The Bitcoin mining landscape has become one of fierce competition and razor-thin margins as large private and publicly listed companies and even countries enter the space. The race to secure the next block and win some newly minted Bitcoin along with the fees for that block requires more and more hash rate as more participants join the market.

To generate more hash rate, you must either improve your current set of ASICs or acquire new ASICS to add to your arsenal. Either way, you’ll have to shell out a sizable amount of fiat and hope you make it back in the future.

Every miner has different expenses.

If you’re a large-scale miner, these include energy costs, debt, rent, taxes, overheads, salaries, and maintenance, and you’re constantly watching the price of Bitcoin, trying to sell as little as possible and prolong your hold period as you cover your burn rate, which can be tricky.

If you’re an ordinary garage miner, you’ll mainly be concerned with the energy costs, trying to offset that and how much you paid for the ASIC while hoping to make a little extra Bitcoin as a profit.

Mining is not some magic money-printing endeavour; many miners from small or large scales have miscalculated and seen themselves run unprofitably or call it quits. With Bitcoin’s block rewards steadily decreasing, miners must make projections on whether they can remain profitable.

A new digital gold rush

It was a projection exercise that was complicated enough, even with Bitcoin’s known issuance and incentive structure. Enter the Ordinials craze, a phenomenon that has unexpectedly become a new source of revenue for mining pools and their various miners or, should I say, hashers.

Ordinals market themselves as arbitrary data that, once embedded into the Bitcoin blockchain, magically take on the attributes of digital artefacts with a loose tie to individual satoshis (the smallest unit of Bitcoin) via a third-party protocol.

The Ordinals craze has resulted in a surge of activity on the network, leading to increased hash rate and transaction fees. In the short term, this translates to higher block rewards and transaction fee income for mining pools and their miners.

Ordinals and inscriptions have birthed a new secondary market for speculative assets traded using the Bitcoin blockchain. The creation and trade of various unregulated securities like NFTs and tokens make up the majority of this new activity, driving up transaction fees, which miners love.

But another collectors market has also emerged for “rare satoshis” based on some arbitrary metrics. Collectors of these rare satoshis are willing to pay a premium to own them, and as a result, mining pools are responding.

When a mining pool secures a block and finds a rare satoshi, they’re not passing on the funds as normal to miners. Instead, they’re claiming that UTXO and putting it up for auction, hoping to generate an alternative income source. Miners participating in this mining pool hope that funds generated from auctions will provide additional revenue.

Why are miners sticking with Ordinals despite the controversy?

The emergence of Ordinals has sparked debate within the Bitcoin community, with some concerned about the potential impact on Bitcoin’s core functionality and decentralisation. However, miners have primarily remained supportive of ordinal projects for several reasons:

Increased income from fees

As mentioned earlier, Ordinals and inscriptions have directly contributed to increased revenue for mining pools and miners. This financial incentive plays a significant role in miner support. If you’re making more money per block you secure, will you complain?

No, you’re running a business, and your incentive is to generate as much income as possible.

MEV opportunities

Now, it’s one thing to sit back and secure blocks with additional fees, but it’s another ball game to participate in markets actively. Having all these new “assets” traded on-chain can present some opportunities for miners to make even more money in the way they order transactions.

Miners could passively benefit from MEV as traders try to front-run certain on-chain trades and overbid for the chance to secure those trades. They could also accept out-of-band payments (sometimes through transaction accelerators) to structure a block in a certain manner, or they could actively be structuring blocks in a certain way to benefit their own in-house trading team.

