As a South African earning in Rands, you might have noticed over the past 25 years that your Rands aren’t going as far as they used to. We’ve all sat around the braai revealing stories of Oupa and Ouma buying, walking out with a trolly full of groceries using only a handful of Rands.

Those days are long gone; you can’t simply save your Rands under the mattress; you must go out and invest or get left behind. While banks are offering positive nominal rates on savings accounts, and South Africa does have a fairly mature capital market, local investment products are not providing enough of a return, which is why more South Africans are looking toward international markets.

While previously offshore investing was not accessible or affordable to the average South African investor, changes in exchange control legislation have made offshore a realistic option for local investors.

The South African Rand is Number Go Down Technology

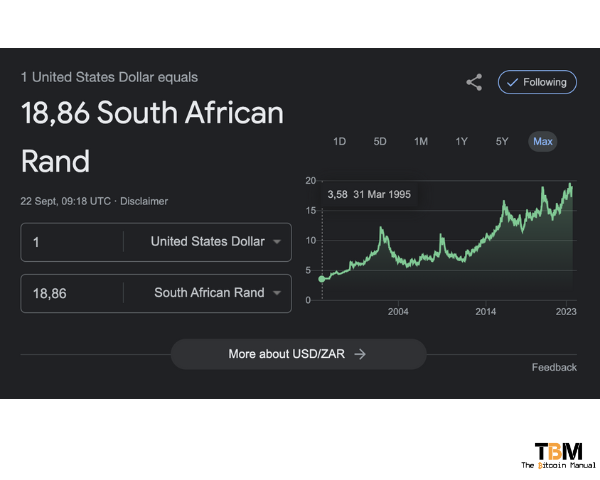

Since 1994, the Rand has seen massive devaluation, starting at around R3.58 to 1 US Dollar; it’s nearly R19 per USD today, having hit that R19 figure twice in recent history.

This decline is due to a number of reasons, namely:

- Political and economic instability: South Africa has experienced a number of periods of political and economic instability over the last 25 years, including the end of apartheid and the transition to democracy. This instability has made it difficult for the country to attract foreign investment and grow its economy.

- Trade deficit: South Africa has a trade deficit, meaning that it imports more goods and services than it exports. This trade deficit puts pressure on the Rand, as the country needs to sell more rands to buy the foreign currency that it needs to pay for its imports.

- Current account deficit: South Africa also has a current account deficit, meaning that the country spends more money on foreign goods and services than it earns from its exports. This current account deficit also puts pressure on the Rand.

- High inflation: South Africa has a high rate of inflation, which means that the prices of goods and services in the country are rising rapidly. High inflation makes the Rand less attractive to foreign investors and can lead to capital flight.

- Load shedding: South Africa has experienced regular power outages, known as load shedding, over the last few years. This load-shedding has negatively impacted the economy and made it more difficult for South African businesses to compete.

- Government corruption: South Africa is well known for State Capture, where political corruption is used to fund private interests and raid state coffers, along with driving malinvestment.

In addition to these factors, the Rand has also been affected by global economic trends, such as the rise of China and the slowdown in global economic growth.

The South African government and the South African Reserve Bank have taken several steps to address the factors causing the Rand to depreciate. However, these measures have yet to be entirely successful, and the Rand continues to be one of the weakest currencies in the world.

The poor performance of the Rand has had several negative consequences for the South African economy. It has made it more expensive for South African businesses to import goods and services, which has led to higher prices for consumers. It has also made it more difficult for South African businesses to compete in the global market.

The poor performance of the Rand has also had a negative impact on the lives of ordinary South Africans. It has made it more difficult for people to save money and has reduced their purchasing power. It has also made it more difficult for people to invest in their future.

When you’re dealing with an annual debasement rate of over 12% to the US dollar, as a holder of Rands, you need to look for ways to park your money offshore actively or try and source investments that generate higher returns.

Capital controls in South Africa

Like many emerging economies, South Africa faces the challenge of maintaining currency stability amidst global market fluctuations. Exchange controls are utilised to prevent excessive volatility in the value of the South African Rand (ZAR).

By imposing restrictions on the buying and selling of foreign currency, the government aims to stabilise the Rand and create a favourable environment for international trade and investment.

Since individuals and businesses have limitations on how much money they can move offshore each year, we see that the excess demand for moving capital out of South Africa is reflected in the local Bitcoin price.

What is Bitcoin Arbitrage?

Bitcoin arbitrage is the process of exploiting price differences between different local exchanges and international markets.

This can be done by buying Bitcoin on one exchange and selling it on another exchange for a profit, where the market is trading at a higher price. Typically, this trade involves buying Bitcoin in more liquid markets like the US and EU and then reselling it in South Africa, similar to the Kimchi Premium we see out in South Korea emerging from time to time.

South African Bitcoin arbitrage is particularly attractive because Bitcoin typically trades at a consistent premium in South Africa, ranging between 1 and 5%. This is due to a number of factors, including exchange controls and limited liquidity on local exchanges.

