Nostr is a decentralised communications protocol that allows people to transfer and share information without relying on large central servers but broadcasting to a series of relays that anyone can spin up. It is censorship-resistant and private, making it a valuable tool for anyone looking to take control of their data, those living in countries with oppressive regimes, or those who want to protect their privacy and guard against censorship.

Nostr is a generalised protocol that can transfer different events, but it started as a method of hosting short-form posts that clients could read and then render into feeds and create a Twitter-like clone. Today, its user base still focuses on this use case as the core, but we are seeing the protocol expand into new fields like long-form content, live streams, shopping, classifieds, and much more.

To use Nostr, all you need is to generate a set of private keys representing your account, and you can use those keys to access any Nostr client. This set of keys represents your identity, your account and any associated data such as your follower count, notes you’ve posted, zaps and more.

Moving value across nostr

Nostr’s combination of clients, relays and users forms the basis of the network, but the network would only grow with value exchange. Remember, this is not some social media website subsidised by big tech or a massive ad-serving platform.

Instead, nostr monetises through Bitcoin, with users paying one another directly for content in the form of zaps, paying relays to host their content, and even paying clients to encourage them to add new features.

Today, the nostr ecosystem relies heavily on Bitcoin and the Lightning network, with nostr accounts tying their npubs (public key) with a specific Lightning address as the method of payment. When a nostr user wants to pay another, they have to enable a Lightning wallet and associate it with their account. This could be a non-custodial Lightning wallet, but most opt for custodial wallets.

Another option that has started to see adoption among nostr account holders is the Cashu wallet; this uses a nostr public key as a wallet address by tying a nostr account to an eCash mint. eCash tokens can be sent directly to users and is also interoperable with the Lightning Network so that users can send and receive funds as Lightning payments or eCash payments.

While these two payment methods are users’ primary options today, others are available, such as Nostr Asset Protocol, which aims to offer a different solution that appeals to those outside the Bitcoin ecosystem.

What is the Nostr Asset Protocol?

Nostr Assets Protocol is a new open-source protocol focusing on bringing Taproot assets and native Bitcoin payments into the Nostr ecosystem. It uses your nostr account as a wallet, with your npub becoming a static wallet address, while your private key now has rights over content events and monetary events.

This smoothes out wallet creation and makes interacting with different nostr users seamless regarding payments and online commerce, like trading or eCommerce. Instead of requiring a separate Bitcoin wallet, your nostr account could be used to pay users online or in person as long as they have a nostr account.

The Nostr asset protocol allows you to interact with other payment protocols, like the Lightning Network and Taproot assets. Once the assets are introduced, users can send and receive them at the Nostr Protocol layer using Nostr’s public and private keys.

The settlement and security of assets still rely on the Lightning Network, and the Nostr Assets Protocol itself does not issue assets but only introduces assets into Nostr through the protocol, allowing you to trade a claim that can be redeemed on the Lightning network.

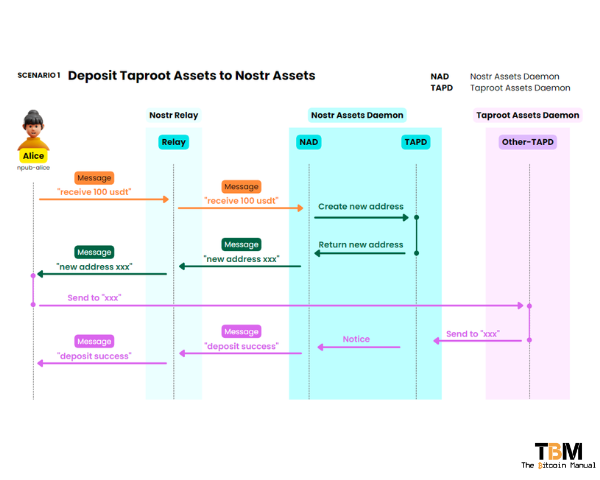

What is Nostr Assets Daemon (NAD)?

The Nostr Assets Daemon (NAD) is a backend process that implements the Nostr Assets Protocol for issuing assets on the Nostr Protocol.

It serves as a wrapper for Taproot Assets (formerly known as Taro) and Lightning Network, allowing users to effectively manage their assets on Bitcoin (BTC), the Lightning Network, and Taproot using their Nostr accounts.

While this is the core focus for now, the Nostr Assets Daemon could be used to incorporate assets hosted on other protocols, too, like RGB or the Liquid network.

What does the Nostr Asset Protocol do?

- Bridge Taproot assets or Lightning balances to trade them via Nostr events

- Mint Nostr Assets

- Send and receive Nostr Assets

- Provide separate accounts for end users

- Compatible on both Self-Custodial and Custodial users

- Redeem your nostr assets for funds on your preferred network

Chat-To-Trade

Users can transfer, receive and query Nostr assets using chat commands directly through any Nostr Protocol frontend clients such as Damus, Amethyst on mobile or Iris, Primal and Snort on Desktop.

Zero-gas transactions

Since the Nostr asset protocol does not use a blockchain and does not transfer funds that require interaction with the chain, it costs no fees, as you’re creating another nostr event like you would when making a post. As Nostr Protocol is an off-chain decentralised protocol, all transactions can be encrypted and gas-less to operate.

Besides deposit and withdrawal functions, all transactions on Nostr Assets Protocol are Zero-Gas transaction fees; users can save on fees and redeem to their Lightning Network or on-chain wallet when ready.

Trade using your preferred asset

Since the Nostr Asset Protocol can support any asset bridged into it, if Taproot Assets shows support for Stabelcoins like Tether USDT, users would be able to bring those assets into nostr and use them to pay other users, tip them in a native currency of their choice or conduct sales and even P2P trades using the protocol.

This opens up Nostr to users who might not be interested in Bitcoin but still want to take advantage of the network’s other benefits.

Run your own Nostr Assets Node.

Nostr Assets Protocol enables users to set up and run their own Nostr Assets Node for self-custodial management of Nostr assets, so you don’t have to trust someone else data on these assets.

Nostr Assets are still in their early stages of development. Still, they can change the value proposition ecosystem by appealing to users who want to use a different unit of account. By combining the censorship resistance of Nostr with the scalability and security of the Lightning Network, Nostr Assets offers a new way to conduct online trade.

Nostr prepares for the digital and attention economy migration.

Appealing to a broader community requires the support of assets others want to trade in. Despite Bitcoin’s growth, the total addressable market for fiat settlement every day is orders of magnitude larger. The lack of native assets or currency in the Nostr ecosystem has hindered effective commercialisation and limited venture capital investment.

If, for example, traditional social media users begin to realise they can migrate their content and user base to nostr and collect a more significant revenue share than if they used other online platforms like Patreon or payment providers like PayPal, they might be more likely to move over.

By bridging existing networks into nostr, you allow the market to decide how they want to interact with one another as nostr assets would be platform and asset agnostic.

Do your own research.

If you want to learn more about nostr assets, use this article as a jumping-off point and don’t trust what we say as the final say. Take the time to research, check out their official resources below or review other articles and videos tackling the topic.