South Africa is becoming a hotspot for Bitcoin adoption; with a high internet penetration rate and a population looking for alternatives in an economic climate financial landscape that makes the Rand and Rand-based assets a poor place to park your wealth, Bitcoin’s unique properties attract significant interest.

South Africa has been at the forefront of cryptocurrency adoption in Africa. The country boasts the continent’s most developed financial infrastructure, making it fertile ground for digital currencies. The first Bitcoin exchange in Africa, Luno (Previously BitX), was founded in South Africa in 2013, showcasing the early interest of this new asset class.

Today, South Africa has 6 local exchanges that provide most of the country’s trade volume, while some trade through off-shore exchanges or P2P platforms.

While estimates vary, studies suggest that South Africa has one of the highest cryptocurrency ownership rates globally. Some reports indicate that over 10% of South Africans (roughly 6 million people) own Bitcoin or some form of digital asset. If these figures are to be believed, this puts South Africa among the top 20 global leaders in Bitcoin adoption.

Who is buying Bitcoin in South Africa?

I think it goes without saying that the main attraction is Number Go Up; that’s why we all pay attention to Bitcoin or hear about it in the first place: because of its wealth-creation properties.

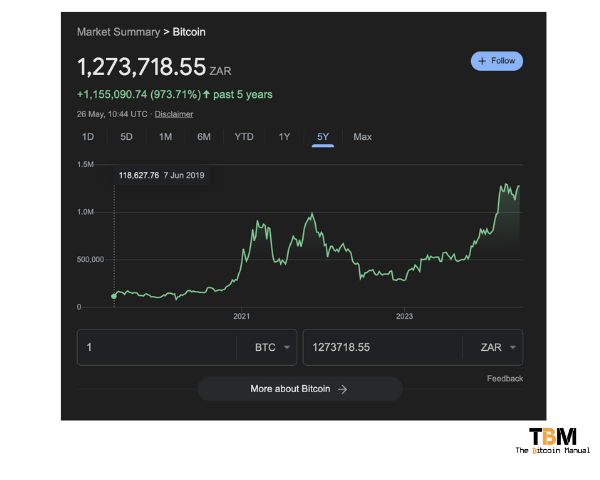

Bitcoin’s potential for high returns, particularly compared to traditional investment options in South Africa, makes it attractive. With inflation concerns and a desire to diversify portfolios, many South Africans view Bitcoin as a speculative instrument to acquire more Rands.

FOMO is a hell of a drug, and news of early Bitcoin adopters becoming millionaires has driven some South Africans to invest in Bitcoin.

Hedge against currency fluctuations and inflation

Apart from the speculators, there is also a cohort of people who simply want to have a pot of capital outside of Rands.

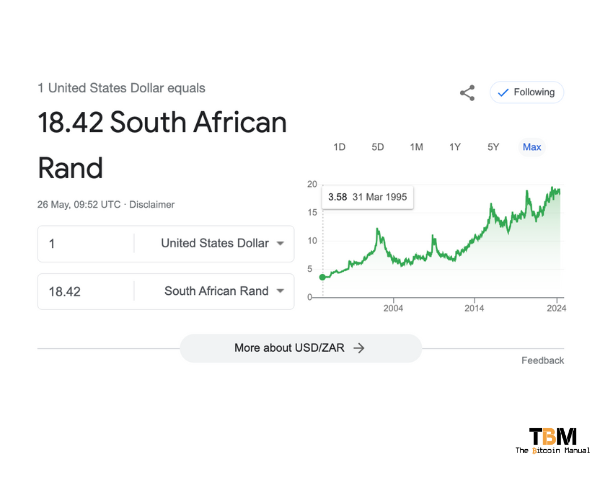

The South African Rand (ZAR) has performed abysmally compared to the dollar over the last few decades. To access US dollars, some South Africans would play the jurisdictional arbitrage game, setting up accounts in Mauritius. The demand for dollars as a hedge saw capital leave the country; however, some banks are now offering forex accounts to serve this demand and keep capital onshore.

These products only serve a minority of South Africans.

