After the scaling debate, which resulted in the block size wars, settled down, the small blockers continued with SegWit. The Lightning Network (LN) emerged as a beacon of hope for Bitcoin’s scalability woes. The second-layer network enabling off-chain transactions promised to usher in an era of faster and cheaper Bitcoin transactions, and to a degree, it did and continues to do so for those few who use Lightning regularly.

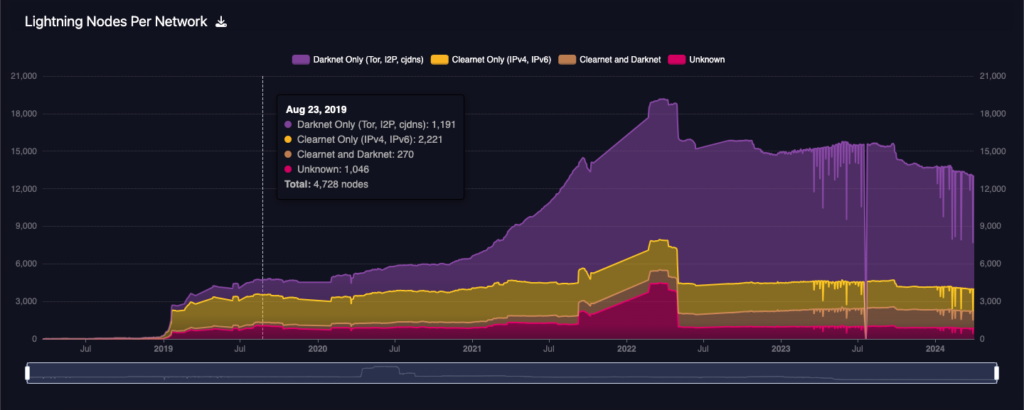

Lightning is an opt-in network; you can ignore it, or if you find its incentives and trade-offs worthwhile, you can take on the requirements to move your Bitcoin into this network for temporary use. Bootstrapping a peer-to-peer payment network takes time, and Lightning has had plenty of time to grow, expanding to over 4500 nodes today.

With transaction fees so cheap and transactions so instantaneous, Bitcoiners started buying coffee and groceries over the Lightning Network, sending one another micro-payments and experimenting with new ideas like streaming payments.

The adoption of Lightning has been sparse, with few exchanges adopting it as a payment rail along with a niche market of Lightning apps leveraging the technology.

But is LN a silver bullet for mass adoption?

Some influencers in the space oversold the launch and promotion of Lightning; yes, it brought about additional throughput, but it also had its limits, limits we needed to be honest about.

First, there are complications and requirements to run Lightning non-custodially. Second, Lightning does have a cap due to block space; there are only so many channels that can be opened and closed per block, and the costs involved in acquiring block space do add up, putting the speed breaks on how efficient the network can be and how many people can be onboarded non-custodially.

Would Lightning be able to onboard all the next 1 billion users in its current state? Probably not, but it could support a few hundred million users as its infrastructure matures.

Lightning has a learning curve

Scaling through layers isn’t easy, but it has to be done to preserve the base chain’s integrity, which results in some trade-offs. Lightning is an entirely different model from the broadcast network of the base chain, so it’s not exactly intuitive for the average user.

LN relies on payment channels – pre-funded bilateral agreements – to facilitate transactions. This presents a hurdle: channels require users to lock up funds, which can be inconvenient for small transactions or those with limited capital.

Imagine needing a $100 bill for every cup of coffee you buy or sell a cup of coffee – that’s the crux of the liquidity challenge.

The reality can be jarring for new users, thinking they’re moving to a cheaper solution only to find they had to pay an on-chain premium and acquire inbound liquidity at cost just to get started.

Why is there a channel open fee to receive a payment a payment with Phoenix every time you receive?

— RGBrad Mills 🔑⚡️ (@bradmillscan) November 17, 2023

The person had to increase the channel fee to 25,000 sats.

Sent $100 CAD they received $88.95

I thought Phoenix was supposed to be non custodial AND cheap? pic.twitter.com/ZheKeK7e7V

Centralisation concerns

As the network grows, well-connected Lightning nodes become crucial for efficient payment routing. The hub-and-spoke model creates a potential for centralisation, where a few powerful nodes manage the traffic on the network. These nodes become honeypots or central points of failure.

Governments or malicious actors could target these nodes, take them down, and temporarily disrupt the network. The takedown would force peers to close channels to the now-defunct node and create new connections and routing capacity for users.

Large nodes are also often ones that manage funds for custodial users, and if those nodes go down or decide to rug their customers, it would be catastrophic for those users.

Besides, custodial management goes against Bitcoin’s decentralised philosophy.

The channel conundrum

Opening and closing channels require on-chain transactions, subject to Bitcoin’s block size limitations. The cost of block space can lead to bottlenecks, especially if many users constantly open and close channels.

During the Ordinals hype, block space was bid up to astronomical levels, rendering many Lightning channels open or closed financially pointless.

Imagine rush hour traffic on a single-lane road, and the toll road keeps hiking the price to get into a lane– that’s the channel conundrum in action.

Layered networks are not a One-Size-Fits-All fix

LN shines for micropayments, but the on-chain security of the Bitcoin blockchain remains paramount for more significant transactions. LN isn’t a magic solution that replaces Bitcoin itself but rather a complementary layer. It’s like having a high-speed rail network for everyday travel but still needing aeroplanes for long-distance journeys.

Bitcoin is complicated enough to grasp as it is already; expecting people to understand these distinctions off the bat is a stretch, and it will take time and considerable educational drives, trial and error combined with UI improvements or updates like BOLT12 can make use of the two networks a seamless approach.

