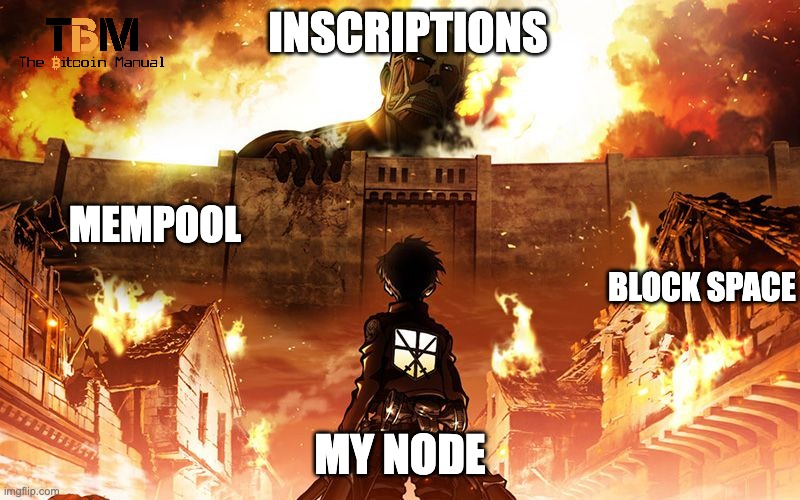

Inscriptions and the Bitcoin spot ETF approval have been hot topics in recent months, with both deployments splitting investor opinions and inciting fierce debate online. While the ETF could bring an entirely new threat model further down the line, the battle for block space today is the most pertinent.

On the one hand, Bitcoin is a free market, and those who pay their fees get to use the network’s resources when and as they please. Ordinal users have demonstrated a boost in trading activity, reflecting a genuine demand from users for personalised Inscriptions on the blockchain in the form of collectables, NFTs, Token issuance and trading.

This is true, but for every speculator bidding up fees and eating up block space, it serves to exclude a host of traditional transactions and Lightning Network channel management from the next block or make it very expensive to secure a next block.

It leaves the average ordinal disrespecter with the tough decision to move off-chain, be patient with their block confirmations or fight it out, coughing up higher fees. As someone who doesn’t see the benefit of Ordinary transactions, you might feel that you and your use cases are being marginalised.

From the view of those who want to use Bitcoin and don’t like ordinals or don’t know they even exist, they see a crowded highway choked with semi-trucks carrying mountains of data in the form of token-minting metadata and image files. That’s what’s happening to the blockchain, thanks to these “inscription” style transactions.

What are Inscription-style transactions?

Unlike traditional transactions that move UTXOs from one address to another, Inscription transactions store additional data directly on the blockchain.

This data is embedded on the blockchain and assigned a serial number attacked to a certain amount of satoshis in a UTXO. This “data payload” can be anything from text messages to images to complex smart contracts. While seemingly versatile, this added baggage comes at a steep price.

These transactions gobble up block space and are a highly inefficient use of resources for their intended use case.

Spam, scams and node RAM

Inscriptions have blown up in the last few months, with these transactions eating up the majority of block space in each block and BRC-20 tokens and NFT collections generating billions in trading volume.

Inscriptions might seem harmless to those trading tokens and creating easy-to-reproduce NFTs, all with the aim of making a quick buck off the trend currently sucking in greater fools, but it has some downstream effects.

Bloated block size

Every inscription transaction carries its data payload, significantly increasing the block size. This slows down transaction processing, creates long queues, and hikes up fees. It also reduces the time we have for nodes to run with smaller hard drives and forces nodes to upgrade sooner, which can reduce the decentralisation of a network.

Storage demands

Blockchains are not meant for storing used sums of arbitrary data. To get the most out of a distributed ledger, your data sets need to be lean and efficient, but inscription transactions gobble up storage space. Storing everything from cat videos to legal contracts on the blockchain is unsustainable in the long run.

Security risks

Inscribing complex data opens up new attack vectors for hackers. Malicious actors can exploit users by embedding vulnerabilities in the data payloads to compromise the wallet and other indexers reading this third-party data.