Since many South Africans don’t have access to inflation-beating assets or can acquire USD, they look to Bitcoin or Stablecoins to hedge their bets.

If you held USD over the last five years, you’d be up 30% in Rand terms; if you held BTC over the same period, you’d be up 973.71%

Capital controls

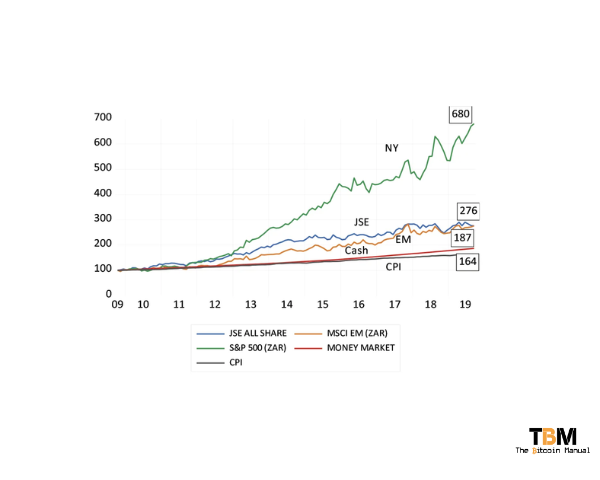

The JSE is a $1.3 trillion market, similar to the size of Bitcoin now, and it got there and stays there through capital controls. Any investor with half a brain would realise that off-shore allocations work better, but because of the R11 million cap, funds need to be diverted elsewhere, and the JSE has been the primary sink for many years now despite weaker returns.

Compared to the S&P 500, which delivered growth in index earnings per share in US dollars of 11.7% a year over the last ten years, the JSE delivered growth in index dollar earnings per share of only 1.46% a year and 5.5% in rands over the same period, barely ahead of inflation.

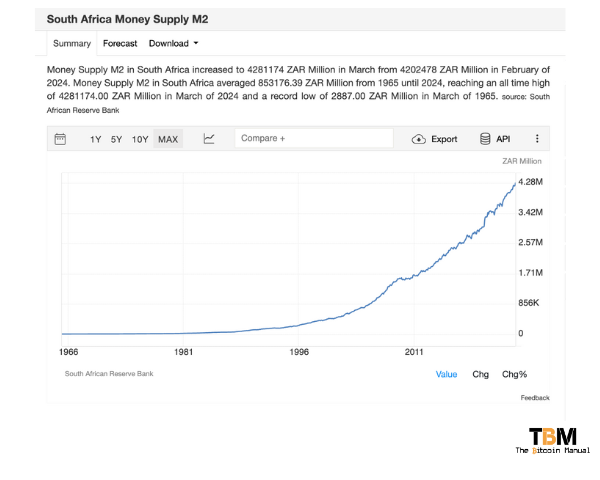

When the South African M2 money supply expansion averages around 10% over the last decade, you’re just stemming the bleeding with these returns.

Financial inclusion

While South Africa has a large banked population compared to other African countries, a significant portion remains under-banked with no exposure or access to financial assets like ETFs or direct investment in the JSE.

Previously, you would need a certain amount of capital to enter these markets, and the fees on these financial products made them unattractive. In recent years, the barrier has been lowered with the introduction of retail investment apps like EasyEquities and Clarity.

Access is one thing, but if there aren’t assets offering inflation-outpacing returns, what’s the point? Bitcoin offers a simple vehicle that only requires a piece of software on your device. The barrier to access is extremely low, and the access to potential alpha versus local markets is extremely high.

Remittances

If you’re a remote worker or a business that accepts payments from overseas, you’ll know the pain of getting your money into the country.

First, you must pay the wire service fees and declare it with the SARB.

Once it lands in your local bank forex account, you get shafted with a take-it-or-leave-it conversion rate to convert your money back into local currency.

Bitcoin transfers can offer significant cross-border savings, especially when using the Lightning Network. Bitcoin’s fast, secure, and relatively low-cost international transactions make it an appealing option for sending and receiving money abroad.