To participate in South African Bitcoin arbitrage, you must have accounts on both a South African exchange and an international exchange. You will also need to have a way to fund your international exchange account.

Once you have your accounts set up, you can start arbitraging by following these steps:

- Check the price of Bitcoin on both exchanges.

- Buy Bitcoin on the exchange where it is cheaper.

- Transfer your Bitcoin to the exchange where it is more expensive.

- Sell your Bitcoin on the exchange where it is more expensive.

- Repeat steps 1-4 until you are satisfied with your profits.

Alternatively, if this sounds too complicated for you or you don’t have the skill, time and appetite to go after this market, you can look to several local arbitrage partners. Since the market for bringing Bitcoin onshore has been so lucrative, several trading desks have popped up to cater to this market. These firms will take on your capital and use it to exploit this trade and pay you a return after they’ve taken their fee.

| Company | Website |

|---|---|

| Currency Hub | https://www.currencyhub.co.za/ |

| Future Forex | https://futureforex.co.za/arbitrage/ |

| Kuda | https://kuda.co.za/fx/arbitrage/ |

| Ovex (Exited arb market Jan 2022) | https://www.ovex.io/ |

| Shiftly | https://shiftly.co.za/ |

Note: We do not endorse any of these companies; please do your own research before pursuing any investments with any of these entities listed above or other firms that may offer this type of service.

No reward without risk

According to Future Forex, a realistic net profit target after fees are deducted ranges between 1% to 1.5% per trade, so if you commit capital and reach the maximum cap on trades, which is R11 million, you could stand to make R110 000 – R165 000 per annum.

Considering the minimum investment on these trades starts at around R200 000 – R250 000, your projected annual return could be between 44% and 82%.

Of course, past performance doesn’t equate to future returns; this only gives you an idea of why local investors are moving into this market.

It is important to note that there are a few risks associated with South African Bitcoin arbitrage:

- Exchange rate volatility: The value of the South African Rand can fluctuate wildly, which can impact your profits.

- Liquidity risk: There may be times when there is limited liquidity on either the South African or international exchange, which can make it difficult to buy or sell Bitcoin.

- Scams: There are a number of scams in the Bitcoin arbitrage industry, so it is important to do your research before choosing an arbitrage provider.

Despite the risks, South African Bitcoin arbitrage can be a lucrative way to make money. If you plan on diversifying into riskier plays like this, it is essential to understand the downsides involved and research before getting started.

Here are some additional tips for South African Bitcoin arbitrage:

- Use a reputable arbitrage provider.

- Start small and increase your investment as you become more comfortable.

- Monitor the market closely and be prepared to exit your position quickly if the market conditions change.

- Be aware of the tax implications of Bitcoin arbitrage in South Africa.

Limitations of Bitcoin Arbitrage in South Africa

As a South Africa tax resident, you are permitted to invest up to R11 million per calendar year directly offshore. This comprises a Single Discretionary Allowance (SDA) of R1 million plus a Foreign Investment Allowance (FIA) of R10 million. While permission from Sars is not required to utilise your SDA, you must apply for a tax clearance certificate before you can access your R10 million.

- With Bitcoin Arbitrage Trading, you do not invest directly in Bitcoin but instead in the margin between the different markets. As such, you will never own the cryptocurrency as part of this investment.

- Each trading cycle takes a total of 24 hours.

- This investment opportunity is available to any South African tax resident over the age of 18.

Getting paid to bring Bitcoin into the local market

There is a clear and consistent demand for Bitcoin in South Africa, evident by the premium South Africans are willing to pay on local markets. South Africans are signalling their need for Bitcoin through this willingness to overpay even on KYC-regulated markets.

As an arbitrage trader, you bring Bitcoin into the country and feed that demand, and as a reward, you exploit the price inefficiencies. You are getting paid to help South Africans gain access to Bitcoins NGU technology along with providing the necessary liquidity needed to grow local Bitcoin Circular Economies.

While you might not be interested in Bitcoin, the asset, the incentive to trade it locally, is a possible way of netting a healthy return on your capital.

These premiums might not always exist at the ranges it is today, but as more traders come in or existing traders command more capital, they will reduce the spreads and make the South African market more efficient.

Regulation is coming

Given the popularity of this asset class amongst South Africans and the numerous scams and implosions with Ponzi scams and multiplication schemes, regulation is coming into this space.

The FSCA (Financial Services Conduct Authority) has clarified its intentions, with the window period for Bitcoin and crypto service providers to apply to the FSCA ending on 1 December 2023.

At this point, service providers must be registered as CASPS (crypto asset service providers), which should be closely aligned to the requirements of an authorised FSP (financial service provider) to protect consumers while creating space for an emerging asset class.

So, if you plan on tackling this market soon, you should ensure that the firm you’re using complies with local regulations.

Do your own research.

If you want to learn more about Bitcoin Arbitrage, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.

- Financial Advisory and Intermediary Services Act 37 of 2002

- Moneyweb – Crypto regulation: SA takes action