Operating a Lightning Network node is not only about accessing a layer two network so that you can perform cheap and instant bitcoin payments but also about being a constructive member of the network. As a liquidity provider to the network, it is your duty to ensure that it’s running as smoothly as possible. Lightning requires active management and rewards those who keep bitcoin flowing through channels that route the most payments.

The more payments you route, the more fees you earn and any channels that aren’t producing a return unless created for a specific reason are often cut. Finding reliable peers on the Lightning network is the key to a successful routing node, and you will need to audit your channels from time to time.

As you connect with different peers around the world, routing payments, the chances are high that, eventually, you will have zombie channels attached to your node.

What are zombie channels?

Zombie channels are lightning channels that are most likely dead but are still around. This can happen if one of the channel peers has gone offline for an extended period of time or for good (possibly due to a hardware or software failure) and didn’t close its channels. Channels cannot technically be dead; only nodes can. Hence the adoption of the name zombie channel is a channel that is technically still functional, but the lights are off back home at the node level.

Zombie channels are not only a pain for the partner, but if it’s a public channel, it becomes a burden on the network. As long as the zombie channel stays open, all network peers must maintain information about that channel.

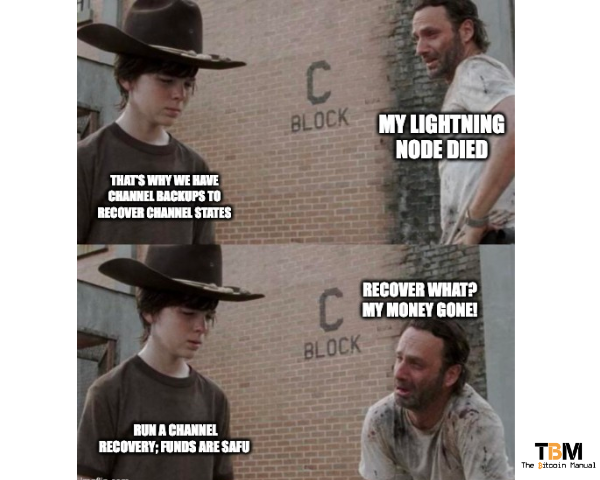

If the zombification of a channel is only temporary due to a node going down, watchtowers protect the funds in your zombie channels. Even if the node operator didn’t bother running the recovery process for weeks, the watchtowers would keep the funds in the zombie channels safe.

Once the node owner gets around to running the recovery process, channel states will return, and the channel will be deemed active again.

The risks of zombie channels

When a Lightning node goes down, the other side of the channel is still online, but the node doesn’t necessarily know if its partner will ever come back online. If your partner is offline, you’re not able to route balances between that channel, and you’re effectively “wasting” away liquidity that could be partnered with an active node instead. The economic incentive should be strong enough to cut ties with zombie channels and put your liquidity to work somewhere else.

Additionally, funds that are locked in such channels are at risk since funds in a zombie channel require the other party to recover the node after a failure, and static channel backups (SCB) won’t be able to recover those funds. Since SCB restore relies on both nodes cooperating and agreeing to recover balances to that previous status.

If your own node crashes, and now both parties are zombified, you lose all the money you kept in zombie channels!

That’s why it’s important to close channels with peers that have been offline for a length of time as a precautionary measure. Short of you having direct communication lines with your channel partner and knowing that they will be online shortly, you can rather cut your losses and close the channel and deploy your channel with an active partner instead.

A temporary zombified channel state

As with many things like bitcoin, there are always edge cases to be considered. If you’re a routing node runner, your incentive is to curate your channels to ensure you’re earning the optimum fees as compensation for putting up capital and the active management you’re doing. While cutting ties with zombie channels is the more conservative option, it might not always suit the situation.

Depending on the size of the channel and on-chain fees at the time, you might want to keep that channel state going if you think that there is a chance the partner node will come back online or wait until on-chain fees are lower to close.

In addition, mobile users tend to swap between active and zombie states quite often, as mobile devices tend to be offline either due to issues with internet connections or the battery being dead. If you’re constantly cutting channels with your mobile partners, it can be costly, and you could lose those users for good. Additionally, you could miss out on fees as lightning wallets might hold a range of asynchronous payments that will be settled once the user is back online.

If you deal with mobile users, you might want to label specific channels as such and treat them differently. Most mobile wallets only open private channels as they do not intend to route payments through them. A routing node operator should therefore consider if a channel is public or private when considering closing it when in a zombie state.

How do I identify zombie channels?

The problem with zombie channels is that there is no clear indicator if your partner is crawling around in the bushes after a drunken evening of pub crawling or they’re actively looking to satisfy their craving for brains.

As the responsible channel manager you are, you will have to diagnose the condition yourself and assume whether a remote node is shut down forever or only temporarily. You can look at specific indicators like:

- Status of the node: Is it active or inactive?

- Last channel update

- If its a private or public channel

- Channel age

- Channel initiator

- If the node is tagged as disabled

If you’re running LND, you can also use tools like Faraday to help you identify telltale signs of a channel that could possibly be lifeless.

Zombie channel recovery matcher

If the worst case happens and parties go zombie, you can try using a zombie channel recovery matcher to try and resolve the issue and release funds. This is a third-party service where node operators submit their contact information to a database. If two Lightning nodes require a means of communicating with one another, they can register with the service.

With the help of the recovery device and chantools it is possible to close a channel even if both nodes only have the seed available. Lightning node operators must cooperate and communicate through the service to agree on the process.

New side project: node recovery guide and "Zombie Channel Recovery Matcher": https://t.co/f3VZ0DSAS1

— Oliver Gugger (@guggero) May 1, 2021

Couldn't recover all your channels because of Zombies? Submit your node ID for a second chance. If the remote peer also registers, I'll facilitate the recovery.

RT for reach plz!

What is a zombie attack?

Another possible security concern for Lightning network users is that a sizeable non-economic actor with more means could build up a seriously large routing node presence on the network only to use its broad reach for malicious actions. Once the node feels it’s large enough, it could attack node operators by holding the channels in zombie states.

Thereby pausing a large portion of the network and locking up funds could cause widespread failure to route payments as many channels are now locked up. This is why more individuals should run nodes and expand the topology of the Lightning network; the more routes for payments and the more peer-to-peer connections, the more robust the network becomes over time.

In addition, tools like a well-configured watchtower and active channel management ensure a proper appropriation of the user’s fund fully restored back in other to avoid loss of assets due to attack whenever there’s a compromise.

Do your own research.

If you want to learn more about zombie channels on bitcoin, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research other sources, and you can start by checking out the resources below.

Are you a bitcoin and lightning fan?

Have you been using Lightning to make micro-payments? Stream sats or engage with apps? Which app is your favourite? Do you run a Lightning node? How do you handle channel rebalancing? Have you tried all the forms of Lightning payments? Which one do you prefer?

Let us know in the comments down below.