You also get to choose when, why, and if you plan to convert back into Rands, which gives you far more control.

Physical attacks

South Africans are no strangers to home invasions, hijackings, muggings and armed robbery; we are well aware that the little wealth we are allowed to keep after taxes is constantly under threat.

Individuals have limits on how they can protect their wealth. We can’t all afford an army on call, so we seek out those who can offer protection or assets with built-in security.

If you have a considerable amount of wealth, you’re not keeping it on cash or precious metals, hoping you can protect it yourself; you’re looking toward a custodian to manage it for you or putting it into a property, something immovable.

Custodians are not without their risk; ask those who banked with VBS Mutual Bank, which turned out to be insolvent in 2018, or speak to those who invested in Steinhoff in 2017.

While property in certain parts of the country have done relatively well, with that increase in value comes an increase in taxes.

Bitcoin provides a unique method of storing as much wealth as you would like. You could hold R100 or R100 000 000 in the same wallet, and it would make no difference in how you manage it. All you need is 24 words, and you can take those funds anywhere. The attack surface doesn’t increase with the amount of wealth you hold, nor does the cost to store it.

Navigating the Digital Frontier: Challenges and considerations

Moving into Bitcoin isn’t without its pitfalls; when you leave the perceived safety of the fiat system and take personal responsibility for your funds, you accept that you are the single point of failure.

If you do something stupid, you will pay the price for it.

There are no do-overs, chargebacks, or call centre helplines, and no one will be there to save you.

Scams and ponzis

Bitcoin education is almost nonexistent in South Africa; despite the reported number of owners, only a few people know what they own and how it works.

This makes the space susceptible to scams, and when you can scam someone for easy money, you can be sure South Africans will be at the bleeding edge of it; it’s a national pastime.

Large Ponzi schemes like Mirror Trading International (MTI) and AfriCrypt made headlines, attracting millions in investment based on the claims that they use Bitcoin to provide returns. While these scams capture all the headlines, there is no shortage of smaller multiplication scams making the rounds on WhatsApp every day.

South Africans must be aware of these risks and employ appropriate security measures when dealing with Bitcoin. If you’re not holding your funds in a wallet where you are the only one who holds the keys, you’ll get scammed sooner or later, simply as!

Friction in spending your Bitcoin

While growing, the number of merchants accepting Bitcoin in South Africa remains relatively low; apart from shopping at merchants supporting CryptoConvert like Pick ‘n Pay and Bulters Pizza, you can swap Bitcoin for gift cards from Bitrefill and then use that gift card at a local retailer.

The only other alternative is to find someone who will accept Bitcoin for cash or make direct deals with your local merchants to accept Bitcoin.

And who was time for that?

Until the shop owner comes around, its use as a day-to-day transactional currency is limited.

South Africans testing out bCommerce

South Africa has several Bitcoin circular economies, like Bitcoin Ekasi and Bitcoin Witsand, driving grassroots adoption and use of Bitcoin. Some of their content goes viral on social media, giving outsiders the idea that the average South African is on a Bitcoin standard.

While these transactions are still exceptions rather than the norm, their increasing frequency is raising eyebrows. Governments are now expressing a growing concern over the implications of this trend.

More South Africans and foreign business owners are turning to Bitcoin as a practical solution to bypass South African taxes and exchange controls. As I mentioned before, remittance is a pain-it’s slow and costly. Bitcoin offers a way out, a necessity that is becoming increasingly relevant in today’s economic landscape.

Digital service providers and knowledge workers make up one part of this remittance market, while some physical trade is starting to pick up. As these companies trade in Bitcoin, they can avoid paying excessive import taxes on certain products, bring in much cheaper goods, and pass on that margin to customers.

Bitcoin and cash are king

South Africa has a large cash-run informal economy, making up 20% of total employment in the country, with estimates that it contributes about 5.1% to the national GDP.

These businesses, along with peer-to-peer trade through services like Facebook Marketplace and Gumtree, facilitate economic transactions in which businesses don’t bother registering, charging VAT, or paying company or income taxes.

