South Africa is no stranger to bitcoin-related scams, many of which go unreported as they target lower-income households who don’t tend to report these scams because of fear or shame. It is when these scams hit the middle class and reach obscene amounts of money that these Ponzi programs get media attention. In recent years we’ve seen South Africa become the breeding ground for two major exit scams, namely MTI (Mirror Trading International) and Africrypt.

I hate to sound like captain hindsight or the boy who cried wolf, but as a local bitcoiner, I am exposed to these conversations. I was approached by friends who asked me about MTI, for example. I even knew people were shilling it on social media. In both those cases, I begged and pleaded with them to stay away. These were apparent scams offering up crazy APR’s between 100 and picking whatever crazy percentage APR per year, which is entirely unsustainable.

Both those programs did not end well, and you can read about them on any media site; that’s not what I am here to warn you about today. I am here to warn South African’s about the latest scam making the rounds.

Informed investors are robust investors

If we can nip these programs earlier and exhaust their pool of potential clients, we can see them implode much earlier with less damage. We will never be able to eradicate these scams as there are always naive investors desperate to make money that will fall victim to these programs, but we can limit their spread.

When you recognise the telltale signs, they are easy to spot and avoid as the pitch is often a derivative of the same program. Lucky for me, I’ve been approached twice, while a friend of mine has also been approached by these con artists.

I will take you through the pitch, and feel free to share it with someone who has been approached, or if you are the mark for a pitch, you can share this article with the salesperson.

The mindset of investors they target

These scams have not made headlines yet as they operate on dark social, primarily through WhatsApp and other chat apps. They target low-income people and offer them a simple pitch, leveraging bitcoin and trusted local companies to provide legitimacy.

These scams are actively looking to target people suffering from poor monetary and fiscal policies punishing wage earners. Since South Africa has such a large population of unemployed, underemployed and poor, it makes it a breeding ground for scams. There is no shortage of financially illiterate cohort that would not have the ability to question the legitimacy of these investments.

These scams use a network of affiliates who work on commission; these affiliates provide a buffer between the inner circle and the investor.

These affiliates secure phone numbers from databases or social media and approach vulnerable targets with their pitch of easy returns with guaranteed profit. If you ever hear the world guaranteed used when investing, that should be a red flag for you to run the other way.

The scam pitch

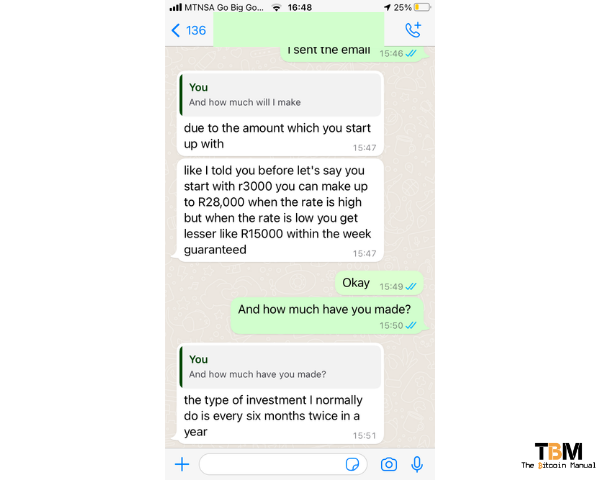

These scammers will generally approach you on WhatsApp and start to chat you up, talking about an investment opportunity. It will either be with a company they “work” for, or they have been investing with the “platform” for some time, and they’ve seen great results.

The usual pitch would be you supply an R3000 investment, and in the space of a week, you could earn anything between R15 000 and R50 000, depending on how the “market”, “trading bot”, or “algorithm” works out for that week.

If R3000 is too much, fear not; it is not a hard limit to entry into their scam; if you cannot afford the R3000 amount, they are still willing to take on smaller amounts. These salesmen use simple figures and lull you into a sense that this could be within the realm of possibility with some special proprietary software.

To the average person, these numbers should sound too good to be accurate; five to fifteen times your money in the space of a week is an astronomical return. They use simple amounts anyone can understand, but when you put it into percentage terms, you get the gist of the scam.

If you could replicate these returns, why would you be looking for other peoples money? You could turn your tiny lump-sum into billions in a short time frame. Warren Buffet, Elon Musk, Jeff Bezos would all be crying, begging for a taste of your success as you blow past their wealth in a matter of years.