Centralisation creep

Large entities with the resources to store and process large amounts of data gain an advantage, as we’ve seen with the building out of ordinary-related infrastructure like indexers and explorers. As Ordinals and Inscriptions try to make their experience more user-friendly, they naturally trend towards centralisation, undermining the very principles of decentralisation and any value they could point to coming from the use of the underlying blockchain.

A burden on all blockchains is the “current thing.”

Since the launch of Inscriptions, we’ve seen plenty of activity on the Bitcoin blockchain, from the minting of new tokens to the teleburning of assets from other chains to Bitcoin, which isn’t a good look for altcoin chains nor their relative liquidity.

In a bit to attract speculators back to alternative blockchains, ETH-scriptions or EVM Inscriptions were born, allowing users to ignore the standard smart contract deployment of tokens and NFTs and instead spam various EVM chains because people want to replicate the success of BRC-20 tokens on these chains.

Many of these transactions involve repetitive tiny mints from the same user or bot accounts. Despite altcoin chains optimised for improved throughput, they’ve seen the same connection issues as Bitcoin. Considering altcoin chains are cheaper to use than proof of work Bitcoin, the cost-effectiveness of Inscriptions on EVM chains has led to rampant spamming.

Several blockchains have already succumbed to the burden of inscription transactions.

Inscriptions have taken down multiple chains and caused huge gas spikes over the last couple of days.

— cygaar (@0xCygaar) December 18, 2023

However, very few people actually understand what's going on.

Here's a simple explanation of inscriptions – how they work and why they're being spammed everywhere 🧵: pic.twitter.com/IjQ6wuypRX

Ton under heavy pressure

Altcoin chain Toncoin released its Inscription service called Tonano, and after a week, a spike in trading activity caused the TON blockchain to a near stop. The scale of demand for TON inscriptions produced a 61x spike in trading activity in just 30 minutes, which strained TON validators and resulted in a network-wide bottleneck where transactions per second dropped to just 1 TPS.

Abitrum can’t handle Arbitrary data

On Dec. 15, Ethereum layer-2 Abitrum went offline for over 70 minutes from Inscription spam.

I went from $500 in $AVAX wallet to $50 because of a couple failed transactions.

— Cited (@cited) December 16, 2023

And I never even got my transaction through. pic.twitter.com/c00XxxyDZF

The rest had no success either

Avalanche, Cronos, zkSync and The Open Network have all experienced partial or full outages recently due to inscriptions, with modular data availability network Celestia also baulked under the pressure of Inscription demand.

Attack of the 50-foot monkey JPEG

While Inscriptions show how well Bitcoin handles the pressure of a spam attack versus that of the so-called “advanced” altcoin chains, it doesn’t make the spam transactions any less tolerable for the ecosystem. While Bitcoin’s resilience to the current inscription spam attack might suggest it’s not harmful in the present moment, that doesn’t negate the potential negatives associated with inscriptions and similar approaches.

Bitcoin, at its core, is a simple peer-to-peer payment system. Inscriptions and their focus on data storage clash with this philosophy, raising concerns about the network’s core purpose and potential misuse. Encouraging data storage on the blockchain incentivizes users to prioritize data-heavy transactions over simple transfers, potentially harming the network’s efficiency and original intent and skewing incentives.

While Bitcoin might survive this specific wave of Inscription spam, it’s crucial to acknowledge the potential drawbacks and engage in thoughtful debate about the future of data storage on the network.

The future of inscription-style transactions remains uncertain, despite the billions flowing into it right now; as is the case with all things crypto and shitcoin related, the madness can perpetuate further than any rational person can imagine.

The shills will paint it with every narrative under the sun, from digital artefacts to uncensorable metadata of these transactions, to see what sticks and attracts dumb money. Still, the truth remains that inscriptions offer no real intriguing possibilities for data storage and smart contracts, and their drawbacks are undeniable.

The majority of inscriptions are meant for speculation in a new market for unregulated securities with the aim of fueling another shitcoin bubble backed by interest in Bitcoin.

Finding a balance between the resource allocation towards Ponzis and real Bitcoin transactions is going to be the focus for the next few months or even years; while it might be annoying, the shitcoiners will eventually run out of fools to buy their scams, and those that made out with a profit will move on to the next narrative grift.