Cash makes up the majority of this trade, but some of this economic activity has no choice but to move towards Bitcoin or stablecoins as a means of settlement. After a certain amount, cash can be unwieldy to transport and custody, while cash also carries the risk of physical attacks and the painful reality of depreciating purchasing power.

Similar to cash, SARS has no insight into the flow of Bitcoins unless it enters or exits a system that it can access, namely exchanges and banks. Since citizens can now perform larger economic transactions through the Bitcoin network, it’s beginning to eat into revenue that would have gone through traditional payment methods and be subject to tax.

Bitcoin is now a headache for the South African Revenue Service (SARS). When used in a self-custodial manner and employing privacy practices, Bitcoin users can make it difficult to track transactions and nearly impossible for authorities to confiscate these funds.

SARS want your SATS

SARS is ramping up its tax collection on cryptocurrencies in 2021 by tightening collection on crypto transactions. Disposing of any digital assets as a financial instrument is a taxable event, and SARS requests information from South African crypto exchanges to keep track of transactions.

Last year, South Africa adopted a Common Reporting Standard to help crack down on individuals who use crypto assets to dodge tax and launder money. The CARF was signed in March 2023, and 48 countries adopted this travel rule standard.

If you’re buying and selling Bitcoin using local exchanges or participating in off-shore exchanges, you can be assured your transaction data will be passed on to SARS. While the onus is on taxpayers to declare all cryptocurrency-related taxable income in the tax year it is received or accrued, don’t think you’ll get away with not declaring like you did in the past.

P2P Bitcoin and law-abiding Bitcoiners

SARS will get funds from paper Bitcoin holders who buy and sell on centralised exchanges; as for the rest who might be under the radar, scare tactics will be used to get them to fall in line. People and businesses who want to avoid or evade taxes can still use a combination of cash and Bitcoins to fly under the radar, and while this is illegal, it’s tough to stop.

If you purchase Bitcoin directly from a miner, mine it yourself, or buy it on a P2P exchange, it is transferred to a self-custody wallet. It does not touch a South African crypto exchange or a friendly off-shore exchange, meaning SARS does not know it exists.

For law-abiding citizens who purchase KYC or non-KYC Bitcoin and hold Bitcoin, self-custody doesn’t create taxable events, so if you’re a long-term holder stashing your sats for the long haul, you have nothing to worry about.

The ANC is the best promoter of BTC

The ANC’s controlled demolition of the currency has been quite the advertisement for Bitcoin. Citizens see the gross misallocation of capital thrown in their faces daily, resulting in a few getting rich from corruption and fraud while the rest enjoy a lack of essential services, failing infrastructure and loss in purchasing power.

Some still believe that a change of government is the answer and good luck to those people. Keep your money in Rands, enjoy the ROI from your decision, and see if it works out for you.

I don’t think any other political party would do anything different.

During the campaign rally, have you heard a single politician speak about the growing debt and the R285 billion in interest the country adds to it annually?

Because no one in government, regardless of their beliefs, gives a damn about fiscal responsibility, their only goal is secure an income for themselves by extracting it from you.

Before Bitcoin, the hope was a change of government. However, Bitcoin’s arrival in South Africa has sparked a significant conversation about the future of finance and governance. It allows individuals to opt out of a failing system and maintain the fruits of their labour, which is far more important and impactful than who you get to vote for every four years.

While challenges remain, the country’s unique socio-economic landscape offers exciting opportunities for Bitcoin adoption, as we would like to see it, a peer-to-peer medium of exchange.

As South Africans continue to rush for the exit door or get pushed towards this new technology, Bitcoin’s impact on the nation’s financial future will make for a fascinating case study. As more value leaves the Rand, governments will want to control the exits the same way they did with traditional finance, but it won’t be as easy with Bitcoin.

Since individuals can manage Bitcoin and interact with the network directly, it will be more complex than passing regulations and getting a few financial institutions to toe the line.

Whether we like it or not, Bitcoin has ignited a conversation about financial inclusion, innovation, and the future of money in South Africa.