Lightning wallets have come a long way in the last few years, but they are nowhere as slick as what custodial services can provide, giving users a unified balance and the preferred rails are chosen at the time of payment.

Lightning has had a few bugs along the way

Lightning has had its fair share of issues, too; in October 2023, Lightning developers disclosed a vulnerability called replacement cycling attacks.

"Effective now, I'm halting my involvement with the development of the lightning network and its implementations" ~Antoine Raird

— John Carvalho (@BitcoinErrorLog) October 21, 2023

fwiw I raised concerns about the handling of a recent critical flaw disclosure to Antoine a few days ago, and we've been discussing the current… pic.twitter.com/BMiPU5mM8U

Later, another vulnerability, channel jamming, started to circulate on Twitter.

The more I study the lightning network the more I realize with shock that there are so many misconceptions about the privacy of Lightning in the wild for which often just the opposite seems to be true

— Rene Pickhardt (@renepickhardt) August 27, 2020

I am scared that even in Mastering lightning we won't be able to fix that 🙁

In November 2022, another unattributed Lightning routing bug came to light with the popular Lightning implementation, LND. This bug froze money inside Lightning for hours after a developer called Burak (developer of Ark) decided to broadcast a 998-signature Taproot transaction that broke the network.

Sometimes to find the light, we must first touch the darkness.https://t.co/dhCwF0DxpE

— B🪨 (@brqgoo) November 1, 2022

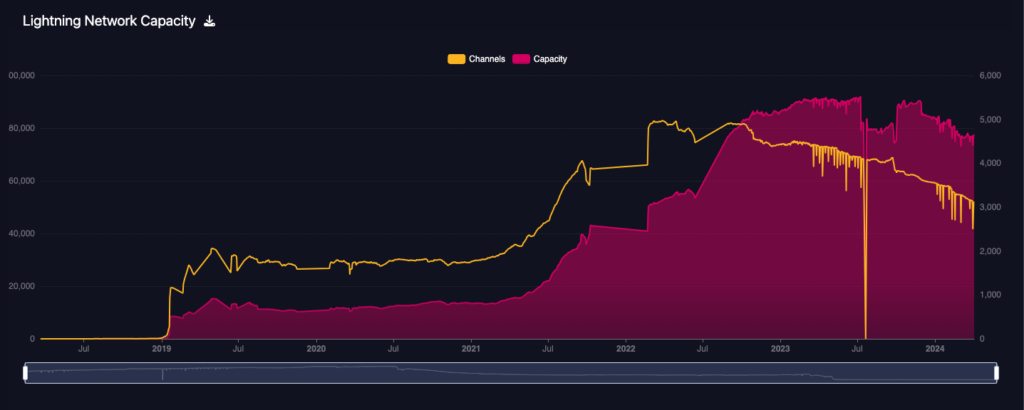

Lightning capacity is falling

One critique I’ve seen thrown at Lightning is the idea that reducing capacity means it’s failing. The amount of Bitcoin that users have placed into Lightning Network had been on a steady incline for the first few years, but recently, we’ve seen it start to trim down as some users shut down their nodes, reduce their channels and take some risk off the table.

The Lightning channel began dipping below its peak of around 5,000 in December 2023, so does this mean LN is dying?

No, not really.

Sure, some people might shut down their nodes for good; every network has user churn, and some are temporarily taking it offline or reducing their capacity because they might not need to commit a lot of capital to use Lightning as they thought previously.

Another reason for reducing channel capacity is that other peers might go down. Suppose you’re connected to a peer that goes down or closes down, and you don’t have a mutual close. In that case, you risk having capital locked in a zombie channel, so pruning those channels or even low-traffic channels is a wise move in responsible capital management.

Lighting payments settle instantly, which means the turnover of SATs is fast. If you’ve ever used a V4V app, you can see how quickly the velocity of SATs turns over from user to user.

The number of UTXOs locked into Lightning is not the be-all and end-all metric. If the network can turn over payments with smaller capital requirements, it’s merely becoming more efficient for its current user base.

Networks find an equilibrium

If base chain fees drop, it encourages users to open more efficient channels, close down channels, or even use the base chain for transactions and skip Lightning altogether.

Lightning is for added throughput; if the current blocks handle current transaction demand, why would you need to add more capital to Lightning?

As transaction demand ebbs and flows, capital will be between the base chain and Lightning.

The road ahead

Despite these challenges, the Lightning Network is still under development; with plenty of venture capital flowing into the space to try and provide innovative solutions, there is no shortage of BOLT proposals addressing some of Lightning’s shortfalls.

However, finding the right balance between usability, security, and scalability will be key to LN’s long-term success.

.@craigraw gives a sober warning to consider – if we hyperfocus on scaling, do we risk losing the ‘Crown Jewels’ features of Bitcoin? Decentralization, privacy, no permissions, no trusted third parties… will we give these up to scale?

— Ben (@Lewified) March 31, 2024

> “We have this overwhelming demand in the… pic.twitter.com/Luj73FSoZ7

The Lightning Network holds immense promise for scaling Bitcoin transactions. However, it’s crucial to acknowledge its limitations. LN is a valuable tool in the Bitcoin ecosystem, but there are better solutions for global adoption.

Understanding these challenges allows us to navigate the path towards a more scalable and accessible future for Bitcoin.

Thankfully, even if Lightning does hit the limits of its ability to scale and meet user needs, other layered protocols can pick up the slack and cater to a different audience with its own set of trade-offs that the user base might be comfortable adopting instead.