another option for “offshoring”.

Why invest in Bitcoin?

There are several reasons why people invest in Bitcoin. Some people believe that it has the potential to become a global currency, while others see it as a way to hedge against inflation or to protect their assets from government seizure.

Bitcoin is also an artificially scarce asset, with a total supply of just 21 million coins, making it attractive to investors looking for a store of value.

If held correctly, Bitcoin cannot be confiscated or forcibly liquidated by governments or institutions, making it a hedge against regulatory uncertainty, political uncertainty and austerity measures.

Depending on your base case for Bitcoin, what you plan to use it for, and how you plan to acquire and hold it will all affect the size of your position.

How much Bitcoin should I own?

No single answer is suitable for every individual, and how much Bitcoin you should buy depends on your individual financial circumstances, cash flow risk tolerance, age, and investment goals. Experts recommend allocating 1% – 5%, while more aggressive predictions focused on the younger crowd say you should look to put up to 30% of your investment capital in Bitcoin.

What does it take to be a one-percenter?

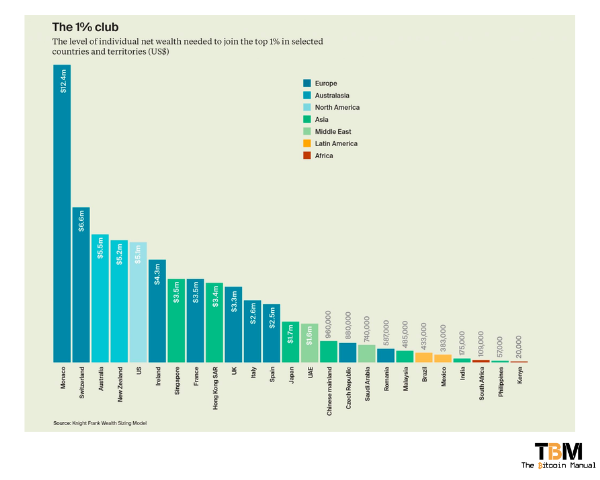

If you are considering investing in Bitcoin, you may be wondering how much you need to invest to be in the top 1% of Bitcoin holders in South Africa. According to Knight Frank’s Wealth Sizing Model, you need a net wealth of $109,000 (R2.08 million) to join the top 1% of richest South Africans.

As of October 25, 2023, the price of Bitcoin is $34 624,90 USD or R662 954,30. Therefore, you would need approximately 3.14 Bitcoin to put yourself in the top 1% of South Africans in terms of Bitcoin wealth.

It is important to note that this is just an estimate, and the actual amount of Bitcoin you need to be in the top 1% may vary depending on the overall value of Bitcoin and the wealth distribution in South Africa.

If we take a look at the data coming from the World Inequality Lab, their simulator reveals that in terms of overall wealth, one would require a net worth of about R4.2 million to be a member of South Africa’s top 1%. If we take this figure as our base case, you would need closer to 6.33 BTC to walk around as a member of the 1%.

However, that same study states the average net worth of the 1% in South Africa is closer to R22.6 million, so if you’re keen on rubbing shoulders with the top end of the wealth spectrum, you would need 34.08 BTC. These figures might sound out of reach for most South Africans, but if the price of Bitcoin continues to rise, you’ll need a lot less Bitcoin to become part of the 1%.

The average South African probably doesn’t have several Bitcoins’ worth of cash lying around, and to drum up that capital, they would either need to liquidate other assets or come into some labola or inheritance.

But that doesn’t mean there aren’t cash-rich individuals in the country; business owners, informal traders, tenderpreneurs and political cadres all have to put their money somewhere. While they can choose to hold it in Rands and face up to rising currency debasement rates, the other option is to put it into assets like Bitcoin.

Why Bitcoin wealth can pay extra dividends in South Africa

South Africa has a very high crime rate and is rated as one of the top 3 unsafe countries in the world. Having wealth that is easily recognisable, like real estate, jewellery, cars, and precious metals, only makes you a target for criminals. When you hold your money in Bitcoin, no one is the wiser; you could have 0.1 Bitcoin or 1000 Bitcoin, and all you need is a single hardware wallet to store those funds, and no one will be the wiser. If you keep your keys safe, no criminal can access your wealth.

Speaking of criminals, the ANC government is in desperate need of a cash infusion and has made its SARS mandate to target wealthy taxpayers clear since it re-established the High Wealth Individual (HWI) Segment in 2021 to focus on the tax affairs of the rich.

In September 2022, SARS warned that it was increasing its focus on trusts following its analysis of tax compliance by trusts and beneficiaries. As SARS cracks down on loopholes, your wealth could come into their view, and you will need to look at new ways of keeping them away from your government.

If you want to secure offshore wealth, consider mining it yourself, purchasing KYC-free Bitcoin, or acquiring Bitcoin through a holding company instead.

Savings give you optionality and security.

If you are interested in investing in Bitcoin, there are several things to remember. First, it is essential to research and understand the risks involved and how to store Bitcoin properly; if you’re not holding it in self-custody, all you have is a promise of Bitcoin, not real Bitcoin.

Your next step would be to source a reputable way to acquire Bitcoin; depending on the amounts you want to clear and the privacy required, you can look at mining, P2P purchases, voucher purchases, Bitcoin ATMs, local exchanges or OTC desks.

Once you have your stack of Bitcoin, you now have a set of savings that are outside the control of the South African government, which is not only a huge responsibility to safeguard but also provides you with optionality and security that South Africans are going to need as the country continues down its current path.

Having savings outside the South African Rand offers you the following:

- Freedom to make choices: When you have savings, you can make choices about your life without being limited by financial constraints. For example, you can afford to quit your job and start your own business or take a career break to travel or pursue your hobbies.

- Ability to take risks: Savings can also give you the ability to take risks, such as investing in a new business or starting a new career. If things don’t work out, you have a financial cushion to fall back on.

- Power to negotiate: Having savings can also give you more power to negotiate in business and in your personal life. For example, if you are buying a house or car, you may be able to get a better deal if you are able to pay cash.

- Financial cushion in case of unexpected expenses: Savings can provide a financial cushion in case of unexpected expenses, such as a job loss, medical emergency, or home repair.

- Peace of mind: Knowing that you have savings can give you peace of mind and reduce financial stress.

- Ability to achieve financial goals: Savings can help you achieve your financial goals, such as buying a house, retiring comfortably, or starting your own business.

Bitcoin has had more than a decade’s worth of performance data, and in that time, it’s made early adopters fabulously wealthy. If the trend continues, many more will reap the benefits of increased wealth, but only time will tell, and it will definately not happen in a straight line; there will be several ups and downs along the way.

Remember that Bitcoin is a volatile asset, and its price can fluctuate wildly. Therefore, you shouldn’t jump in hastily; you must know what you’re buying and signing up for. Having a long-term investment horizon and being patient is essential.

Having money is not about being flashy and part of the 1%. Money is a tool that can be used to achieve various goals, such as financial security, independence, and the ability to help others.

Some people choose to use their money to live a lavish lifestyle, but this is not the only way to enjoy the benefits of having money; you can build a business, a family, a community or a legacy and leave something behind that will last long after you’re gone.