Out-of-band transactions

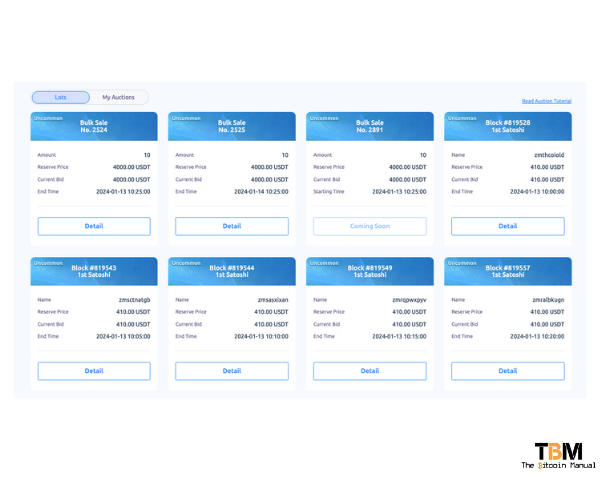

Rare sats can be traded for Bitcoin on various marketplaces, but with F2Pools auctions, payments in the auction are out-of-band. The auctions sell a particular type of rare satohsi in bulk, and the only payment accepted is the stablecoin Tether (USDT), which can be deposited via Ethereum, Tron, BNB Chain, Arbitrum and Polygon.

I’m surprised they didn’t offer support for Liquid since it is a Bitcoin side chain with support for USDT.

In some cases, out-of-band transactions can be attractive to miners as they receive the money upfront versus when done on-chain with the output of the coinbase transaction rendered unspendable for 100 blocks.

Why is ordinal income a double-edged sword?

Miners have not been passive recipients of these fees; some miners and pools are actively supporting development in the Ordinals space, hoping to prolong this on-chain speculation and fee-insensitive transaction frenzy. Now, these pools are moving to markets that are not their core competencies, which can bring on additional operational risk and even regulatory risk as pools take on more custodial responsibilities.

It also encourages miners to invest in projects like marketplaces, wallet development, and other ordinary software infrastructure rather than investing in their core business or investing in their mining operations and efficiencies.

Ordinal income versus ordinary income

Bear markets are usually pretty brutal for miners, but with ordinals, they managed to find a stop-gap instead of the usual slog towards the bull market.

Additional income for miners is great for the network, but when that income comes from speculation in secondary markets, these incentives could have downstream effects.

If miners are used to a certain level of income, they might not factor in how markets can change if, for example, the ordinal trend fades, regulation on inscriptions becomes more restrictive, or a new protocol displaces Inscription demand. Should a change occur, miners might have over-invested in expanding their operations and now do not have the runway to support themselves going forward.

The Ordinal income might throw off their projections or encourage miners to take on more risk than they should, thinking what happens today will automatically extend into the future.

Mining pool competition heats up

The once-familiar landscape of mining pools is drastically being reshaped.

Gone are the days of simple pay-per-hash models, replaced by a diverse smorgasbord of incentives and approaches. The Ordinals boom has become a prime example, splitting the pool scene along the lines of risk and reward.

Some pools, like F2Pool, have embraced the Ordinals wave, diving headfirst into auctions and facilitating inscription services. The potential gains here are undeniable, with rare satoshis fetching eye-watering sums. However, this path isn’t without its thorns. Concerns around network overload, decentralisation risks, custodial capture, regulatory risk and long-term sustainability loom large.

On the other hand, some pools like OCEAN have decided to take a firm stance against the Ordinals. They prioritise the core functionality and stability of the Bitcoin network, wary of the potential complications this new technology brings. Their approach offers miners stability and predictability, albeit with potentially lower but consistent returns.

This diversification leaves miners in the driver’s seat. They can now carefully weigh risk and reward, choosing pools that align with their individual risk tolerance and financial goals. Those comfortable with venturing into the uncharted territory of Ordinals can chase the potential for high returns, while others can opt for the comfort and security of pools dedicated to traditional mining.

It’s still too early to predict the ultimate winners and losers in this evolving game. What’s clear is that the mining pool landscape is no longer a uniform plain. It’s become a diverse ecosystem, catering to a variety of miners with varying appetites for risk and reward. This shift not only offers miners greater choice but also injects a much-needed dose of innovation and adaptability into the Bitcoin mining industry.

So, buckle up, miners. The journey through this evolving minefield has just begun, and the choices you make will determine your fortune. Remember, with great risk comes great potential reward, but choosing the right path requires clear eyes and a calculated stride.