The world is filled with half-truths and whole lies, and in the case of money, it’s probably one of the biggest delusions we have in the world today. Fiat money has used basic math to obfuscate fundamental truths and control the masses in ways they hardly notice. Wealth is almost always measured in nominal terms; the more money you have, the richer you are; it was a simple formula that everyone accepted and accepted to this day.

Everyone wants a higher salary over time; everyone wants their house to be worth more; everyone wants their investments to grow faster; it’s simple. However, what isn’t simple as getting a higher salary, is beating the market to get great returns or finding a place that is affordable now but will be in demand later.

What’s easier is taking the measurement value you use to calculate your wealth to debase it so that theirs more of the method of accounting, and because everyone still believes in the power of nominal value, they feel they are getting rich even when they are not.

Stonk prices bull market or bullshit market?

The stock market in the US, the biggest in the world, has been on a rampage in the most significant bull run with the regular breaking of all-time highs regardless of the underlying performance of the company and the economy. Many look to the stock market as the sign of economic stability when, in fact, it has long been divorced from it.

The stock market is manipulated in a range of ways, from stock buybacks to leveraged buyouts; there’s always some sort of game to be played. However, one of the primary reasons why the stock market is so high is because the measurement value of the US Dollar is getting weaker.

People tend to pile cash into the stock markets during times of crazy currency debasement. You only have to look as far as the stock market in Venezuela and Zimbabwe to see what currency debasement does to a stock market.

Adjusting the measurement tool

So if the stock market is at an all-time high, how can I prove that the high is not what it seems. Well, one way is to measure the S&P, for example, in gold ounce terms, which does not look pretty.

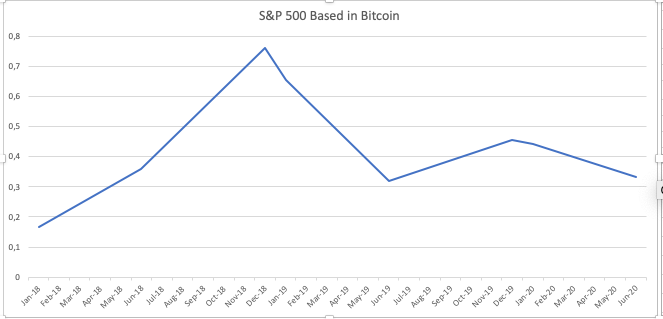

As you can see, since Setempeter 2018, the stock market priced in gold has been on a steady downward trend. WHile gold is an excellent way of seeing things differently, it too is manipulated to keep prices artificially low, which is why another way to look at it is through the eyes of Bitcoin.

Source: – macrotrends.net

If we take a look at the S&P500 when measured in Bitcoin, it’s pretty bleak viewing. I’m going to take a few dates and give you the overall value on the 1st of those months to illustrate.

| Date | S&P 500 | Bitcoin |

|---|---|---|

| Jan 2018 | 2819 | 17 040 |

| June 2018 | 2734 | 7 639 |

| December 2018 | 2633 | 3466 |

| Jan 2019 | 2531 | 3872 |

| June 2019 | 2873 | 8978 |

| December 2019 | 3145 | 6901 |

| Jan 2020 | 3265 | 7374 |

| June 2020 | 3193 | 9636 |

I couldn’t find a chart online, and I was too lazy to create a full one, so I pulled some stats randomly to illustrate the chart below, but as you can see, it’s very much in a downward trend over the last two years even when BTC has been surprisingly dull.

Bitcoin and gold seem to tell a different story to what the dollar is saying about the stock market, so who could be right? You decide and place your bets, but my money is on Bitcoin, and gold is right.