Once you agree, they’ll ask you to download and install the Luno app or use another South African bitcoin exchange. This is to leverage the trust these platforms already have locally and the on-ramps they’ve built with local banking services.

You would then fund your exchange wallet and purchase the amount you want to invest in bitcoin. Once you secure the bitcoin, the affiliate will either send you an email address, a Gmail most likely, or send you a link to a dodgy website that was recently spun up.

Using the email address or the website, you would get a bitcoin to receive address, and you would need to send the funds to the address so the platform and start trading your funds. After a week, your funds will then be deposited back into your exchange account with the returns, or so they claim.

The result

The result of the operation is to get more people to provide lump-sum deposits into the scheme. As the lump sums come in, they allow the scheme to payout the earlier investors. As early investors receive their payout, they tend to reinvest and put their new capital back at risk. The reinvested funds also help keep the scheme going as investors are happy with paper gains from the platforms IOU’s rather than receiving an amount.

Combining new deposits and reinvesting helps keep the process going; it pays for the affiliates commissions and the inner circle to siphon off bitcoin into their wallets. Since they receive bitcoin and their obligation to pay you back is in Rands, it’s pretty easy in the beginning to keep a cash balance to service clients while holding on to the bitcoin and liquidating it at price spikes to secure funds when needed.

The schemes will not liquidate all their bitcoin because of the risk of having their bank accounts blacklisted. So most funds remain in bitcoin, making these programs highly illiquid since their liabilities are in a fiat currency.

The fallout

The eventual scam tends to unfold once they run out of new marks to provide capital, and when the supply of new money runs out, they tend to unravel pretty quickly. It may start with delayed repayment for early investors or more extended lock-up periods to buy additional time and keep investors stringing along. Eventually, payouts will dry up, and they’ll plan their escape, the website would be shut down, the phone numbers and email addresses no longer respond, and their affiliate network will also be left high and dry.

Often taking the blame and the brunt of anger from investors as affiliates or sales associates are the soft target while the inner circle make away with the majority of the funds. Sure the affiliates have been paid with funds from a scam; some are naive while others turn a blind eye to the obvious shortcomings and red flags because they are incentivised to do so, working on commissions.

Why do they use bitcoin?

If they’re selling you on an investment where they speak in terms of Rands regarding deposit and returns, why are they asking you for bitcoin? I mean, why can’t I send you Rands instead? Wouldn’t that make the process a lot easier?

The issue with Rands is banks have stricter KYC than bitcoin exchanges; they have third party control over funds and can blacklist accounts that show fraudulent activity flags. It’s too much of a risk for these scam artists, so instead, they ask you to purchase bitcoin and send it to their account. When using bitcoin, the transfer is final, and they have the bearer asset. Once you send the bitcoin, the transaction cannot be reversed, and these con artists can do what they want with the funds once it’s confirmed on the chain.

Depending on how sophisticated the schemers are, they can also use bitcoin to maintain their privacy and thus clear their tracks when the scam finally collapses.

What to do if you have been a victim

If you have fallen for a scam like this, ensure that you capture as much information as possible, which means names and surnames, ID numbers or any identity documentation. Keep the name of the company you’re dealing with, and check if they are registered with CPIC in South Africa as a registered business. Collect the names of any directors and their details of the company where possible. Collect phone numbers and email addresses and the bitcoin addresses used to transfer the funds.

Try to connect with fellow victims online and combine information from multiple sources before taking it to the authorities. The more information you collect, the more it gives law enforcement to track the scammers. If scammers do make a mistake and tie a bitcoin address to their identity, these addresses can be flagged and monitored.

There is no guarantee that the funds can and will be recovered, but you are giving yourself a fighting chance of a resolution.

Bitcoin is savings

Bitcoin is a savings technology; it is already engineered to increase purchasing power over time, so you don’t need to trade it or do anything fancy. Bitcoin rewards you for being frugal and holding your bitcoin in the safest way possible. When you hold it on the chain with a wallet where only you have the keys, you are free from any third party risk, and you will still receive a price appreciation return each year, as it has done for the last thirteen in a row.

Don’t let greed get the better of you; stay safe, store your bitcoin and don’t let anyone get custody of your coins.

I hope this post is helpful and that you will share it with others who have been approached so we can shut these scammers down.